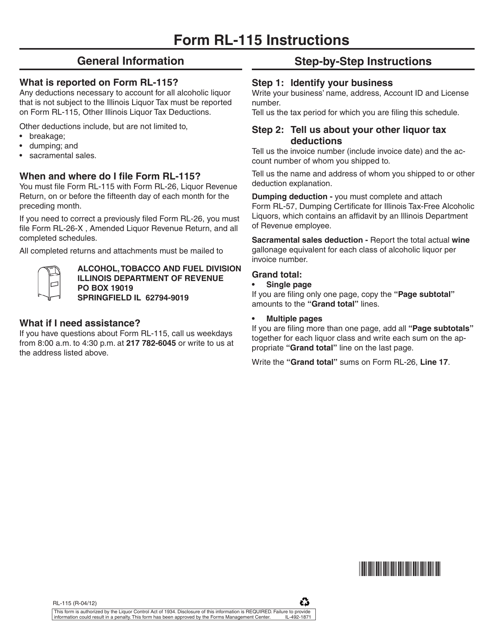

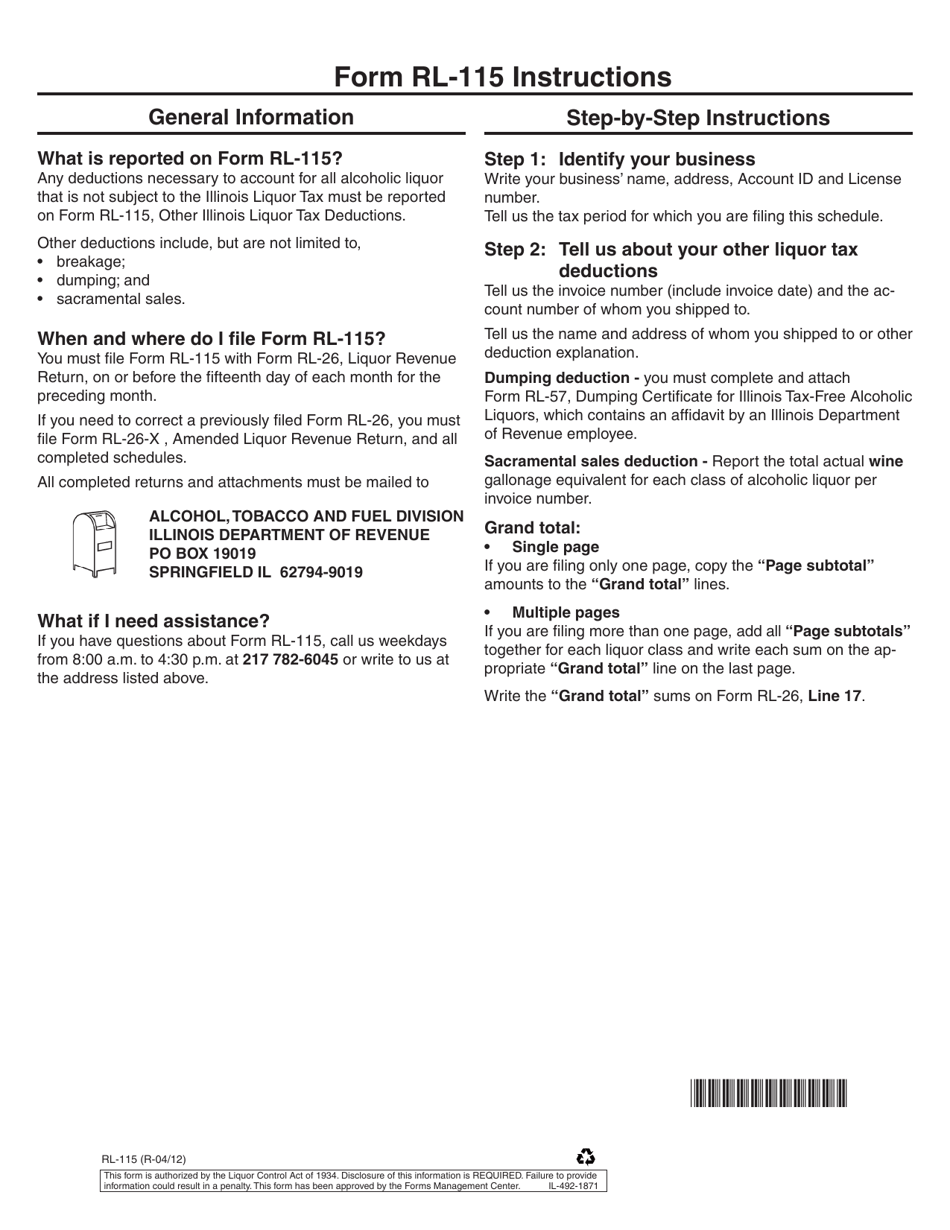

Instructions for Form RL-115 Other Illinois Liquor Tax Deductions - Illinois

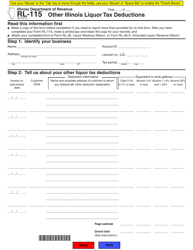

This document contains official instructions for Form RL-115 , Other Illinois Liquor Tax Deductions - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RL-115 is available for download through this link.

FAQ

Q: What is Form RL-115?

A: Form RL-115 is a tax form used in Illinois for claiming deductions on liquor taxes.

Q: What are the deductions that can be claimed on Form RL-115?

A: Form RL-115 allows individuals to claim deductions on certain liquor taxes in Illinois.

Q: Who needs to file Form RL-115?

A: Anyone who wants to claim deductions on liquor taxes in Illinois needs to file Form RL-115.

Q: Are there any specific requirements for claiming deductions on Form RL-115?

A: Yes, there are specific requirements and conditions that must be met in order to claim deductions on Form RL-115. It's best to consult the instructions provided with the form for more information.

Q: When is the deadline for filing Form RL-115?

A: The deadline for filing Form RL-115 may vary. It's important to check the form and consult the instructions for the specific deadline.

Q: Can I e-file Form RL-115?

A: At the time of writing this document, e-filing was not available for Form RL-115. It's best to check the latest instructions or consult the Illinois Department of Revenue for the most up-to-date information.

Q: What should I do if I have questions or need assistance with Form RL-115?

A: If you have questions or need assistance with Form RL-115, you should reach out to the Illinois Department of Revenue for guidance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.