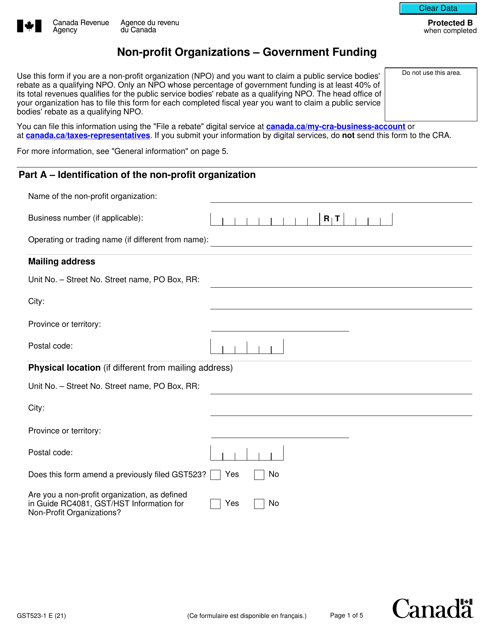

Form GST523-1 Non-profit Organizations - Government Funding - Canada

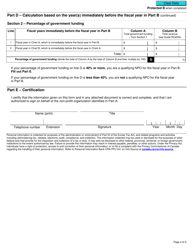

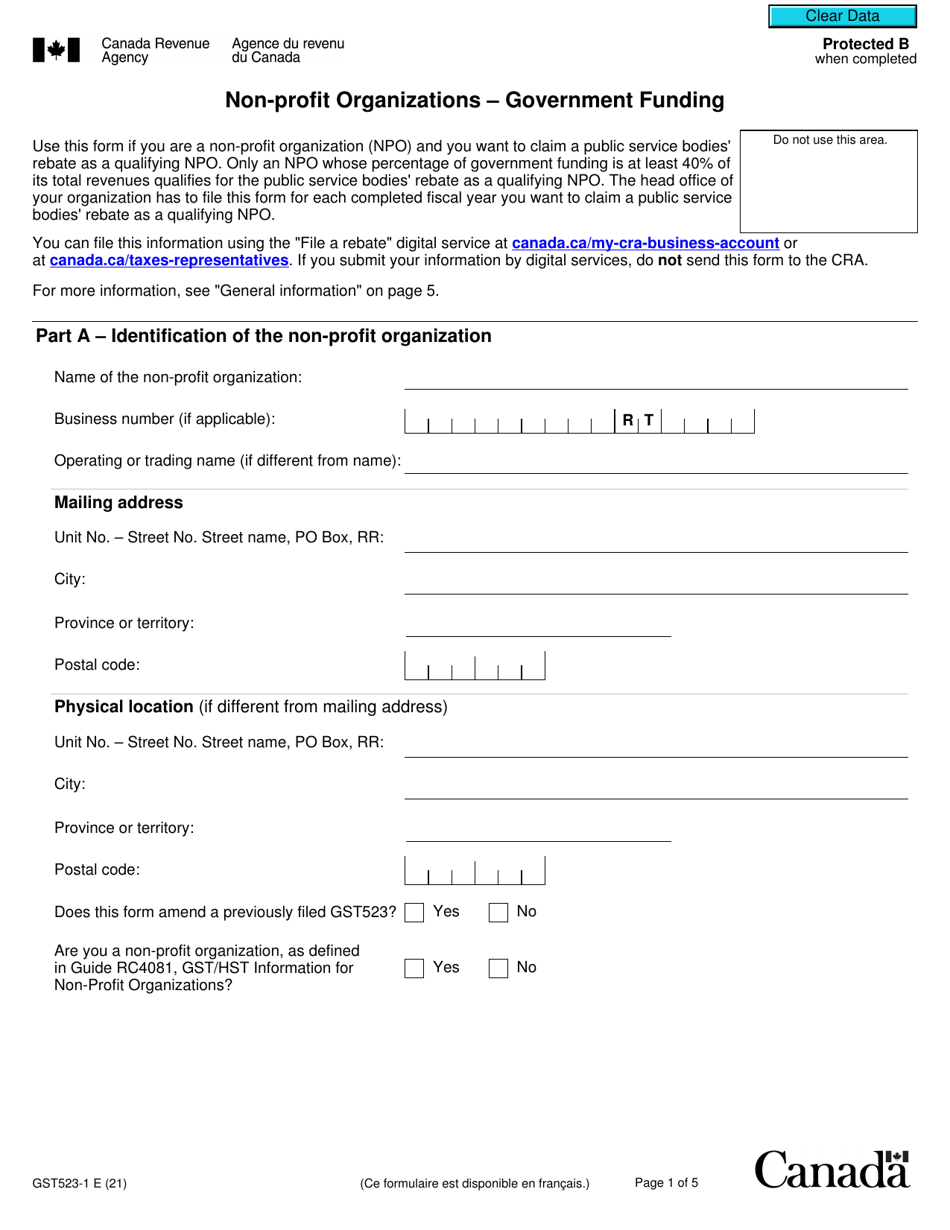

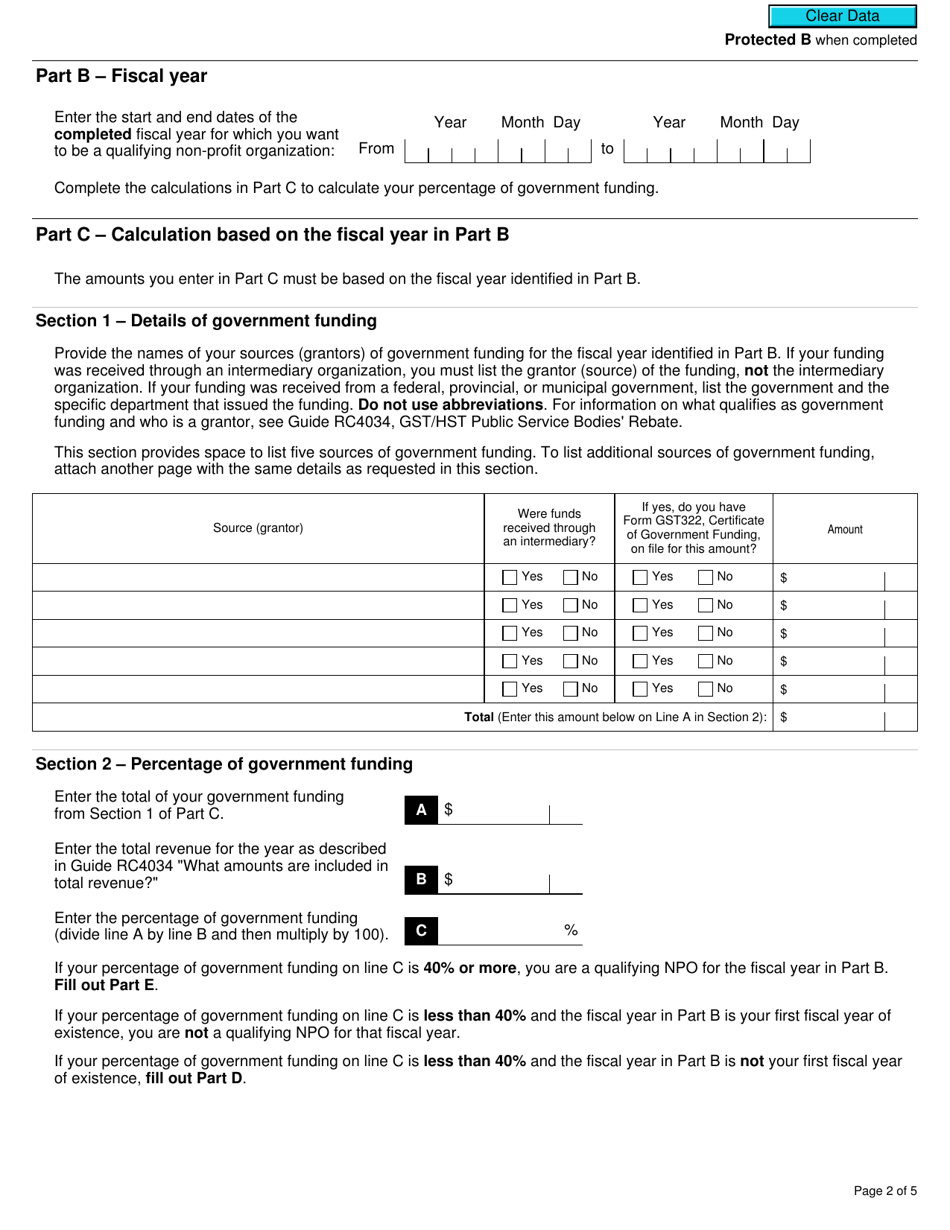

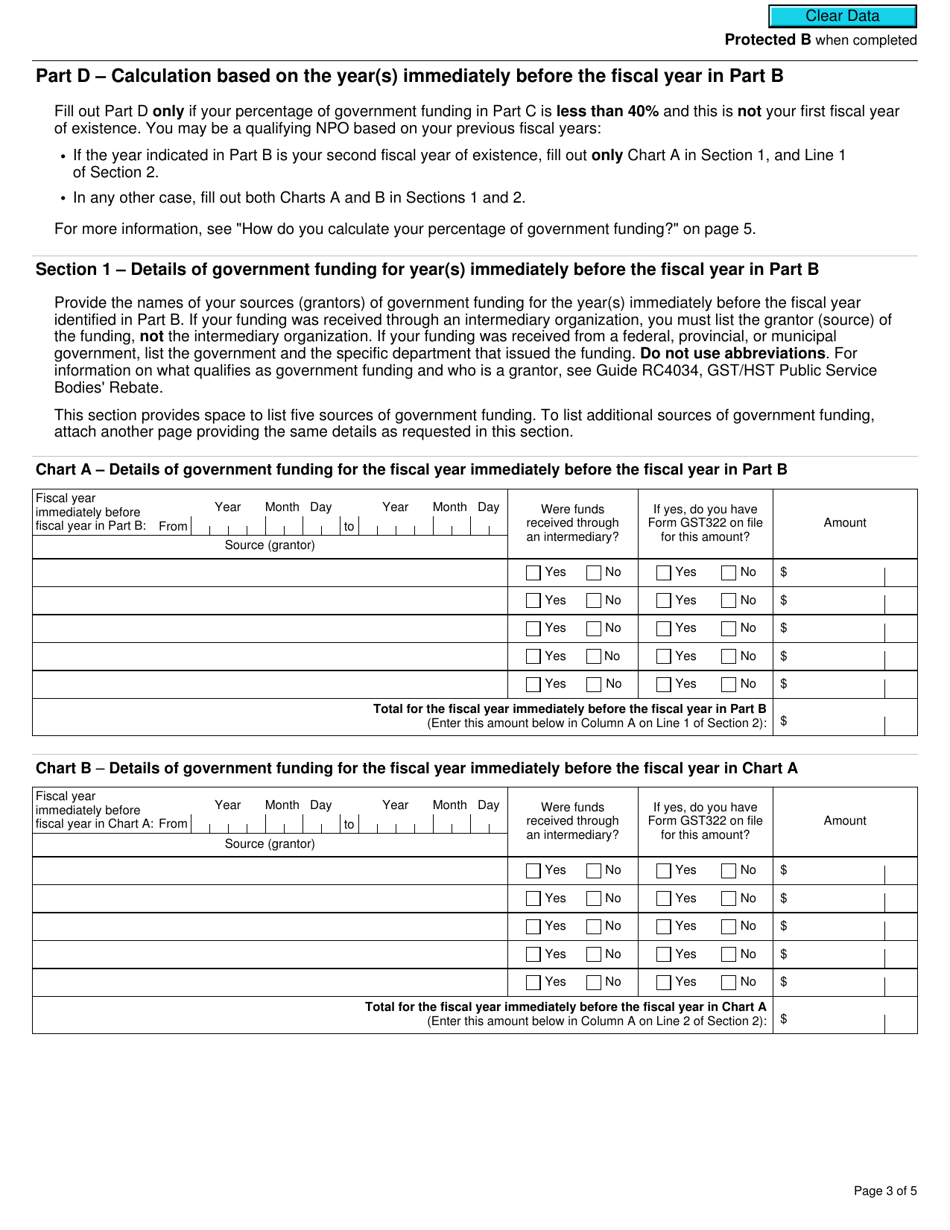

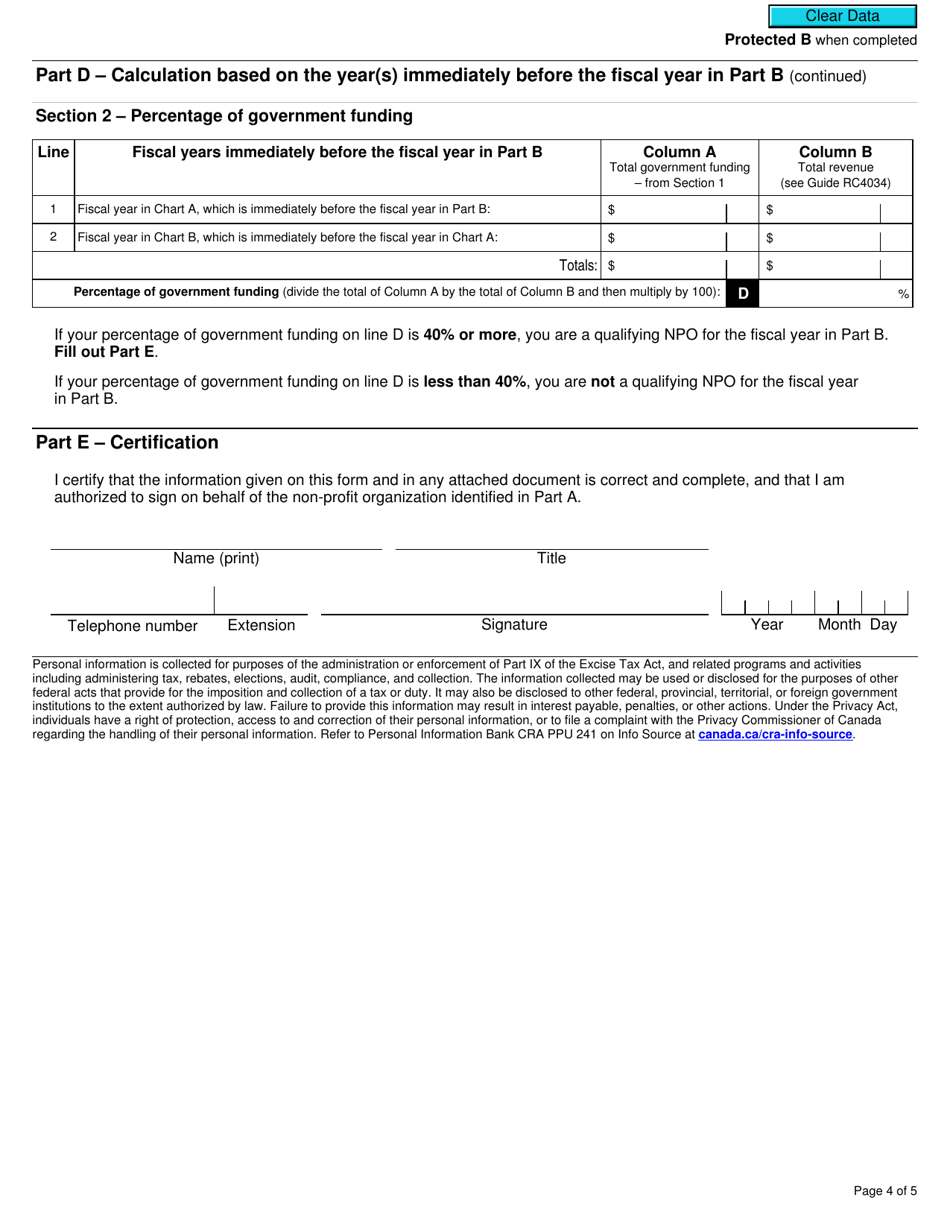

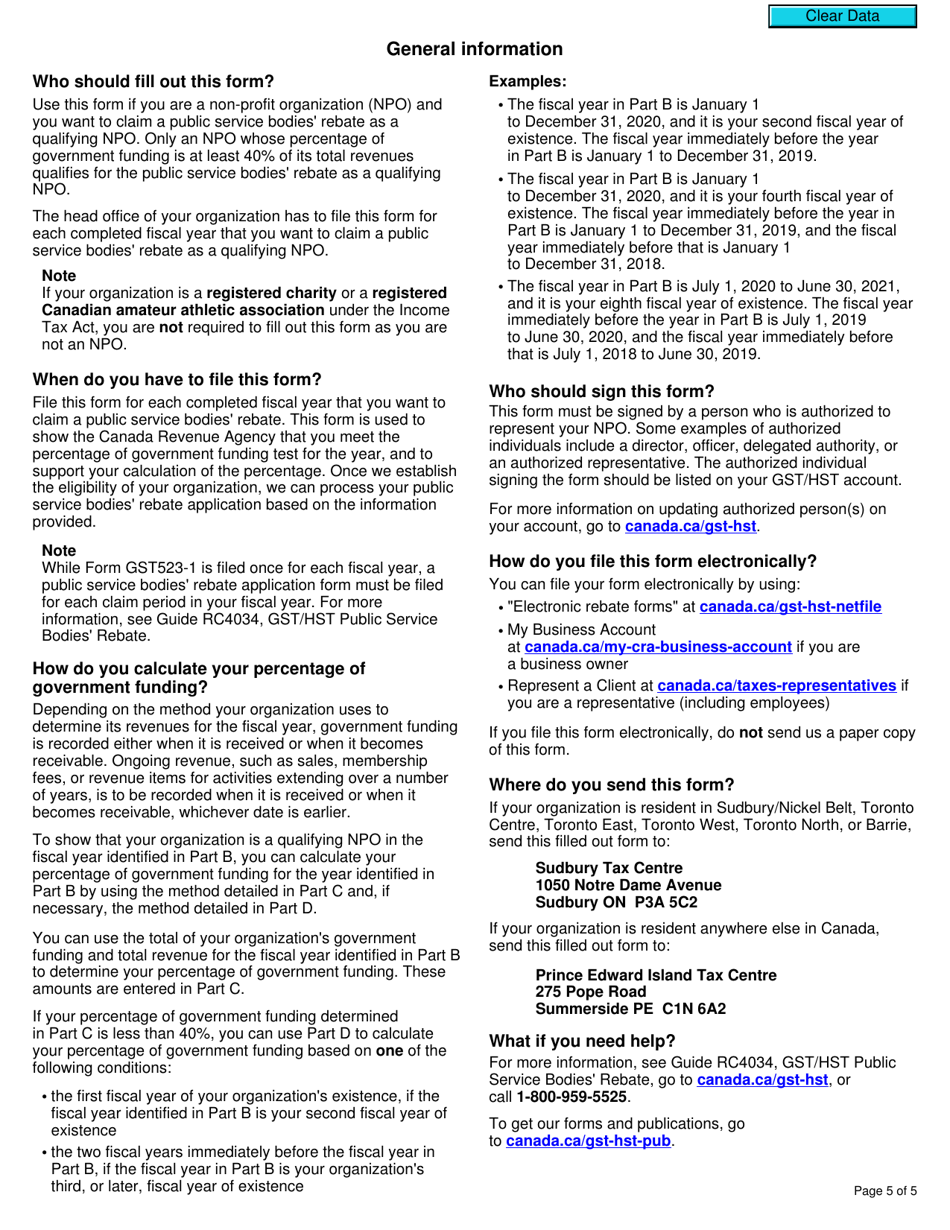

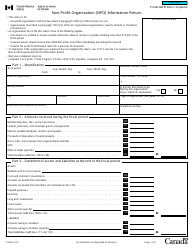

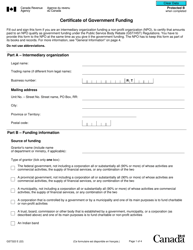

Form GST523-1 Non-profit Organizations - Government Funding in Canada is used for reporting the Goods and Services Tax/Harmonized Sales Tax (GST/HST) status of non-profit organizations that receive government funding. This form helps non-profit organizations determine whether they are required to charge and collect GST/HST on their supplies and services to the government. It is a way for the Canada Revenue Agency (CRA) to gather information and ensure compliance with the tax regulations for non-profit organizations receiving government funding.

The Form GST523-1 Non-profit Organizations - Government Funding in Canada is typically filed by non-profit organizations that receive government funding.

Form GST523-1 Non-profit Organizations - Government Funding - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST523-1?

A: Form GST523-1 is a specific form used by non-profit organizations in Canada to report government funding received.

Q: Who needs to fill out Form GST523-1?

A: Non-profit organizations in Canada that receive government funding are required to fill out Form GST523-1.

Q: What is the purpose of Form GST523-1?

A: The purpose of Form GST523-1 is to report the government funding received by a non-profit organization, as it may have an impact on tax obligations.

Q: Is Form GST523-1 mandatory for all non-profit organizations?

A: No, Form GST523-1 is only mandatory for non-profit organizations that receive government funding. Organizations that do not receive government funding do not need to fill out this form.

Q: When should Form GST523-1 be filled out?

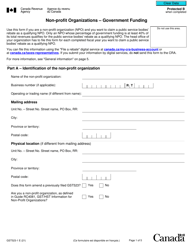

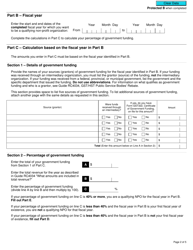

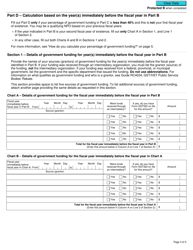

A: Form GST523-1 should be filled out by non-profit organizations at the end of their fiscal year or as specified by the government funding agency.

Q: What information is required to fill out Form GST523-1?

A: To fill out Form GST523-1, non-profit organizations need to provide details about the government funding received, including the amount, the funding agency, and the purpose of the funding.

Q: Are there any penalties for not filling out Form GST523-1?

A: Failure to fill out Form GST523-1 when required may result in penalties or consequences as per the rules and regulations set by the Canada Revenue Agency.