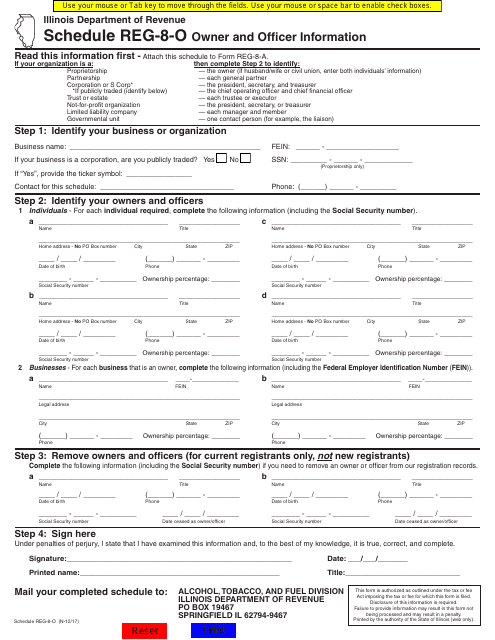

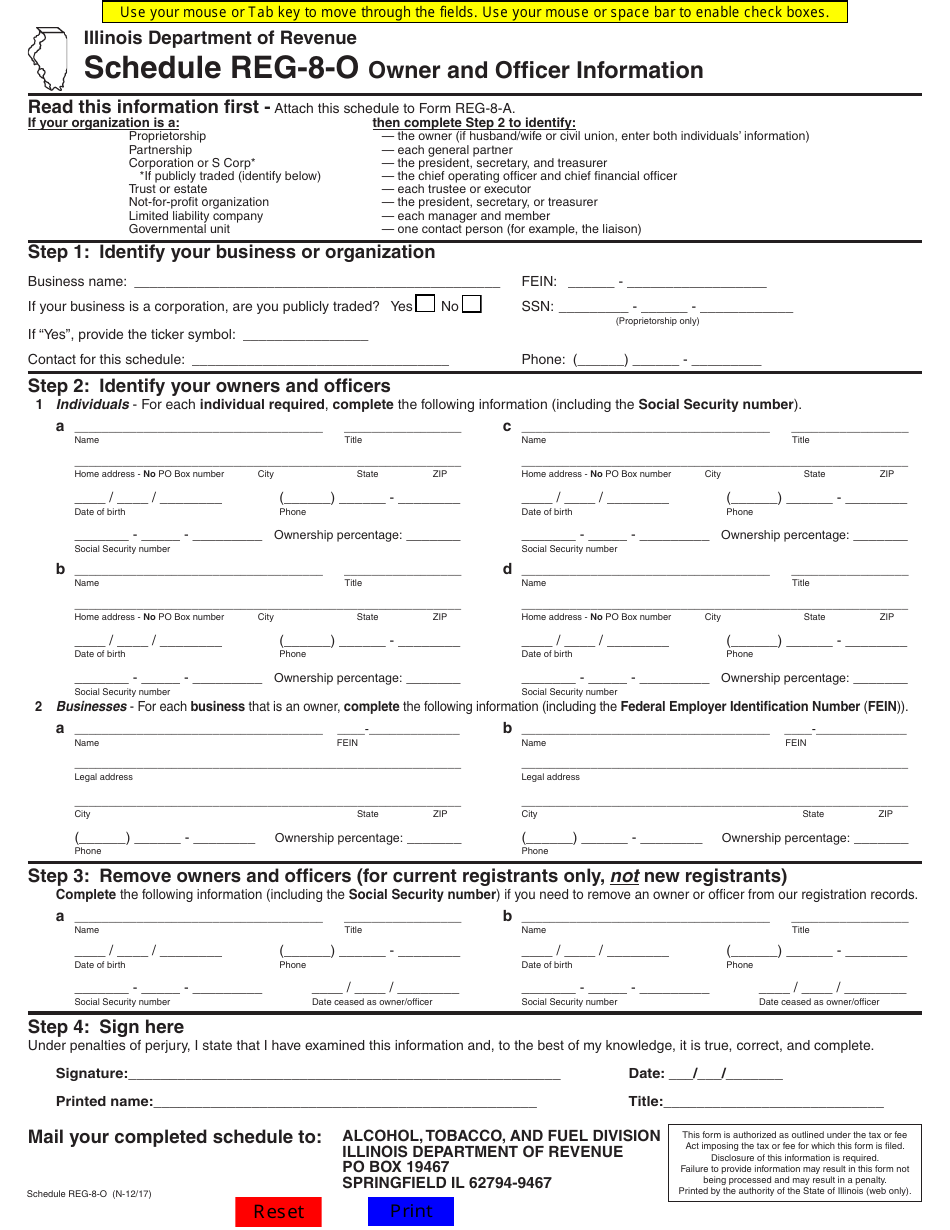

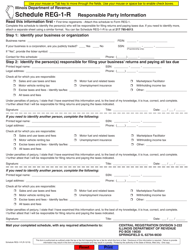

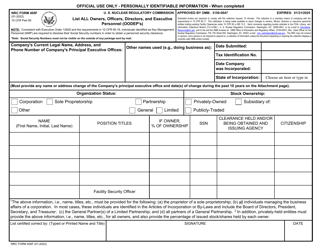

Schedule REG-8-O Owner and Officer Information - Illinois

What Is Schedule REG-8-O?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule REG-8-O?

A: Schedule REG-8-O is a form used to provide information about the owners and officers of a business in Illinois.

Q: Who needs to complete Schedule REG-8-O?

A: Businesses registered in Illinois are required to complete Schedule REG-8-O.

Q: What information is required on Schedule REG-8-O?

A: The form requires information about the owners and officers of the business, including their names, addresses, titles, and ownership percentages.

Q: Why is Schedule REG-8-O important?

A: Schedule REG-8-O helps the state of Illinois maintain accurate records of business owners and officers for tax and regulatory purposes.

Q: Is there a deadline for filing Schedule REG-8-O?

A: Yes, businesses are required to file Schedule REG-8-O within 60 days of its incorporation or registration in Illinois.

Q: Are there any penalties for not filing Schedule REG-8-O?

A: Yes, failure to file Schedule REG-8-O may result in penalties, such as fines or the revocation of the business's registration in Illinois.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule REG-8-O by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.