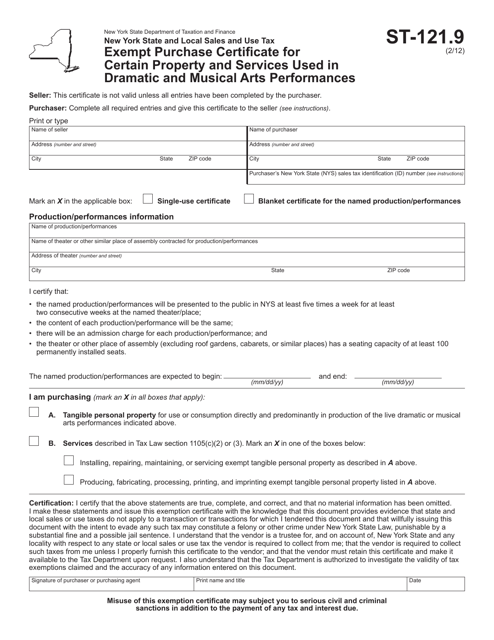

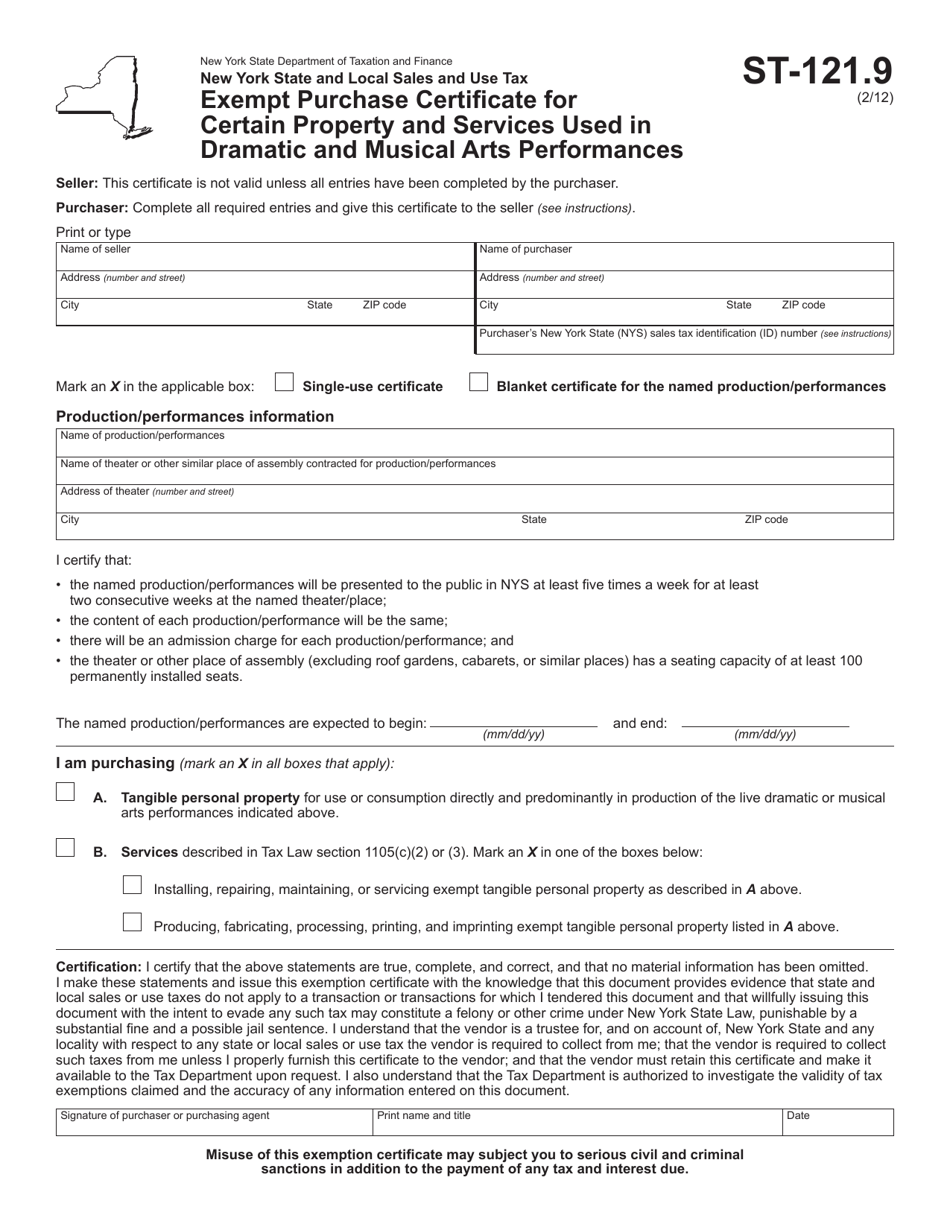

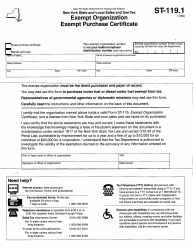

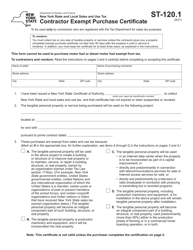

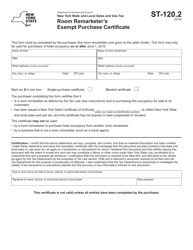

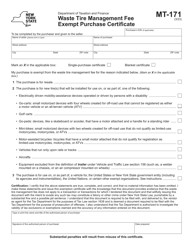

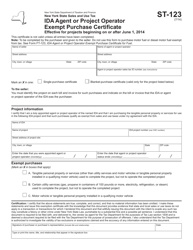

Form ST-121.9 Exempt Purchase Certificate for Certain Property and Services Used in Dramatic and Musical Arts Performances - New York

What Is Form ST-121.9?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-121.9?

A: Form ST-121.9 is the Exempt Purchase Certificate for Certain Property and Services Used in Dramatic and Musical Arts Performances in New York.

Q: What is the purpose of Form ST-121.9?

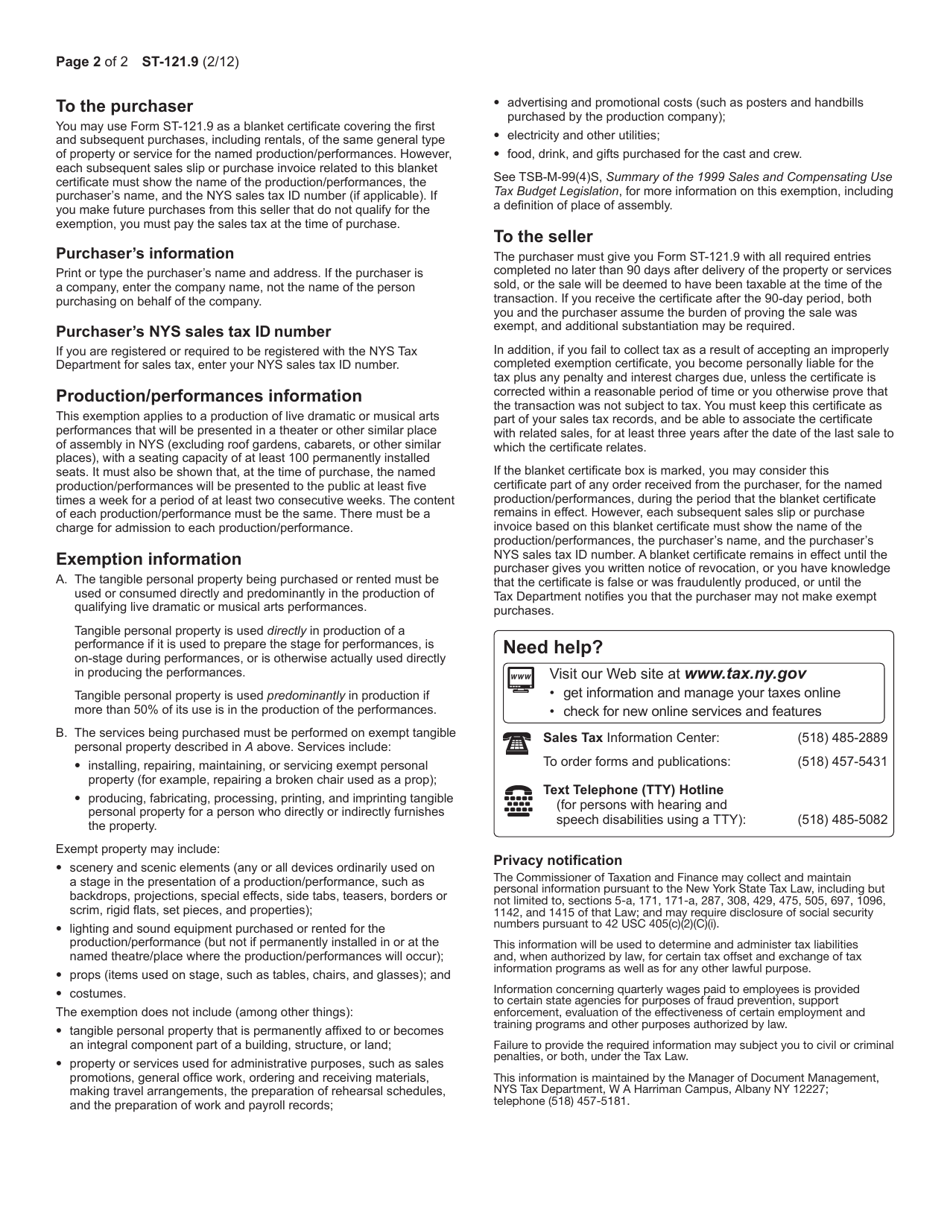

A: The purpose of Form ST-121.9 is to certify that certain property and services will be used exclusively in dramatic and musical arts performances, making them exempt from sales tax in New York.

Q: Who should use Form ST-121.9?

A: Form ST-121.9 should be used by individuals or organizations involved in dramatic and musical arts performances in New York.

Q: What qualifies as exempt property and services?

A: Property and services that are directly used in dramatic and musical arts performances, such as costumes, scenery, sound equipment, and lighting, may qualify as exempt.

Q: Are there any deadlines for filing Form ST-121.9?

A: There are no specific deadlines for filing Form ST-121.9, but it should be filed before the exempt purchases are made.

Q: Can I use Form ST-121.9 for all types of performances?

A: Form ST-121.9 can only be used for dramatic and musical arts performances in New York.

Form Details:

- Released on February 1, 2012;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-121.9 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.