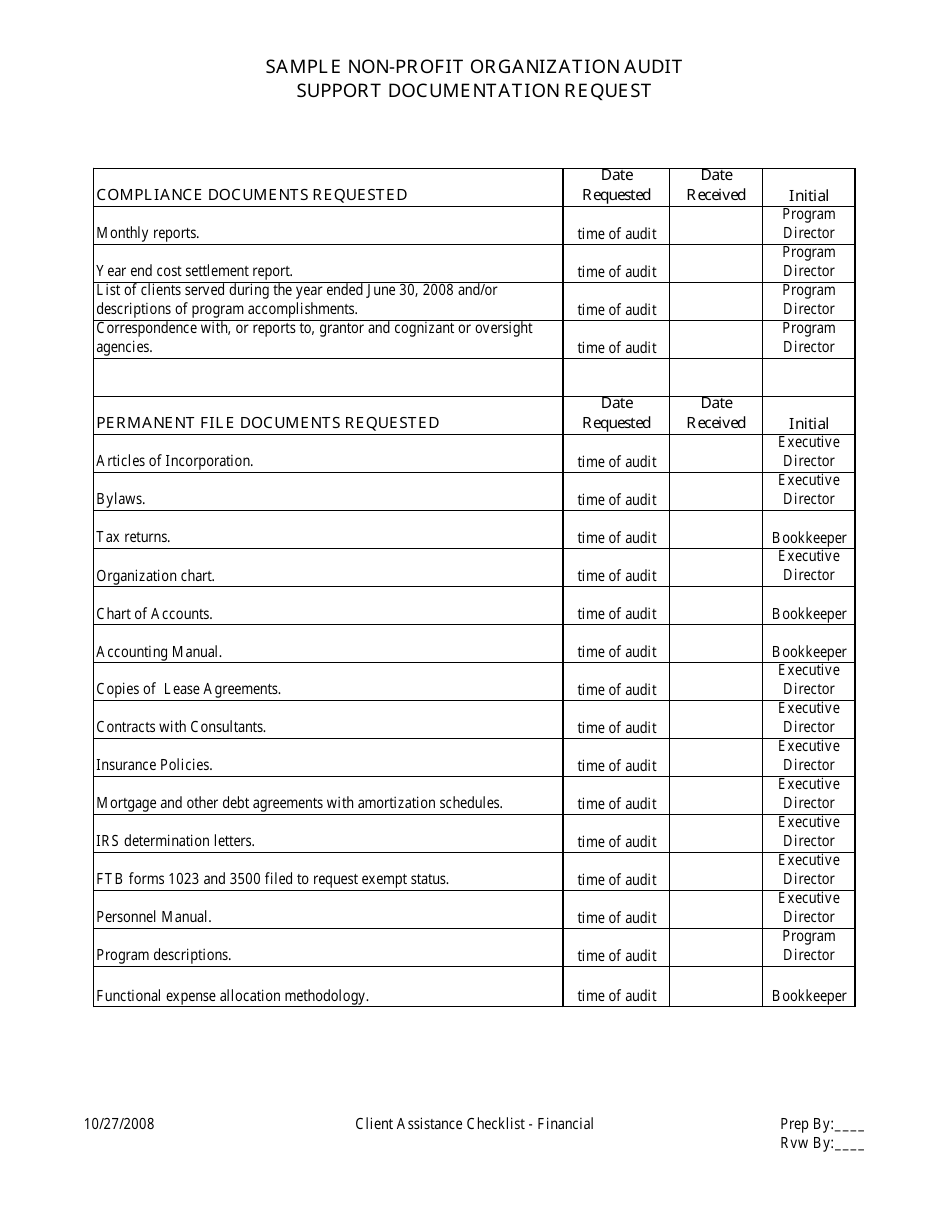

Sample Non-profit Organization Audit Support Documentation Request

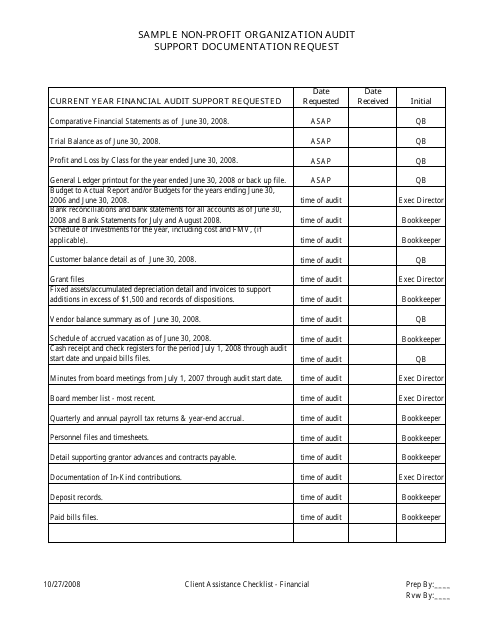

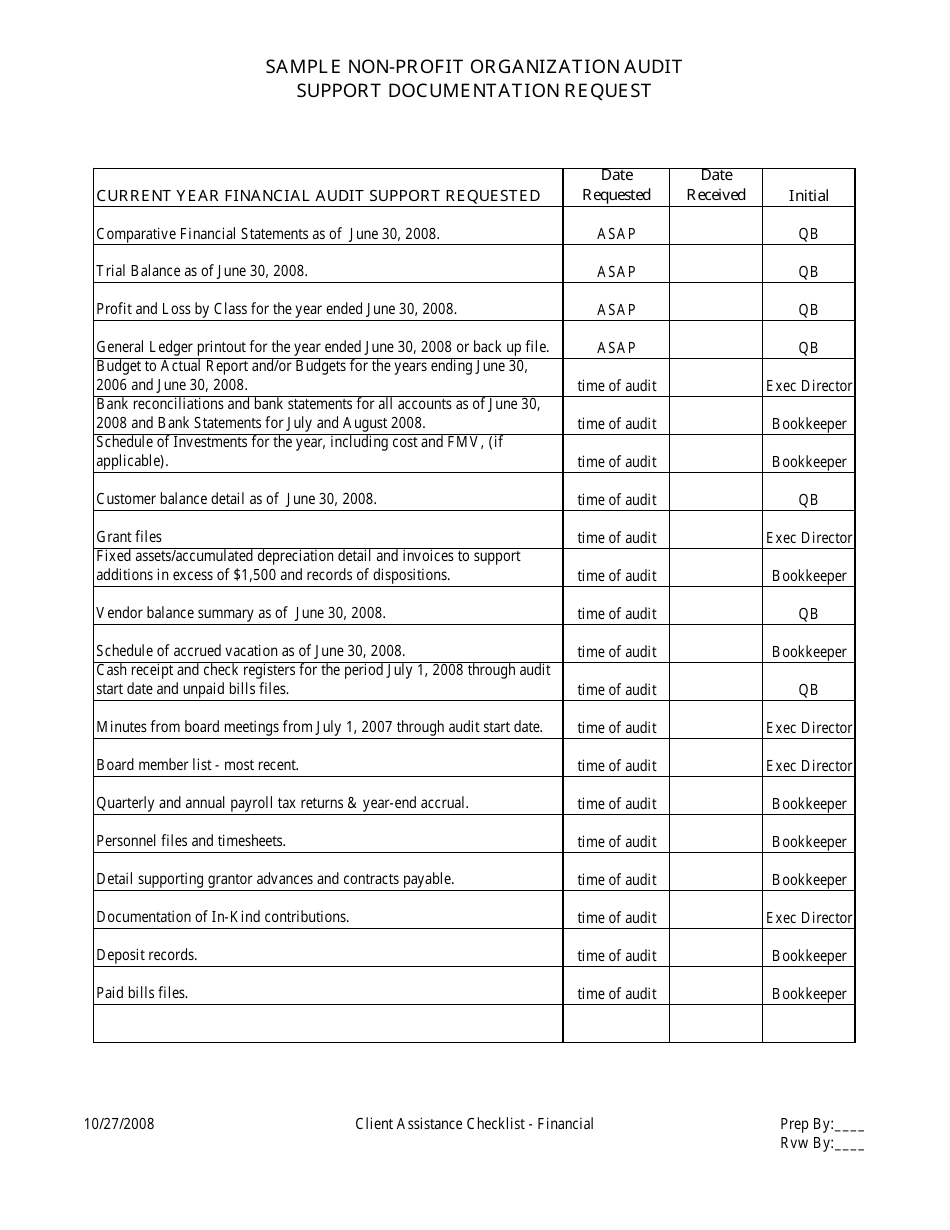

The Sample Non-profit Organization Audit Support Documentation Request is used to request relevant financial and operational documents from a non-profit organization in order to support an audit. These documents are requested to ensure transparency and compliance with legal and financial regulations for non-profit organizations.

The sample Non-profit Organization Audit Support Documentation Request is typically filed by the organization's auditor or accounting team.

FAQ

Q: What is a non-profit organization audit?

A: A non-profit organization audit is a detailed examination of an organization's financial records and operations to ensure compliance with legal and accounting standards.

Q: Why would a non-profit organization need audit support documentation?

A: Non-profit organizations may need audit support documentation to provide evidence and verification of their financial transactions, activities, and compliance.

Q: What types of documents are typically requested for non-profit organization audits?

A: Typically, documents such as bank statements, financial statements, invoices, receipts, payroll records, board meeting minutes, and tax filings may be requested for non-profit organization audits.

Q: What is the purpose of providing audit support documentation?

A: The purpose of providing audit support documentation is to assist auditors in gaining assurance about the accuracy, completeness, and reliability of an organization's financial information.

Q: How can non-profit organizations prepare for an audit?

A: Non-profit organizations can prepare for an audit by ensuring their financial records are accurate and up-to-date, organizing relevant documents, and familiarizing themselves with the audit process and requirements.

Q: Are there any specific regulations that non-profit organizations must follow for audits?

A: Yes, non-profit organizations may have to comply with specific regulations and reporting requirements set by the Internal Revenue Service (IRS) or other regulatory bodies governing non-profit organizations.

Q: What are some common challenges faced by non-profit organizations during audits?

A: Common challenges include maintaining proper documentation, accurately allocating expenses, dealing with restricted funds, and ensuring compliance with grant restrictions.

Q: How long should non-profit organizations keep their audit support documentation?

A: Non-profit organizations should generally retain audit support documentation for a minimum of seven years, although specific retention periods may vary depending on legal and regulatory requirements.

Q: Can non-profit organizations seek professional assistance for audit support documentation?

A: Yes, non-profit organizations can seek professional assistance from accountants, auditors, or financial consultants to help prepare and organize their audit support documentation.

Q: What are the benefits of having audit support documentation?

A: Having audit support documentation provides transparency, demonstrates financial accountability, and helps non-profit organizations build trust and credibility with their stakeholders.

Q: Does providing audit support documentation guarantee a positive audit outcome?

A: Providing audit support documentation does not guarantee a positive audit outcome, but it helps streamline the audit process and increases the likelihood of a favorable assessment.