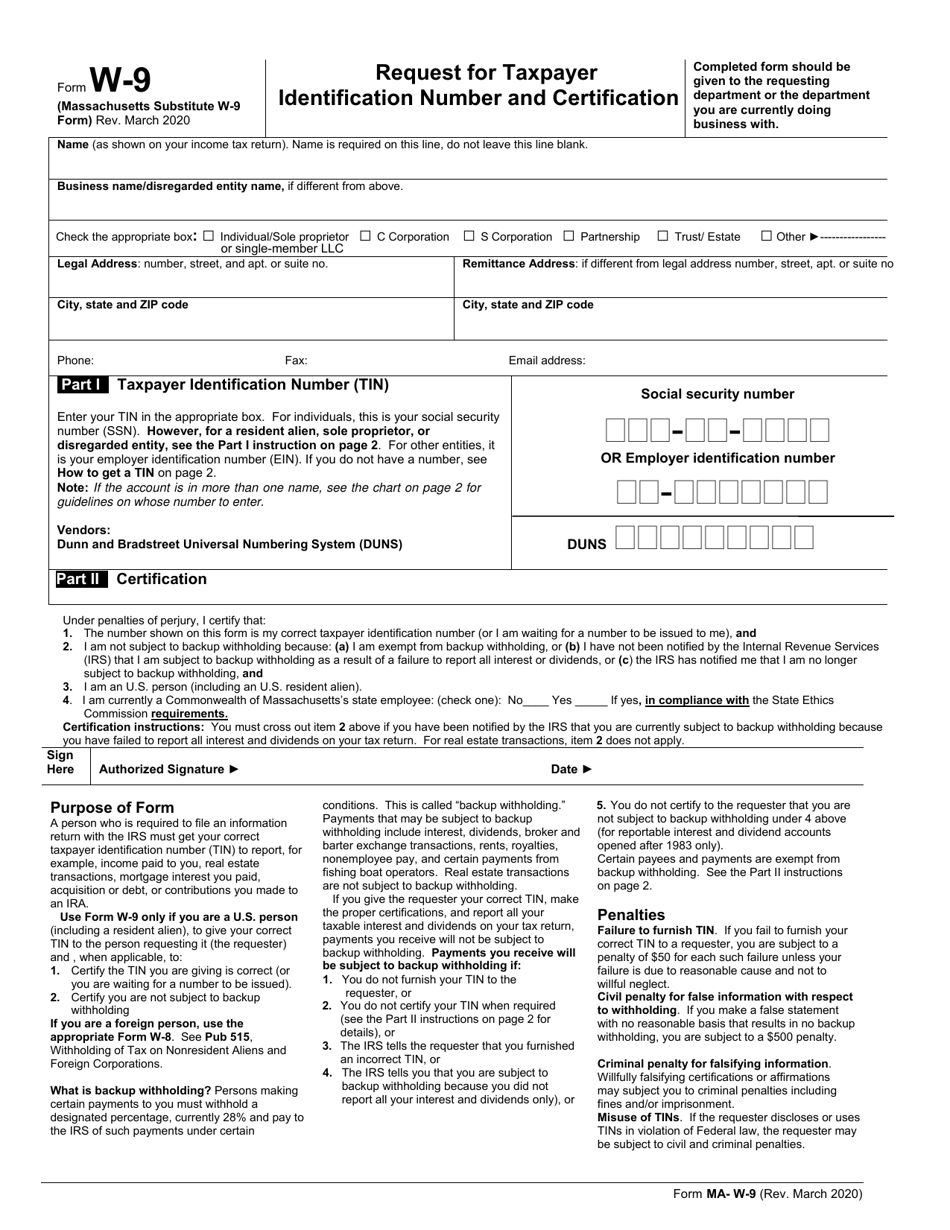

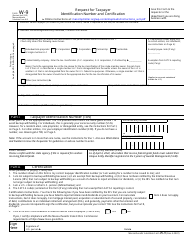

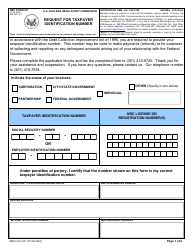

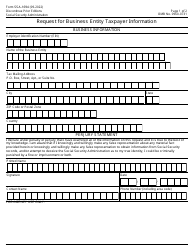

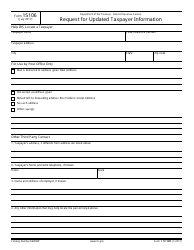

Form W-9 Request for Taxpayer Identification Number and Certification - Massachusetts

What Is Form W-9?

This is a legal form that was released by the Comptroller of the Commonwealth of Massachusetts - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-9?

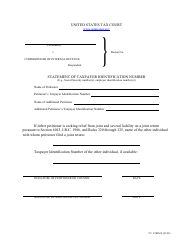

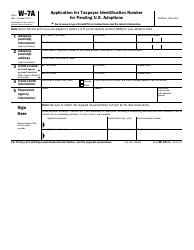

A: Form W-9 is a document used to request taxpayer identification number and certification.

Q: Who uses Form W-9?

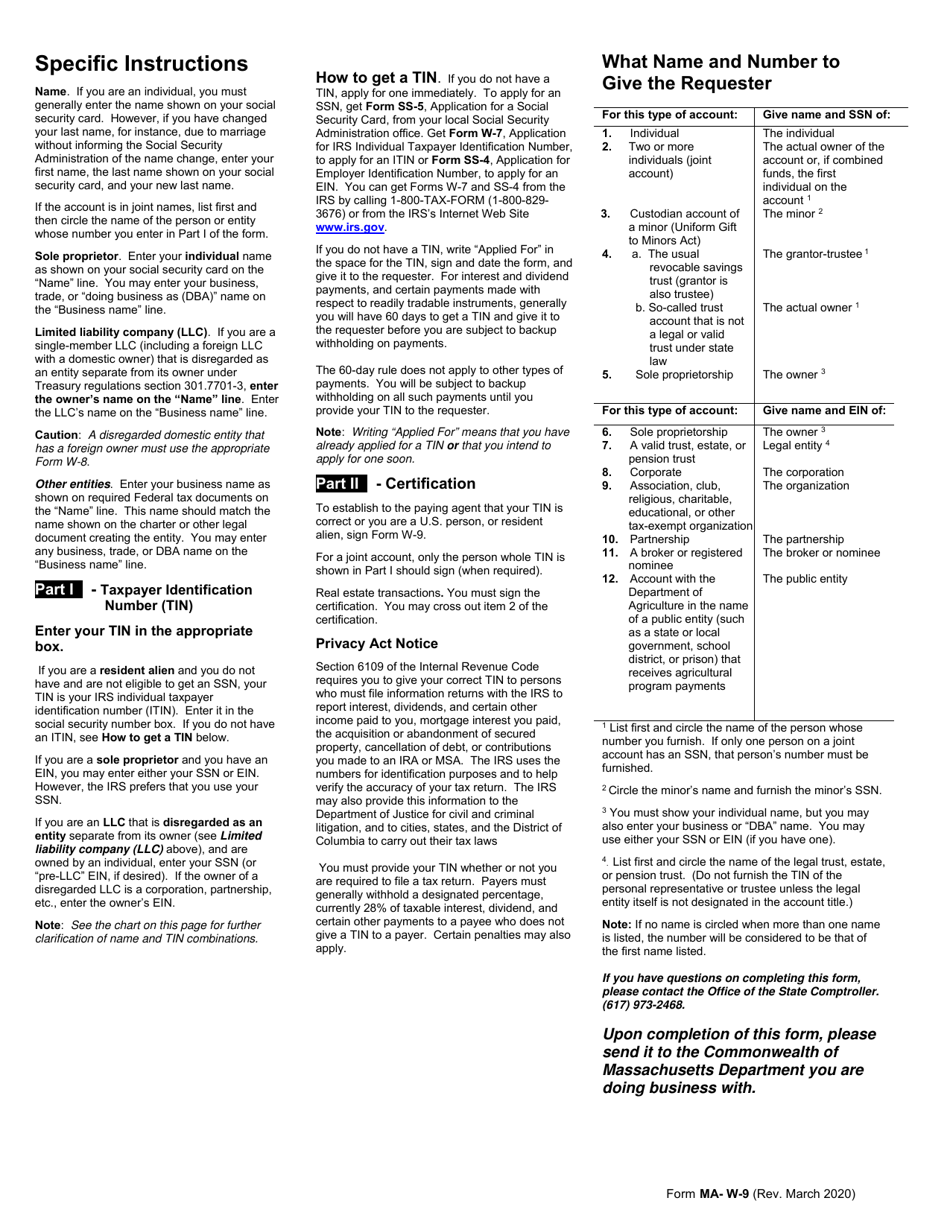

A: Form W-9 is typically used by businesses or individuals that need to gather the tax identification information of another party.

Q: Why is Form W-9 used?

A: Form W-9 is used for various purposes, such as reporting income paid to independent contractors, verifying taxpayer identification information, and complying with backup withholding requirements.

Q: What information is required on Form W-9?

A: Form W-9 requires the individual or business to provide their name, business name (if applicable), taxpayer identification number (such as a Social Security Number or Employer Identification Number), address, and certification.

Q: Are individuals required to fill out Form W-9?

A: Yes, individuals may be required to fill out Form W-9 in certain circumstances, such as when they are being paid as an independent contractor or receiving certain types of income.

Q: Do I need to submit Form W-9 every year?

A: No, Form W-9 does not need to be submitted annually unless there are changes in the taxpayer's information or circumstances.

Q: Is Form W-9 specific to Massachusetts?

A: No, Form W-9 is a federal tax form used across the United States. It is not specific to Massachusetts.

Q: Who should I contact if I have questions about Form W-9?

A: If you have questions about Form W-9, you can contact the IRS or consult with a tax professional for guidance.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Comptroller of the Commonwealth of Massachusetts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-9 by clicking the link below or browse more documents and templates provided by the Comptroller of the Commonwealth of Massachusetts.