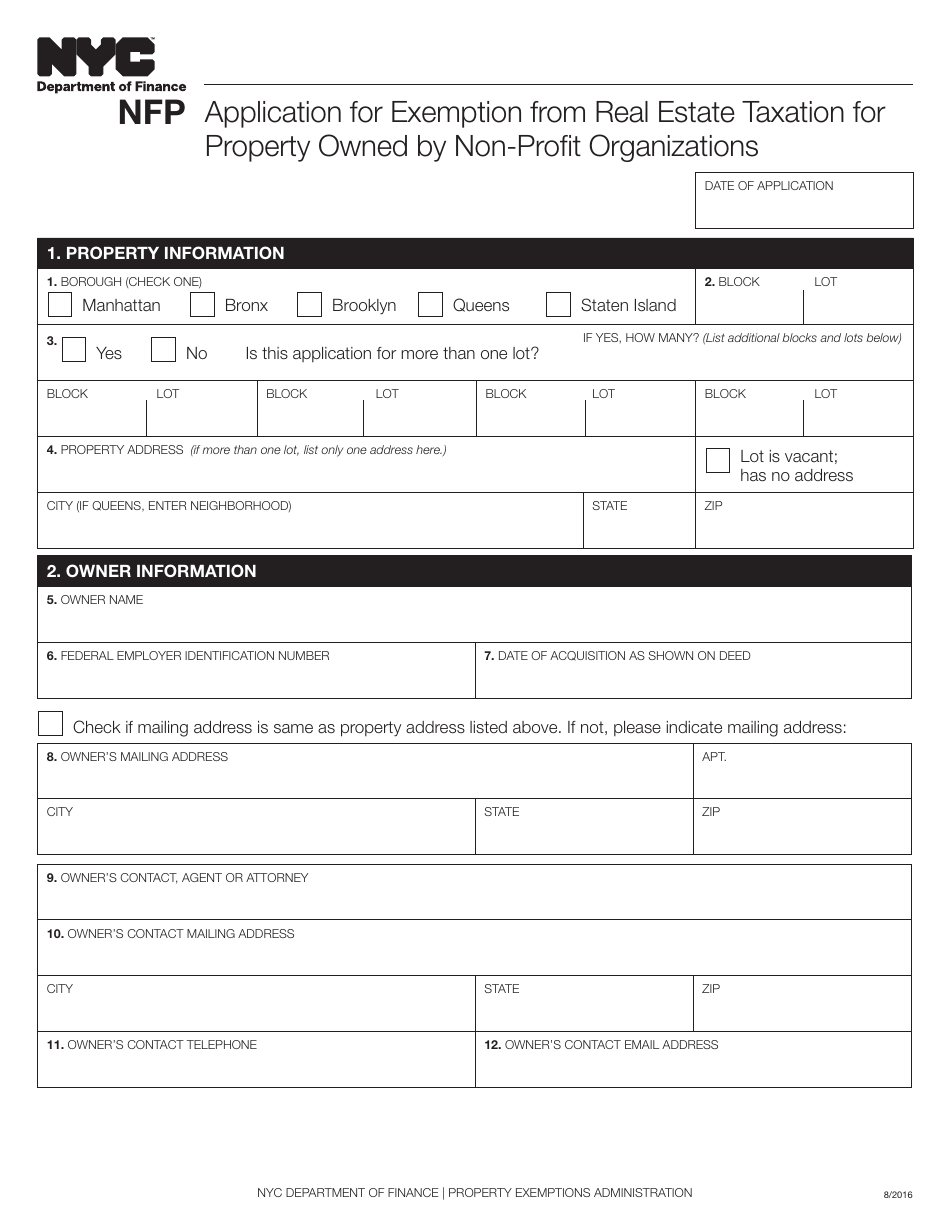

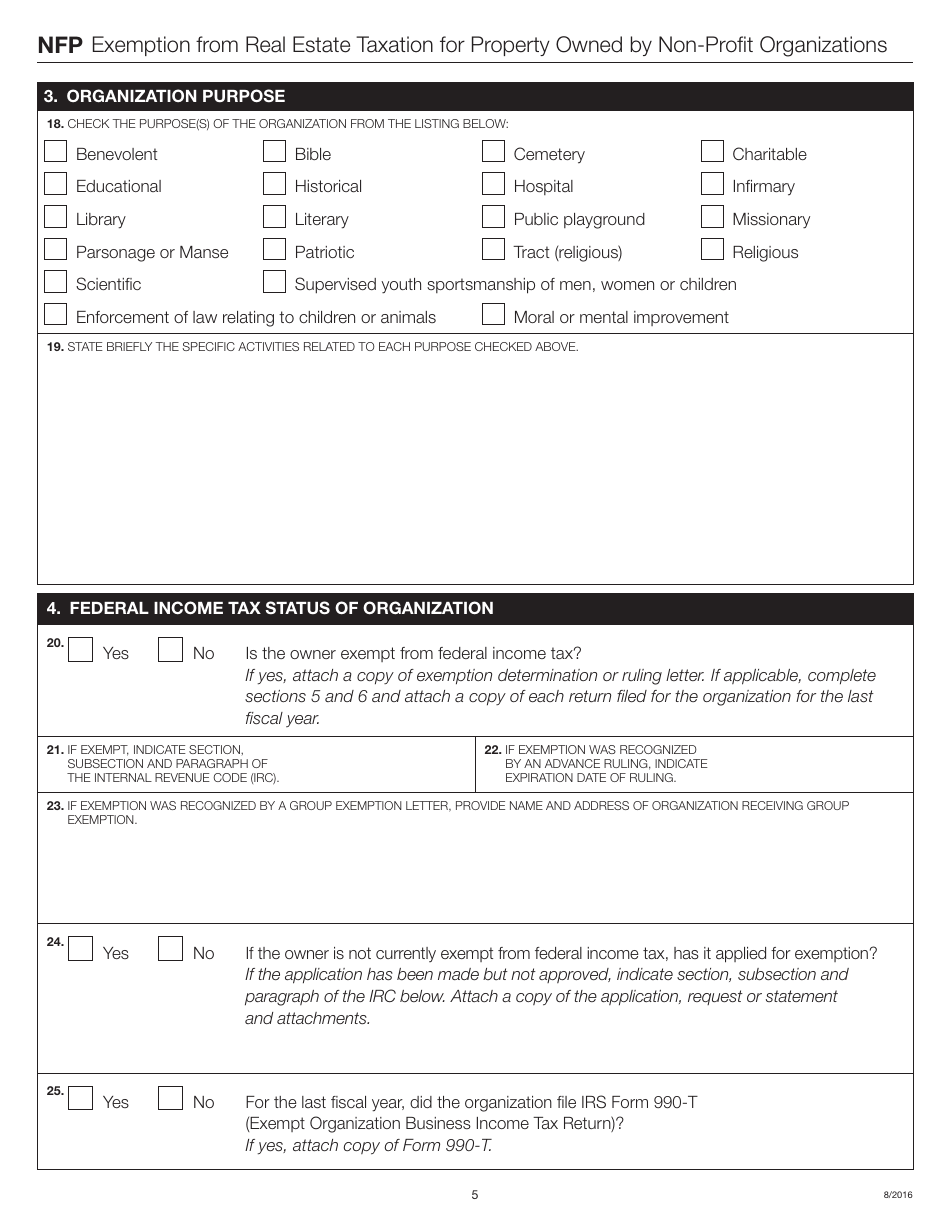

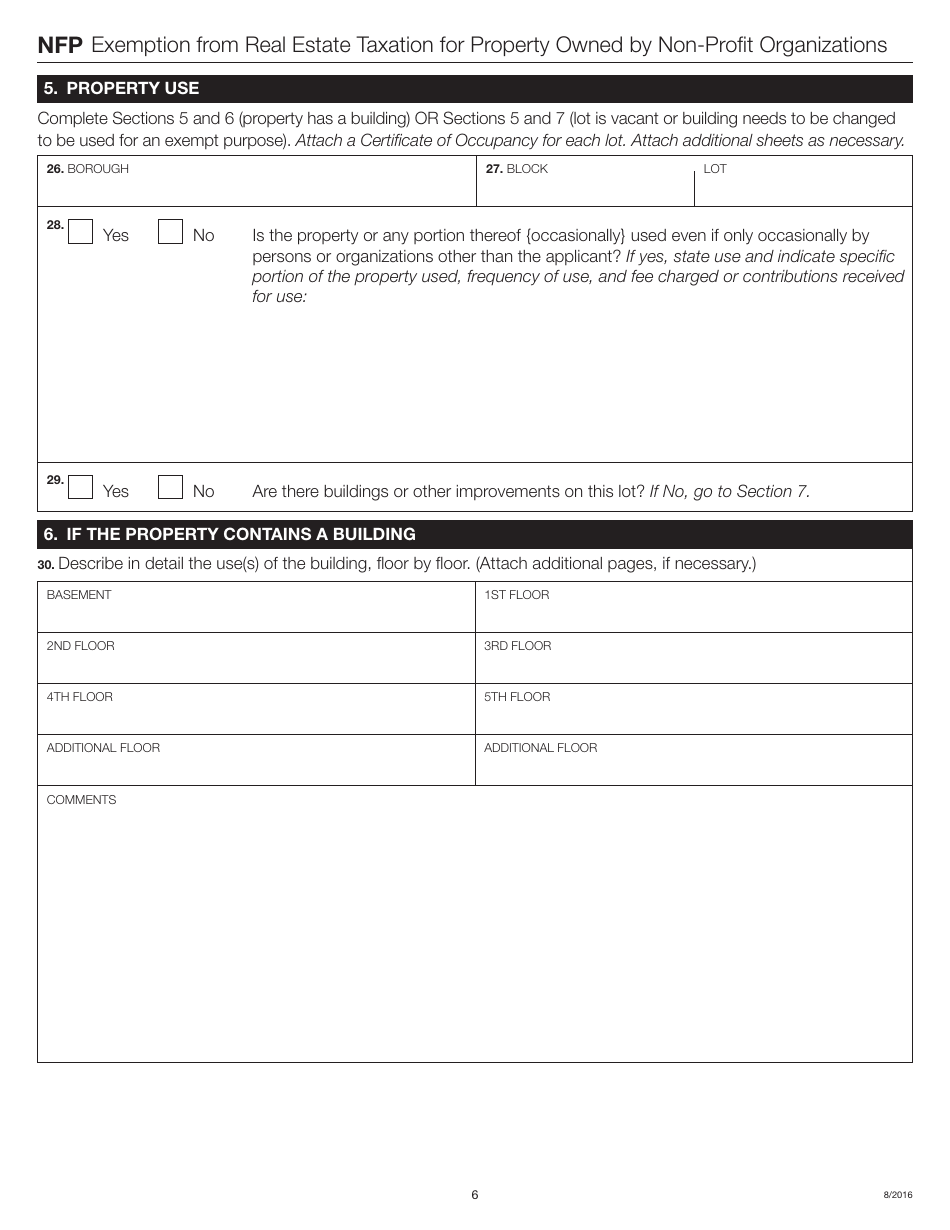

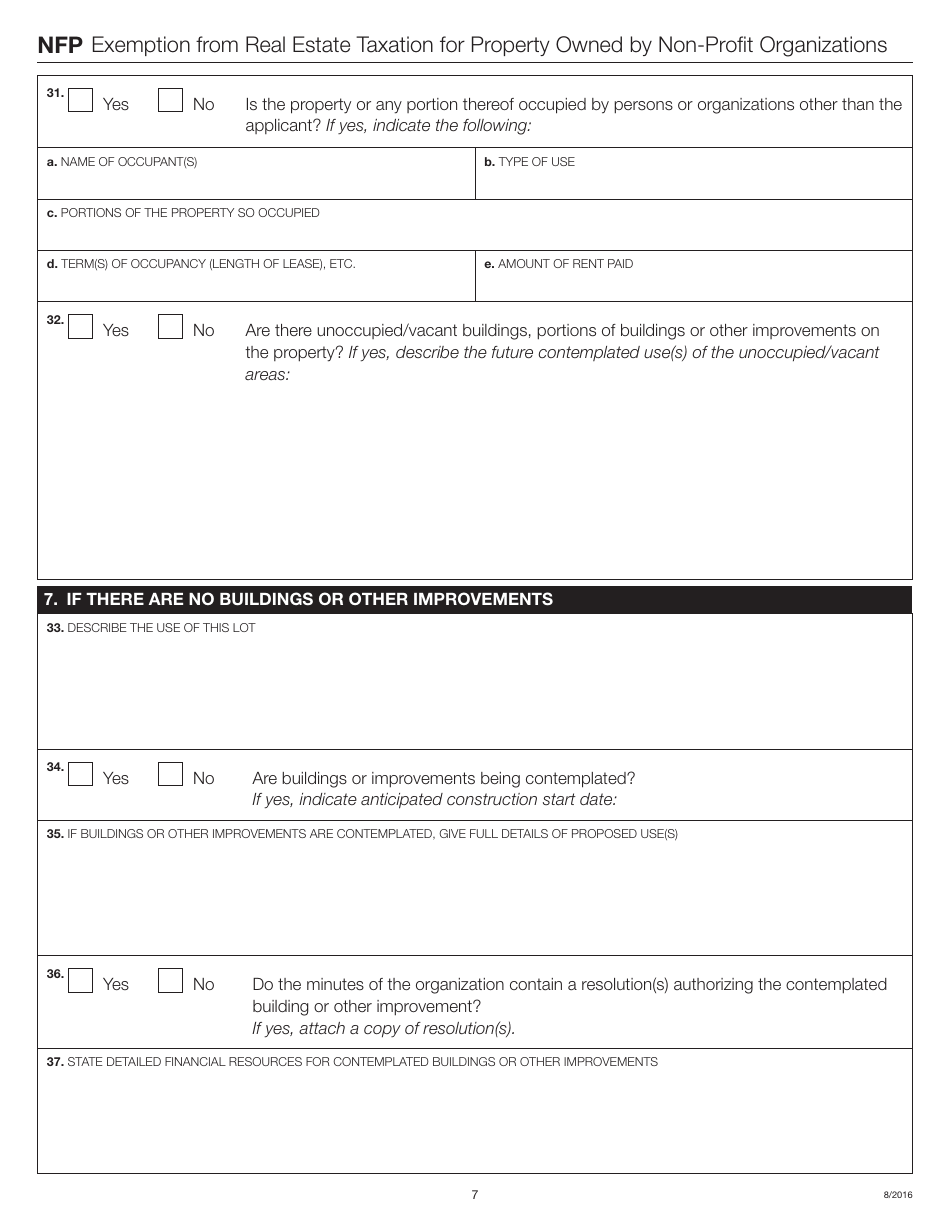

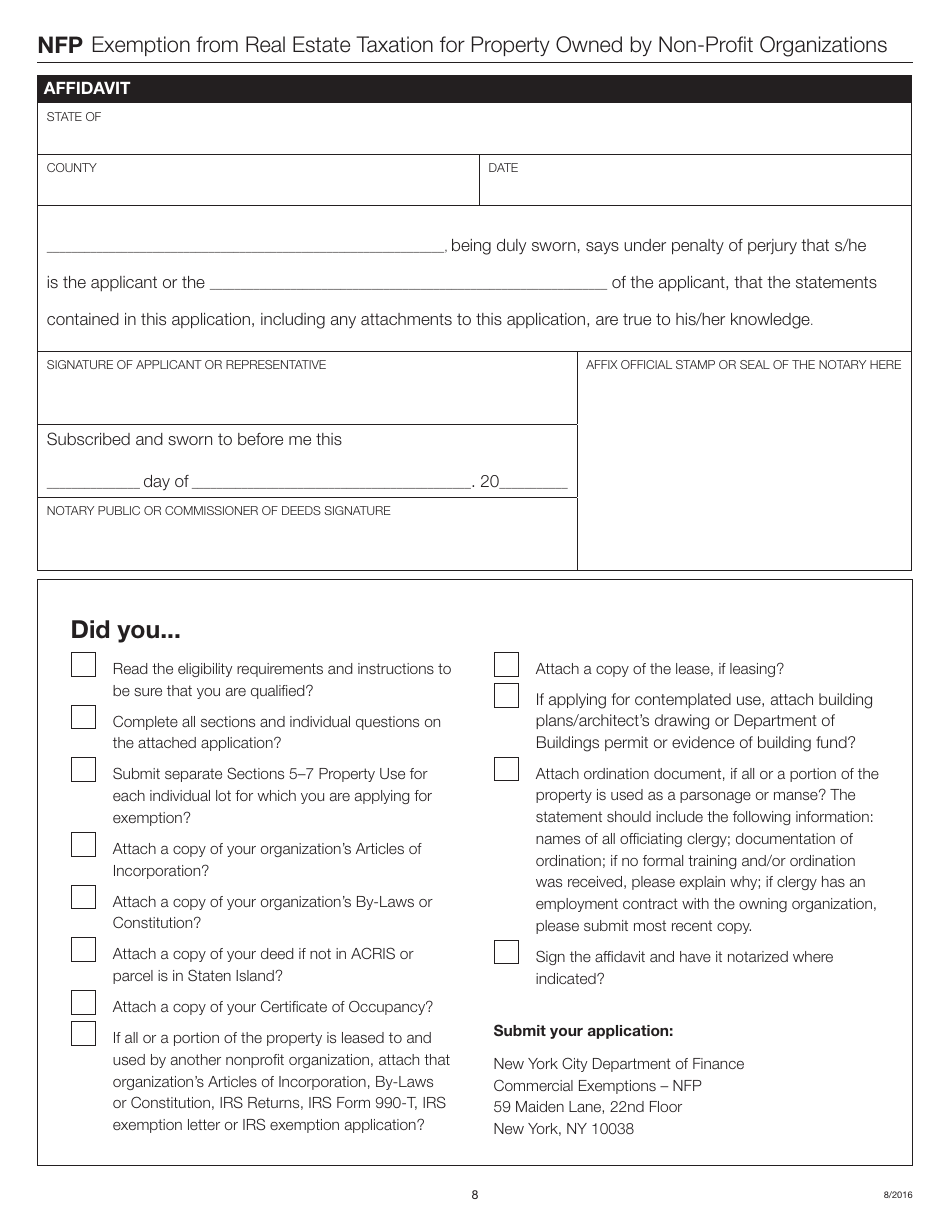

Form NFP Application for Exemption From Real Estate Taxation for Property Owned by Non-profit Organizations - New York City

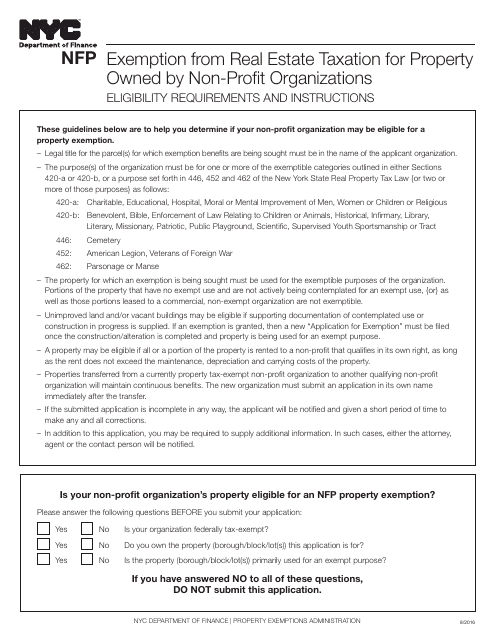

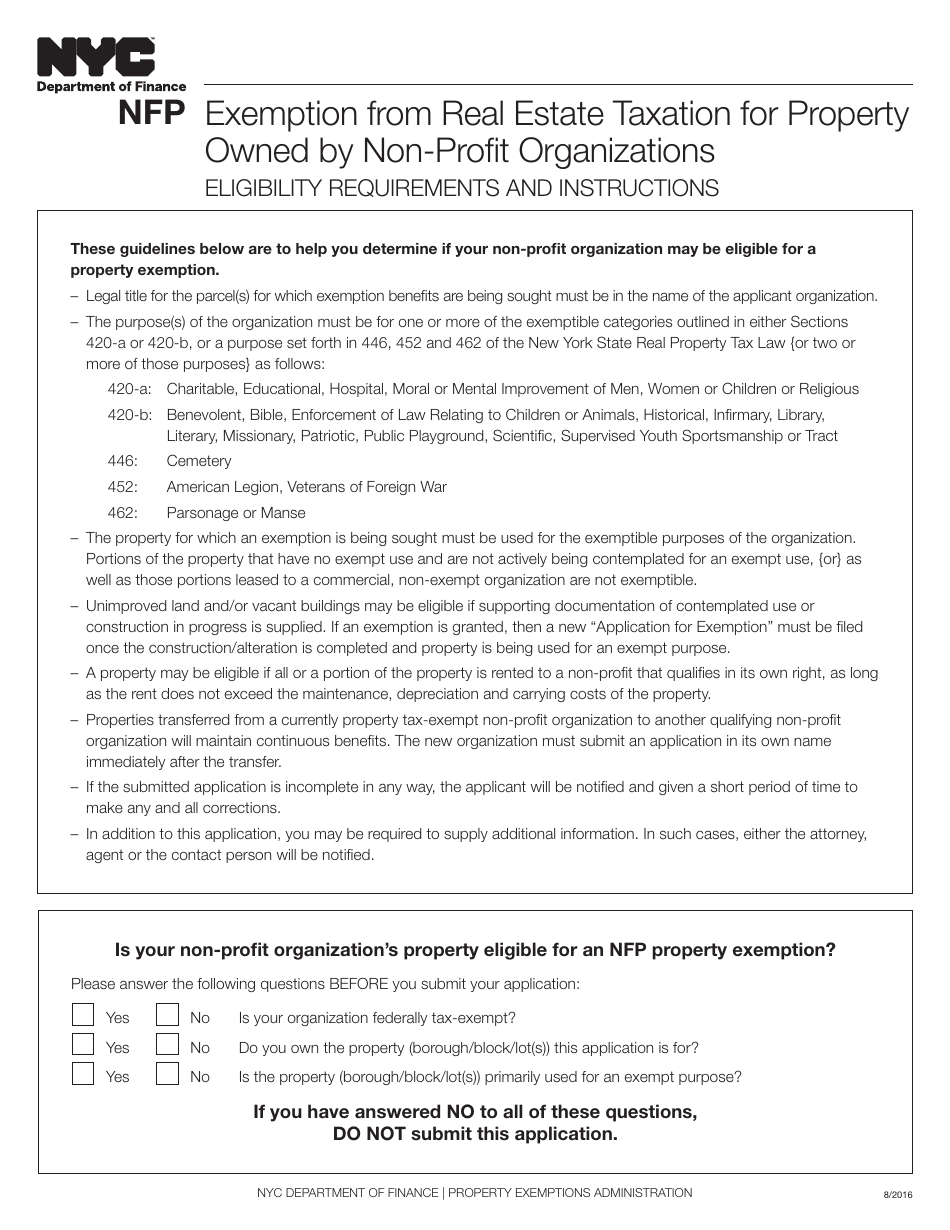

What Is Form NFP?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NFP application?

A: Form NFP application is a document used to apply for exemption from real estate taxation for property owned by non-profit organizations in New York City.

Q: Who can use Form NFP application?

A: Non-profit organizations that own property in New York City can use Form NFP application.

Q: What is the purpose of Form NFP application?

A: The purpose of Form NFP application is to request exemption from real estate taxation for property owned by non-profit organizations.

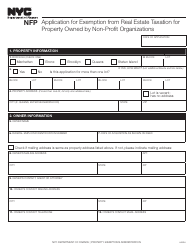

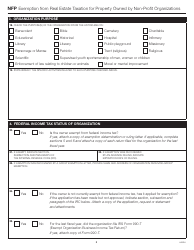

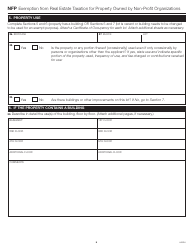

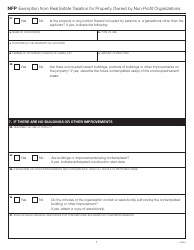

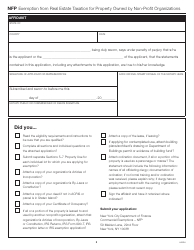

Q: What information is required on Form NFP application?

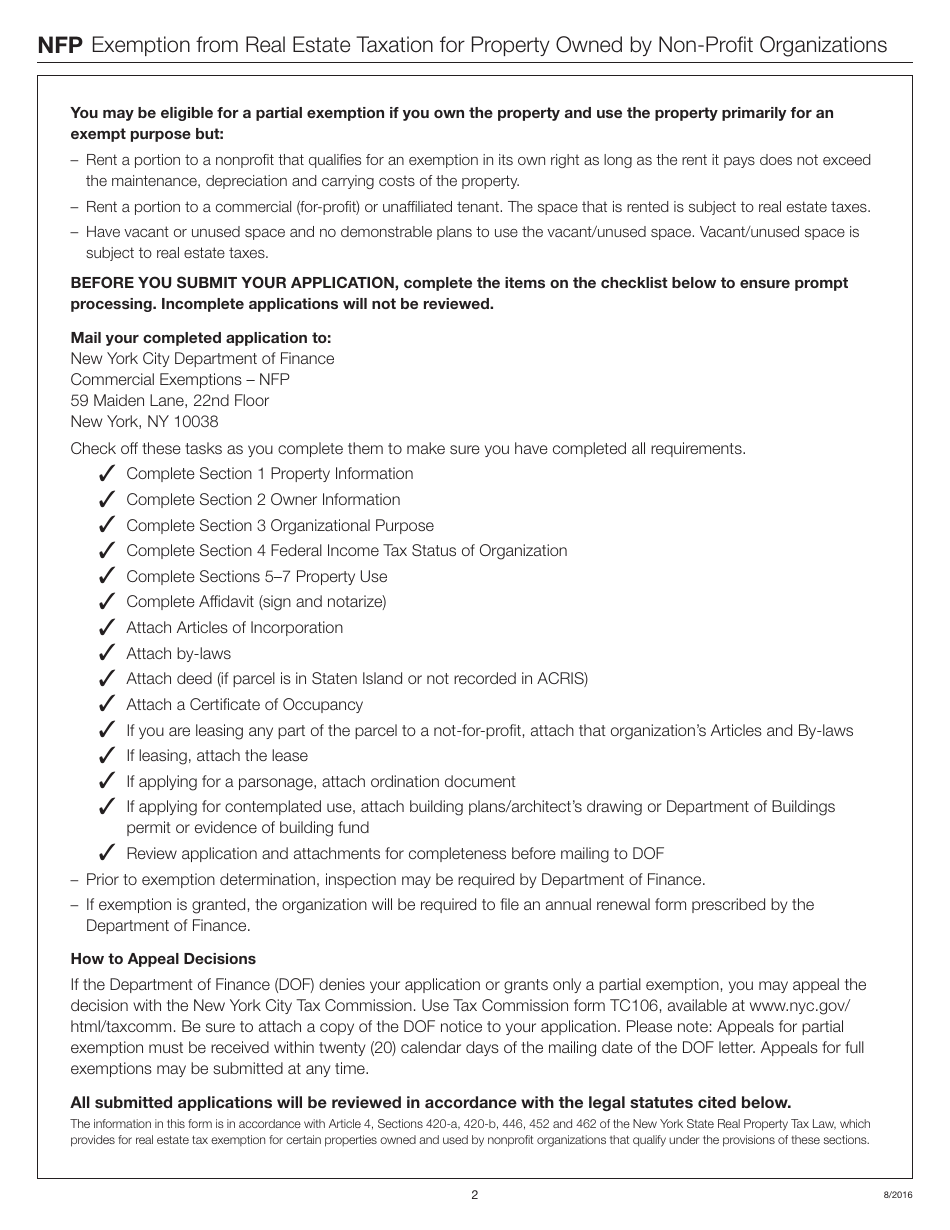

A: Form NFP application requires information about the non-profit organization, details of the property ownership, and supporting documentation.

Q: Are there any filing fees for Form NFP application?

A: No, there are no filing fees for Form NFP application.

Q: Is there a deadline for submitting Form NFP application?

A: Yes, Form NFP application must be filed by March 1st of each year.

Q: How long does it take to process Form NFP application?

A: The processing time for Form NFP application can vary, but it usually takes several months.

Q: Is there an appeal process if Form NFP application is denied?

A: Yes, if Form NFP application is denied, the non-profit organization can file an appeal with the New York City Tax Commission.

Q: Is Form NFP application specific to New York City?

A: Yes, Form NFP application is specific to property owned by non-profit organizations in New York City.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NFP by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.