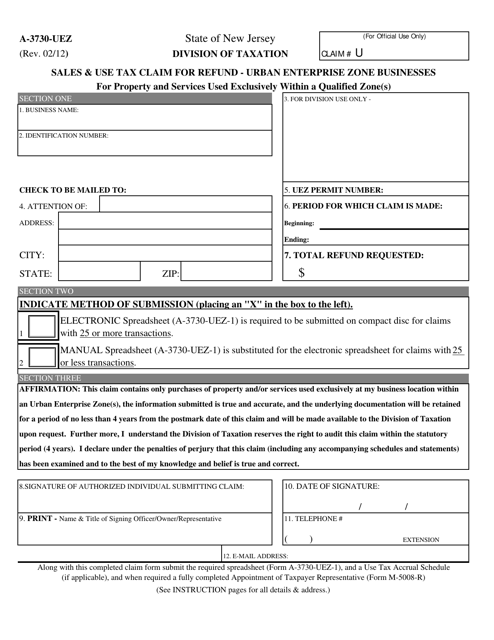

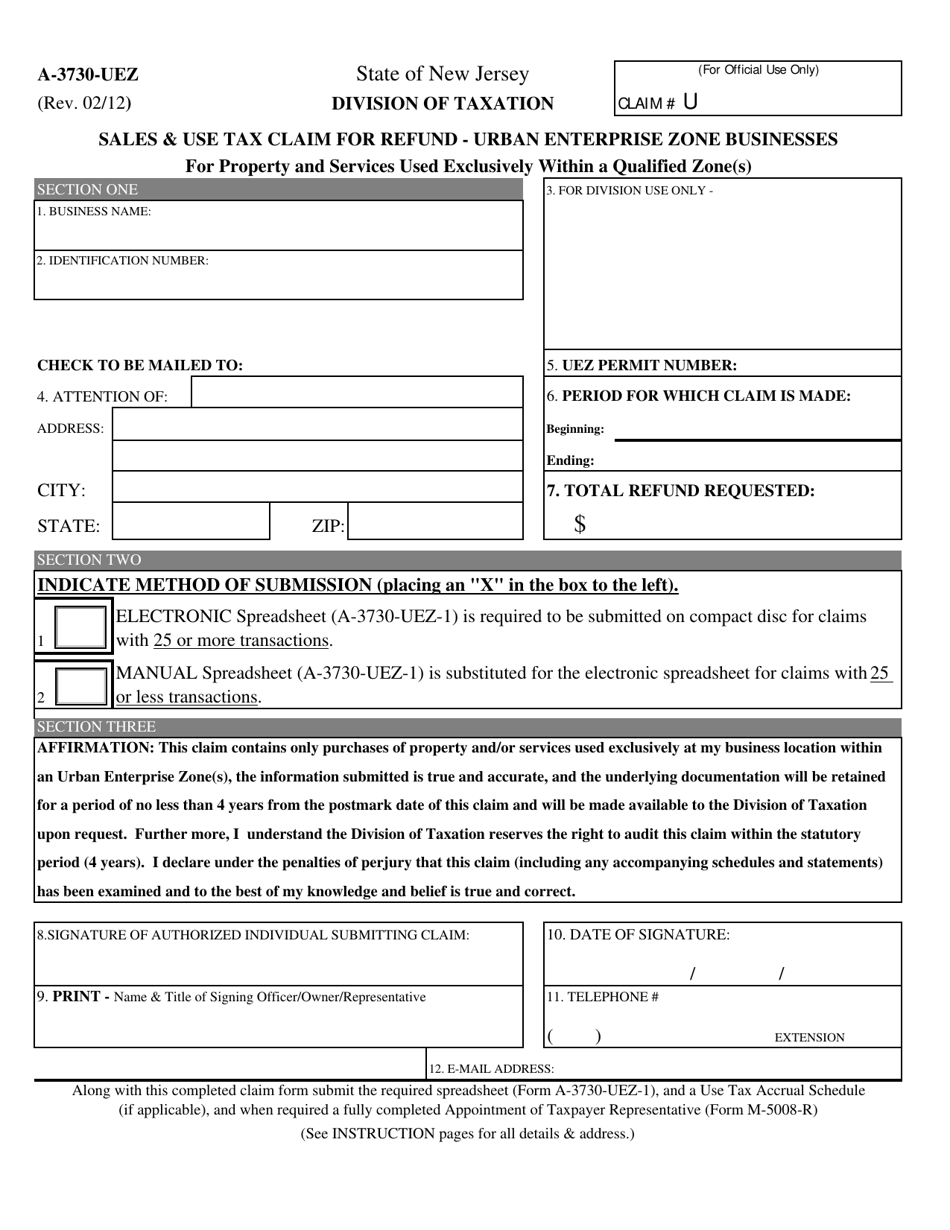

Form A-3730-UEZ Sales & Use Tax Claim for Refund - Urban Enterprise Zone Businesses for Property and Services Used Exclusively Within a Qualified Zone(S) - New Jersey

What Is Form A-3730-UEZ?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-3730-UEZ?

A: Form A-3730-UEZ is a Sales & Use Tax Claim for Refund form specifically for Urban Enterprise Zone Businesses.

Q: What is the purpose of Form A-3730-UEZ?

A: The purpose of Form A-3730-UEZ is to claim a refund for sales and use tax paid on property and services used exclusively within a qualified zone in New Jersey.

Q: Who can use Form A-3730-UEZ?

A: Form A-3730-UEZ can be used by businesses operating within a qualified Urban Enterprise Zone in New Jersey.

Q: What type of property and services can be claimed for refund?

A: Property and services that are used exclusively within a qualified zone and subject to sales and use tax can be claimed for refund using Form A-3730-UEZ.

Q: How should Form A-3730-UEZ be filed?

A: Form A-3730-UEZ should be filed with the New Jersey Division of Taxation.

Form Details:

- Released on February 1, 2012;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-3730-UEZ by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.