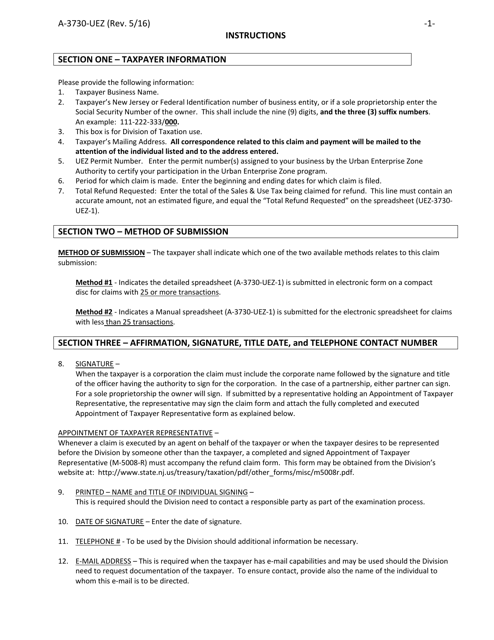

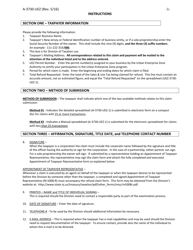

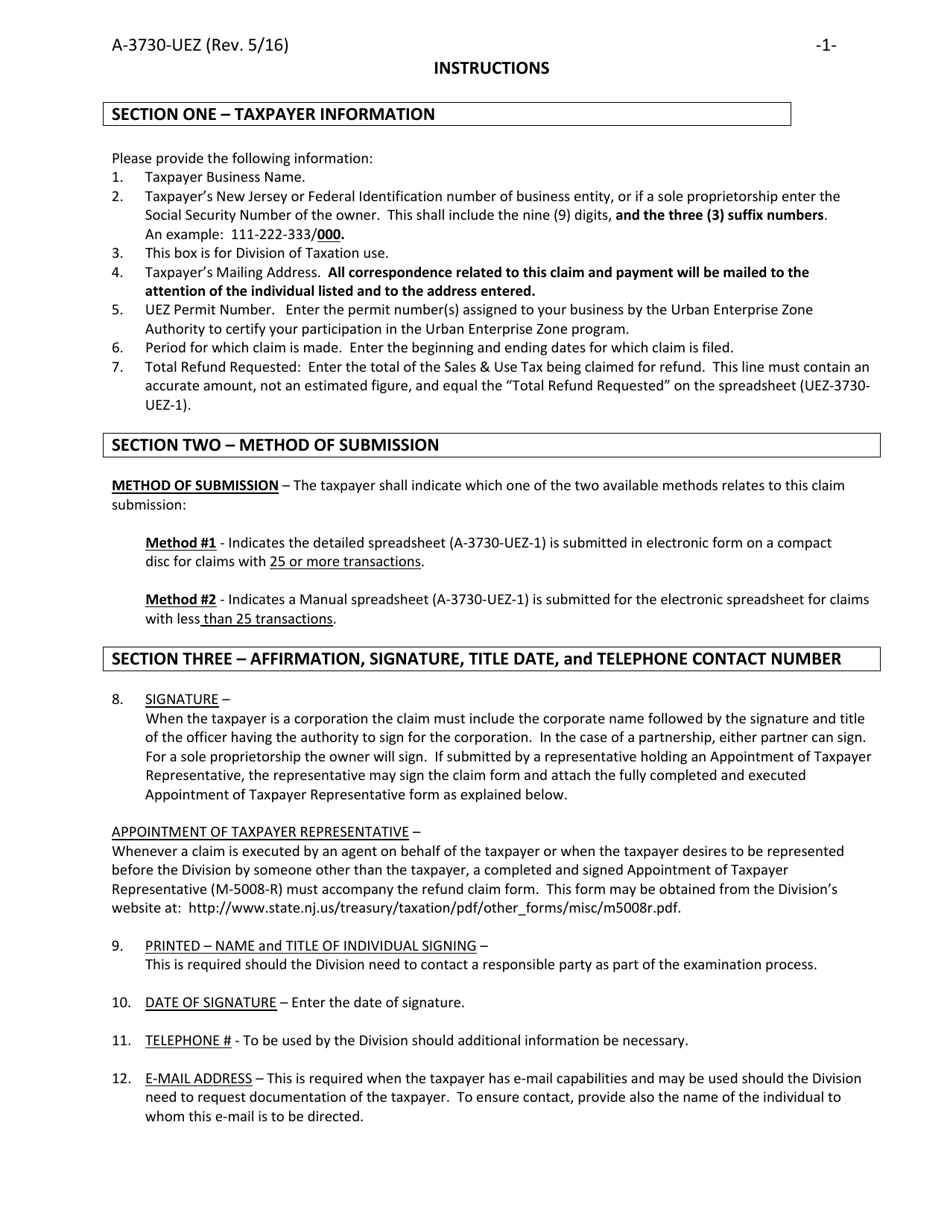

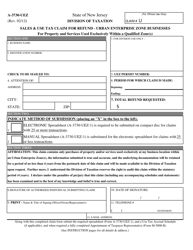

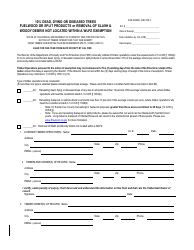

Instructions for Form A-3730-UEZ Sales & Use Tax Claim for Refund - Urban Enterprise Zone Businesses for Property and Services Used Exclusively Within a Qualified Zone(S) - New Jersey

This document contains official instructions for Form A-3730‐UEZ , Sales & Urban Enterprise Zone Businesses for Property and Services Used Exclusively Within a Qualified Zone(S) - a form released and collected by the New Jersey Department of the Treasury.

FAQ

Q: What is Form A-3730?

A: Form A-3730 is a tax claim for refund form for Urban Enterprise Zone (UEZ) businesses in New Jersey.

Q: What is the purpose of Form A-3730?

A: The purpose of Form A-3730 is to claim a refund for sales and use tax paid on property and services used exclusively within a qualified UEZ.

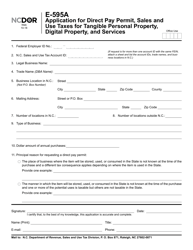

Q: Who can use Form A-3730?

A: Form A-3730 can be used by businesses operating within a qualified UEZ in New Jersey.

Q: What is a qualified UEZ?

A: A qualified UEZ refers to an Urban Enterprise Zone designated by the State of New Jersey.

Q: What types of property and services can be claimed for a refund?

A: Property and services that are used exclusively within a qualified UEZ can be claimed for a refund.

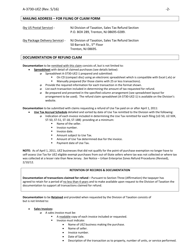

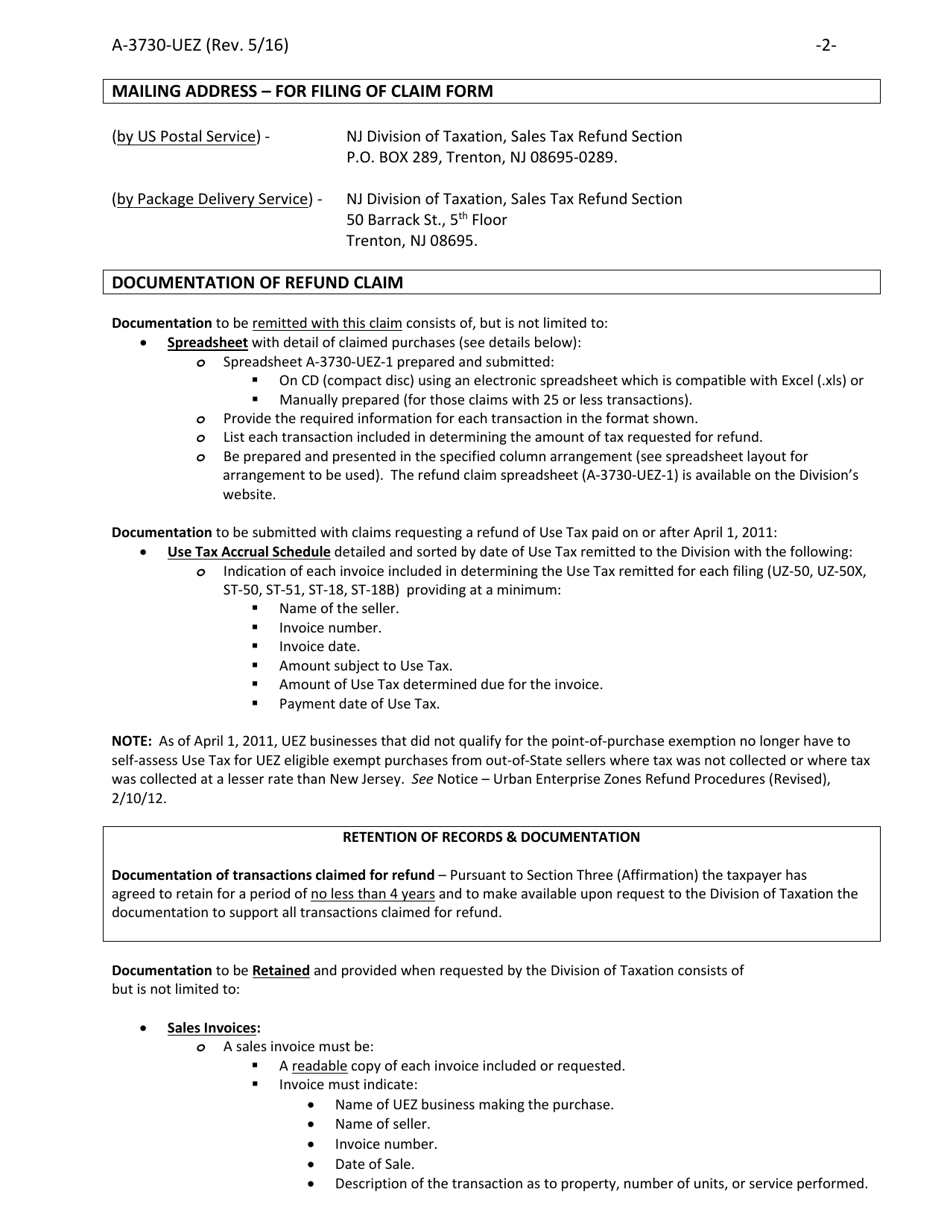

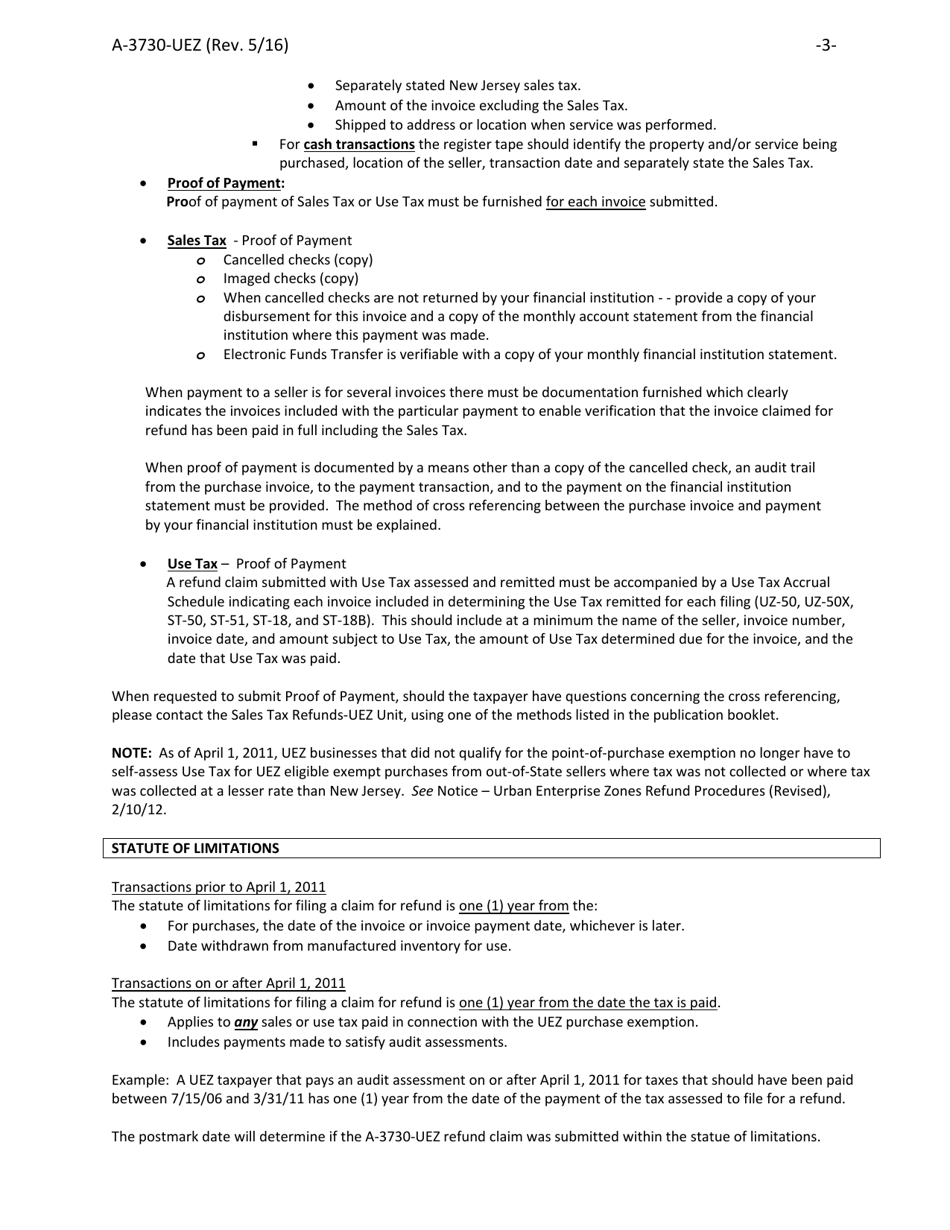

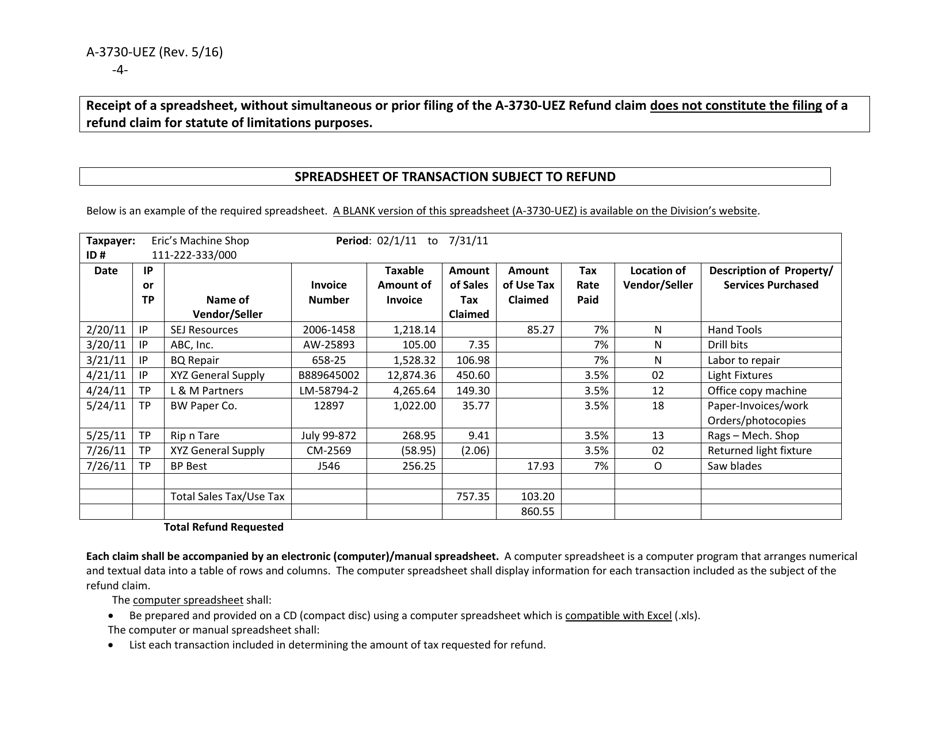

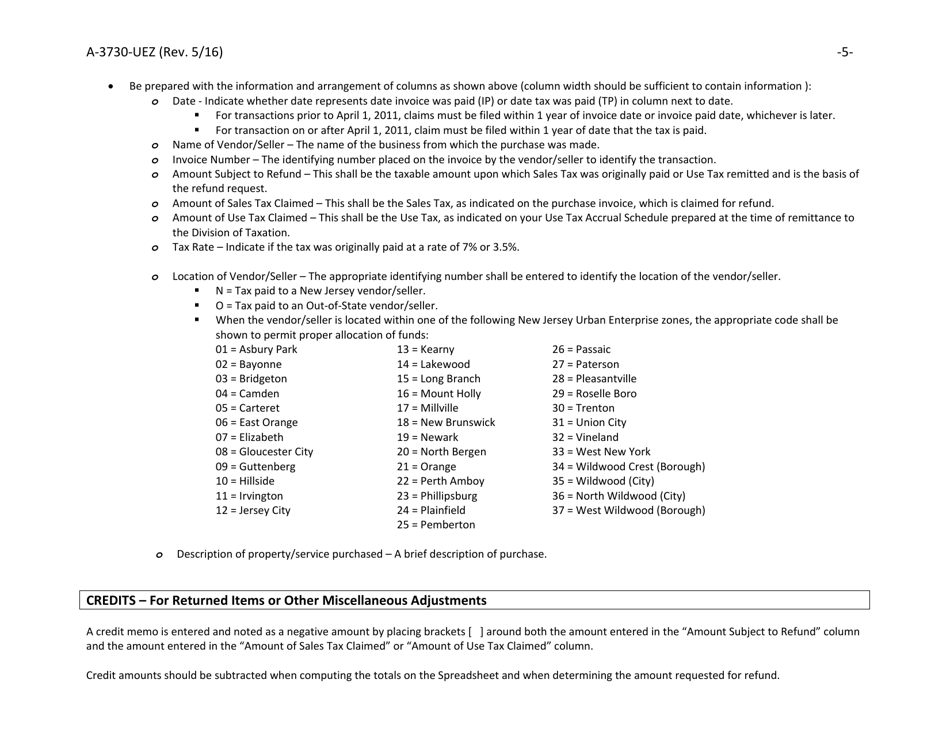

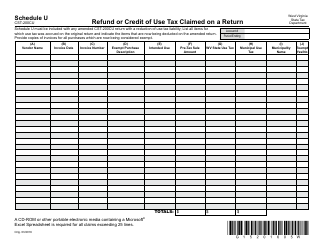

Q: What documentation is required to be submitted with Form A-3730?

A: Documentation such as receipts, invoices, and proof of payment may be required to support the tax claim for refund.

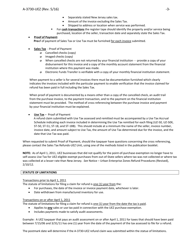

Q: What is the deadline for filing Form A-3730?

A: The deadline for filing Form A-3730 is determined by the New Jersey Division of Taxation, and it may vary depending on the specific tax year.

Q: Can I claim a refund for sales tax paid on property and services used outside of a qualified UEZ?

A: No, Form A-3730 is specifically for property and services used exclusively within a qualified UEZ, and sales tax paid on property and services used outside of the UEZ cannot be claimed for a refund.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.