This version of the form is not currently in use and is provided for reference only. Download this version of

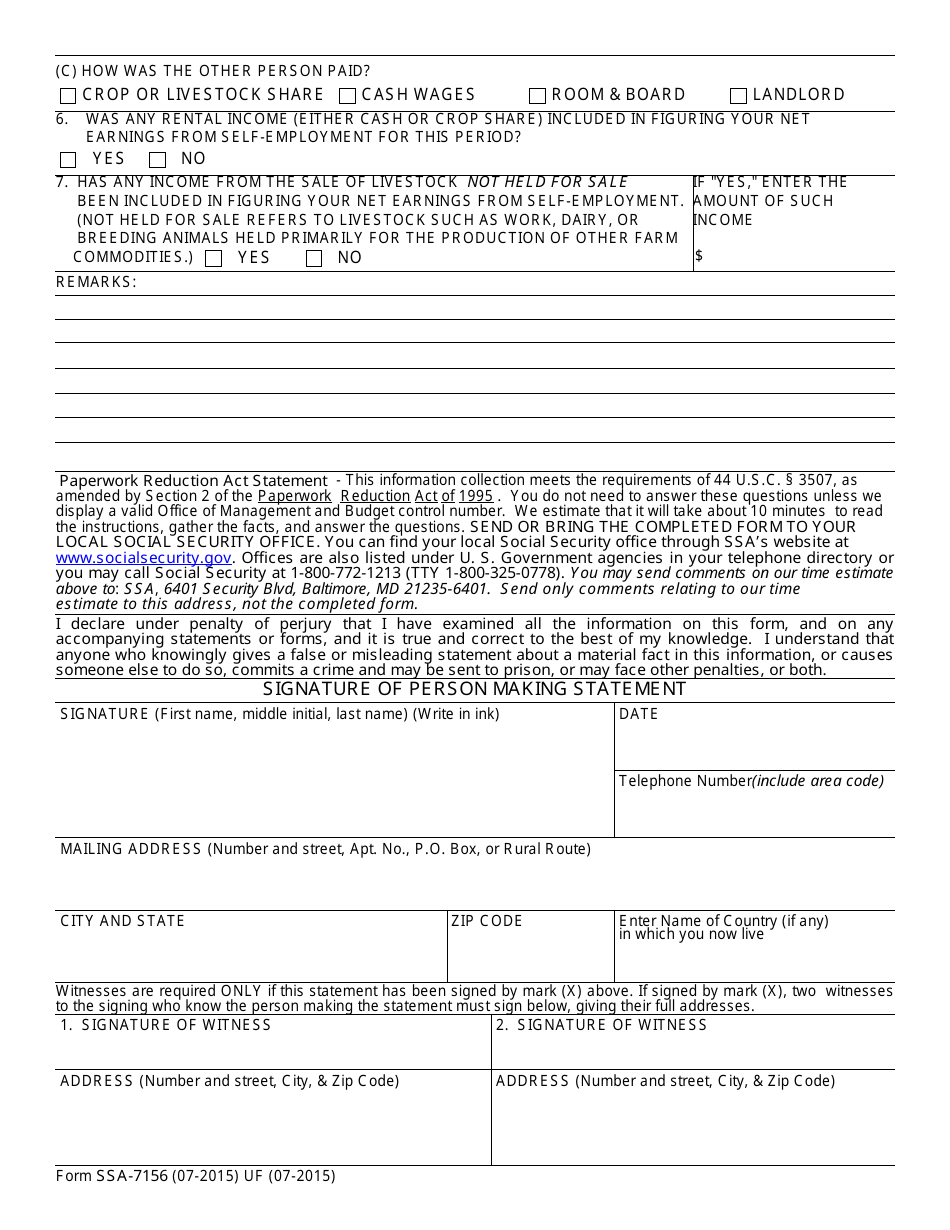

Form SSA-7156

for the current year.

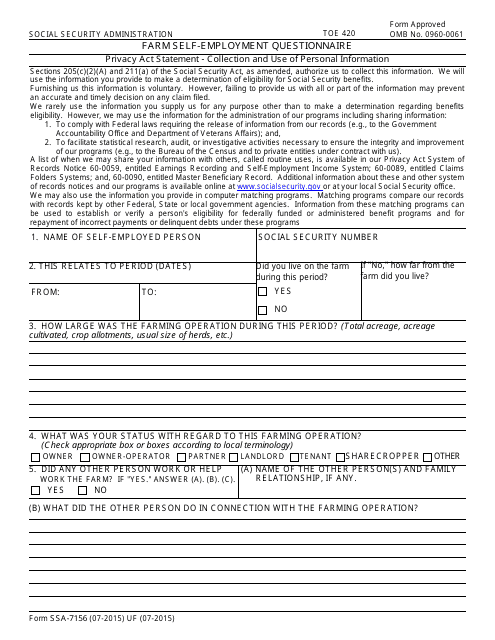

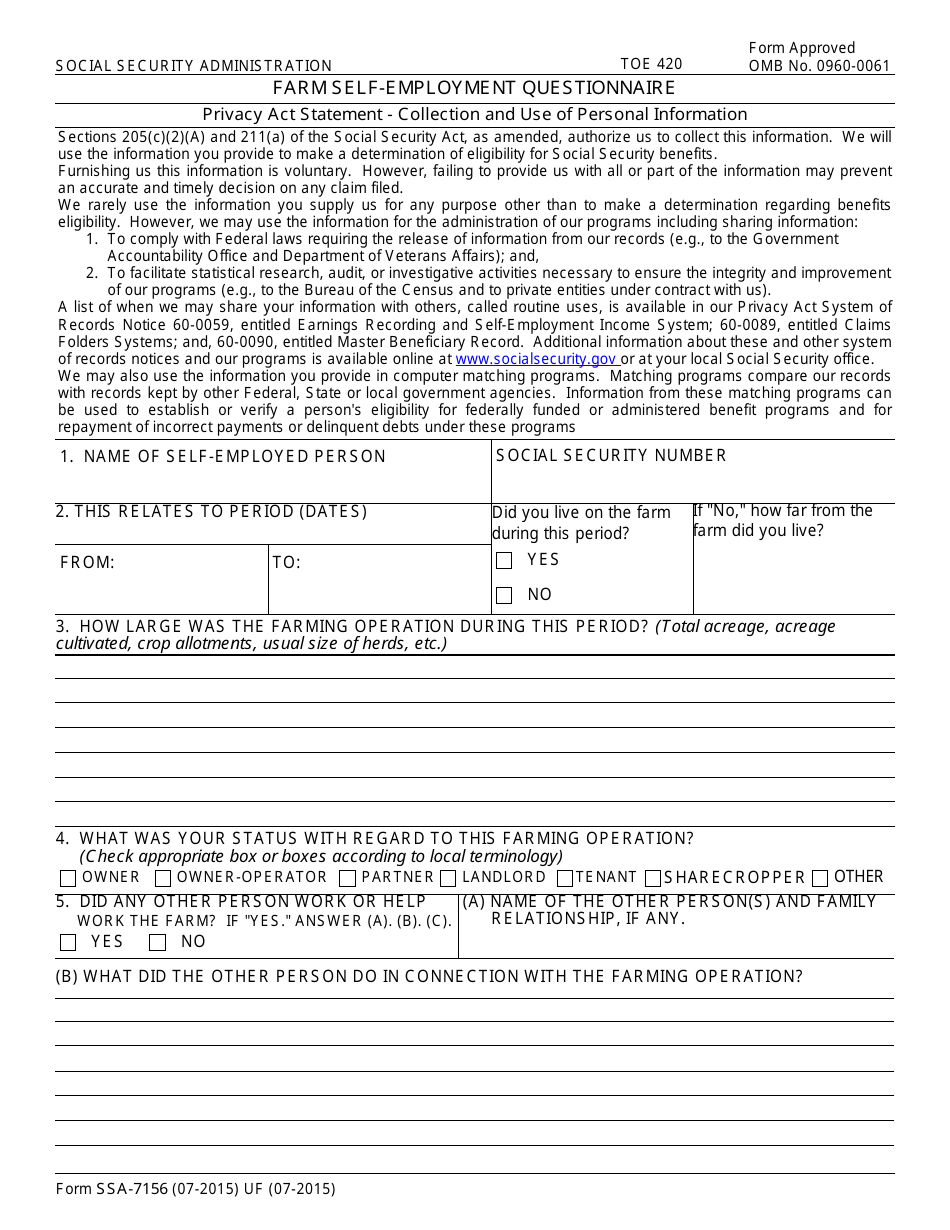

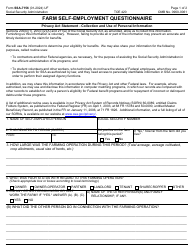

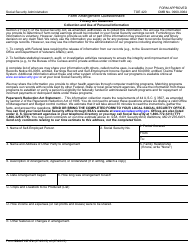

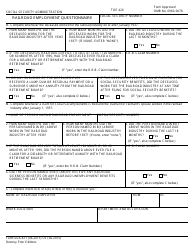

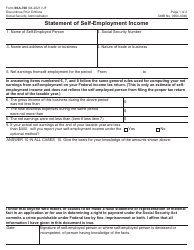

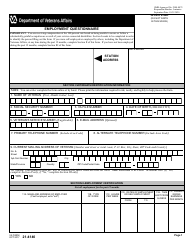

Form SSA-7156 Farm Self-employment Questionnaire

What Is Form SSA-7156?

This is a legal form that was released by the U.S. Social Security Administration on July 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-7156 Farm Self-employment Questionnaire?

A: Form SSA-7156 is a questionnaire used by the Social Security Administration (SSA) to gather information about self-employment income from farming activities.

Q: Who needs to fill out Form SSA-7156?

A: If you are receiving Social Security benefits and have income from farming, you may be required to fill out this form.

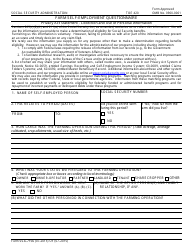

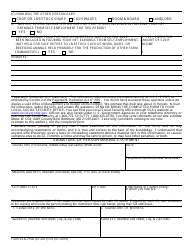

Q: What information is required on Form SSA-7156?

A: This form asks for details about your farming activities, such as income and expenses, equipment ownership, and participation in farm management.

Q: When should I submit Form SSA-7156?

A: You should submit this form as soon as possible after the SSA requests it. Failure to provide the requested information may result in a loss or reduction of your benefits.

Q: Do I need to keep records to fill out Form SSA-7156?

A: Yes, it is important to keep accurate records of your farming activities, including income, expenses, and other relevant information, to complete this form.

Q: What happens after I submit Form SSA-7156?

A: The SSA will review the information you provided on the form and use it to determine your eligibility for benefits or any adjustments to your current benefit amount.

Q: Can I get help with filling out Form SSA-7156?

A: Yes, you can seek assistance from the Social Security Administration or consult with a professional tax advisor or accountant familiar with self-employment in farming.

Form Details:

- Released on July 1, 2015;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-7156 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.