This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1044

for the current year.

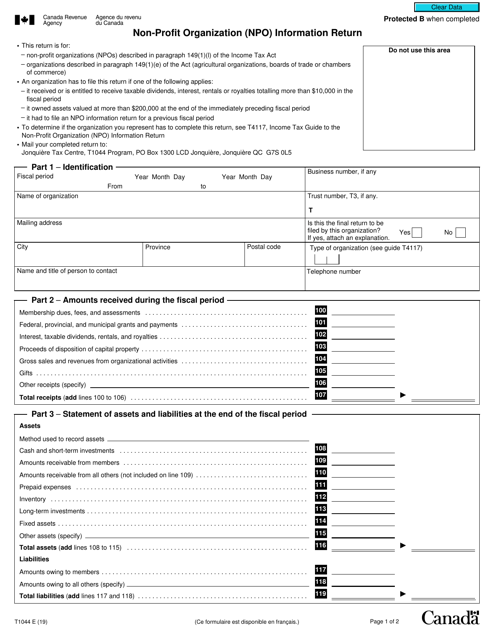

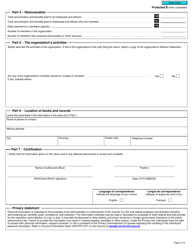

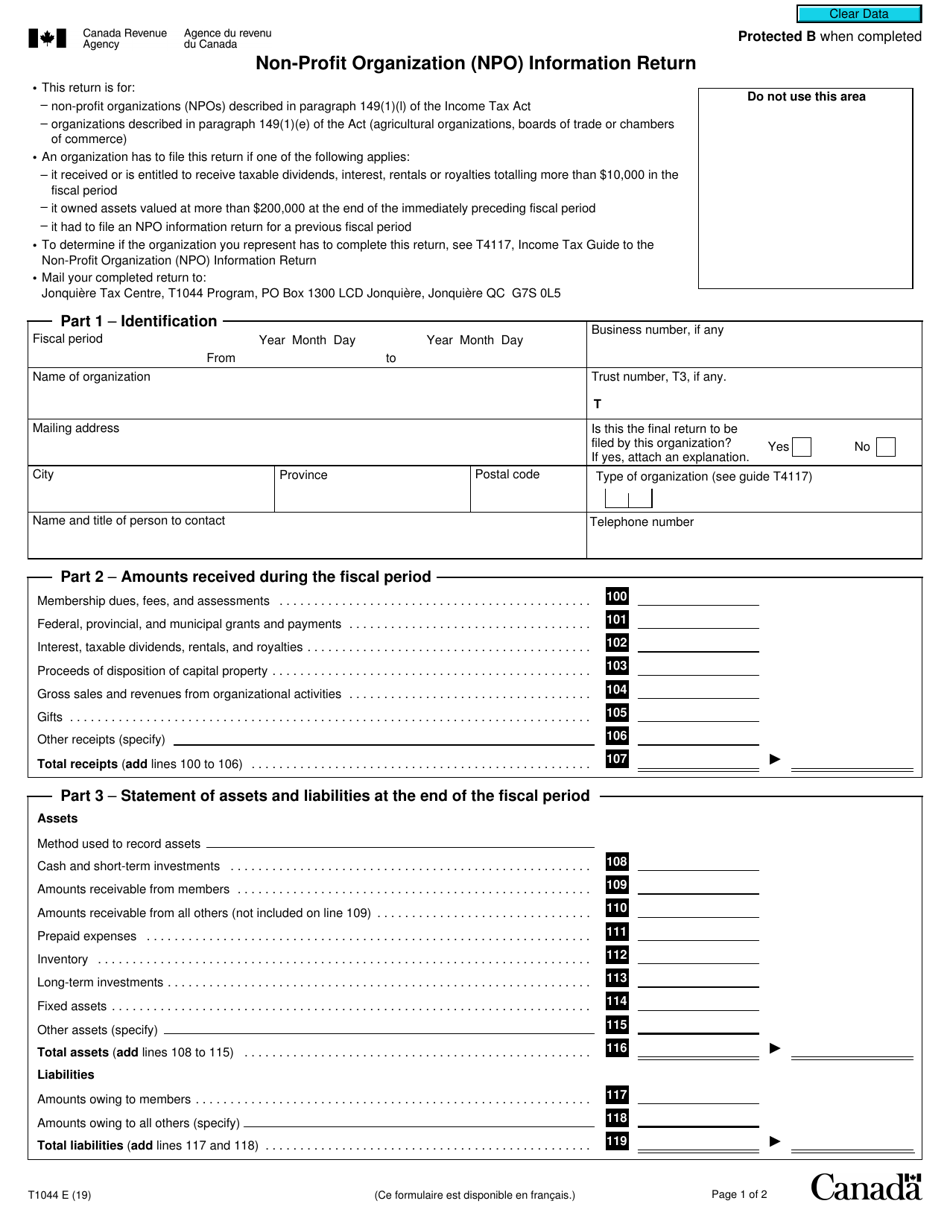

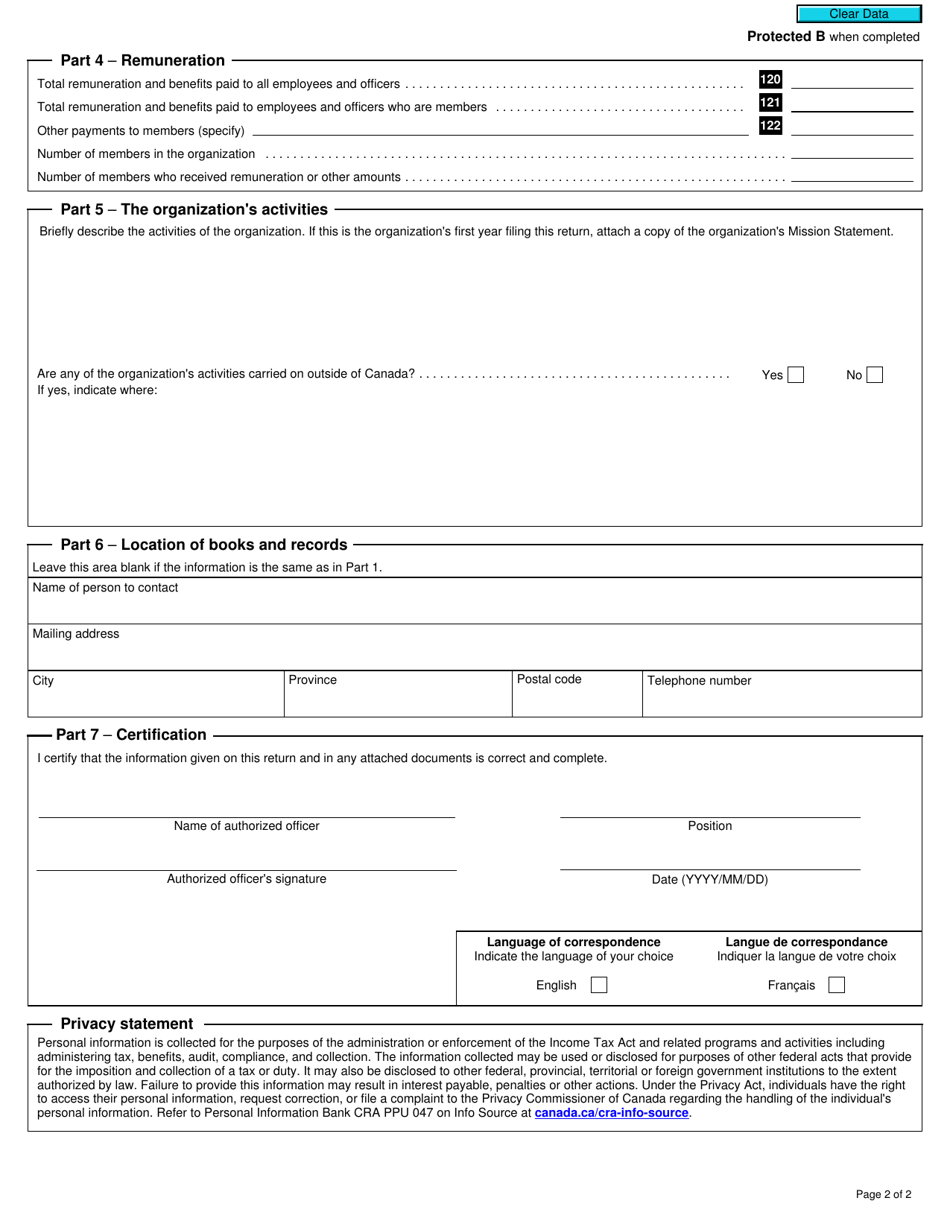

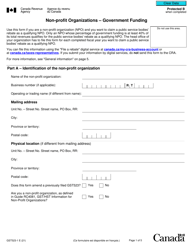

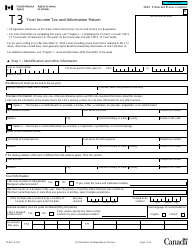

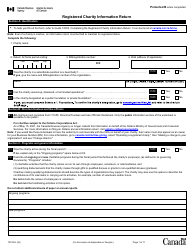

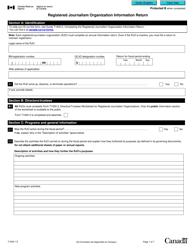

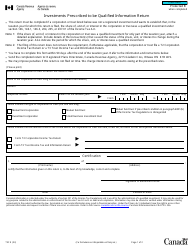

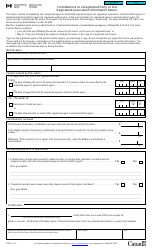

Form T1044 Non-profit Organization (Npo) Information Return - Canada

Form T1044 Non-profit Organization (NPO) Information Return in Canada is used to report information about the activities and finances of a non-profit organization. It is required to be filed by registered charities, charitable organizations, and certain other non-profit entities to fulfill their tax obligations with the Canada Revenue Agency (CRA).

Non-profit organizations in Canada are required to file the Form T1044 Non-profit Organization (NPO) Information Return with the Canada Revenue Agency (CRA).

FAQ

Q: What is Form T1044?

A: Form T1044 is the Non-profit Organization (NPO) Information Return in Canada.

Q: Who needs to file Form T1044?

A: Non-profit organizations in Canada need to file Form T1044.

Q: What information is required on Form T1044?

A: Form T1044 requires information about the non-profit organization's activities, financial details, and governance.

Q: When is the deadline to file Form T1044?

A: The deadline to file Form T1044 is usually within six months after the end of the organization's fiscal year.

Q: Are there any penalties for not filing Form T1044?

A: Yes, there can be penalties for not filing Form T1044, including late filing penalties and potential loss of the organization's status as a non-profit.