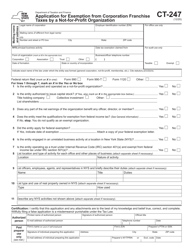

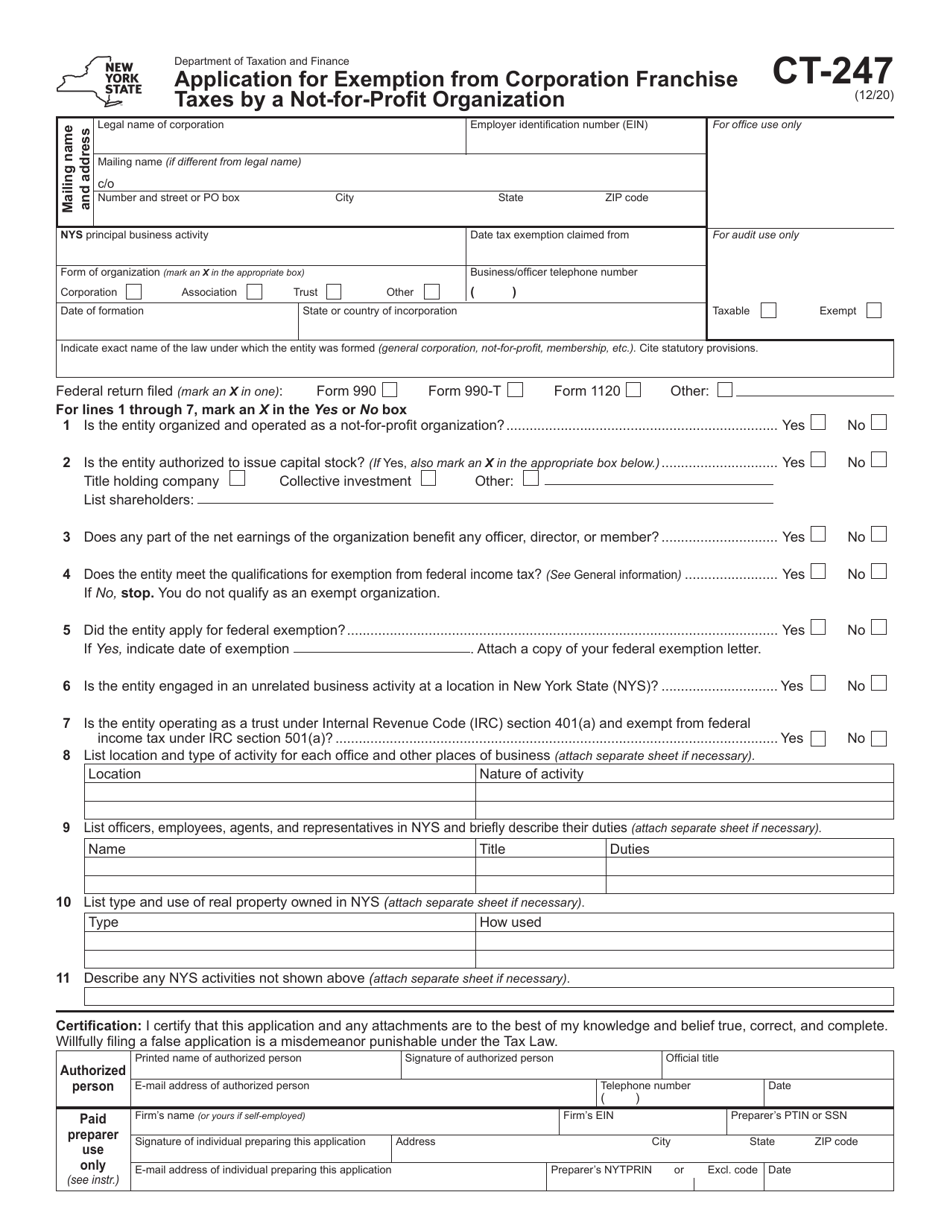

Form CT-247 Application for Exemption From Corporation Franchise Taxes by a Not-For-Profit Organization - New York

What Is Form CT-247?

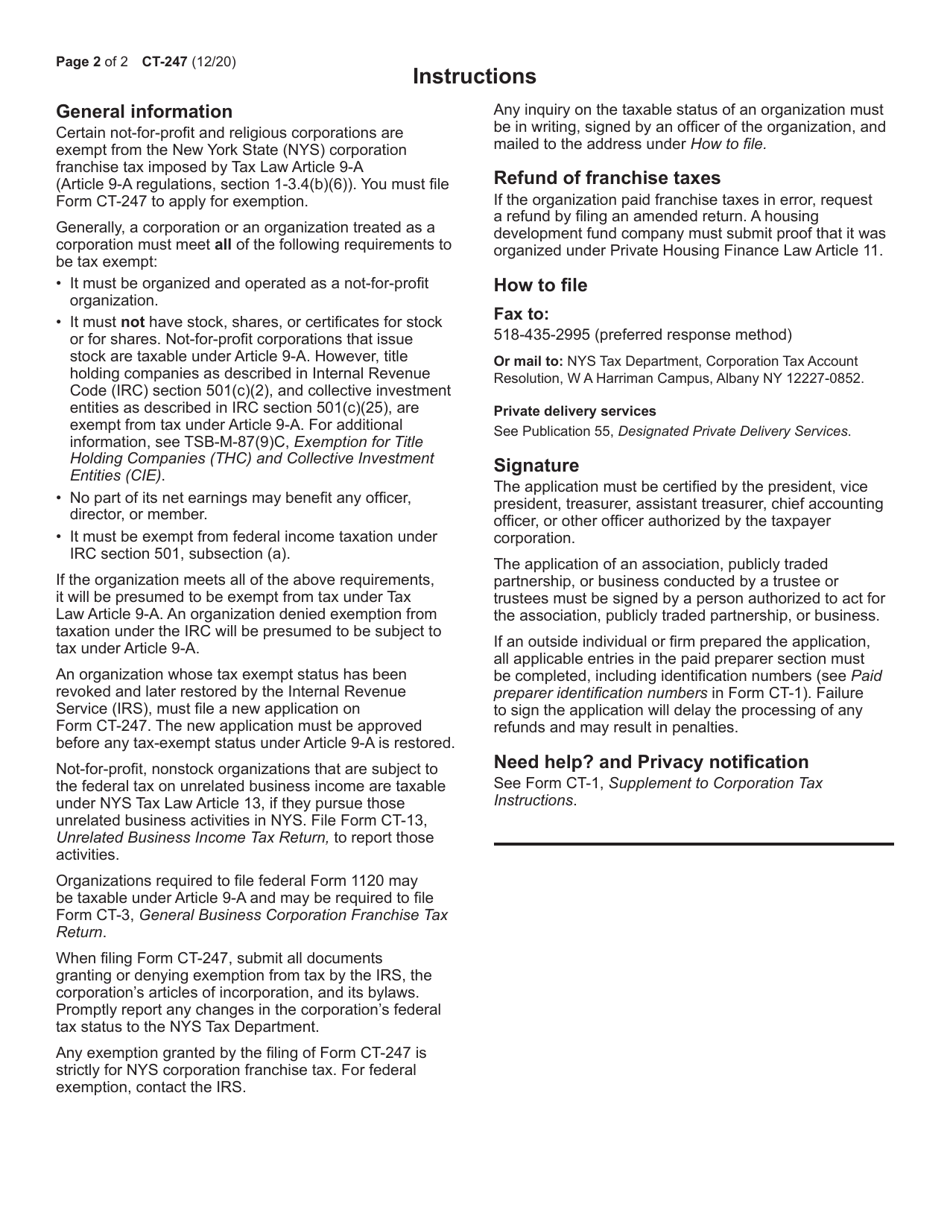

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-247?

A: Form CT-247 is an application for exemption from corporation franchise taxes by a not-for-profit organization in the state of New York.

Q: Who can use Form CT-247?

A: Not-for-profit organizations in New York can use Form CT-247 to apply for exemption from corporation franchise taxes.

Q: What is the purpose of Form CT-247?

A: The purpose of Form CT-247 is to request exemption from corporation franchise taxes for qualifying not-for-profit organizations.

Q: What information is required on Form CT-247?

A: Form CT-247 requires information about the organization's name, address, purpose, and financial activities.

Q: Are there any fees associated with filing Form CT-247?

A: No, there are no fees associated with filing Form CT-247.

Q: Is there a deadline for filing Form CT-247?

A: There is no specific deadline for filing Form CT-247, but it is recommended to file it as soon as possible after the organization is formed.

Q: How long does it take to process Form CT-247?

A: The processing time for Form CT-247 can vary, but it generally takes several weeks.

Q: What happens after the application is approved?

A: If the application is approved, the not-for-profit organization will be exempt from corporation franchise taxes in New York.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-247 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.