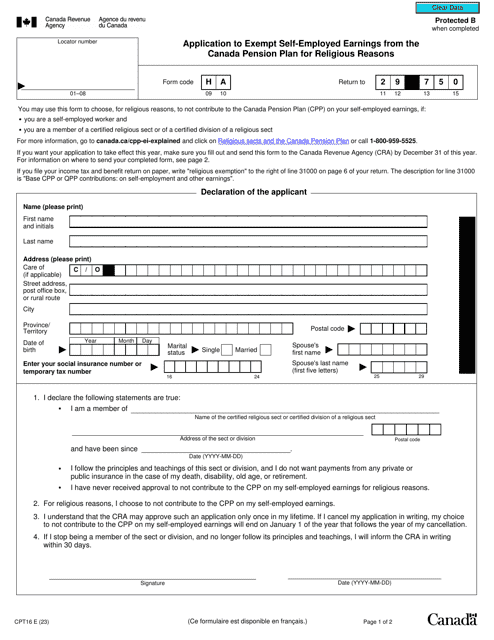

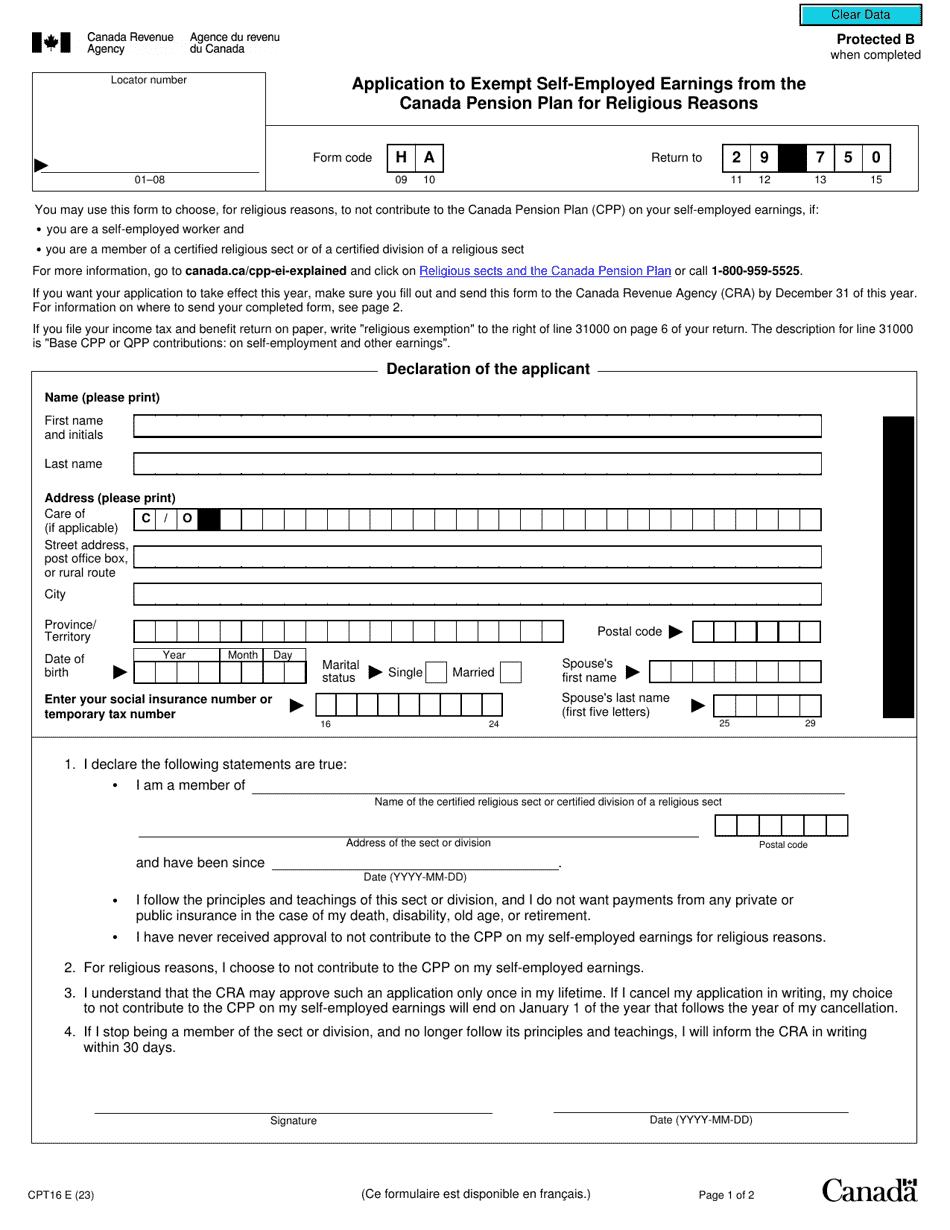

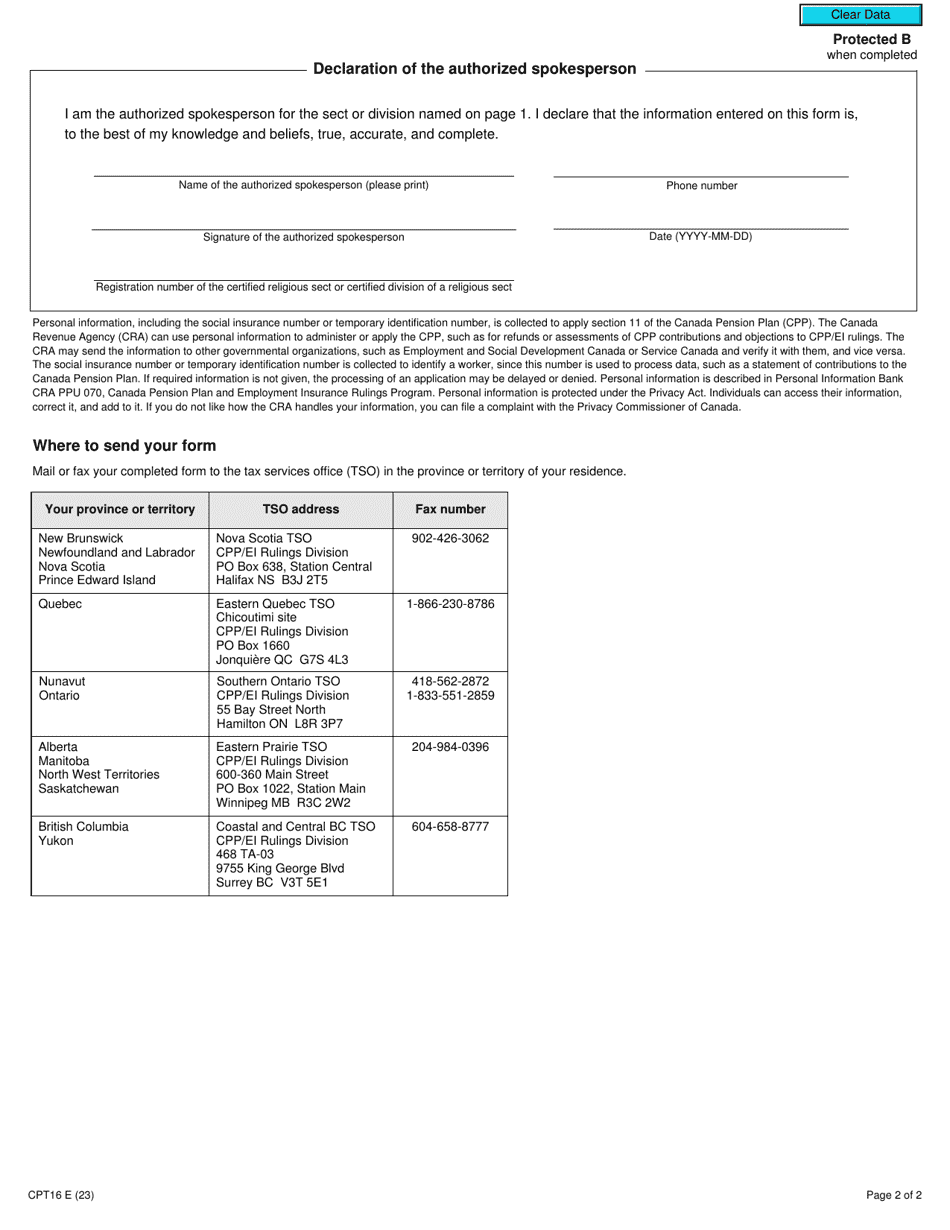

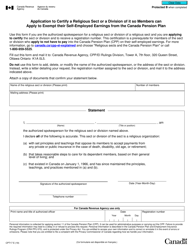

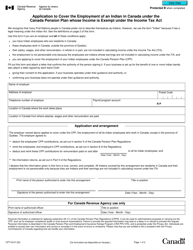

Form CPT16 Application to Exempt Self-employed Earnings From the Canada Pension Plan for Religious Reasons - Canada

Form CPT16, Application to Exempt Self-employed Earnings From the Canada Pension Plan for Religious Reasons, in Canada, is used to request an exemption from contributing to the Canada Pension Plan (CPP) for religious reasons if you are self-employed.

The Form CPT16 application to exempt self-employed earnings from the Canada Pension Plan for religious reasons is filed by individuals who meet the eligibility criteria for such an exemption in Canada.

Form CPT16 Application to Exempt Self-employed Earnings From the Canada Pension Plan for Religious Reasons - Canada - Frequently Asked Questions (FAQ)

Q: What is Form CPT16?

A: Form CPT16 is an application to exempt self-employed earnings from the Canada Pension Plan for religious reasons.

Q: Who can use Form CPT16?

A: Self-employed individuals in Canada who have religious reasons for not participating in the Canada Pension Plan can use Form CPT16.

Q: What is the purpose of Form CPT16?

A: The purpose of Form CPT16 is to apply for an exemption from paying Canada Pension Plan contributions for self-employed earnings based on religious beliefs.

Q: What information do I need to provide on Form CPT16?

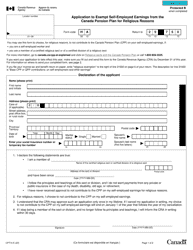

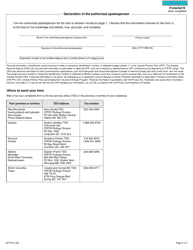

A: On Form CPT16, you will need to provide your personal information, details about your religious beliefs, and information about your self-employed earnings.

Q: What happens after I submit Form CPT16?

A: After you submit Form CPT16, the CRA will review your application and notify you of their decision regarding your exemption from Canada Pension Plan contributions.