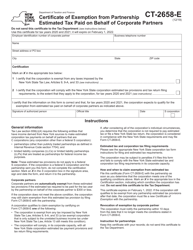

This version of the form is not currently in use and is provided for reference only. Download this version of

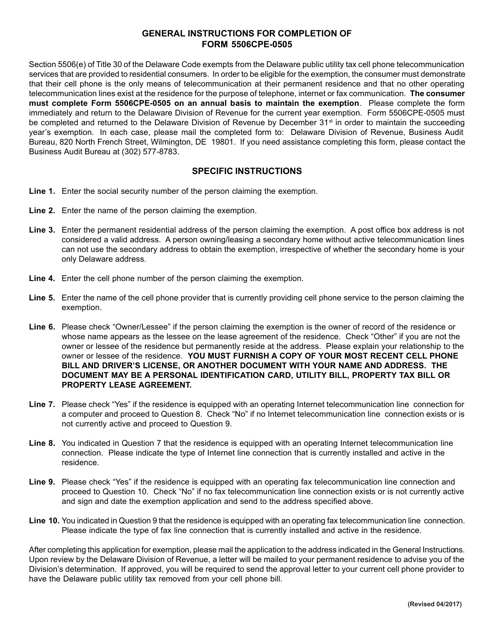

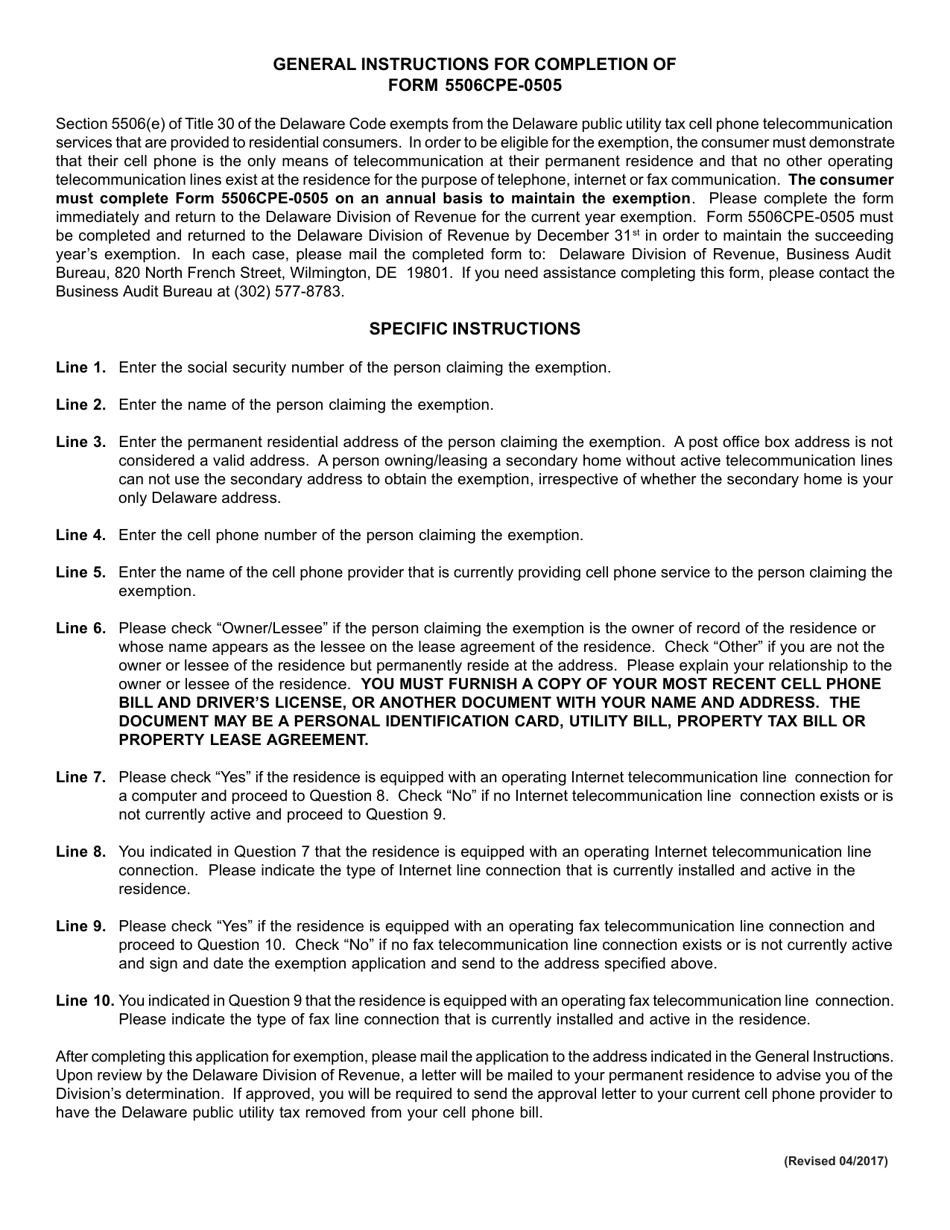

Instructions for Form 5506CPE-0505

for the current year.

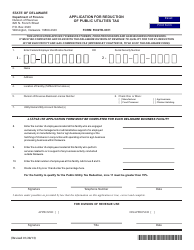

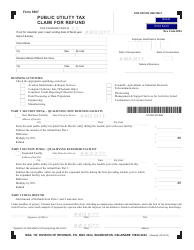

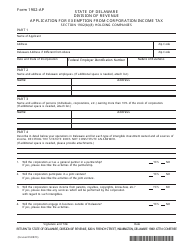

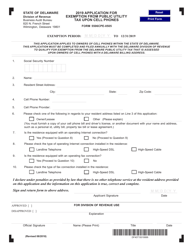

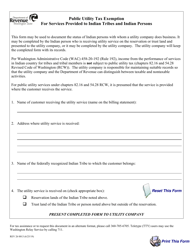

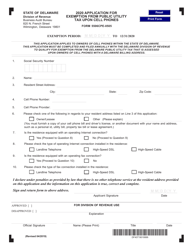

Instructions for Form 5506CPE-0505 Application for Exemption From Public Utility Tax Upon Cell Phones - Delaware

This document contains official instructions for Form 5506CPE-0505 , Application for Exemption From Public Utility Tax Upon Cell Phones - a form released and collected by the Delaware Department of Finance - Division of Revenue.

FAQ

Q: What is Form 5506CPE-0505?

A: Form 5506CPE-0505 is an application for exemption from public utility tax upon cell phones in Delaware.

Q: What is the purpose of this form?

A: The purpose of this form is to apply for an exemption from the public utility tax on cell phones.

Q: Who should use this form?

A: This form should be used by individuals or businesses in Delaware who are seeking exemption from the public utility tax on cell phones.

Q: Are there any eligibility requirements for the exemption?

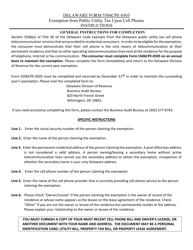

A: Yes, there are eligibility requirements for the exemption. You must meet certain criteria outlined in the instructions of the form.

Q: What supporting documents do I need to submit with the form?

A: You may need to submit copies of your cell phone service provider contract, bills, or other documents as proof of eligibility for the exemption.

Q: Is there a deadline for submitting the form?

A: Yes, there is a deadline for submitting the form. Please refer to the instructions for the specific deadline.

Q: What should I do if I have questions or need assistance?

A: If you have questions or need assistance, you can contact the Delaware Division of Revenue or consult a tax professional.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.