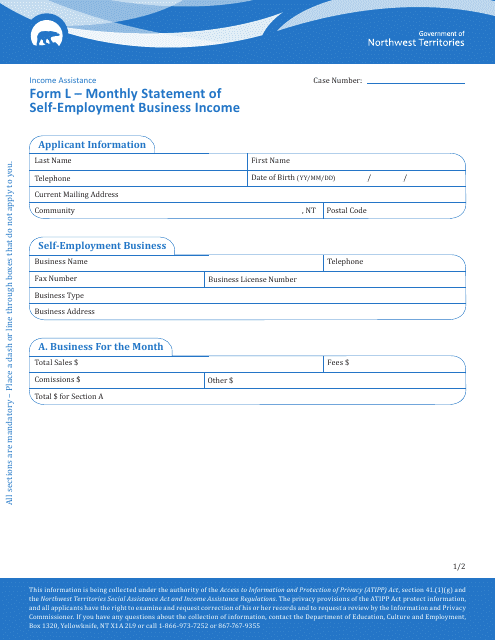

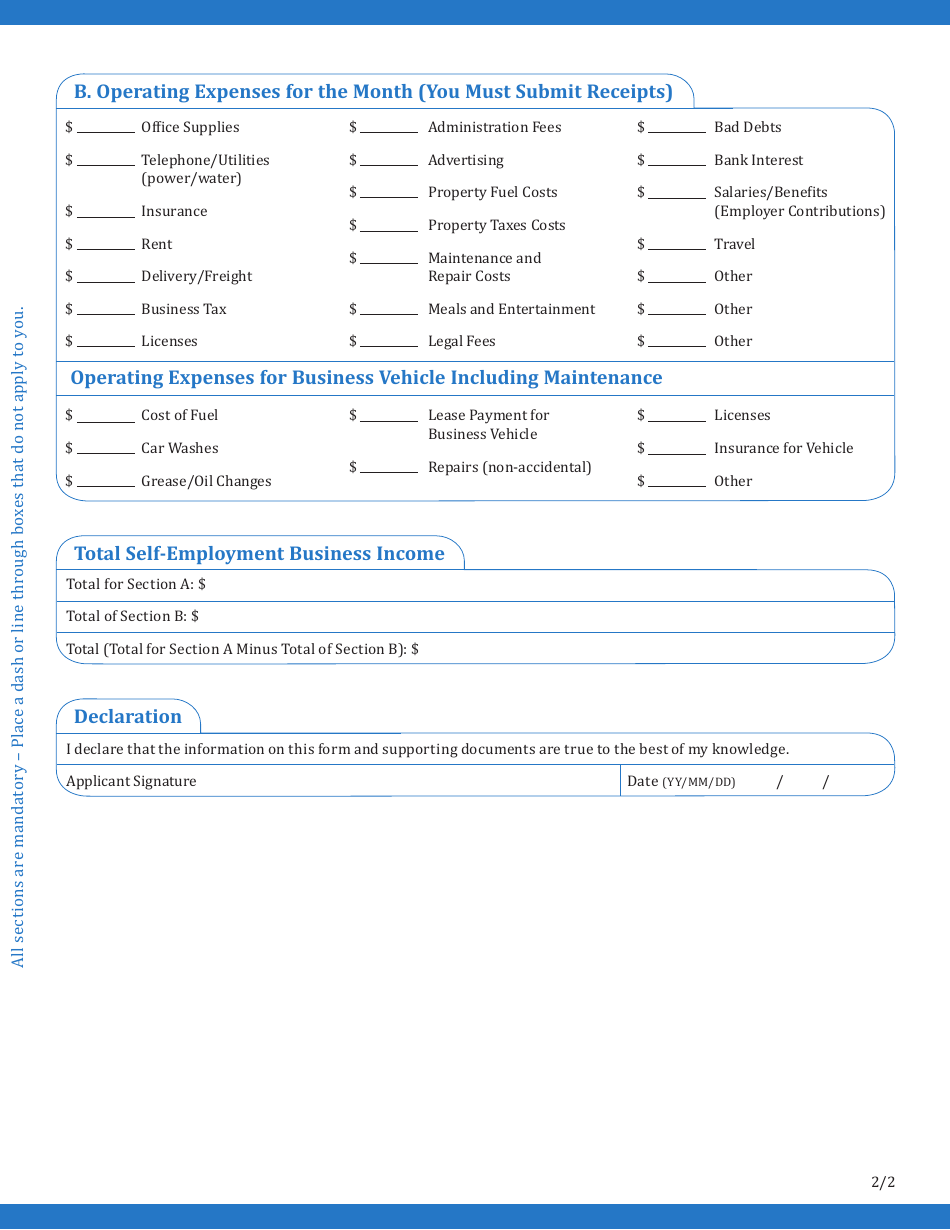

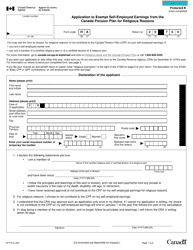

Form L Monthly Statement of Self-employment Business Income - Northwest Territories, Canada

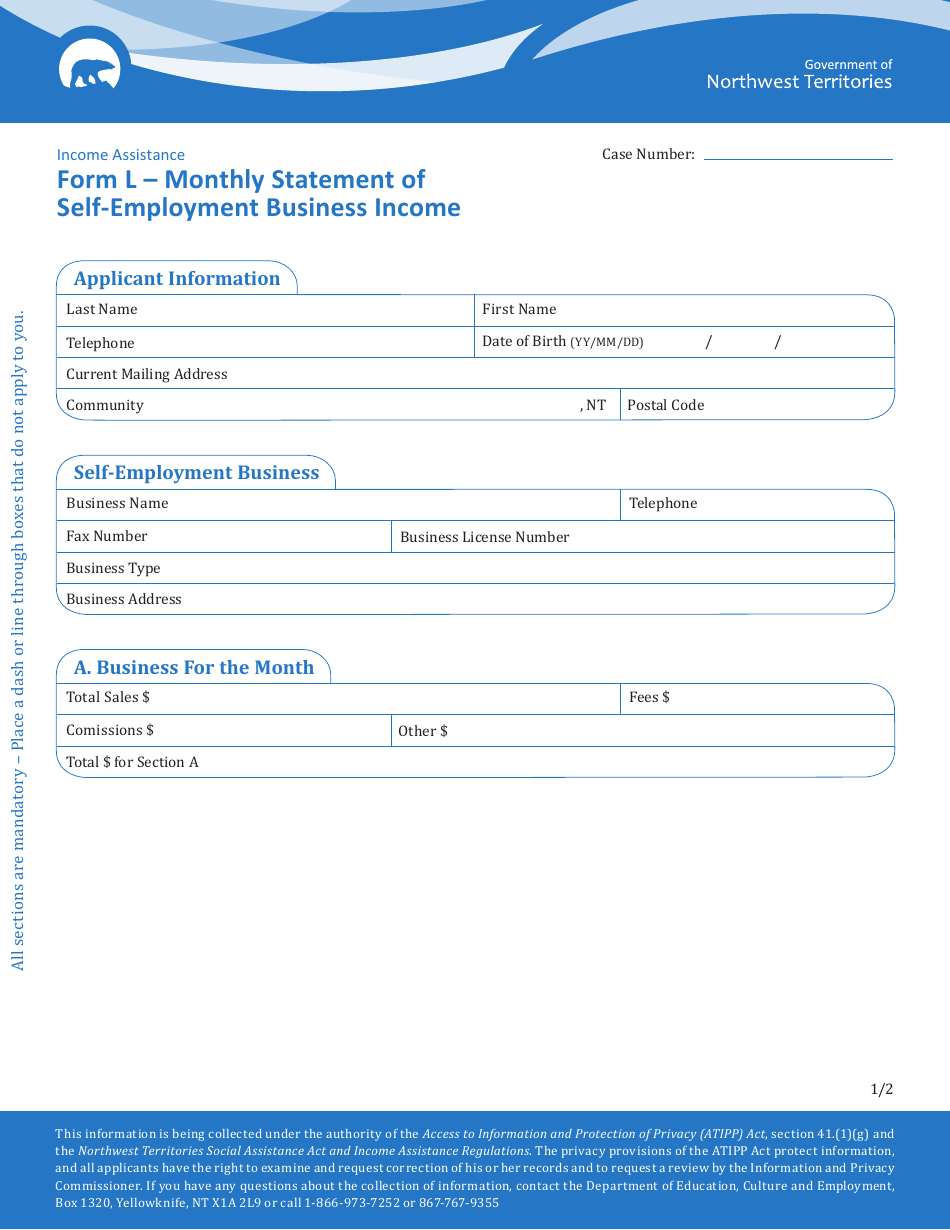

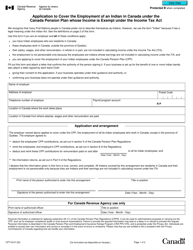

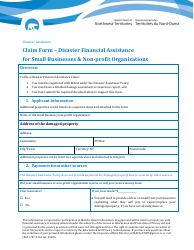

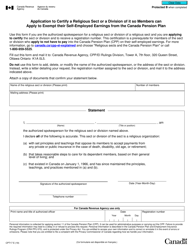

The Form L Monthly Statement of Self-employment Business Income - Northwest Territories, Canada is used by self-employed individuals in the Northwest Territories to report their monthly business income to the government. This form helps in calculating and remitting the appropriate amount of taxes and other obligations related to self-employment.

The individual who is self-employed and conducts business in the Northwest Territories, Canada is responsible for filing the Form L Monthly Statement of Self-employment Business Income.

FAQ

Q: What is Form L?

A: Form L is the Monthly Statement of Self-employment Business Income.

Q: Who needs to fill out Form L?

A: Self-employed individuals in the Northwest Territories, Canada need to fill out Form L.

Q: What is the purpose of Form L?

A: Form L is used to report monthly self-employment business income in the Northwest Territories, Canada.

Q: How often should Form L be filled out?

A: Form L should be filled out on a monthly basis.

Q: Is Form L specific to a certain province?

A: Yes, Form L is specific to the Northwest Territories in Canada.

Q: Do I need to include other supporting documents with Form L?

A: You may need to include additional supporting documents, such as receipts and invoices, depending on your business.

Q: Is Form L required for all types of self-employment businesses?

A: Yes, Form L is required for all types of self-employment businesses in the Northwest Territories, Canada.

Q: Are there penalties for not submitting Form L?

A: There may be penalties for failing to submit Form L or for submitting incomplete or inaccurate information.