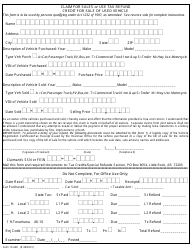

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2004-6

for the current year.

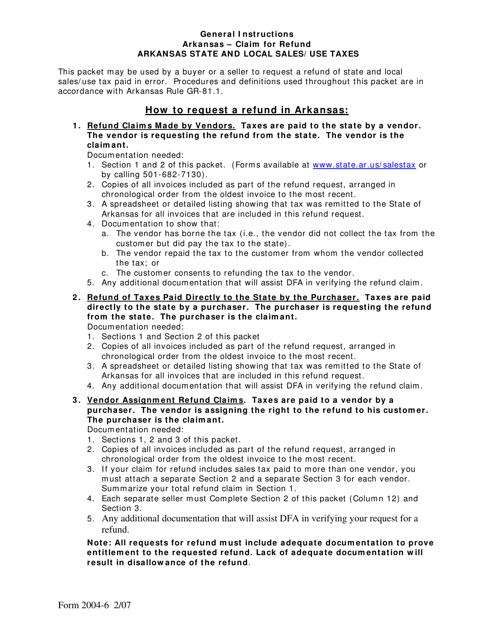

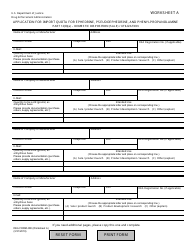

Form 2004-6 Arkansas State and Local Sales / Use Taxes Claim for Refund - Arkansas

What Is Form 2004-6?

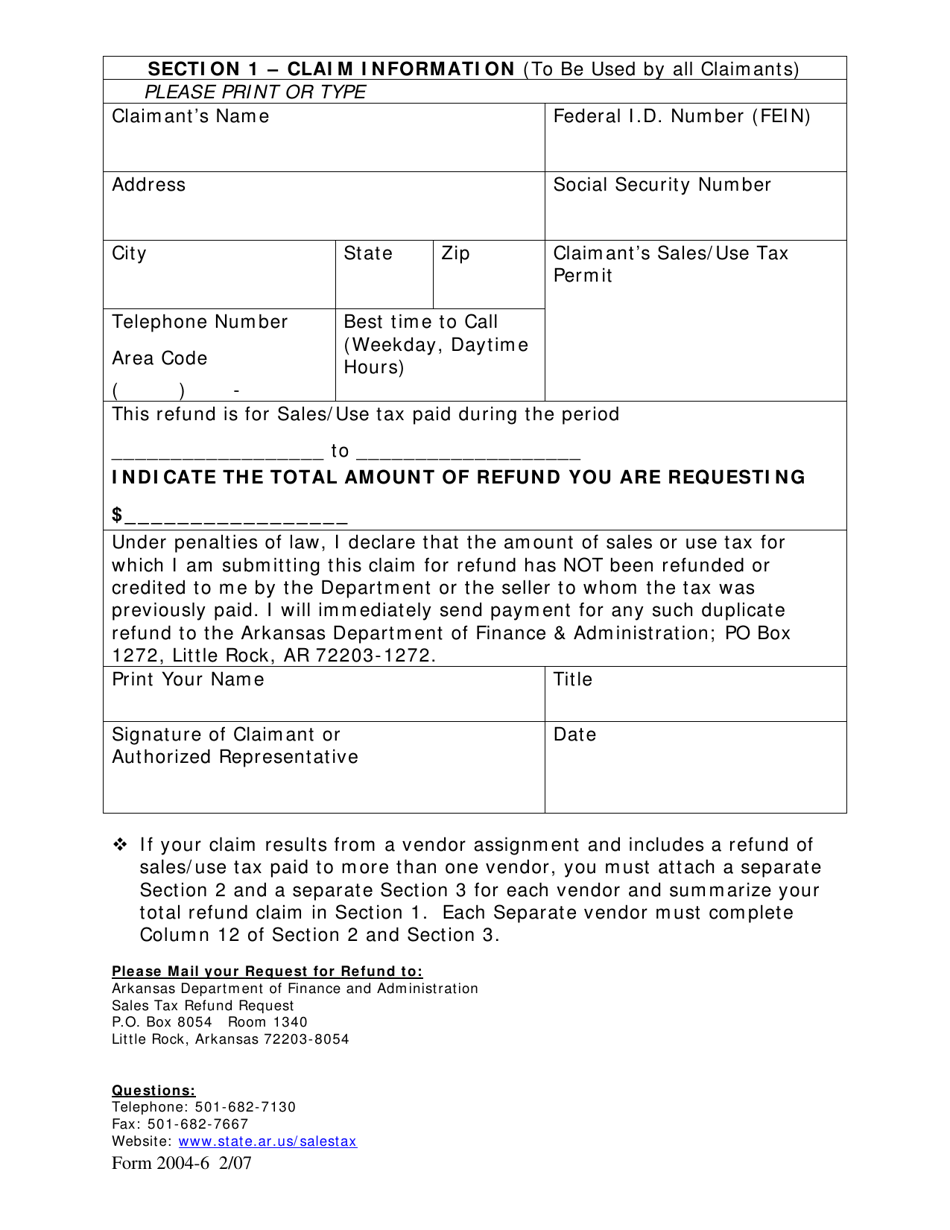

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

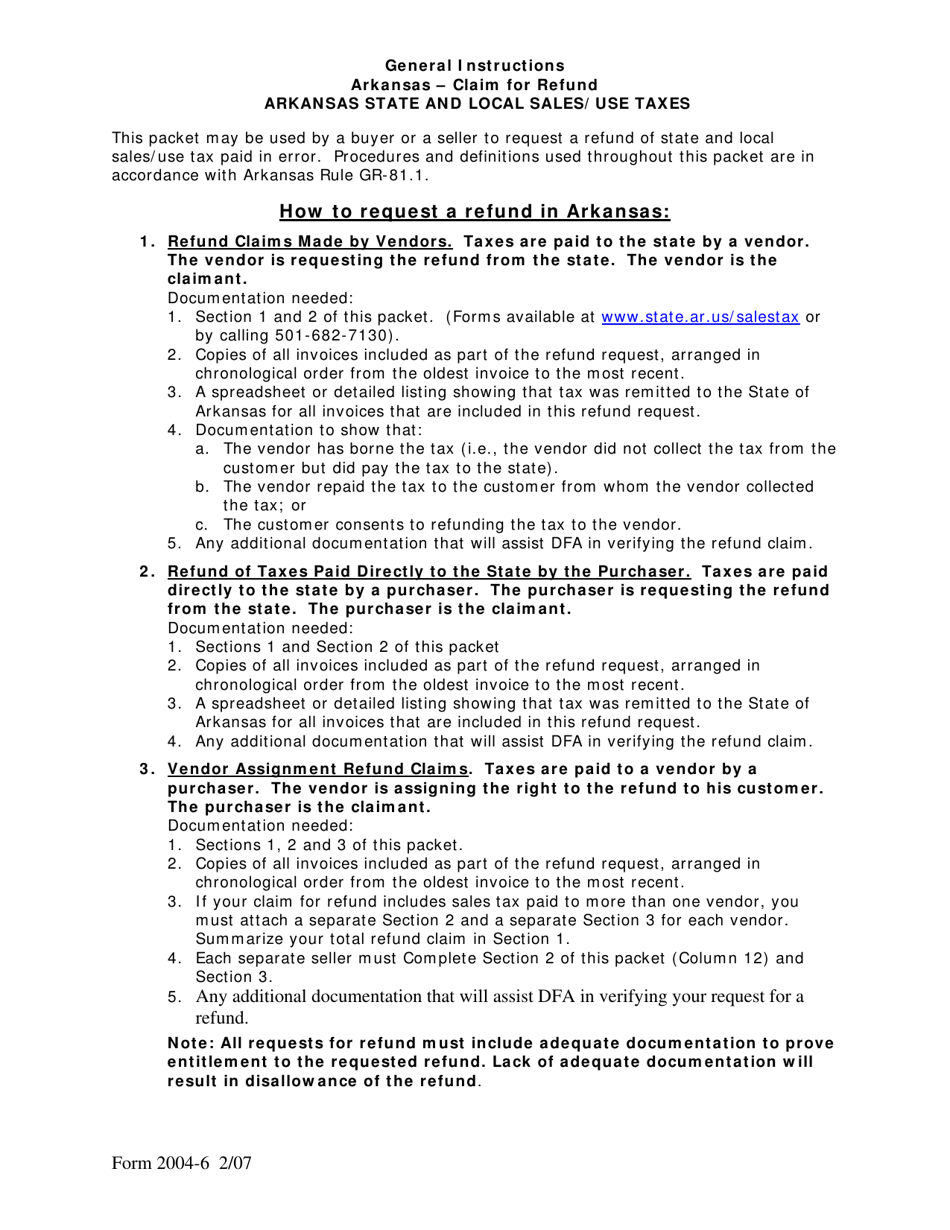

Q: What is the Form 2004-6?

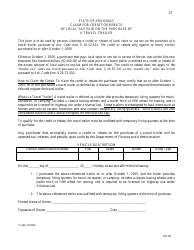

A: Form 2004-6 is a form used to claim a refund on state and local sales/use taxes in Arkansas.

Q: Who can use Form 2004-6?

A: Any individual or business that has paid state and local sales/use taxes in Arkansas can use Form 2004-6 to claim a refund.

Q: What taxes can be refunded using Form 2004-6?

A: Form 2004-6 can be used to claim a refund on both state and local sales/use taxes in Arkansas.

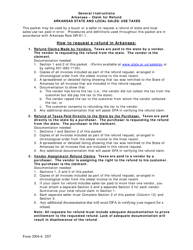

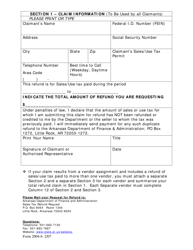

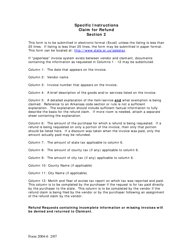

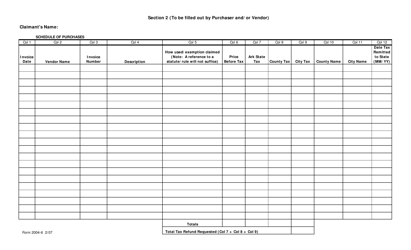

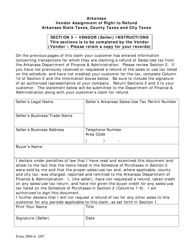

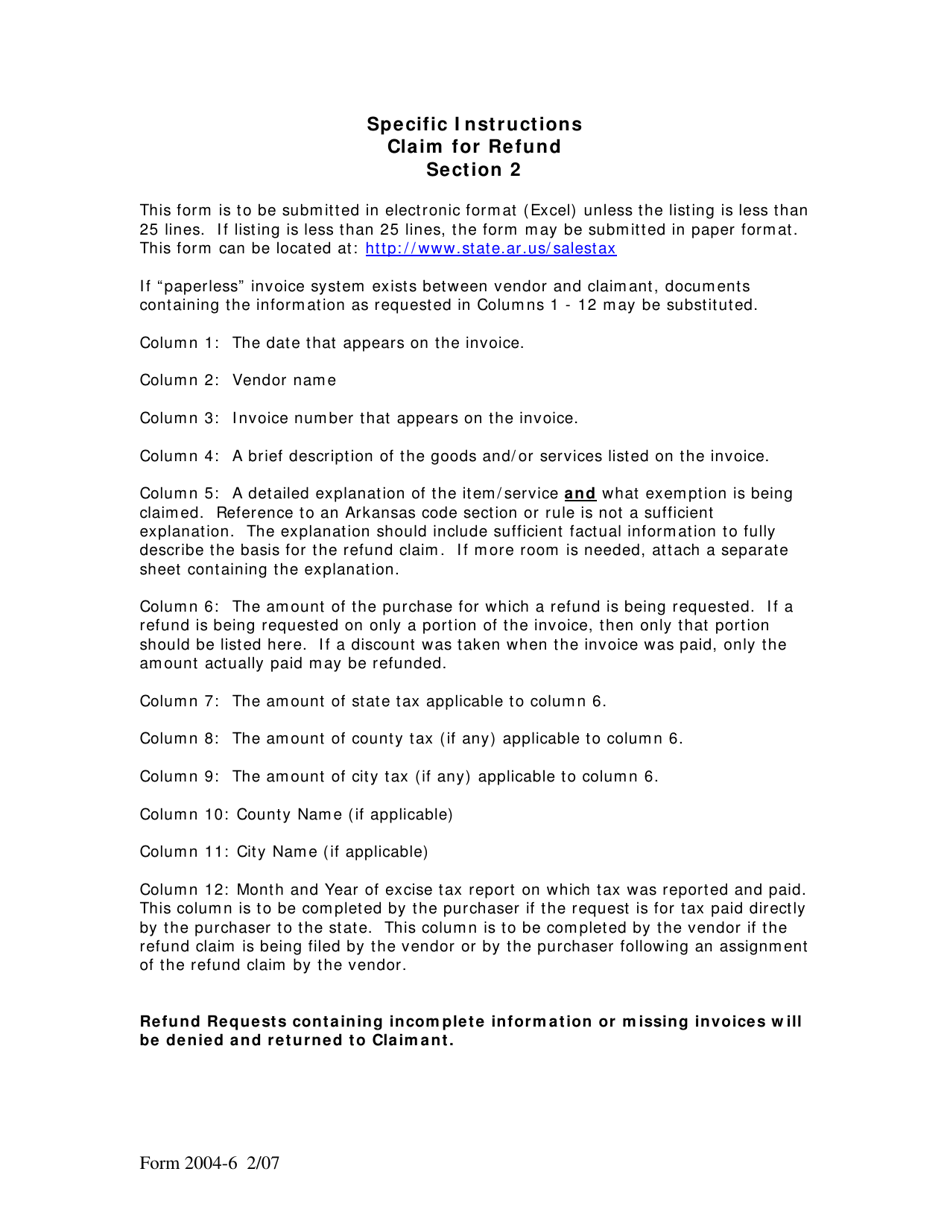

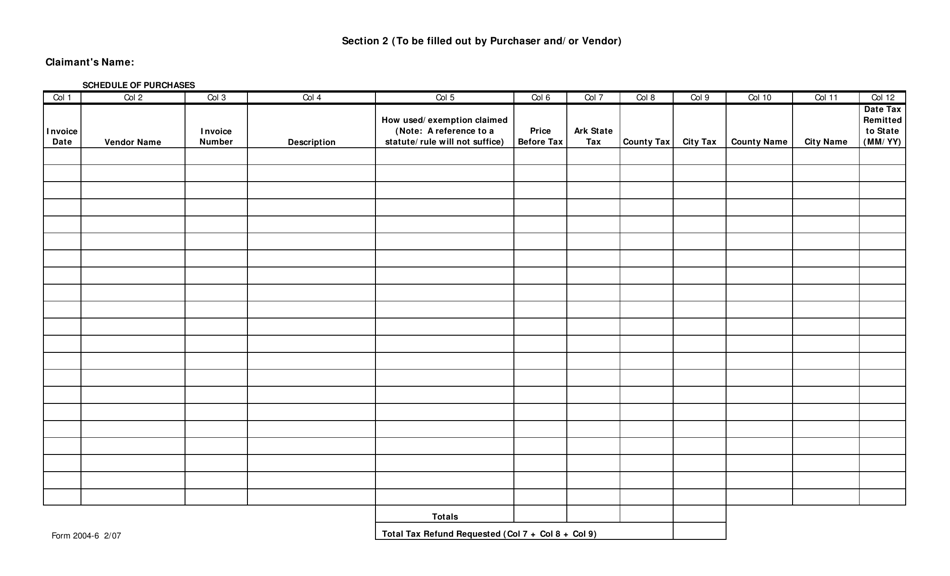

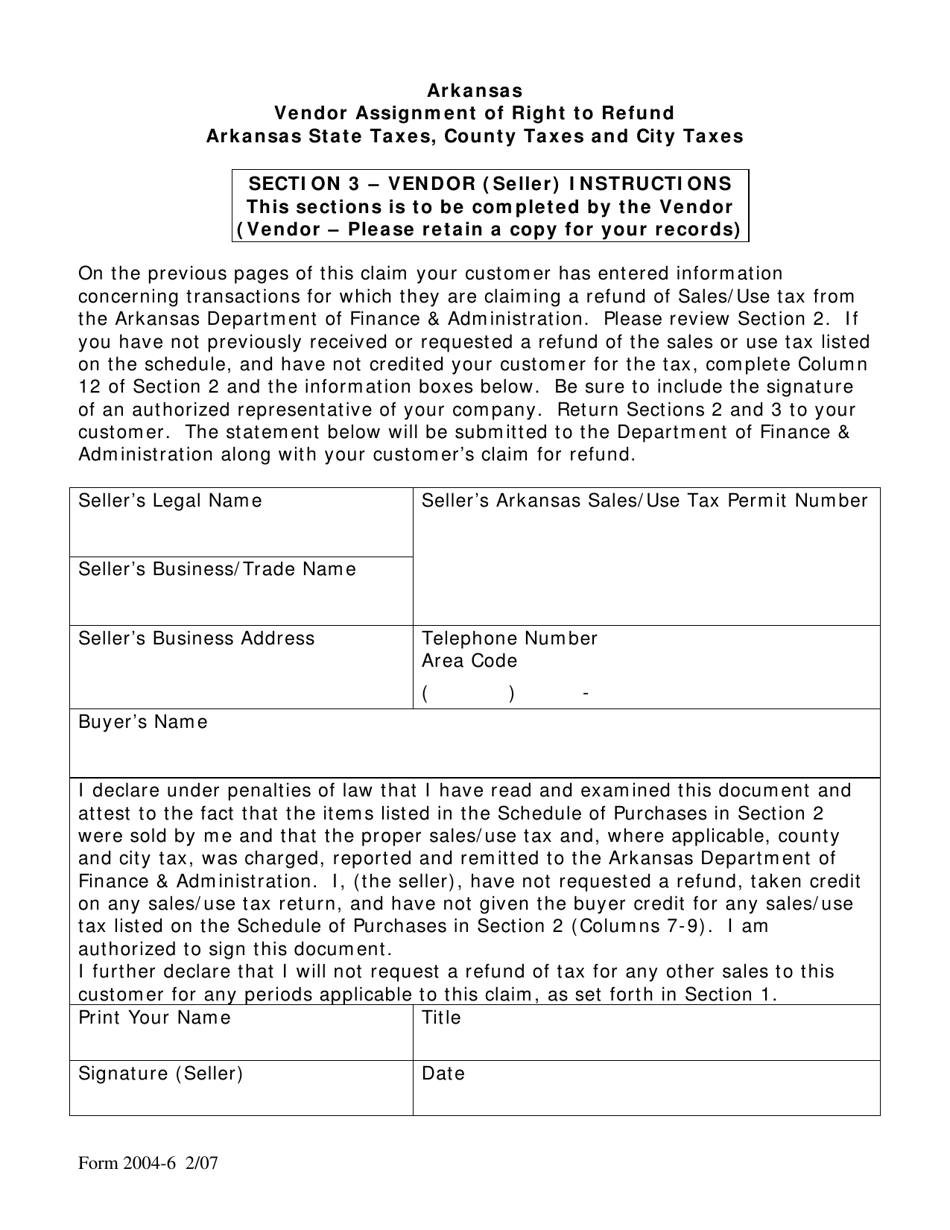

Q: How do I fill out Form 2004-6?

A: You need to provide personal and contact information, details of the taxes paid, and supporting documentation with Form 2004-6.

Q: What is the deadline to submit Form 2004-6?

A: Form 2004-6 must be submitted within three years from the date the taxes were paid.

Q: How long does it take to process a refund claim using Form 2004-6?

A: The processing time for refund claims varies, but you can expect to receive a refund within a few weeks to several months.

Form Details:

- Released on February 1, 2007;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2004-6 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.