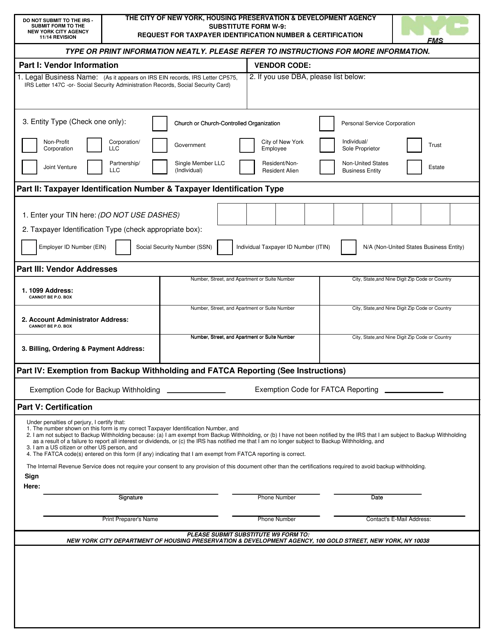

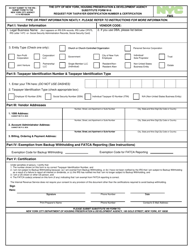

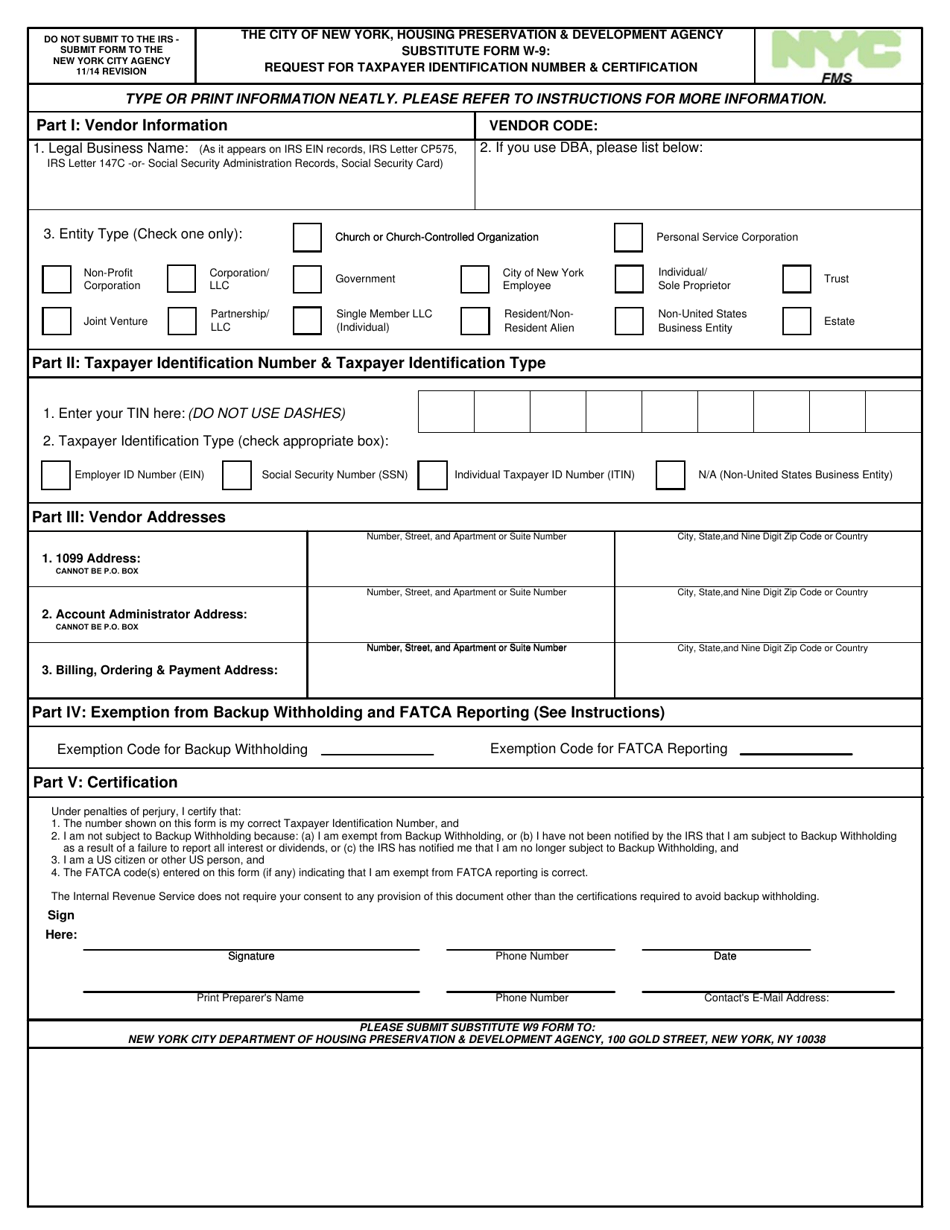

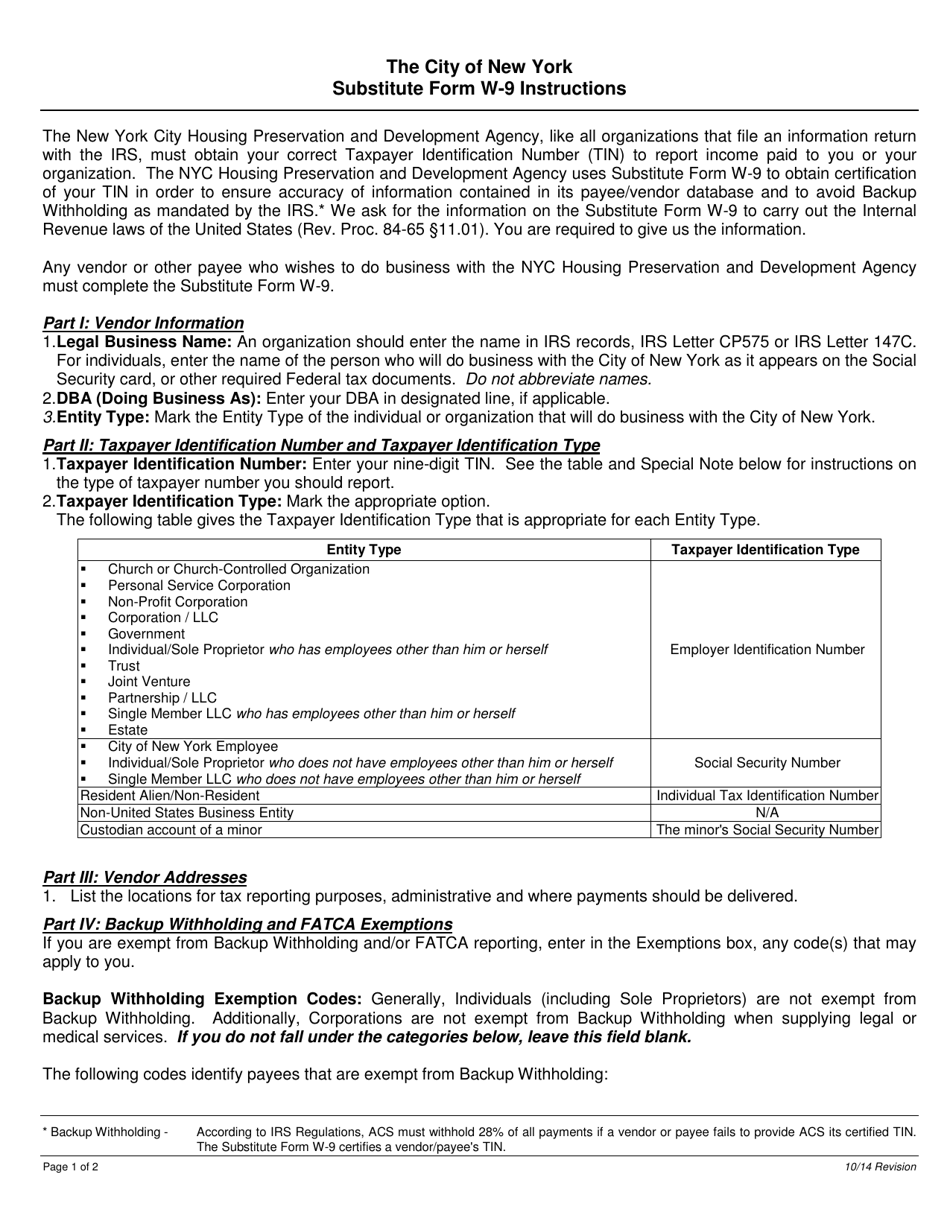

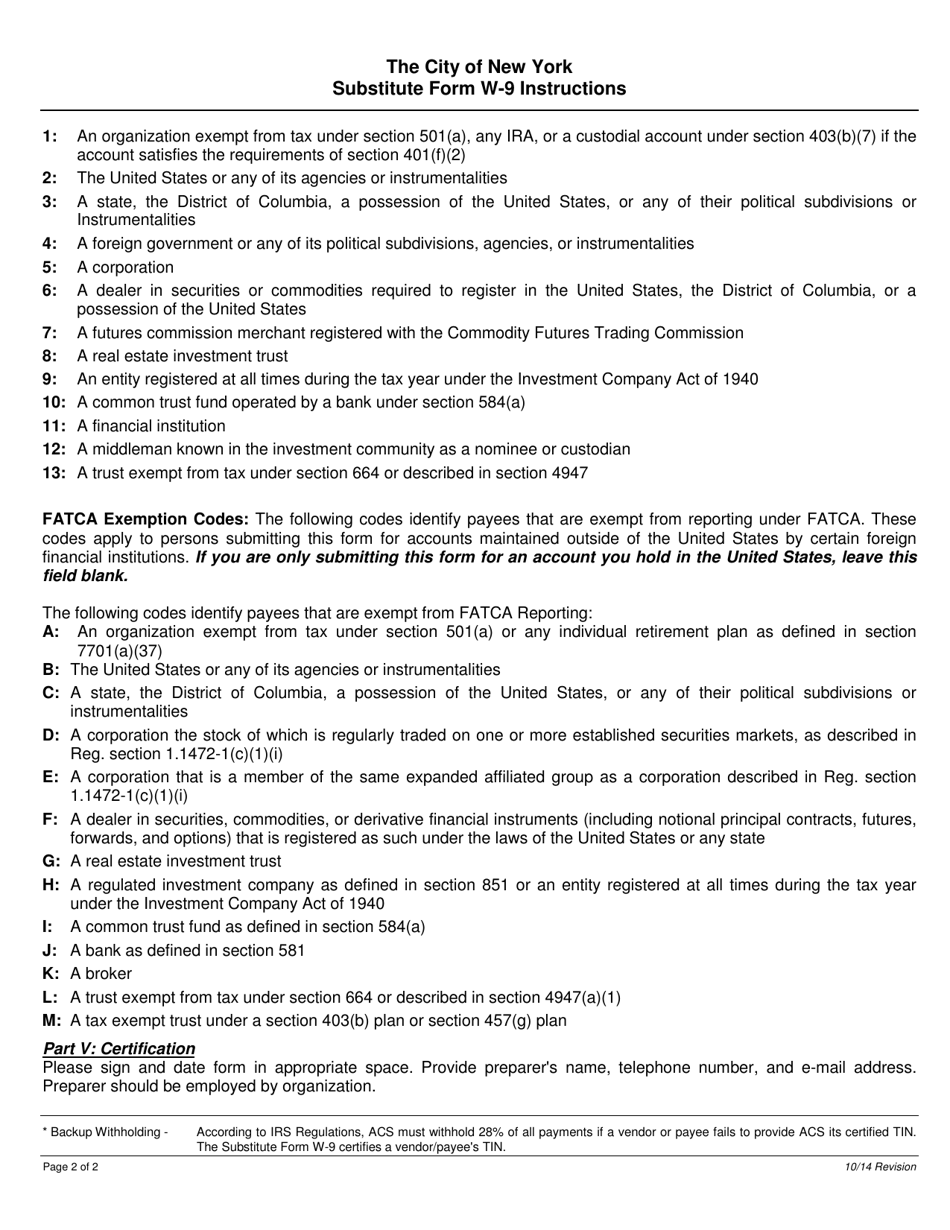

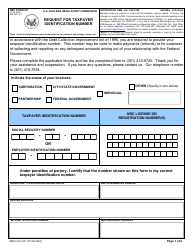

Substitute Form W-9 - Request for Taxpayer Identification Number & Certification - New York City

Substitute Form W-9 - Request for Taxpayer Identification Number & Certification is a legal document that was released by the New York City Department of Housing Preservation and Development - a government authority operating within New York City.

FAQ

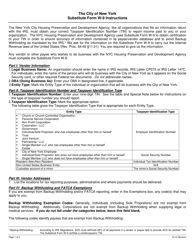

Q: What is Form W-9?

A: Form W-9 is a document used to request the taxpayer identification number (TIN) and certification of a U.S. taxpayer.

Q: When is Form W-9 used?

A: Form W-9 is typically used by businesses or individuals who need to collect TINs from individuals or entities for tax purposes.

Q: Why is Form W-9 important?

A: Form W-9 is important because it helps businesses or individuals comply with their tax reporting obligations.

Q: Who needs to fill out Form W-9?

A: Any U.S. taxpayer or entity who is requested to do so by another party, typically for tax reporting purposes.

Q: Is Form W-9 specific to New York City?

A: No, Form W-9 is a federal form used throughout the United States, not specific to New York City.

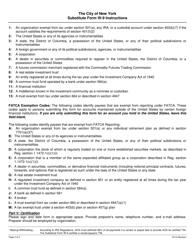

Q: Are there any penalties for not filling out Form W-9?

A: There may be penalties for not providing a valid TIN or for providing false information on Form W-9.

Q: Can I submit Form W-9 electronically?

A: Yes, Form W-9 can be submitted electronically as long as the requester allows for electronic submission.

Q: Is Form W-9 used for personal tax returns?

A: No, Form W-9 is not used for personal tax returns. It is used for tax reporting purposes by businesses and individuals.

Q: What should I do if I receive a request to fill out Form W-9?

A: If you receive a request to fill out Form W-9, you should carefully review the form and provide the requested information if applicable.

Form Details:

- Released on November 1, 2014;

- The latest edition currently provided by the New York City Department of Housing Preservation and Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Housing Preservation and Development.