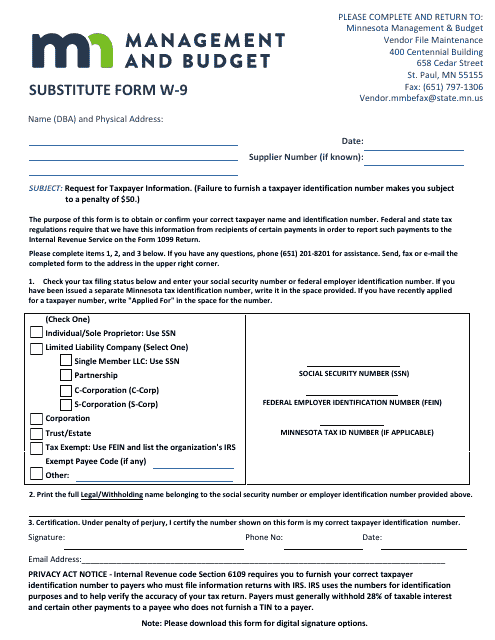

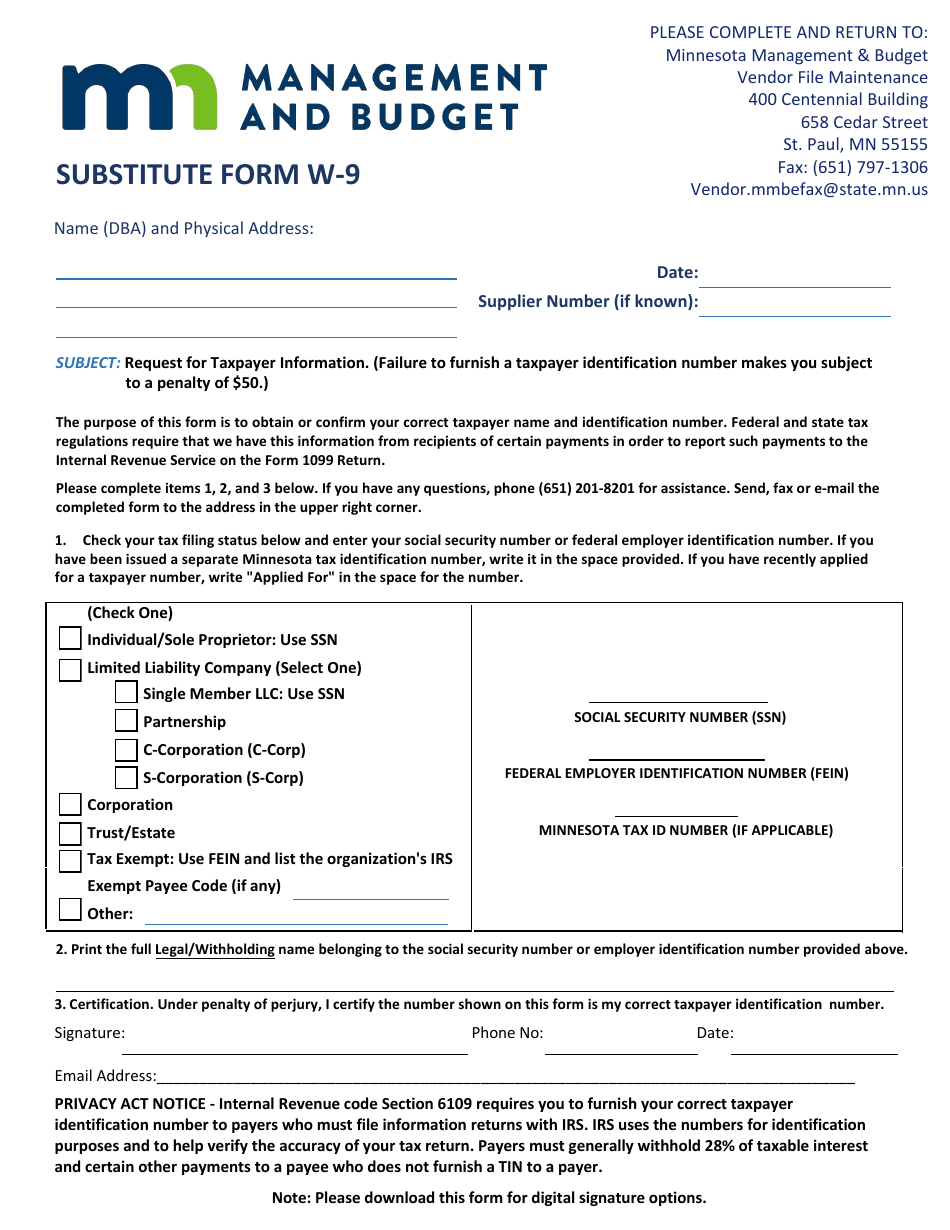

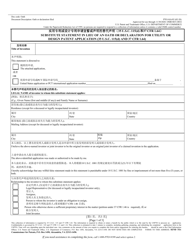

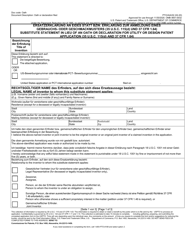

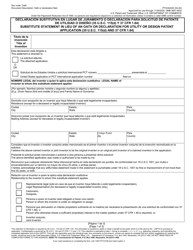

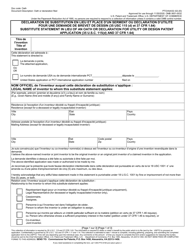

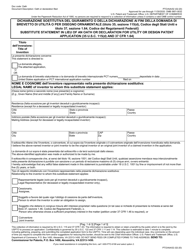

Form W-9 Substitute Form - Minnesota

What Is Form W-9?

This is a legal form that was released by the Minnesota Management and Budget - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-9?

A: Form W-9 is a tax form used to request the taxpayer identification number (TIN) of a US person for tax reporting purposes.

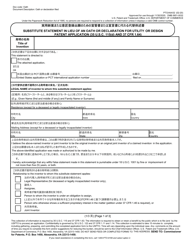

Q: What is a substitute Form W-9?

A: A substitute Form W-9 is a form created by a state or other entity as an alternative to the official IRS Form W-9.

Q: What is the purpose of the substitute Form W-9 in Minnesota?

A: The substitute Form W-9 in Minnesota is used to collect the taxpayer identification information for state tax reporting purposes.

Q: How does the substitute Form W-9 in Minnesota differ from the official IRS Form W-9?

A: The substitute Form W-9 in Minnesota may include additional state-specific questions or instructions that are not present on the official IRS Form W-9.

Q: Do I need to submit both the official IRS Form W-9 and the substitute Form W-9 in Minnesota?

A: No, typically you would only need to submit either the official IRS Form W-9 or the substitute Form W-9, depending on the requirements of the requesting entity.

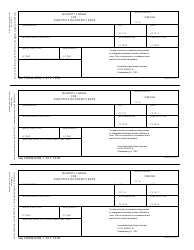

Form Details:

- The latest edition provided by the Minnesota Management and Budget;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-9 by clicking the link below or browse more documents and templates provided by the Minnesota Management and Budget.