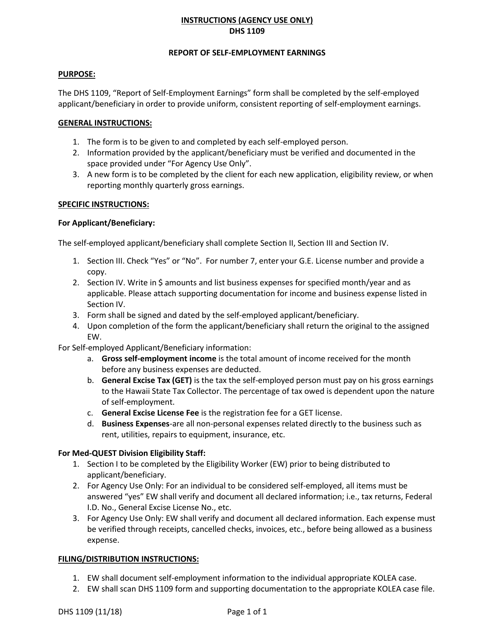

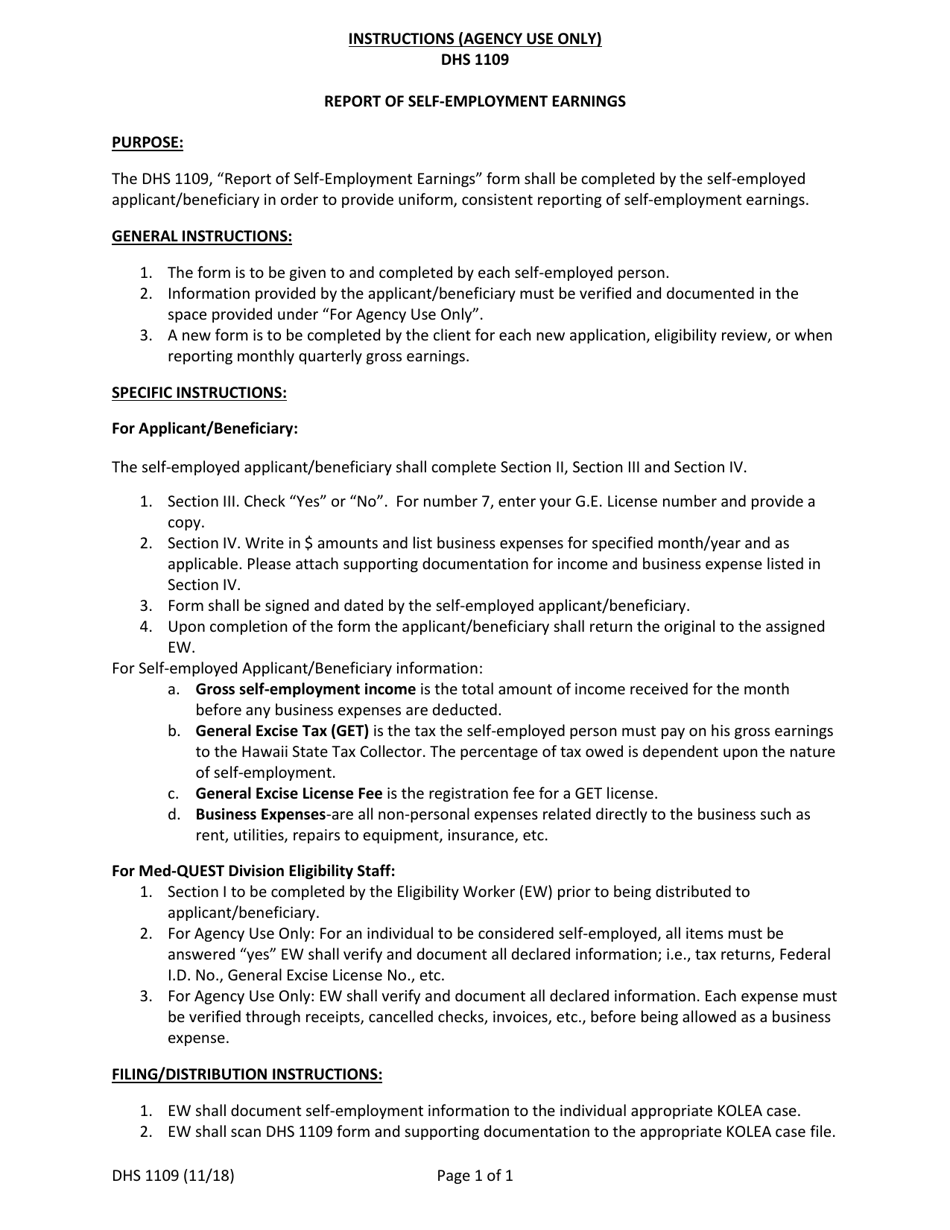

Instructions for Form DHS1109 Report of Self-employment Earnings - Hawaii

This document contains official instructions for Form DHS1109 , Report of Self-employment Earnings - a form released and collected by the Hawaii Department of Human Services.

FAQ

Q: What is Form DHS1109?

A: Form DHS1109 is the Report of Self-employment Earnings - Hawaii.

Q: What is the purpose of Form DHS1109?

A: The purpose of Form DHS1109 is to report self-employment earnings in Hawaii.

Q: Who needs to fill out Form DHS1109?

A: Anyone who is self-employed and earns income in Hawaii needs to fill out Form DHS1109.

Q: When should Form DHS1109 be filled out?

A: Form DHS1109 should be filled out annually and must be postmarked by January 31st of the following year.

Q: What information do I need to fill out Form DHS1109?

A: You will need to provide information about your self-employment income, expenses, and any deductions you are claiming.

Q: Are there any penalties for not filing Form DHS1109?

A: Yes, there are penalties for not filing Form DHS1109, including fines and potential legal consequences.

Q: Can Form DHS1109 be filed electronically?

A: No, Form DHS1109 can only be filed by mail and must include all necessary supporting documentation.

Q: Are there any exemptions or exceptions to filing Form DHS1109?

A: There may be certain exemptions or exceptions to filing Form DHS1109, such as if your self-employment income falls below a certain threshold.

Q: What should I do if I have additional questions about Form DHS1109?

A: If you have additional questions or need further assistance with Form DHS1109, you should contact the Hawaii Department of Human Services for clarification.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Human Services.