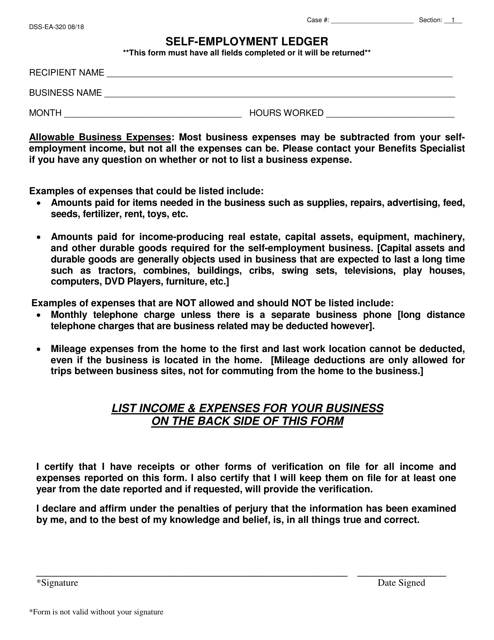

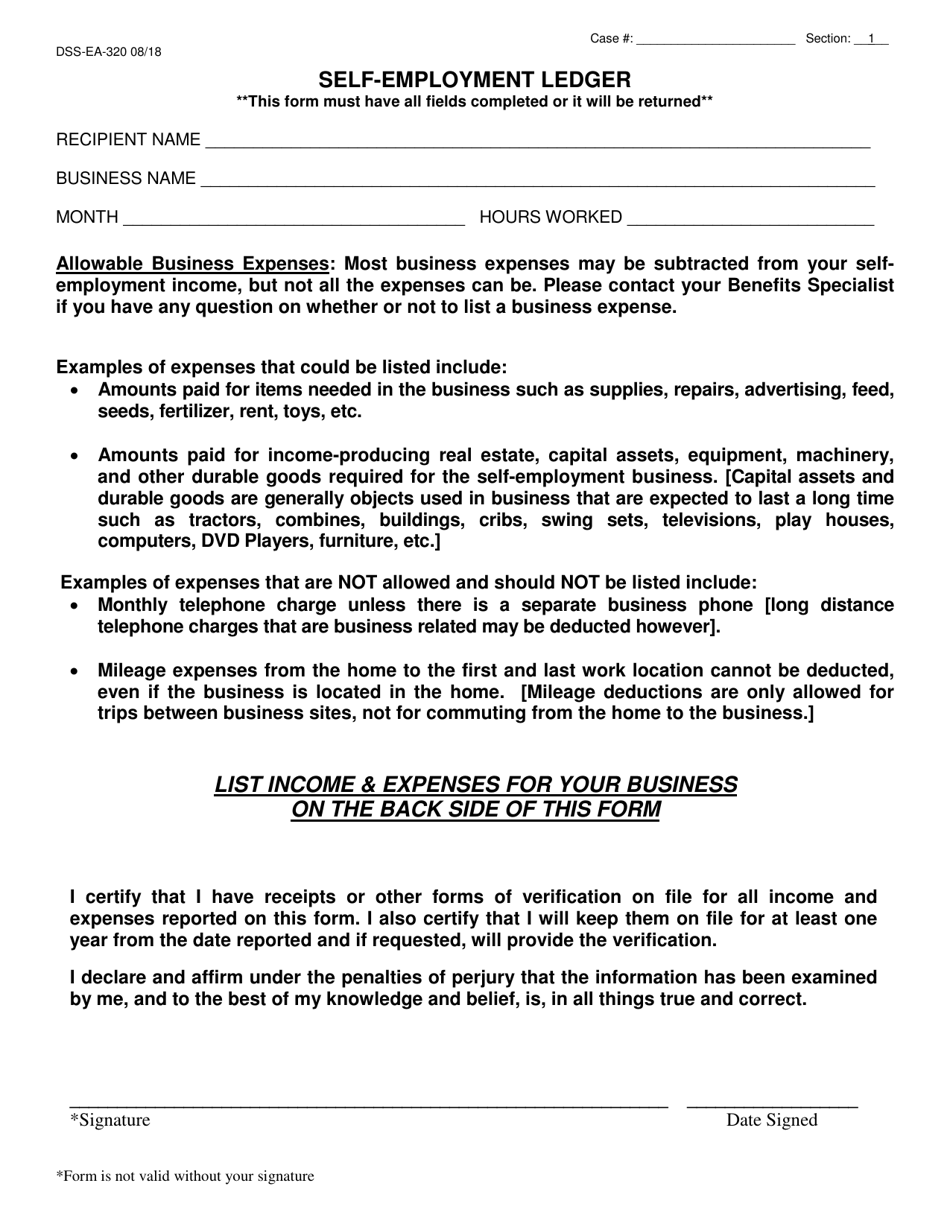

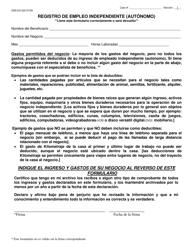

Form DSS-EA-320 Self-employment Ledger - South Dakota

What Is Form DSS-EA-320?

This is a legal form that was released by the South Dakota Department of Social Services - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

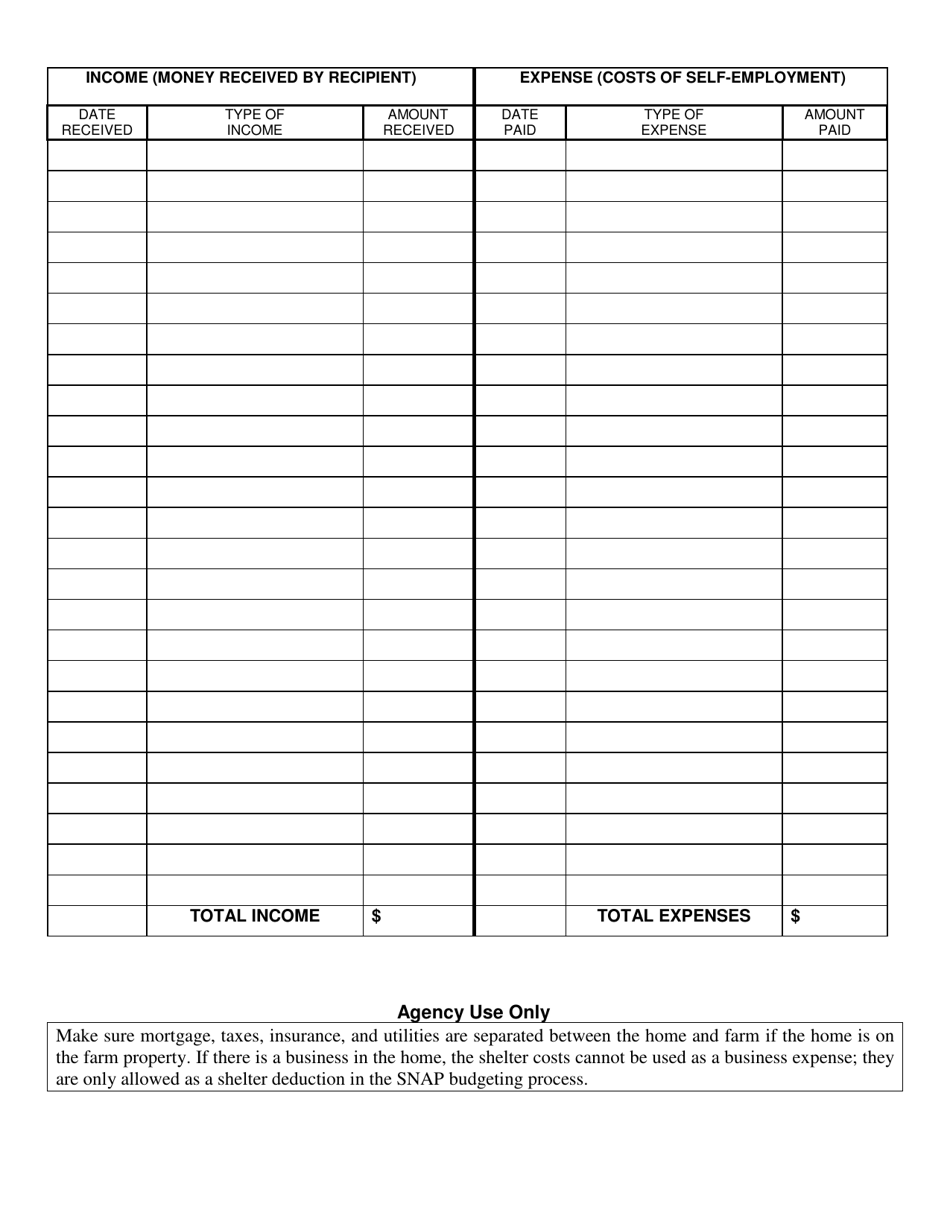

Q: What is Form DSS-EA-320?

A: Form DSS-EA-320 is a self-employment ledger used in South Dakota.

Q: What is a self-employment ledger?

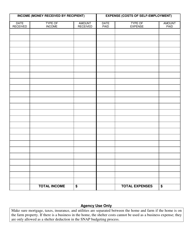

A: A self-employment ledger is a record of income and expenses for individuals who are self-employed.

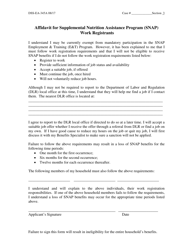

Q: Who uses Form DSS-EA-320?

A: Form DSS-EA-320 is used by self-employed individuals in South Dakota.

Q: What information is required on Form DSS-EA-320?

A: Form DSS-EA-320 requires information such as income sources, expenses, and net profit.

Q: How often do I need to complete Form DSS-EA-320?

A: Form DSS-EA-320 needs to be completed on a regular basis, typically monthly or quarterly.

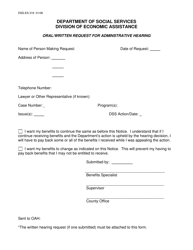

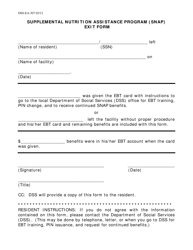

Q: What is the purpose of Form DSS-EA-320?

A: The purpose of Form DSS-EA-320 is to assess the self-employment income and eligibility for social services programs.

Q: Do I need to submit additional documents with Form DSS-EA-320?

A: Depending on the situation, additional documents such as invoices, receipts, or bank statements may be required.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the South Dakota Department of Social Services;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DSS-EA-320 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Social Services.