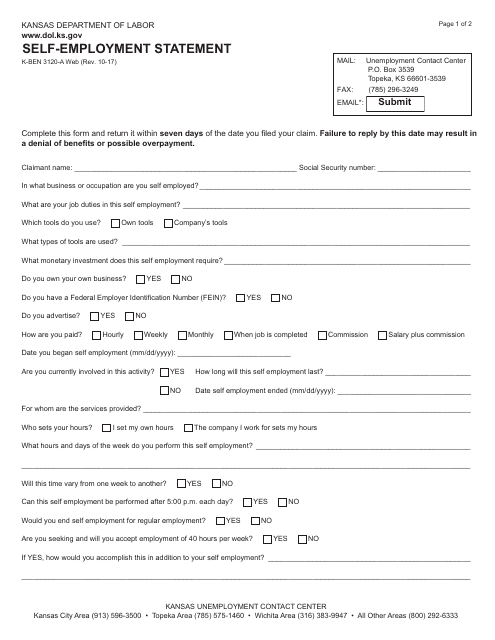

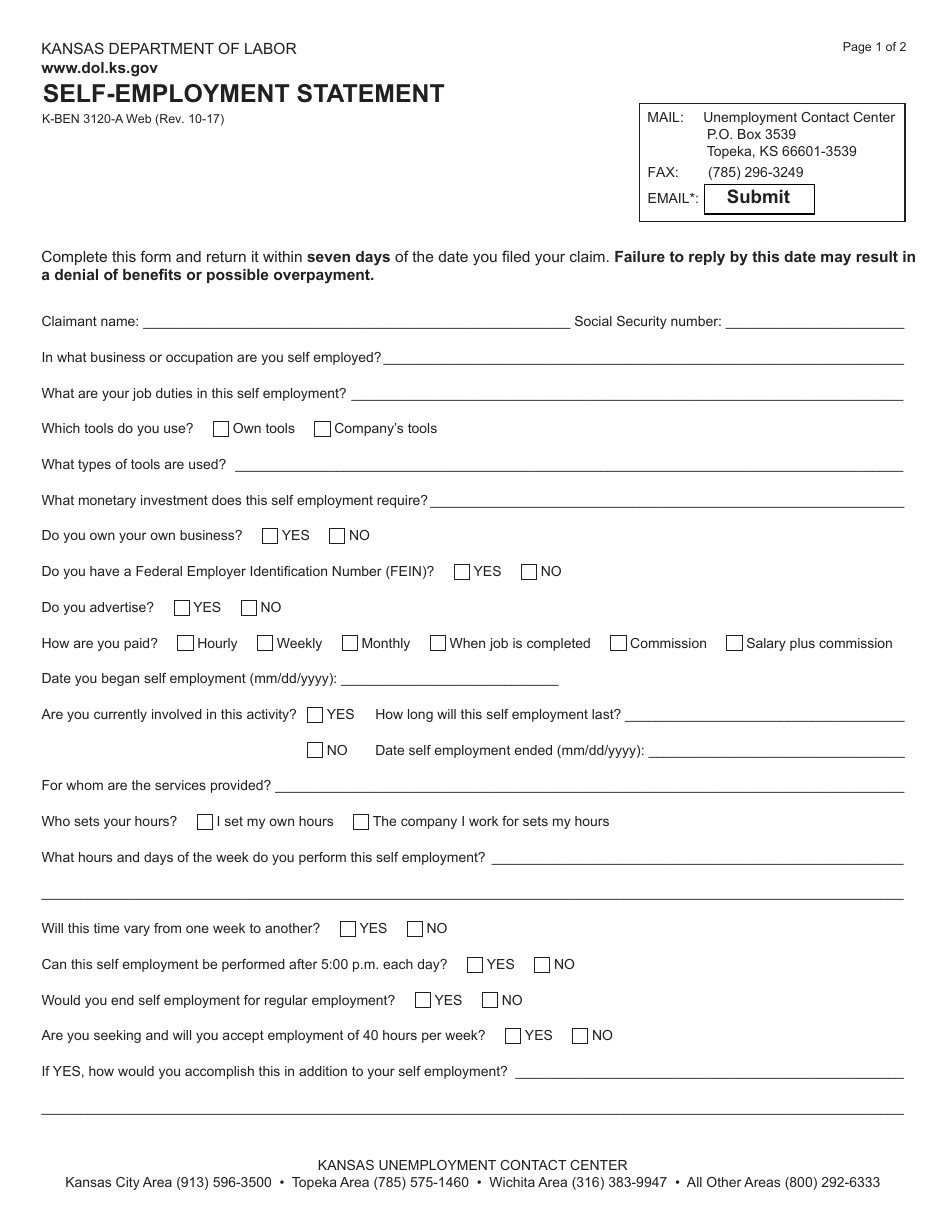

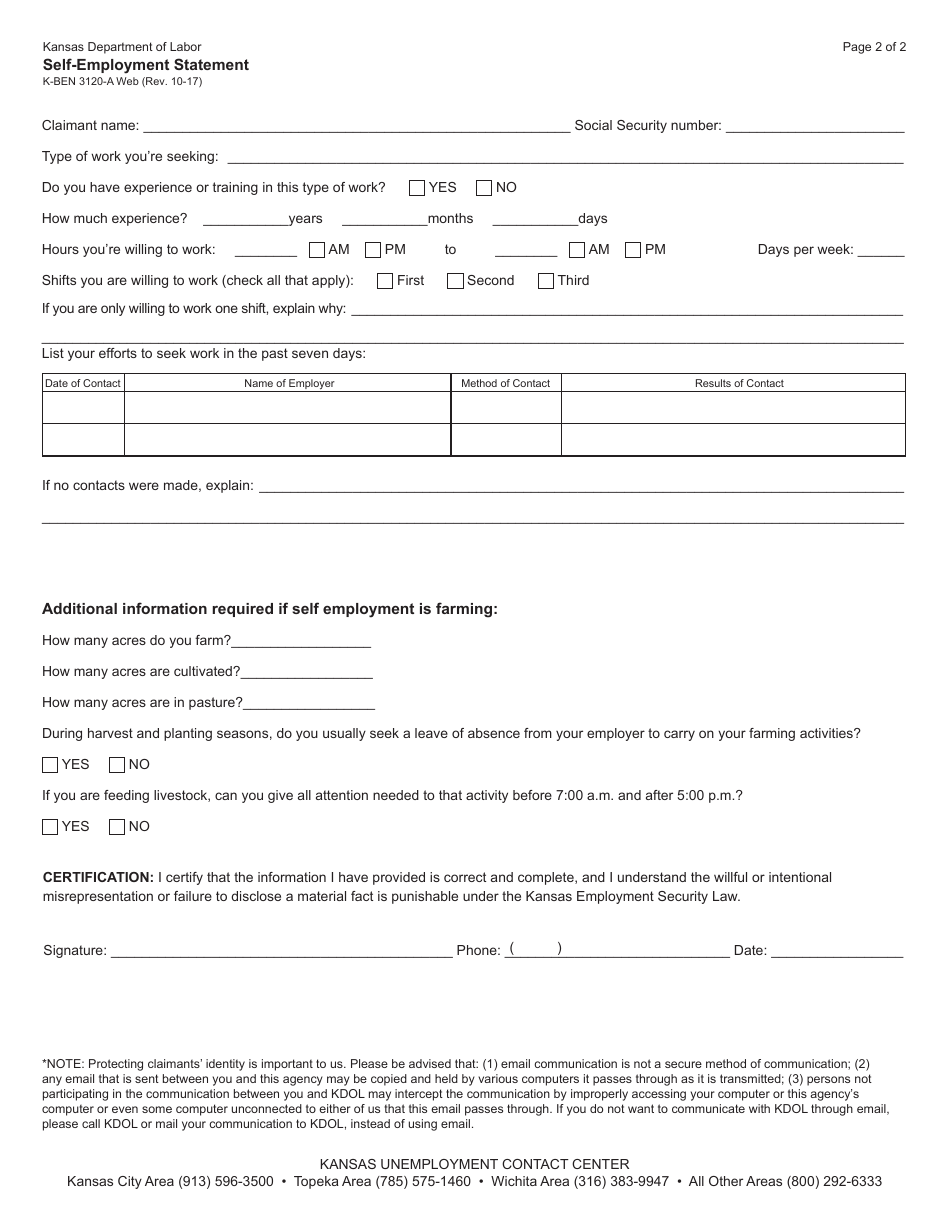

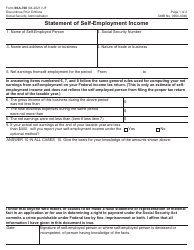

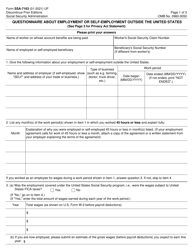

Form K-BEN3120-A Self-employment Statement - Kansas

What Is Form K-BEN3120-A?

This is a legal form that was released by the Kansas Department of Labor - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-BEN3120-A?

A: Form K-BEN3120-A is the Self-employment Statement for the state of Kansas.

Q: Who needs to fill out Form K-BEN3120-A?

A: Self-employed individuals in Kansas need to fill out Form K-BEN3120-A.

Q: What is the purpose of Form K-BEN3120-A?

A: The purpose of Form K-BEN3120-A is to report self-employment income and expenses for tax purposes in Kansas.

Q: When is the deadline for filing Form K-BEN3120-A?

A: The deadline for filing Form K-BEN3120-A is typically April 15th, or the same deadline as the federal tax return.

Q: Are there any penalties for not filing Form K-BEN3120-A?

A: Yes, there may be penalties for not filing Form K-BEN3120-A or for filing it late. It's important to meet the deadline to avoid any penalties.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Kansas Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-BEN3120-A by clicking the link below or browse more documents and templates provided by the Kansas Department of Labor.