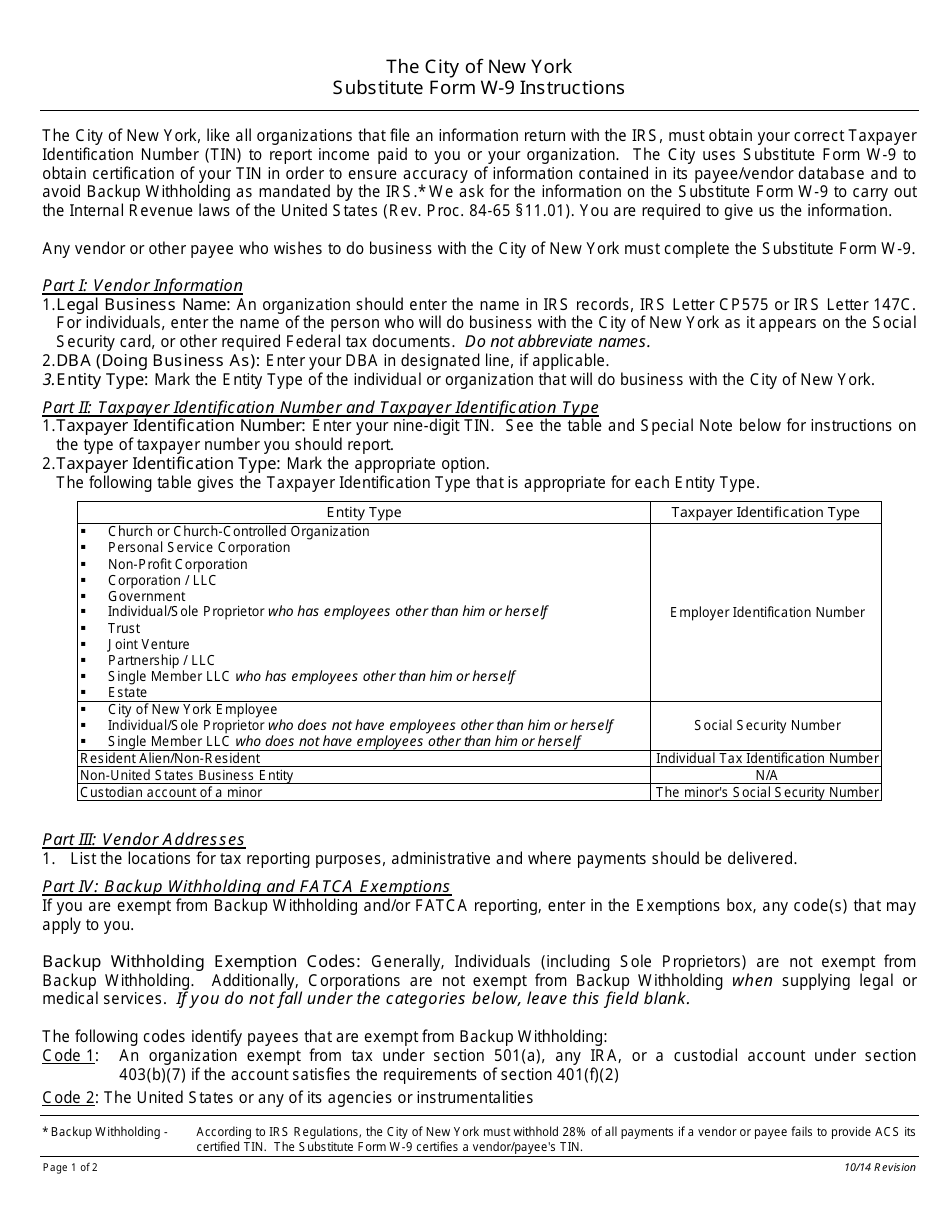

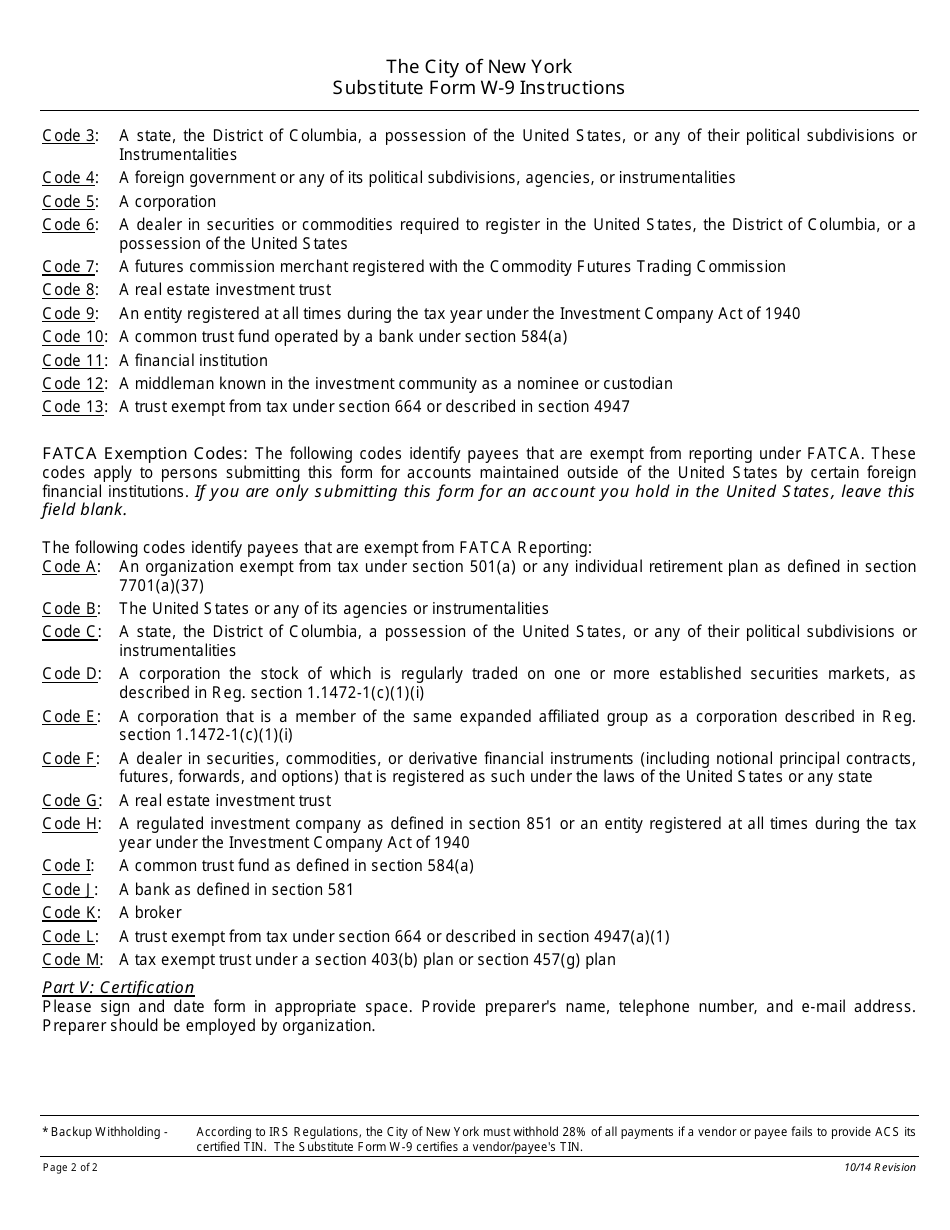

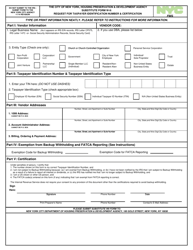

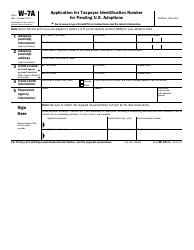

Instructions for Substitute Form W-9: Request for Taxpayer Identification Number and Certification - New York City

This document was released by Office of the New York City Comptroller and contains official instructions for Substitute Form W-9: Request for Taxpayer Identification Number and Certification . The up-to-date fillable form is available for download through this link.

FAQ

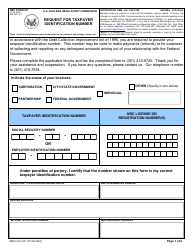

Q: What is Form W-9?

A: Form W-9 is a tax document used to obtain a taxpayer identification number from individuals or entities.

Q: Do I need to fill out a Form W-9?

A: You may need to fill out a Form W-9 if you are being paid by an individual or business and they require your taxpayer identification number.

Q: What information is required on Form W-9?

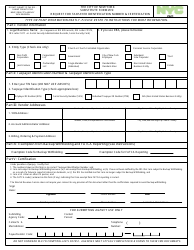

A: You need to provide your name, business name (if applicable), taxpayer identification number (Social Security number or Employer Identification Number), address, and certification that the information provided is correct.

Q: Is Form W-9 specific to New York City?

A: No, Form W-9 is a federal tax form and is used across the United States.

Q: What should I do with the completed Form W-9?

A: You should provide the completed Form W-9 to the individual or business that requested it, as they need the information for tax purposes.

Q: Is Form W-9 the same as Form W-4?

A: No, Form W-9 is used to provide taxpayer identification information, while Form W-4 is used to determine the amount of federal income tax to withhold from your paycheck.

Q: Is there a deadline to submit Form W-9?

A: The deadline to submit Form W-9 is typically when the person or business requesting it needs the information, so it may vary depending on the circumstances.

Q: Do I need to keep a copy of Form W-9?

A: It is recommended to keep a copy of Form W-9 for your records, as it contains important tax information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Office of the New York City Comptroller.