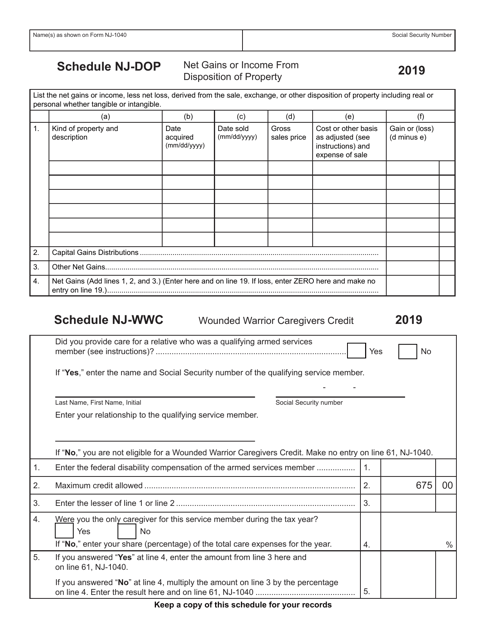

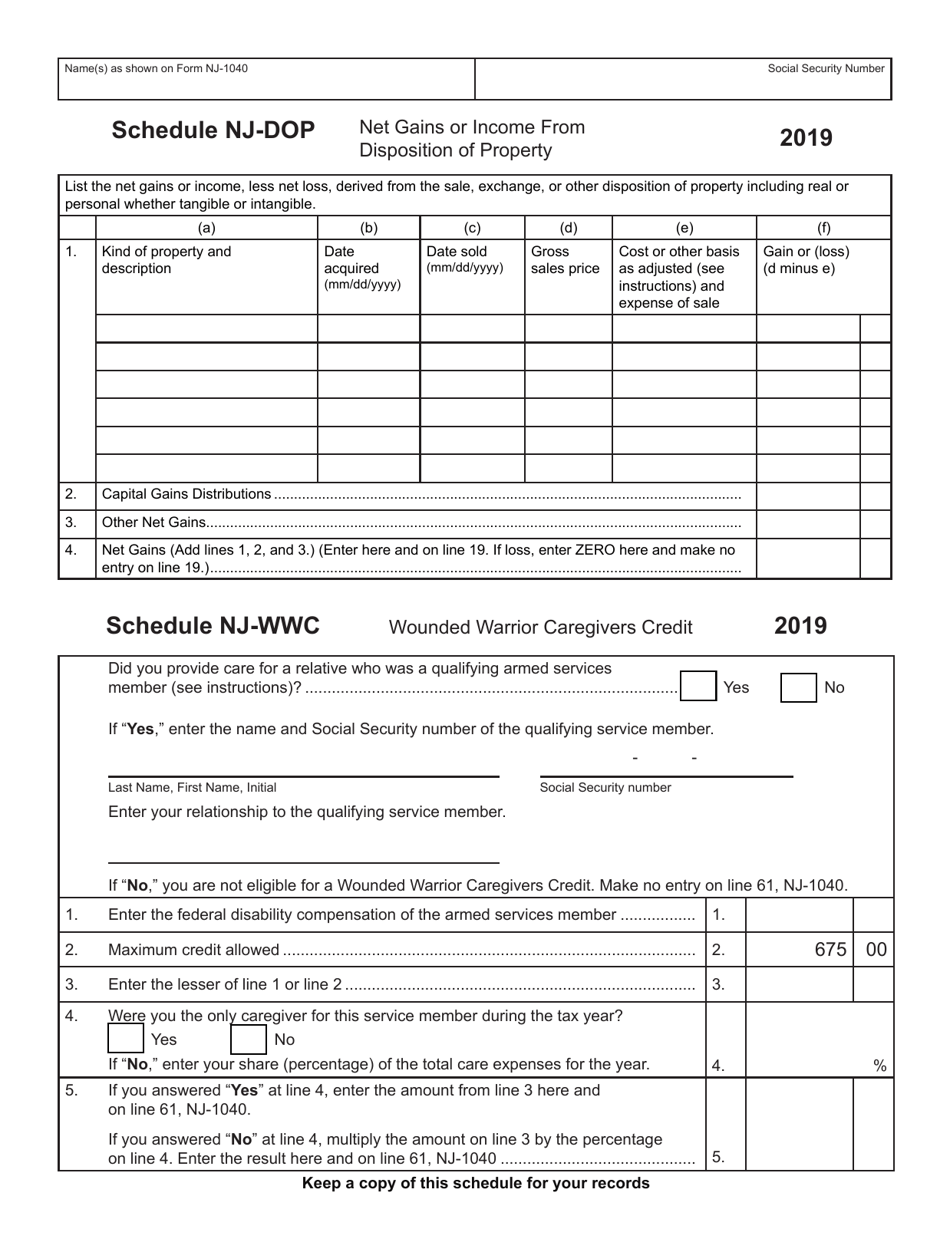

Schedule NJ-DOP, NJ-WCC Net Gains or Income From Disposition of Property & Wounded Warrior Caregivers Credit - New Jersey

What Is Schedule NJ-DOP, NJ-WCC?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NJ-DOP?

A: Schedule NJ-DOP is a tax form used in New Jersey to report net gains or income from the disposition of property.

Q: What is Schedule NJ-WCC?

A: Schedule NJ-WCC is a tax form used in New Jersey to claim the Wounded Warrior Caregivers Credit.

Q: What is net gains or income from disposition of property?

A: Net gains or income from the disposition of property refers to any profits or income obtained from selling or disposing of property.

Q: Who is eligible for the Wounded Warrior Caregivers Credit in New Jersey?

A: The Wounded Warrior Caregivers Credit in New Jersey is available to eligible caregivers of qualified veterans.

Q: How do I claim the Wounded Warrior Caregivers Credit?

A: To claim the Wounded Warrior Caregivers Credit, you need to complete Schedule NJ-WCC and include it with your New Jersey tax return.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NJ-DOP, NJ-WCC by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.