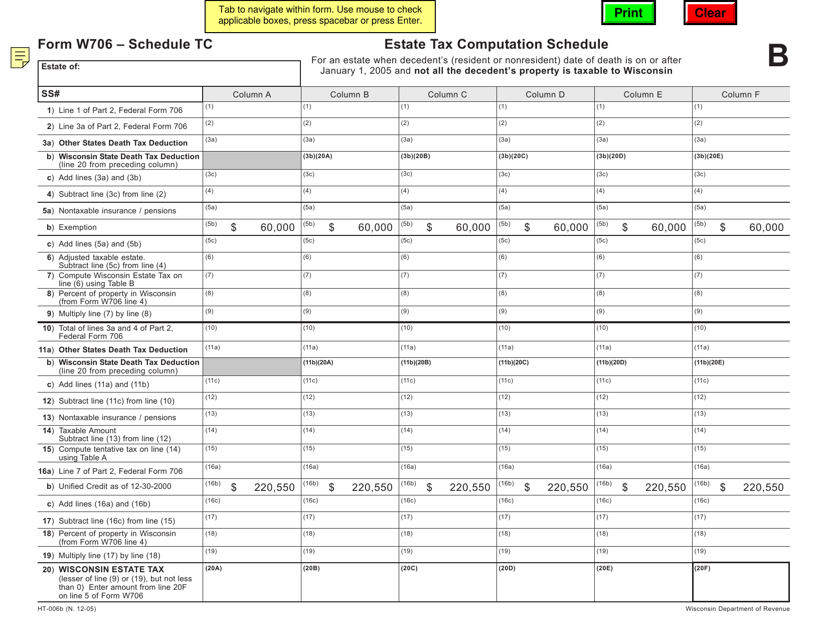

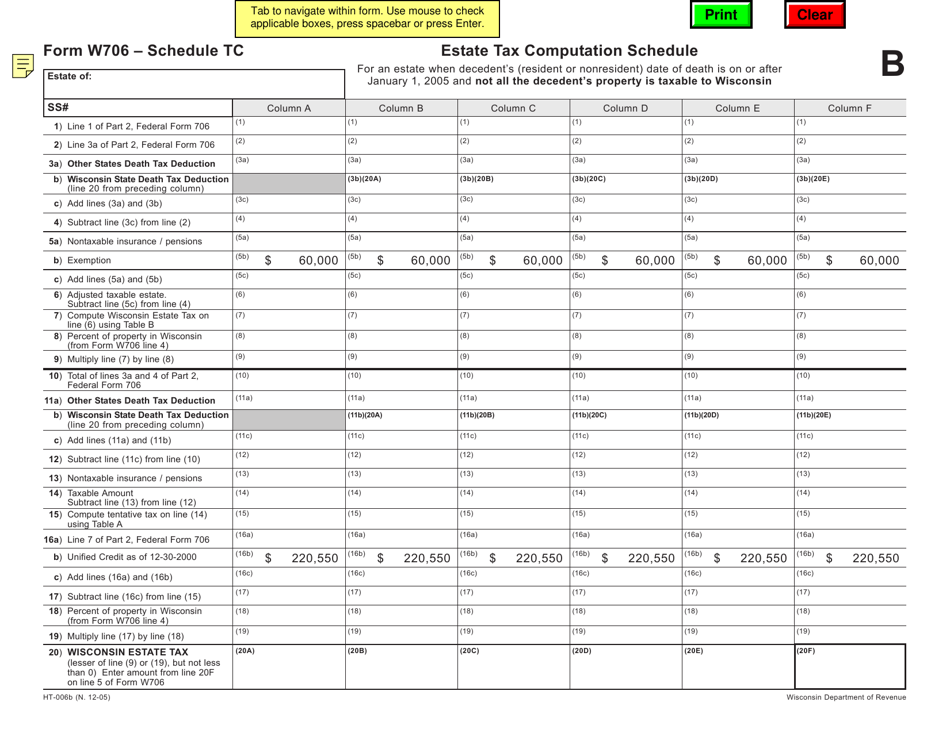

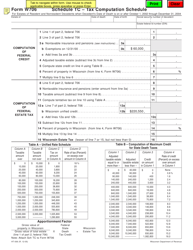

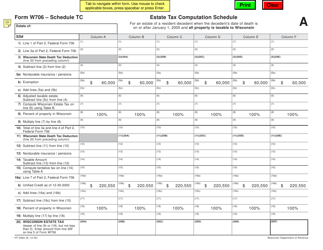

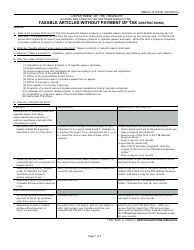

Form W706 (HT-006B) Schedule TC-B Tax Computation Schedule for Deaths on or After January 1, 2005 and Not All the Decedent's Property Is Taxable to Wisconsin - Wisconsin

What Is Form W706 (HT-006B) Schedule TC-B?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin.The document is a supplement to Form W706, Wisconsin Estate Tax Return for Estates of Resident and Nonresident Decedents. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W706 (HT-006B)?

A: Form W706 (HT-006B) is the Tax Computation Schedule for Deaths on or After January 1, 2005 and Not All the Decedent's Property Is Taxable to Wisconsin in Wisconsin.

Q: What is the purpose of Form W706 (HT-006B)?

A: The purpose of Form W706 (HT-006B) is to calculate the correct tax amount for deaths occurring on or after January 1, 2005, when not all of the decedent's property is taxable to Wisconsin.

Q: Who needs to file Form W706 (HT-006B)?

A: Form W706 (HT-006B) needs to be filed by individuals who have a death occurring on or after January 1, 2005, and not all of the decedent's property is taxable to Wisconsin.

Q: When is Form W706 (HT-006B) due?

A: Form W706 (HT-006B) is due when filing the Wisconsin estate tax return, which is generally due nine months after the decedent's death.

Q: Is there a penalty for not filing Form W706 (HT-006B)?

A: Yes, there may be penalties for not filing Form W706 (HT-006B) or filing it late. It is important to timely file all required forms.

Q: What should I do if I need help with Form W706 (HT-006B)?

A: If you need help with Form W706 (HT-006B), you can contact the Wisconsin Department of Revenue or consult a tax professional for assistance.

Form Details:

- Released on December 1, 2005;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W706 (HT-006B) Schedule TC-B by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.