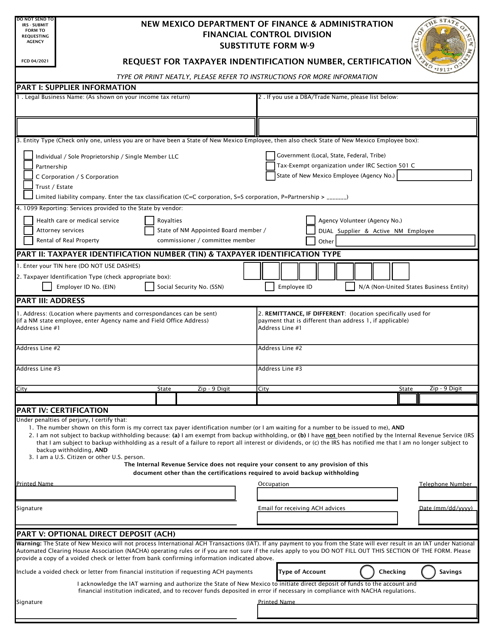

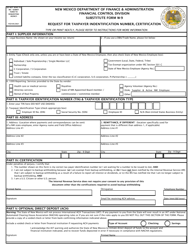

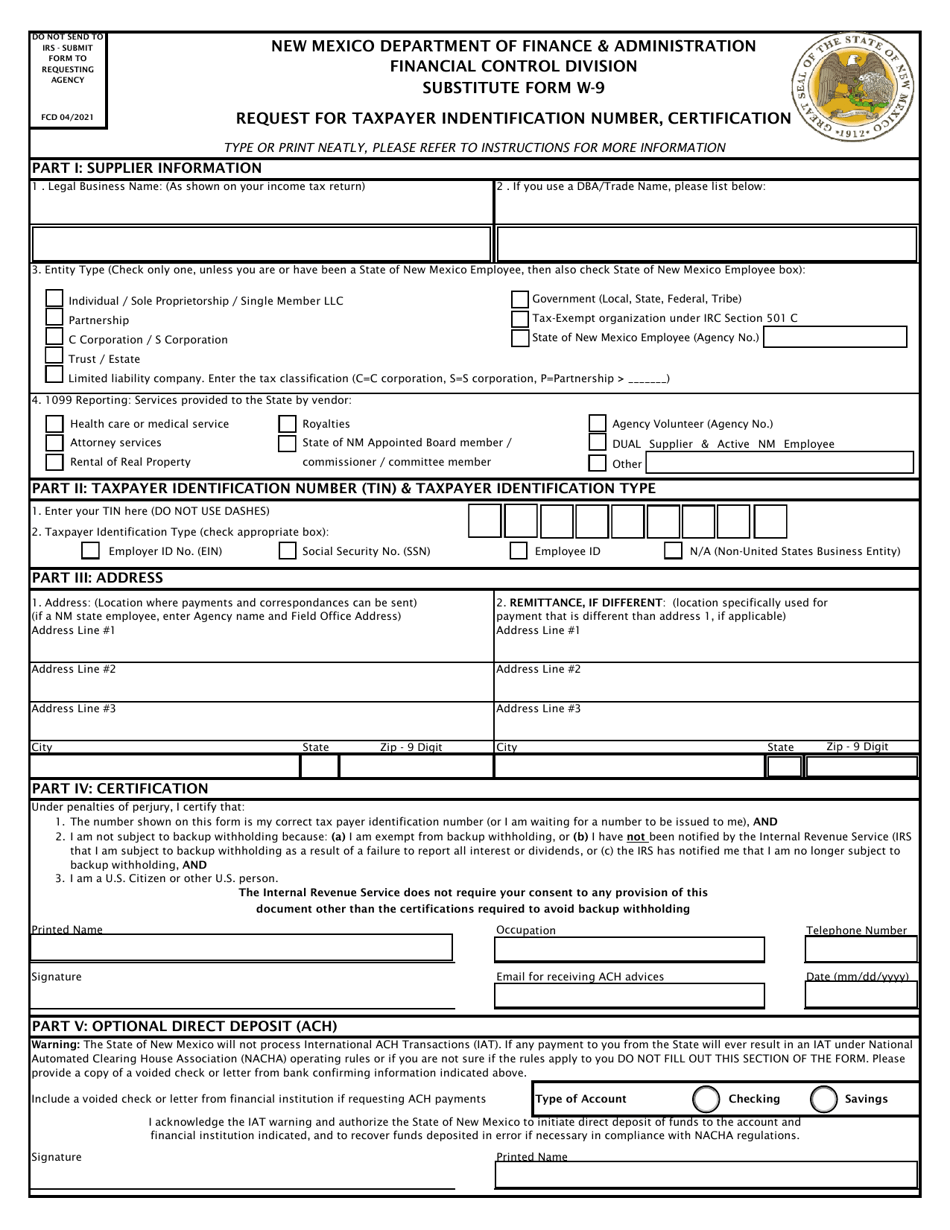

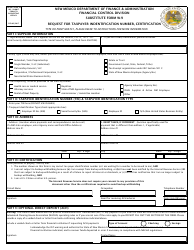

Substitute Form W-9 - Request for Taxpayer Indentification Number, Certification - New Mexico

Substitute Form W-9 - Request for Taxpayer Indentification Number, Certification is a legal document that was released by the New Mexico Department of Finance and Administration - a government authority operating within New Mexico.

FAQ

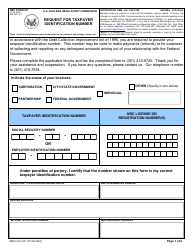

Q: What is Form W-9?

A: Form W-9 is a request for taxpayer identification number and certification.

Q: Who needs to fill out Form W-9?

A: Form W-9 needs to be filled out by individuals or businesses who are required to provide their taxpayer identification number to a requester.

Q: What is the purpose of Form W-9?

A: The purpose of Form W-9 is to provide a requester with the correct taxpayer identification number in order to report income paid to the recipient.

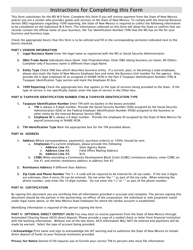

Q: What information is required on Form W-9?

A: Form W-9 requires the individual or business to provide their name, business name (if applicable), address, taxpayer identification number, and certification.

Q: Is it mandatory to fill out Form W-9?

A: If you are requested to fill out Form W-9 by a requester, it is mandatory to provide the requested information.

Q: What happens if I don't fill out Form W-9?

A: If you don't fill out Form W-9 as required, the requester may be required by law to withhold a percentage of your payments and send it to the IRS.

Q: Is Form W-9 specific to New Mexico?

A: No, Form W-9 is a federal form and is not specific to any particular state.

Q: What is the penalty for providing false information on Form W-9?

A: Providing false information on Form W-9 may result in penalties, including fines and potential criminal charges.

Q: Can I e-file Form W-9?

A: Form W-9 is not eligible for electronic filing. It must be filled out and submitted in paper format to the requester.

Form Details:

- Released on April 1, 2021;

- The latest edition currently provided by the New Mexico Department of Finance and Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Department of Finance and Administration.