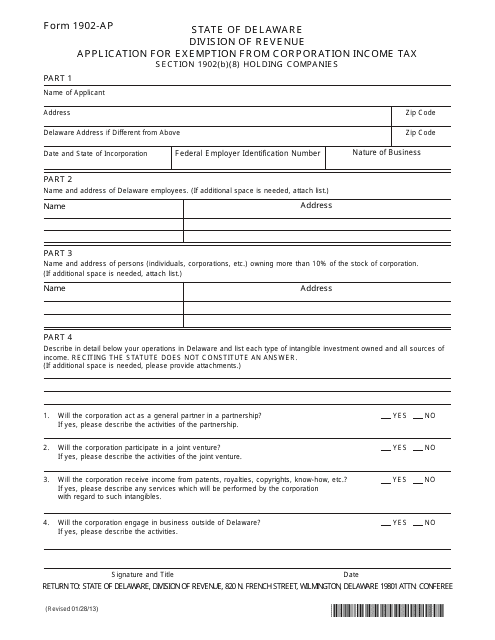

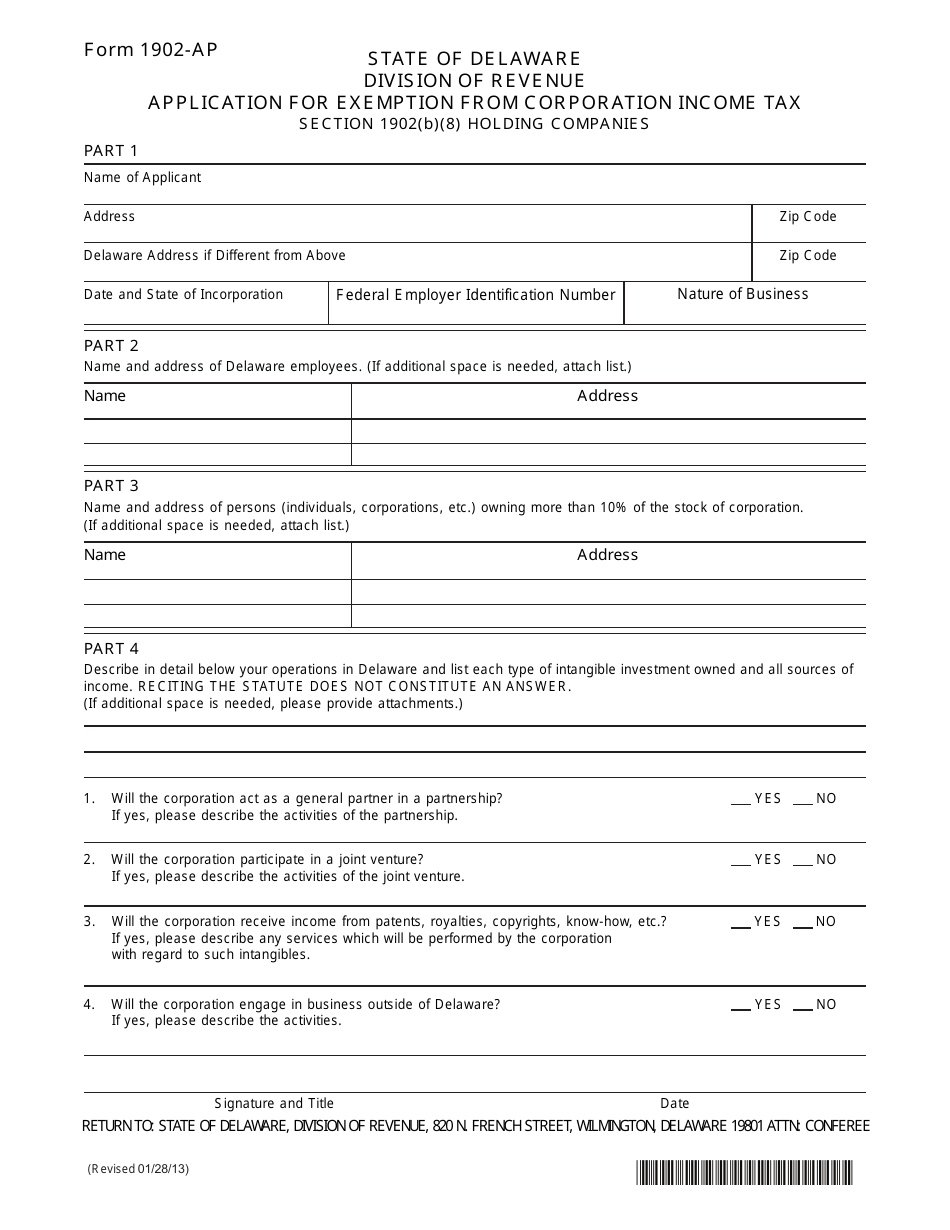

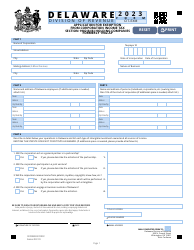

Form 1902-AP Application for Exemption From Corporation Income Tax " Holding Company - Delaware

What Is Form 1902-AP?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1902-AP?

A: Form 1902-AP is the Application for Exemption From Corporation Income Tax for a Holding Company - Delaware.

Q: What is the purpose of Form 1902-AP?

A: The purpose of Form 1902-AP is to apply for an exemption from corporation income tax as a holding company incorporated in Delaware.

Q: Who should use Form 1902-AP?

A: Form 1902-AP should be used by holding companies that are incorporated in Delaware and seeking an exemption from corporation income tax.

Q: Is Form 1902-AP only for Delaware holding companies?

A: Yes, Form 1902-AP is specifically for holding companies incorporated in Delaware.

Q: Are there any fees associated with filing Form 1902-AP?

A: No, there are no fees associated with filing Form 1902-AP.

Q: What documents should be included with Form 1902-AP?

A: The required documents to be included with Form 1902-AP include a copy of the holding company's certificate of incorporation and any other relevant supporting documents.

Q: How long does it take to process Form 1902-AP?

A: The processing time for Form 1902-AP can vary, but it generally takes several weeks.

Q: Is there a deadline for filing Form 1902-AP?

A: Yes, Form 1902-AP must be filed by the due date of the holding company's federal income tax return.

Form Details:

- Released on January 28, 2013;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1902-AP by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.