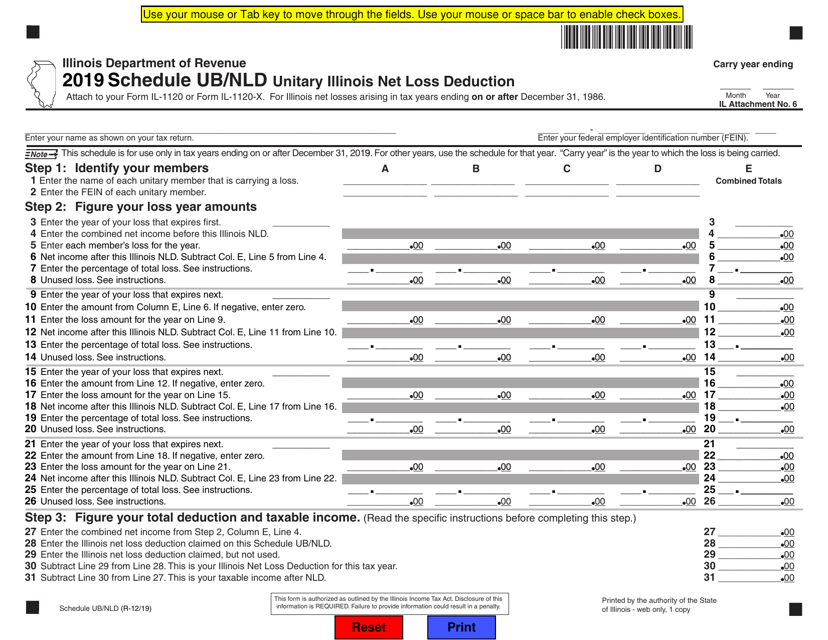

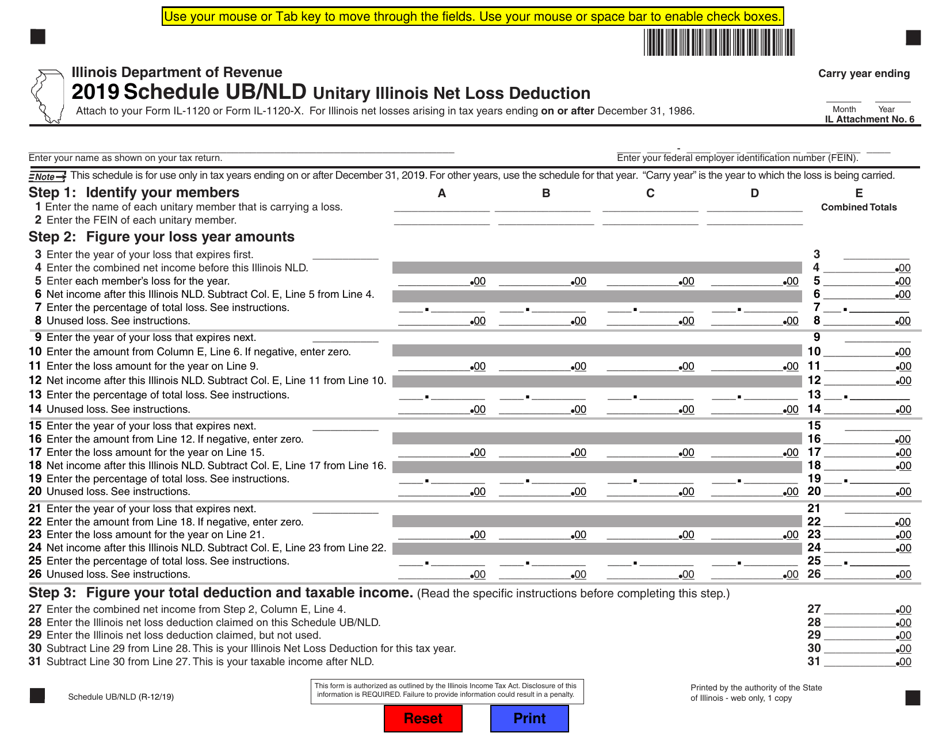

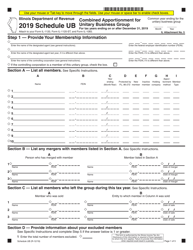

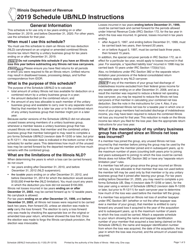

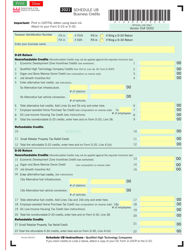

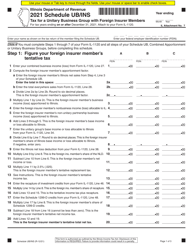

Schedule UB / NLD Unitary Illinois Net Loss Deduction - Illinois

What Is Schedule UB/NLD?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule UB/NLD Unitary Illinois Net Loss Deduction?

A: Schedule UB/NLD is a form used in Illinois to calculate and deduct net losses for unitary businesses.

Q: Who is eligible to use Schedule UB/NLD?

A: Unitary businesses operating in Illinois are eligible to use Schedule UB/NLD.

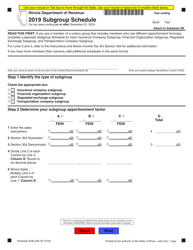

Q: What is a unitary business?

A: A unitary business is a group of related entities that operate and function as a single business.

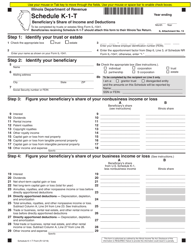

Q: How is the net loss deduction calculated on Schedule UB/NLD?

A: The net loss deduction is calculated by combining the net losses from all unitary business activities and applying certain limitations.

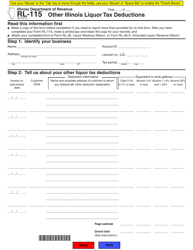

Q: What are the limitations on the net loss deduction?

A: There are limitations based on the amount of taxable income, the age of the losses, and the availability of other deductions.

Q: Why is Schedule UB/NLD important?

A: Schedule UB/NLD allows unitary businesses in Illinois to deduct net losses and reduce their taxable income.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule UB/NLD by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.