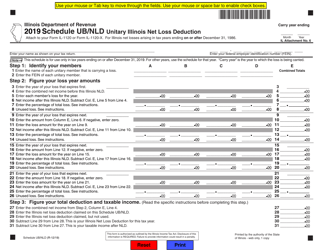

Instructions for Schedule NLD Illinois Net Loss Deduction - Illinois

This document contains official instructions for Schedule NLD , Illinois Net Loss Deduction - a form released and collected by the Illinois Department of Revenue.

FAQ

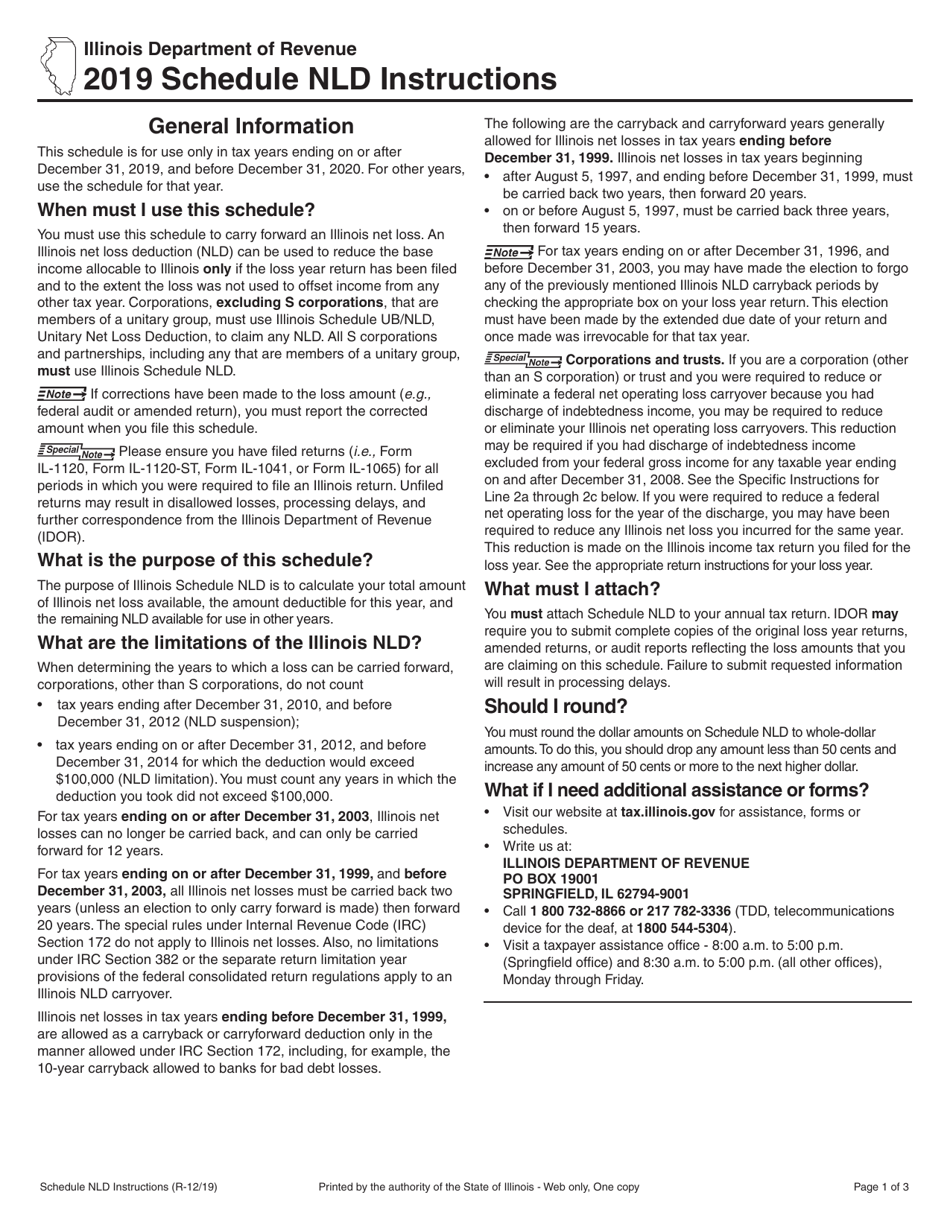

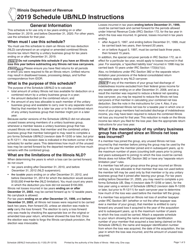

Q: What is Schedule NLD?

A: Schedule NLD is a form used in Illinois to calculate the net loss deduction for businesses.

Q: Who should file Schedule NLD?

A: Businesses in Illinois that have a net loss and want to claim a deduction should file Schedule NLD.

Q: What is the purpose of Schedule NLD?

A: The purpose of Schedule NLD is to determine the amount of net loss deduction that a business can claim on their Illinois tax return.

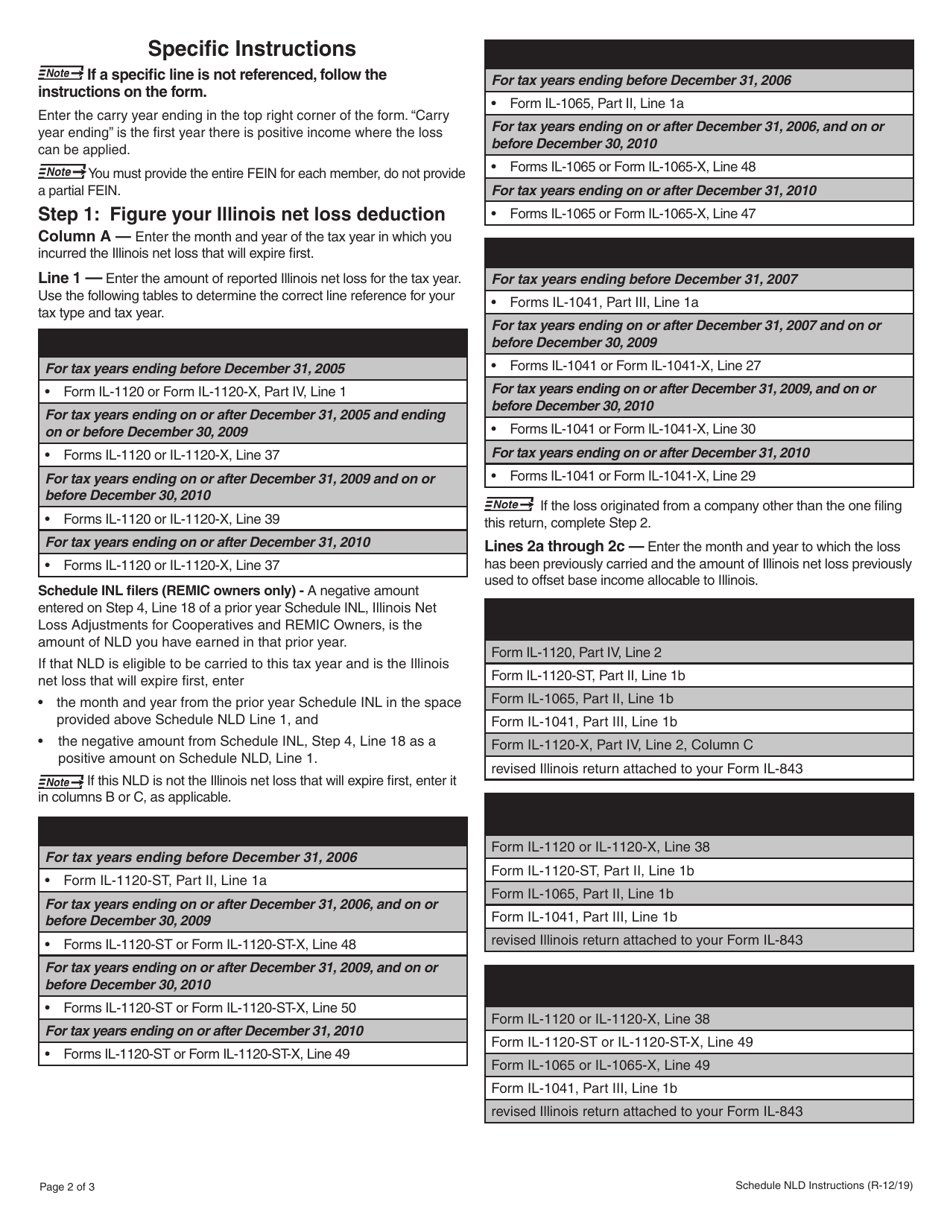

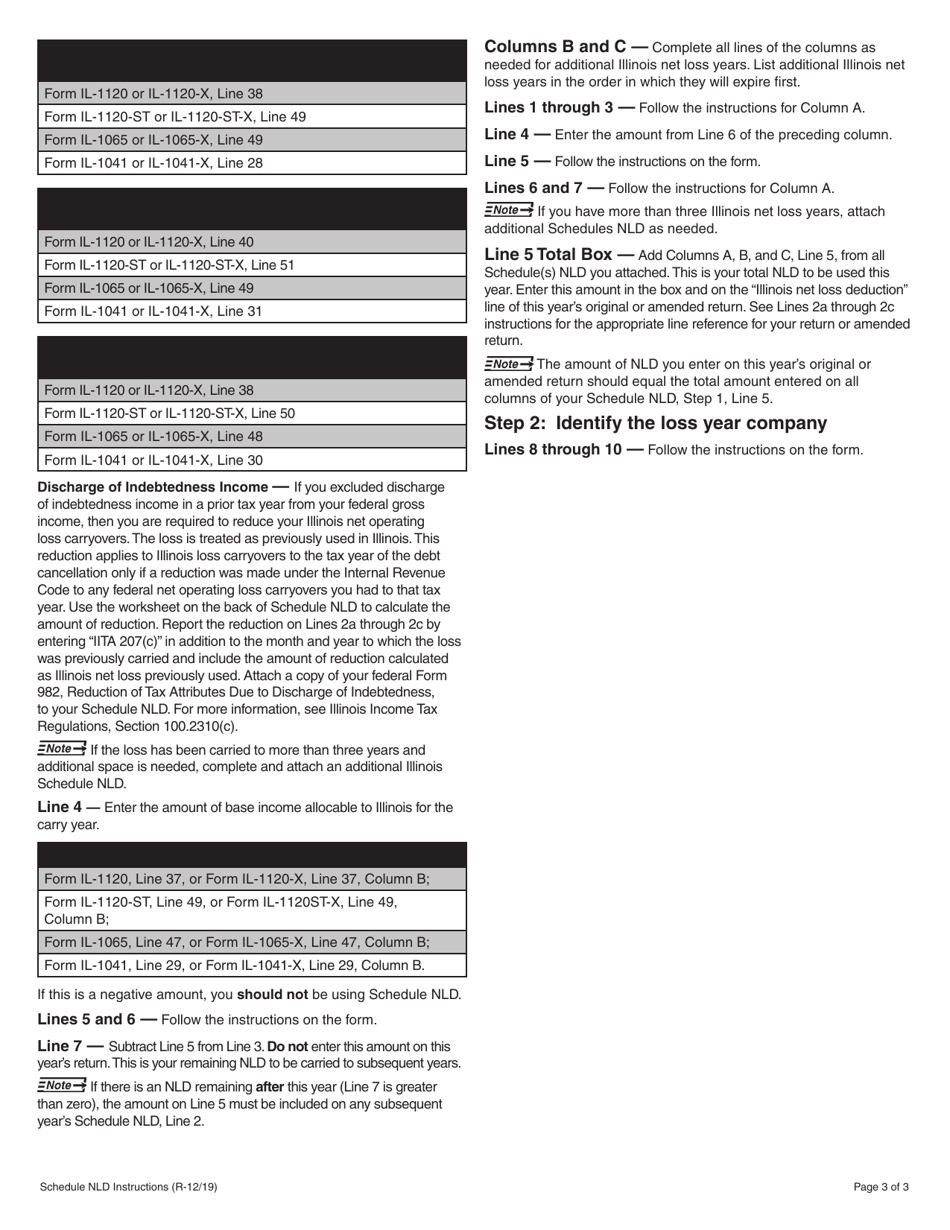

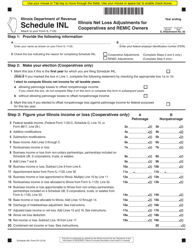

Q: How do I complete Schedule NLD?

A: You will need to fill out certain sections of the form, providing details about your net loss and other relevant information. The instructions provided with the form can help guide you through the process.

Q: When is Schedule NLD due?

A: Schedule NLD is generally due on the same date as your Illinois tax return, which is April 15th for most individuals.

Q: What if I don't have a net loss to deduct?

A: If you don't have a net loss or if it doesn't qualify for deduction, you don't need to file Schedule NLD.

Q: Can I carry forward my net loss to future years?

A: Yes, Illinois allows businesses to carry forward net losses for up to 12 years.

Q: Are there any limitations on the net loss deduction?

A: Yes, there are limitations on the net loss deduction based on the type of business entity and other factors. Consult the instructions or a tax professional for more information.

Q: What other forms may be required in conjunction with Schedule NLD?

A: Depending on your specific circumstances, you may need to file other Illinois tax forms, such as Schedule ICR or Schedule M.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.