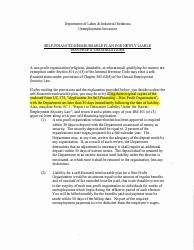

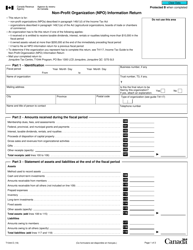

Keeping the Record Straight: Introductory Accounting for Not-For-Profit Organizations

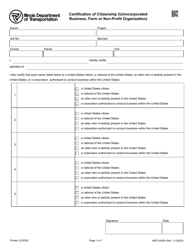

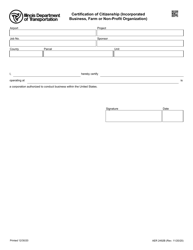

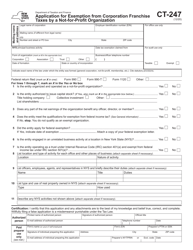

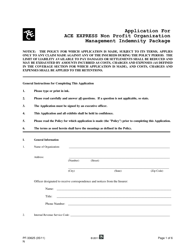

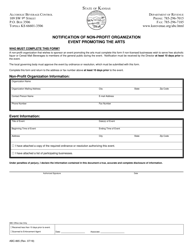

"Keeping the Record Straight: Introductory Accounting for Not-For-Profit Organizations" is a document designed to provide an introduction to accounting principles and practices specifically tailored to the operations of not-for-profit organizations. It aims to assist these organizations in effectively managing their financial records and reporting requirements.

FAQ

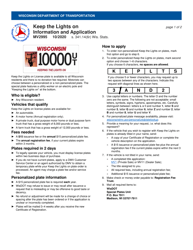

Q: What is the purpose of introductory accounting for not-for-profit organizations?

A: Introductory accounting for not-for-profit organizations helps in keeping track of financial records and understanding the financial health of the organization.

Q: What are not-for-profit organizations?

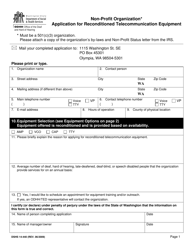

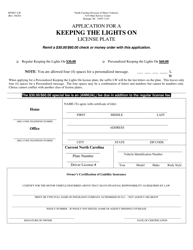

A: Not-for-profit organizations are entities that aim to provide services or benefits to the public, rather than generating profit for owners or shareholders.

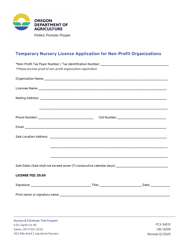

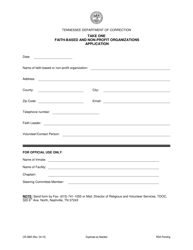

Q: What types of not-for-profit organizations are there?

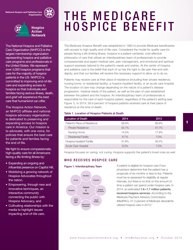

A: Not-for-profit organizations can include charities, religious organizations, educational institutions, healthcare facilities, and more.

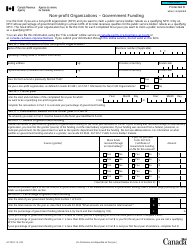

Q: What are some key financial terms used in introductory accounting for not-for-profit organizations?

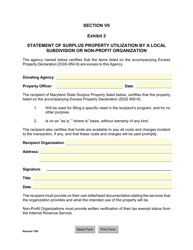

A: Some key financial terms used in introductory accounting for not-for-profit organizations include revenues, expenses, assets, liabilities, and net assets.

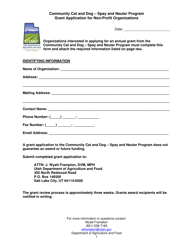

Q: What is the significance of understanding the financial health of a not-for-profit organization?

A: Understanding the financial health of a not-for-profit organization helps in making informed decisions, securing funding, and ensuring the sustainability of the organization's operations.