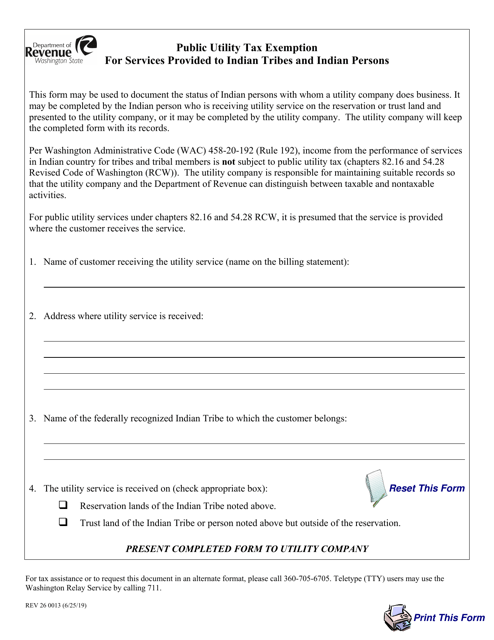

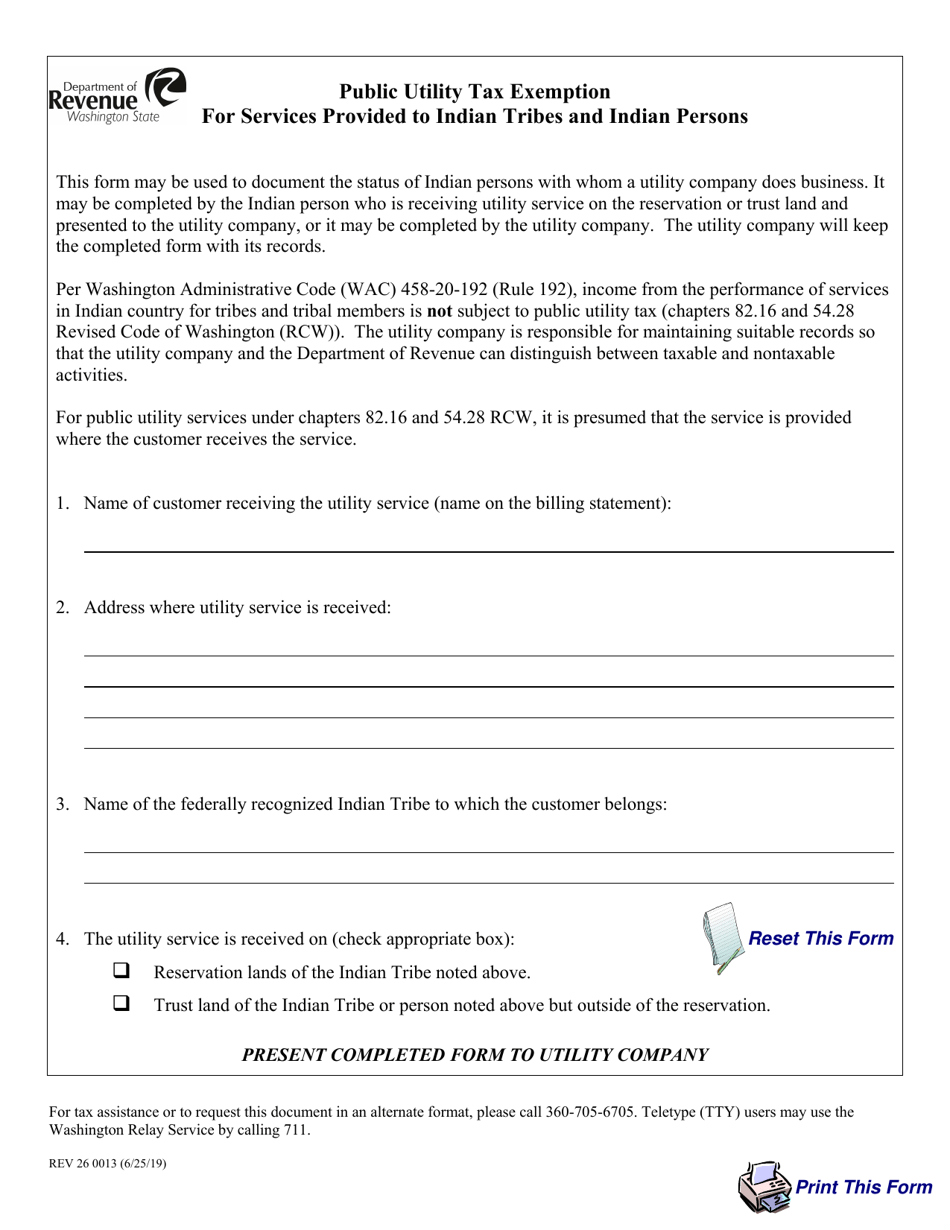

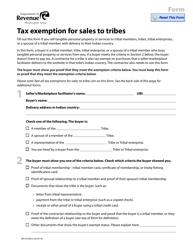

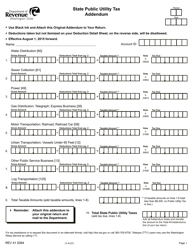

Form REV26 0013 Public Utility Tax Exemption for Services Provided to Indian Tribes and Indian Persons - Washington

What Is Form REV26 0013?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV26 0013?

A: Form REV26 0013 is a tax exemption form for public utilityservices provided to Indian Tribes and Indian Persons in Washington.

Q: Who is eligible for this tax exemption?

A: Indian Tribes and Indian Persons are eligible for this tax exemption.

Q: What is the purpose of this tax exemption?

A: The purpose of this tax exemption is to provide relief from public utility taxes for services provided to Indian Tribes and Indian Persons.

Q: What services are covered under this tax exemption?

A: Services provided by public utilities such as electricity, gas, water, and telecommunications are covered under this tax exemption.

Q: How can Indian Tribes and Indian Persons apply for this tax exemption?

A: Indian Tribes and Indian Persons can apply for this tax exemption by filling out Form REV26 0013.

Q: Is there a deadline to apply for this tax exemption?

A: No, there is no specific deadline to apply for this tax exemption.

Form Details:

- Released on June 25, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV26 0013 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.