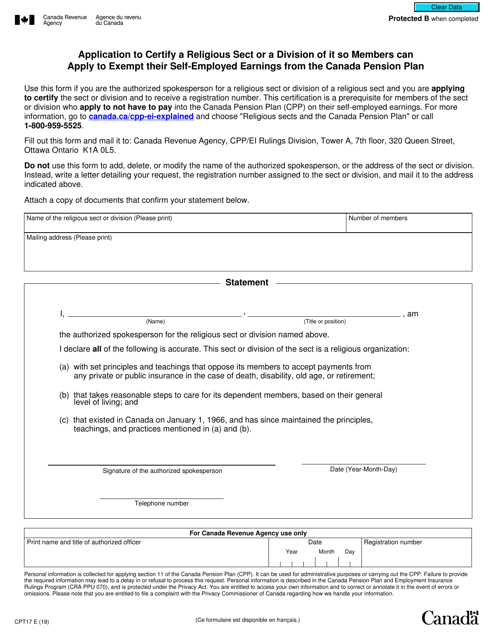

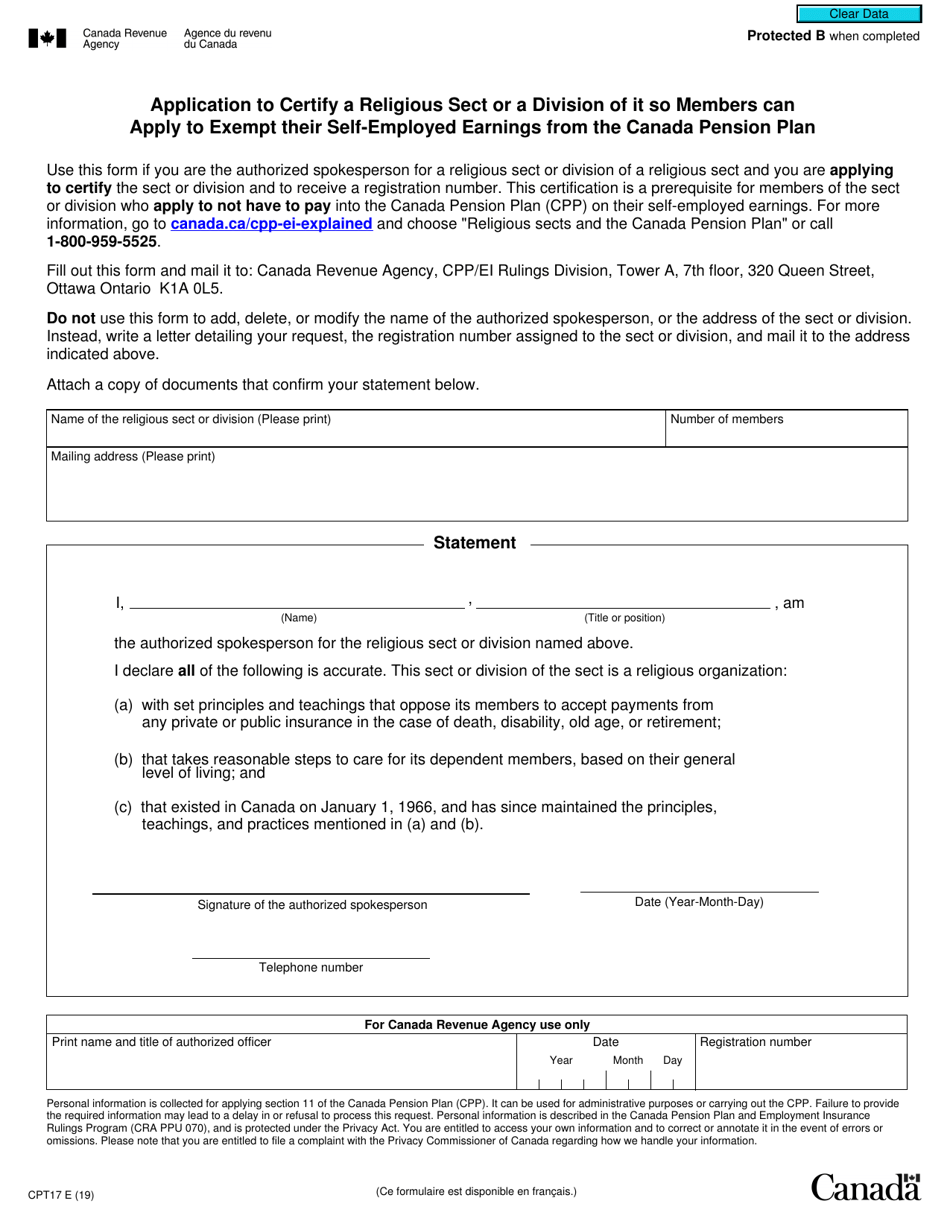

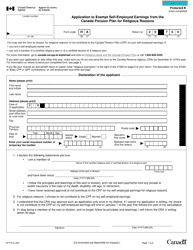

Form CPT17 Application to Certify a Religious Sect or a Division of It so Members Can Apply to Exempt Their Self-employed Earnings From the Canada Pension Plan - Canada

Form CPT17 is an application used in Canada to certify a religious sect or a division within it, so that its members can apply to exempt their self-employed earnings from the Canada Pension Plan. This form allows religious sects or divisions with specific religious beliefs that are opposed to the insurance aspect of the Canada Pension Plan to apply for an exemption.

The religious sect or division itself files the Form CPT17 application in Canada.

FAQ

Q: What is Form CPT17?

A: Form CPT17 is an application used to certify a religious sect or a division of it, allowing members to apply for exemption from the Canada Pension Plan (CPP) on their self-employed earnings.

Q: Who can use Form CPT17?

A: Form CPT17 can be used by members of a religious sect or a division of a religious sect who wish to apply for exemption from the CPP on their self-employed earnings.

Q: What is the purpose of Form CPT17?

A: The purpose of Form CPT17 is to certify a religious sect or a division of it, so that its members can apply for exemption from the CPP on their self-employed earnings.

Q: How does the application process work?

A: To apply for exemption from CPP on self-employed earnings, members of a religious sect or division must complete and submit Form CPT17 to the Canada Revenue Agency (CRA). The CRA will review the application and determine if the sect or division meets the criteria for certification.

Q: What are the requirements for certification?

A: In order to be certified, the religious sect or division must have been in existence before 1965, have sincere religious beliefs that are incompatible with the CPP, and provide for their members in the event of retirement, disability, or death.

Q: What happens after certification?

A: Once the religious sect or division is certified, its members can apply for exemption from the CPP on their self-employed earnings. They will not be required to contribute to the CPP and will not be eligible for CPP benefits.

Q: Is there a deadline for submitting Form CPT17?

A: There is no specific deadline for submitting Form CPT17, but it is recommended to submit the form well in advance of the year in which you wish to be exempt from CPP contributions.