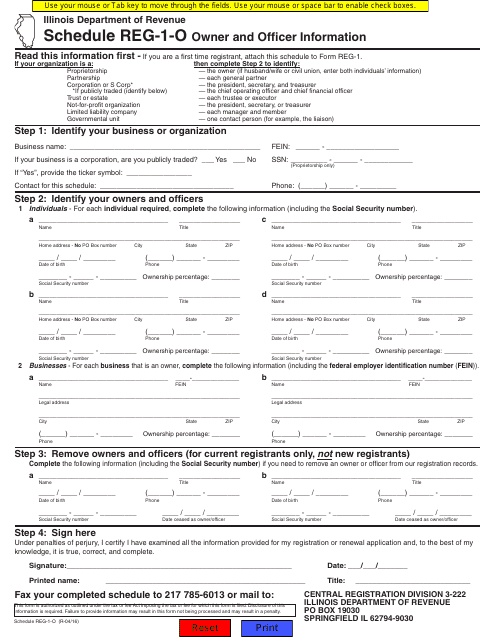

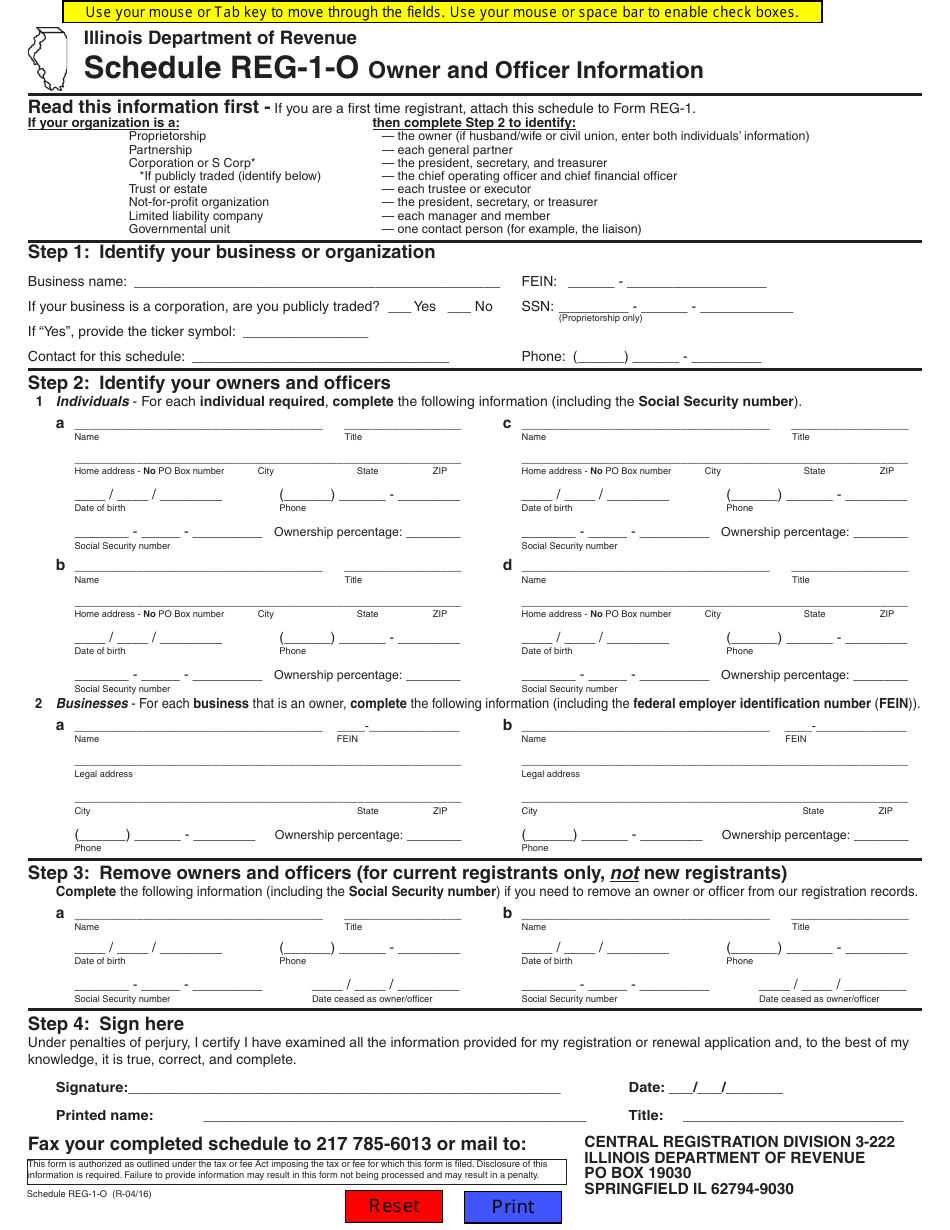

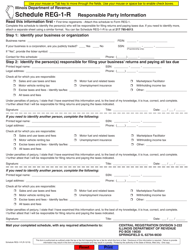

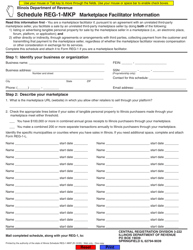

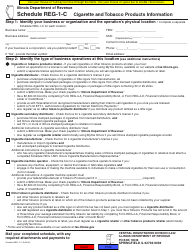

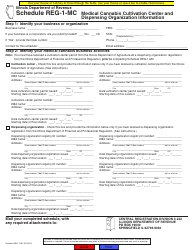

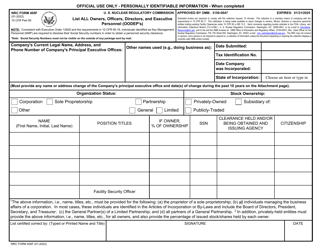

Schedule REG-1-O Owner and Officer Information - Illinois

What Is Schedule REG-1-O?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REG-1-O?

A: REG-1-O is a schedule used to provide owner and officer information.

Q: Who needs to file REG-1-O?

A: Businesses in Illinois that are required to register for sales and use tax.

Q: What information is required on REG-1-O?

A: The schedule requires details about the owners and officers of the business.

Q: How often do you need to file REG-1-O?

A: The schedule needs to be filed at the time of registration and updated if there are any changes in the ownership or officer information.

Q: Are there any fees associated with REG-1-O?

A: No, there are no fees to file REG-1-O.

Q: What happens if I don't file REG-1-O?

A: Failure to file REG-1-O can result in penalties and may affect the business's registration.

Q: Can REG-1-O be revised?

A: Yes, REG-1-O can be revised if there are any changes in the ownership or officer information.

Q: Is REG-1-O required for all businesses in Illinois?

A: REG-1-O is required for businesses that are required to register for sales and use tax.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule REG-1-O by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.