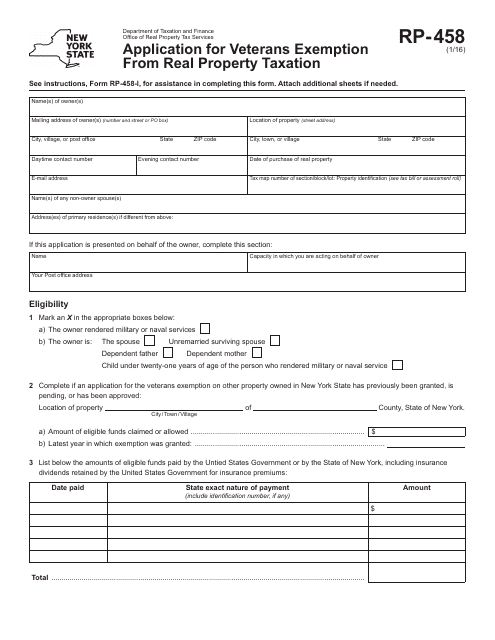

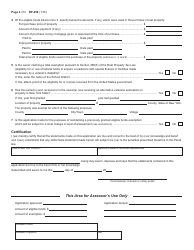

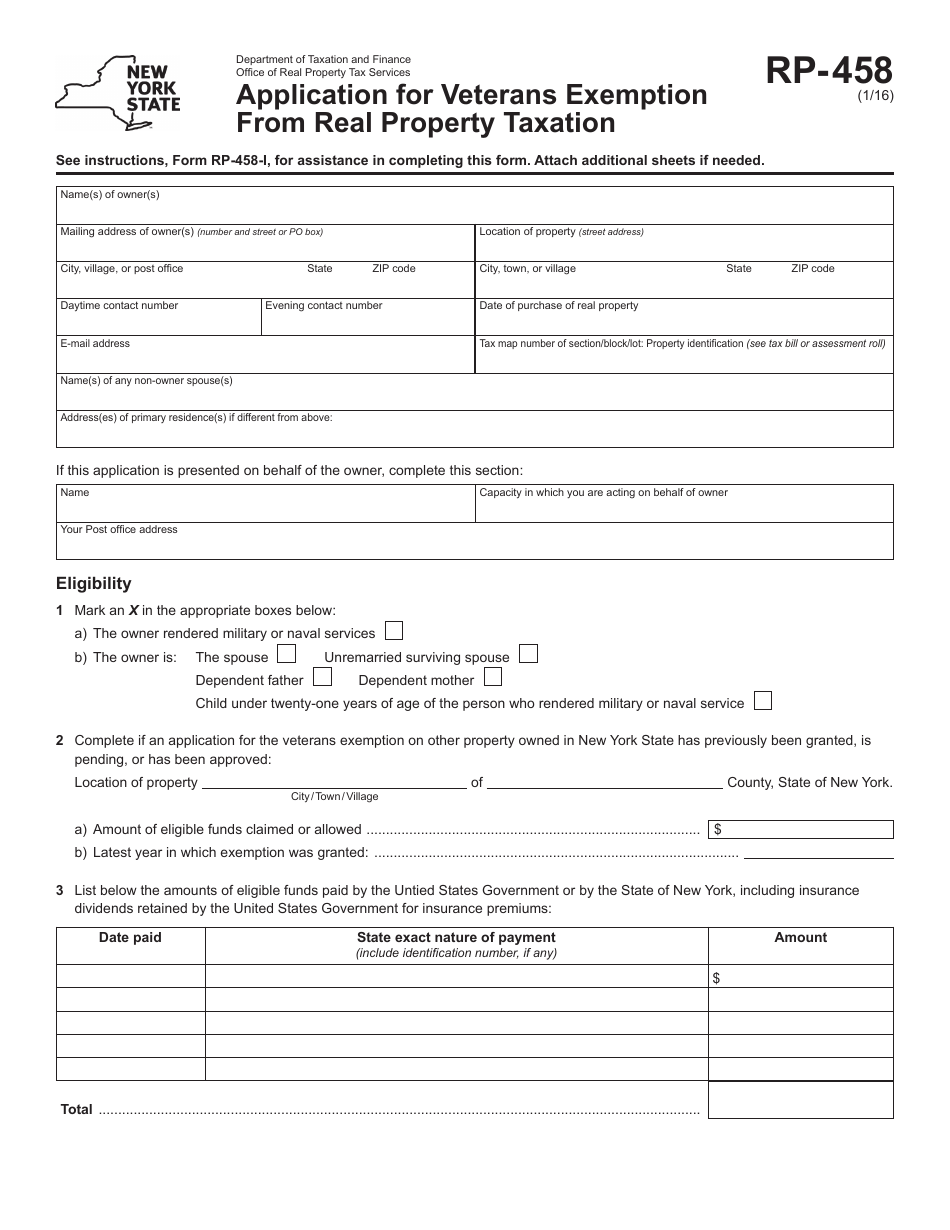

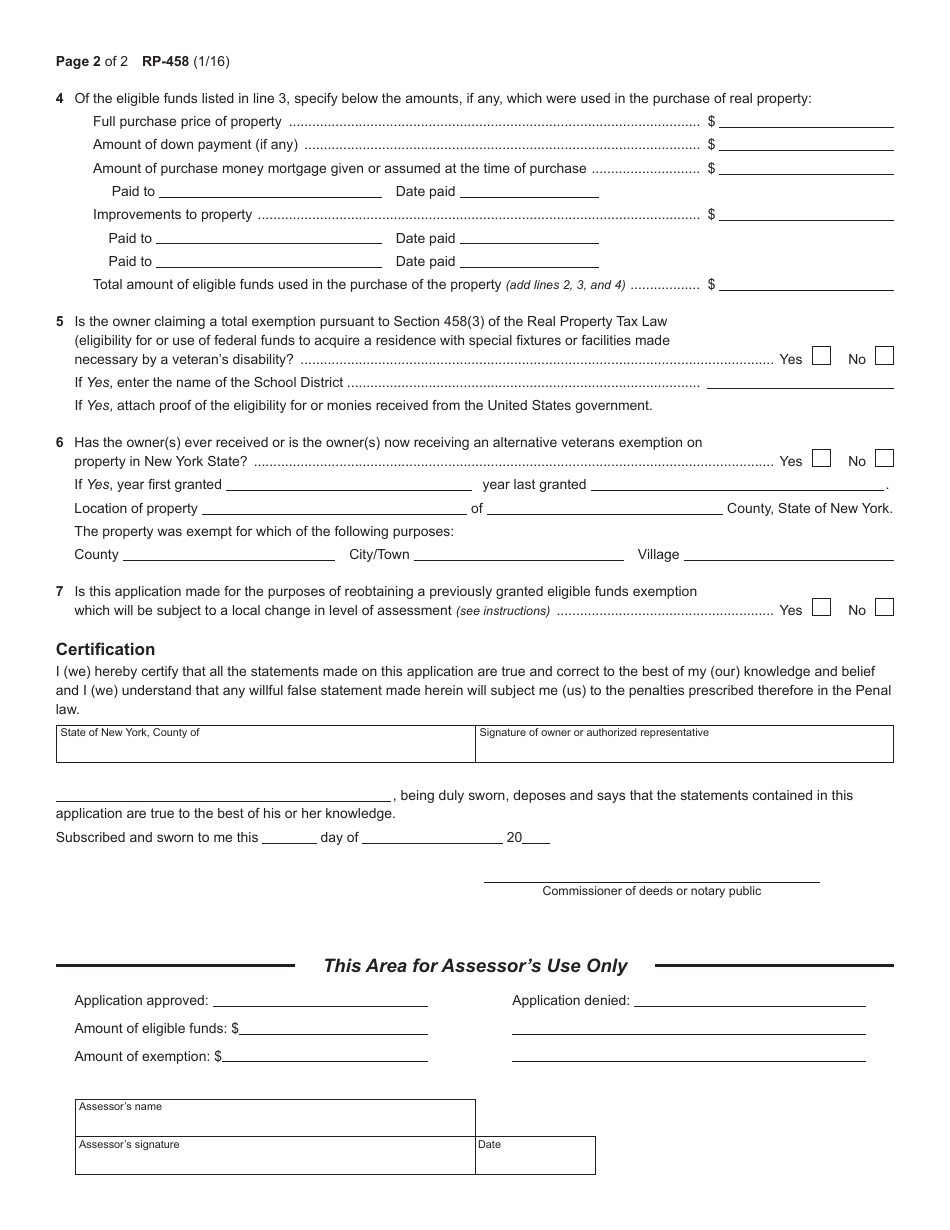

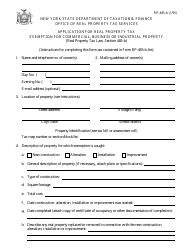

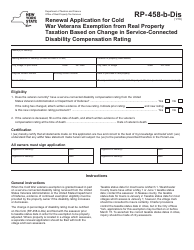

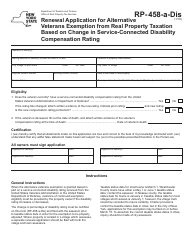

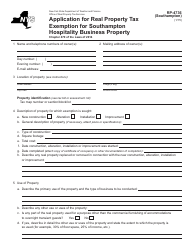

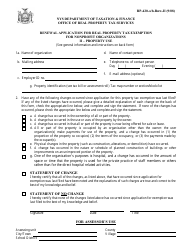

Form RP-458 Application for Veterans Exemption From Real Property Taxation - New York

What Is Form RP-458?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

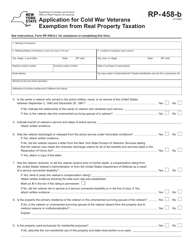

Q: What is Form RP-458?

A: Form RP-458 is the application for veterans exemption from real property taxation in New York.

Q: Who is eligible to apply for the veterans exemption?

A: Veterans who meet certain requirements are eligible to apply for the veterans exemption.

Q: What are the requirements to qualify for the veterans exemption?

A: The requirements to qualify for the veterans exemption vary depending on the specific exemption being sought. It is best to consult the instructions on the form for detailed eligibility criteria.

Q: Is there a deadline for submitting the application?

A: Yes, there is a deadline for submitting the application, which is typically March 1st of each year. It is important to check with your local assessor's office for the specific deadline.

Q: Are there any filing fees or costs associated with the application?

A: There are no filing fees or costs associated with the application for the veterans exemption.

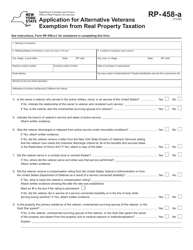

Q: Can I apply for multiple veterans exemptions?

A: Yes, it is possible to apply for multiple veterans exemptions if you meet the eligibility requirements for each exemption. Each exemption has its own separate application form.

Q: What benefits does the veterans exemption provide?

A: The veterans exemption provides a reduction in real property taxes for eligible veterans.

Q: Is the veterans exemption available in all counties of New York?

A: Yes, the veterans exemption is available in all counties of New York, but the specific exemption amounts and eligibility requirements may vary by county.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-458 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.