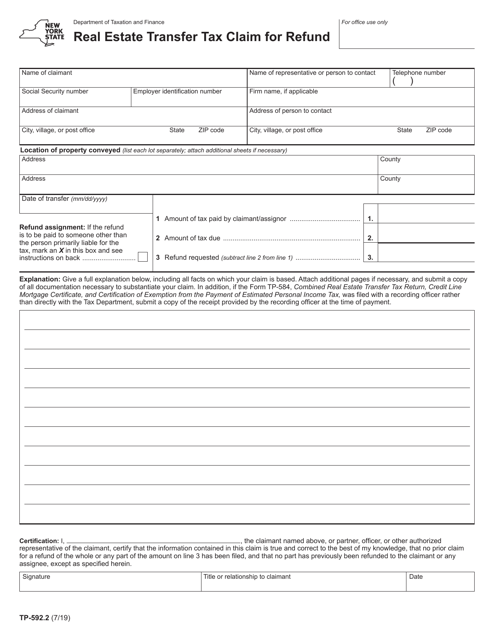

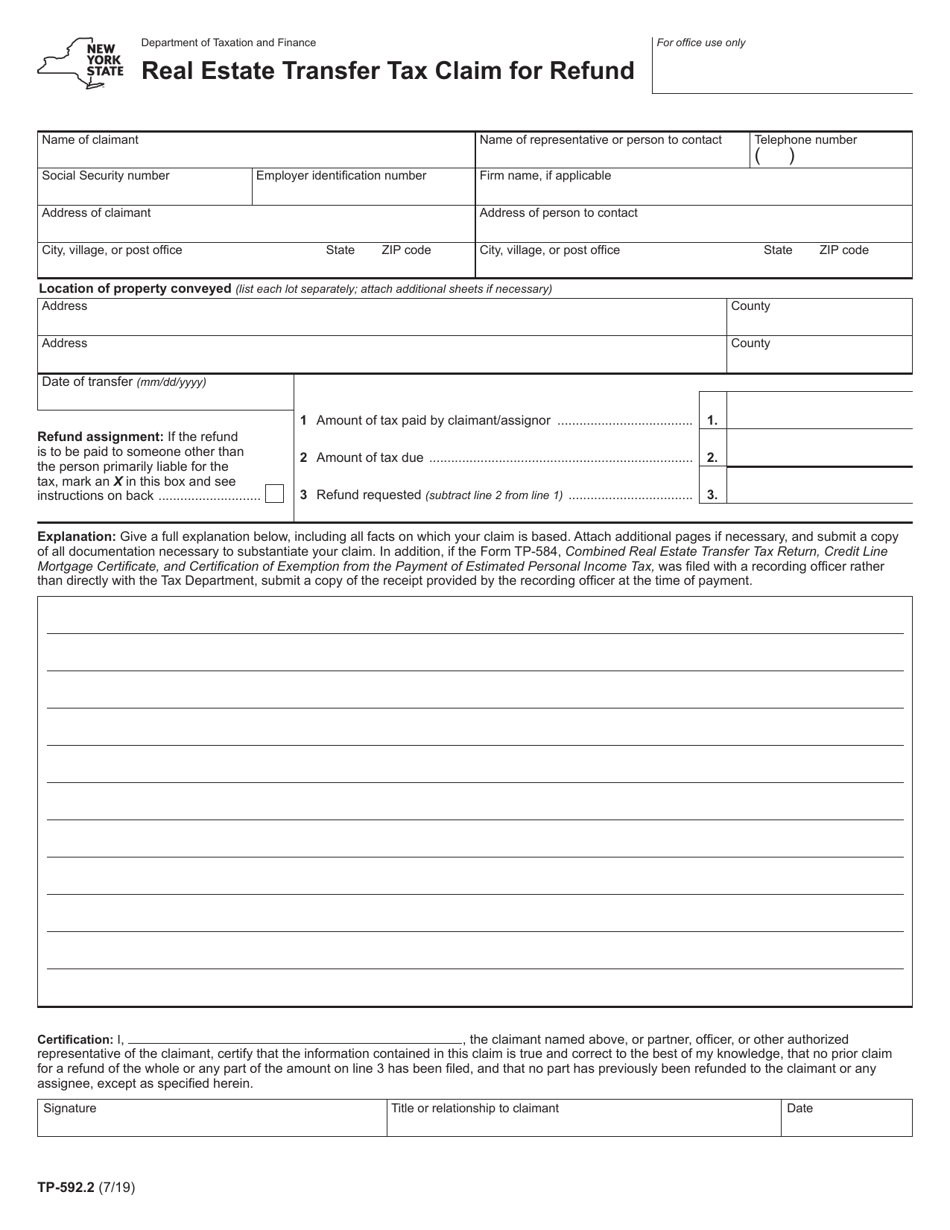

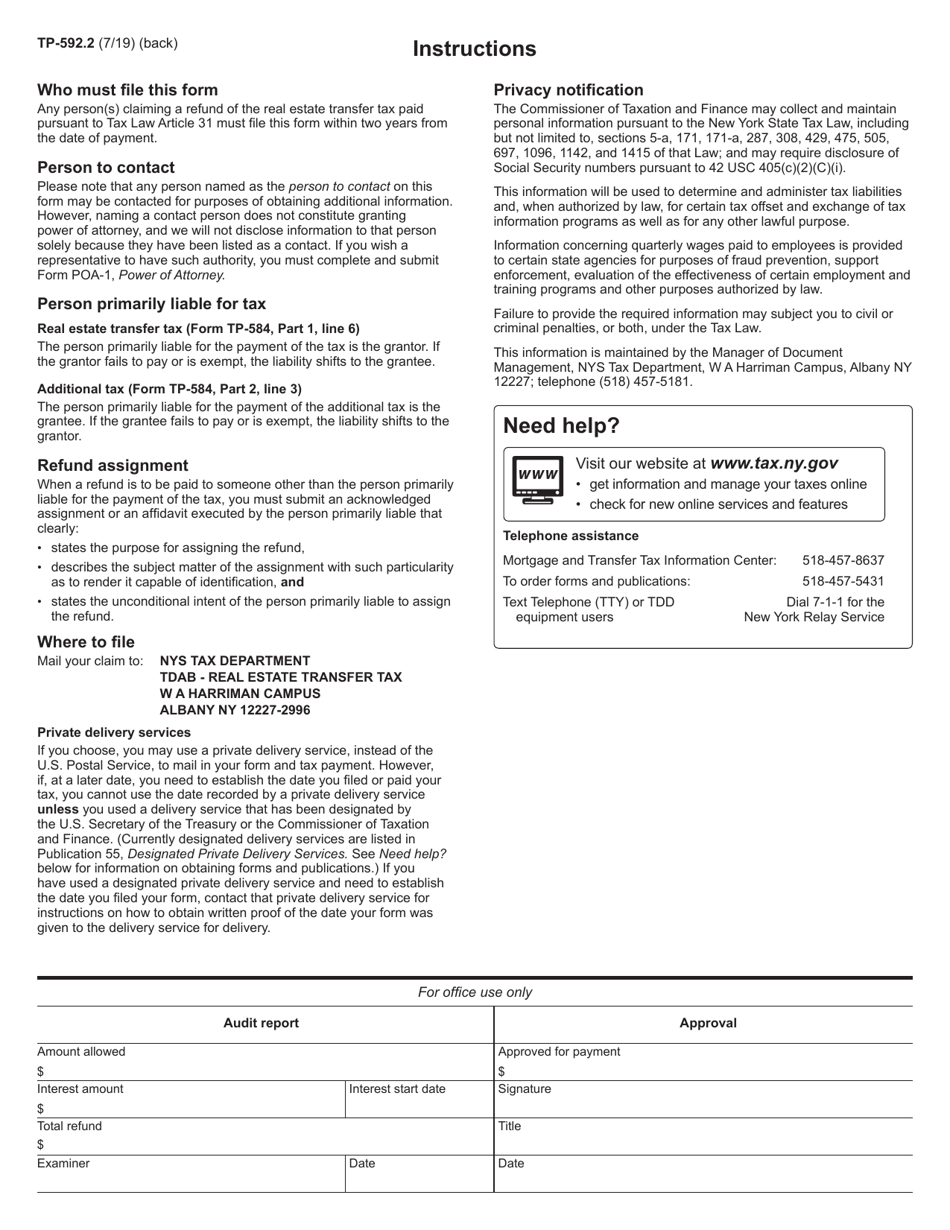

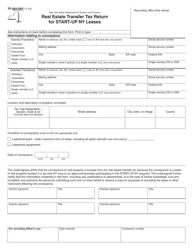

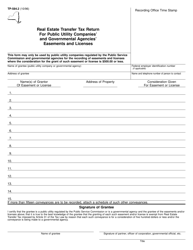

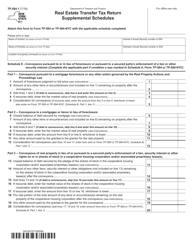

Form TP-592.2 Real Estate Transfer Tax Claim for Refund - New York

What Is Form TP-592.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form TP-592.2?

A: Form TP-592.2 is the Real Estate Transfer Tax Claim for Refund for New York.

Q: What is the purpose of form TP-592.2?

A: The purpose of form TP-592.2 is to claim a refund of real estate transfertax paid in New York.

Q: Who can use form TP-592.2?

A: Anyone who has paid real estate transfer tax in New York and is eligible for a refund can use form TP-592.2.

Q: How do I fill out form TP-592.2?

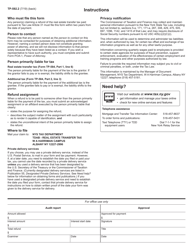

A: You need to provide information about the property, the transferor, the transferee, and the amount of tax paid. Follow the instructions on the form carefully.

Q: Are there any filing fees for form TP-592.2?

A: No, there are no filing fees for form TP-592.2.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-592.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.