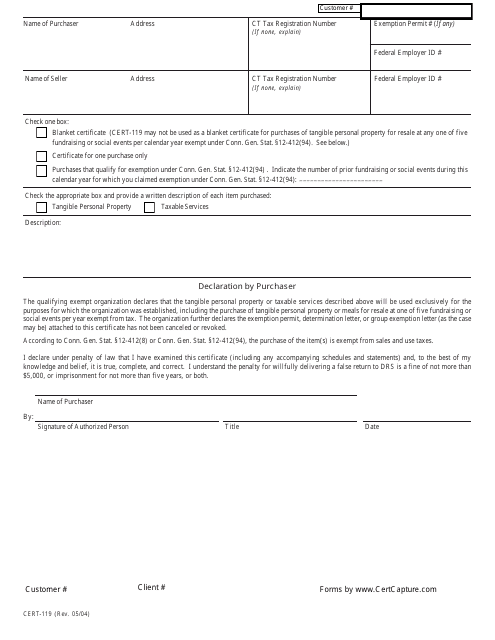

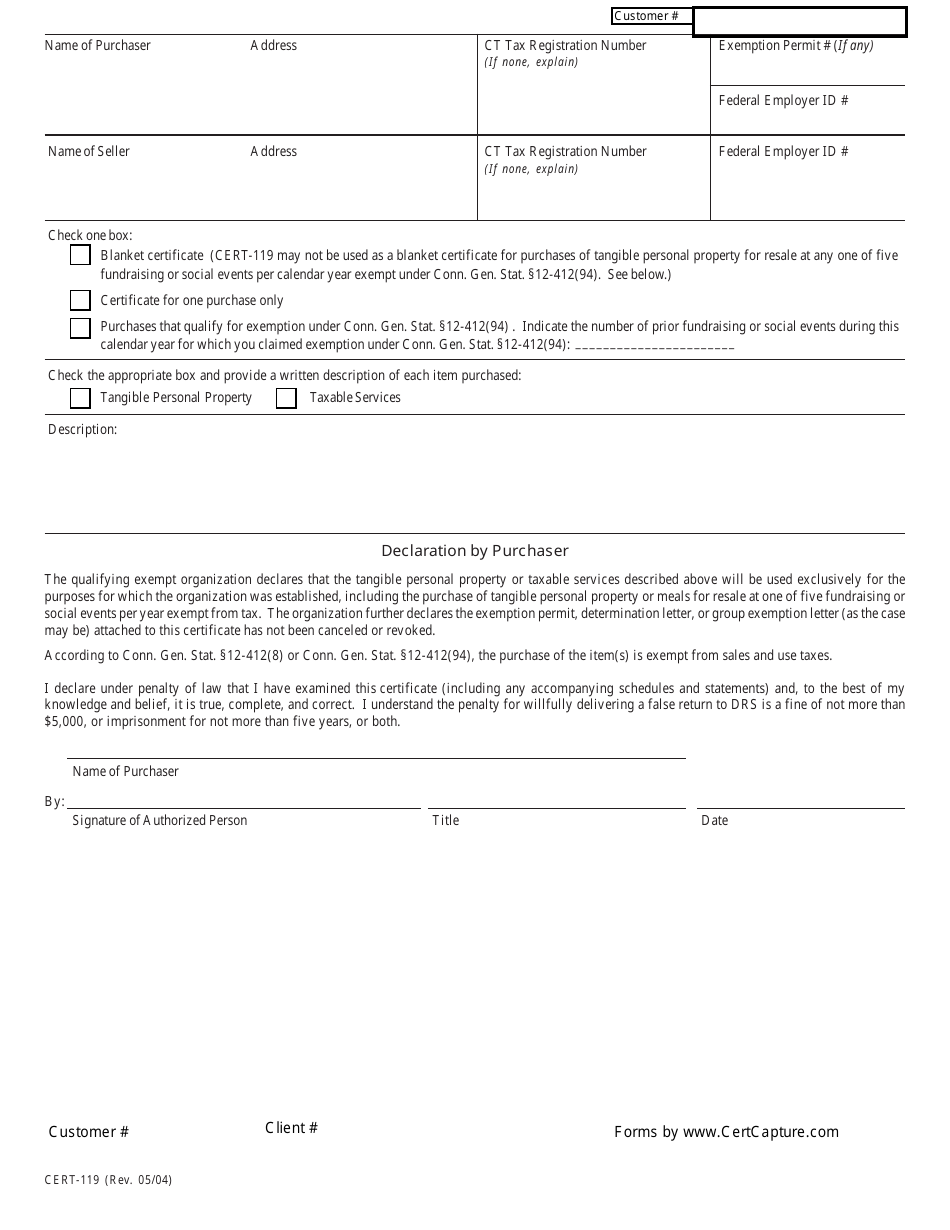

Form CERT-119 Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations - Connecticut

What Is Form CERT-119?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form CERT-119?

A: Form CERT-119 is a document used for reporting purchases of tangible personal property and services by qualifying exempt organizations in Connecticut.

Q: Who needs to file form CERT-119?

A: Qualifying exempt organizations in Connecticut need to file form CERT-119.

Q: What information is required on form CERT-119?

A: Form CERT-119 requires information such as the organization's name, address, federal employer identification number, and details of the purchases made.

Q: When is form CERT-119 due?

A: Form CERT-119 is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing form CERT-119?

A: Yes, there are penalties for not filing form CERT-119 or filing it late. The penalties can vary based on the amount of purchases made by the organization.

Form Details:

- Released on May 1, 2004;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CERT-119 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.