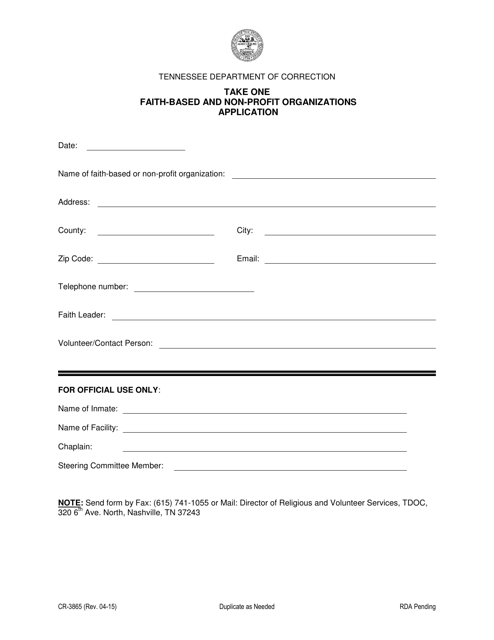

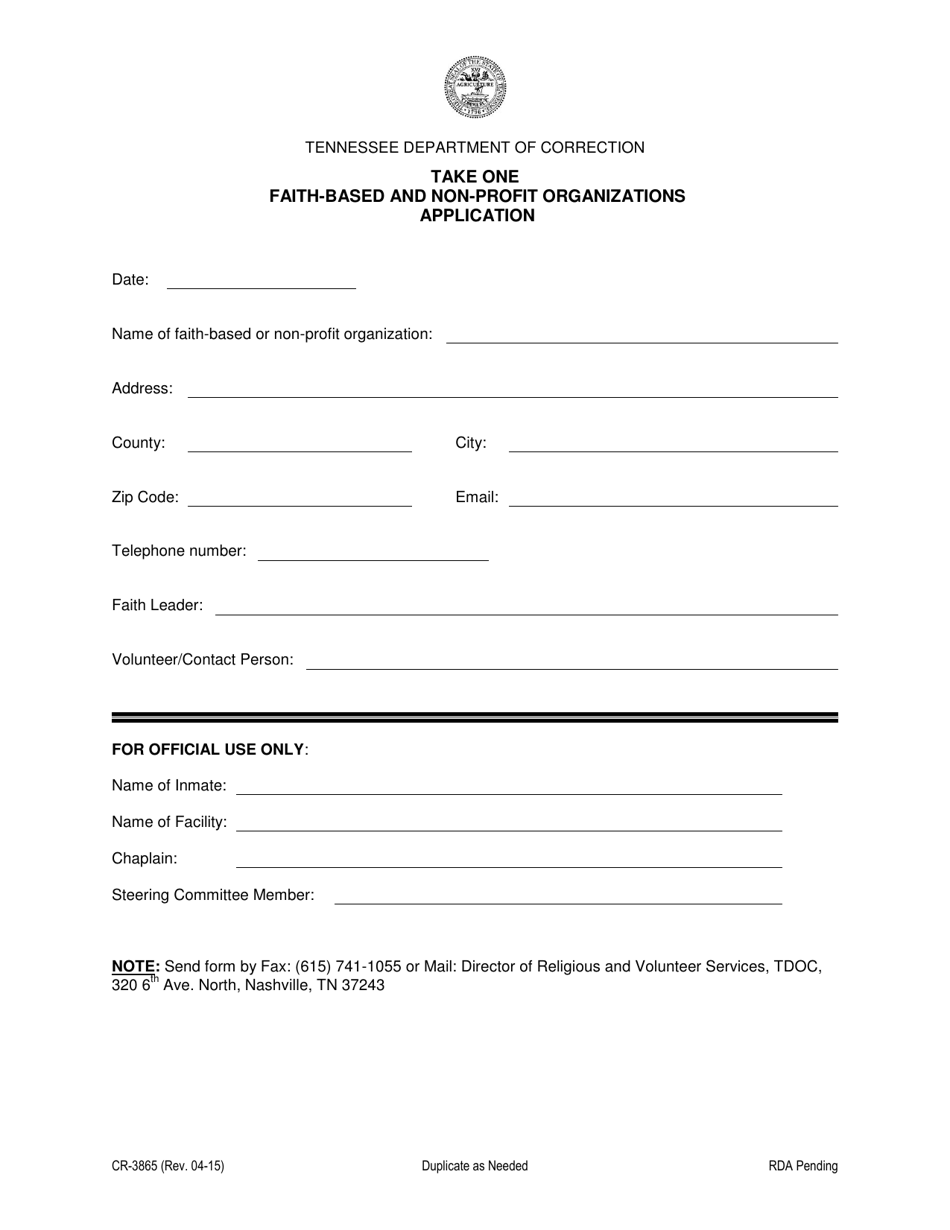

Form CR-3865 Take One Faith-Based and Non-profit Organizations Application - Tennessee

What Is Form CR-3865?

This is a legal form that was released by the Tennessee Department of Correction - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-3865?

A: Form CR-3865 is the application form for faith-based and non-profit organizations in Tennessee.

Q: Who can use Form CR-3865?

A: Faith-based and non-profit organizations in Tennessee can use Form CR-3865 to apply for certain benefits or exemptions.

Q: What are the benefits of using Form CR-3865?

A: Using Form CR-3865 allows faith-based and non-profit organizations to apply for tax benefits and exemptions available in Tennessee.

Q: What information is required on Form CR-3865?

A: Form CR-3865 requires organizations to provide details about their mission, activities, financial information, and other relevant information.

Q: Are there any fees associated with Form CR-3865?

A: No, there are no fees associated with filing Form CR-3865.

Q: Is Form CR-3865 specific to faith-based organizations or can non-profit organizations also use it?

A: Form CR-3865 is designed for both faith-based and non-profit organizations in Tennessee.

Q: How long does it take to process Form CR-3865?

A: The processing time for Form CR-3865 varies, but it typically takes several weeks to receive a response.

Q: Can I make changes to my Form CR-3865 after it has been submitted?

A: Yes, you can make changes to your Form CR-3865 by submitting an amended form to the Tennessee Department of Revenue.

Form Details:

- Released on April 1, 2015;

- The latest edition provided by the Tennessee Department of Correction;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CR-3865 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Correction.