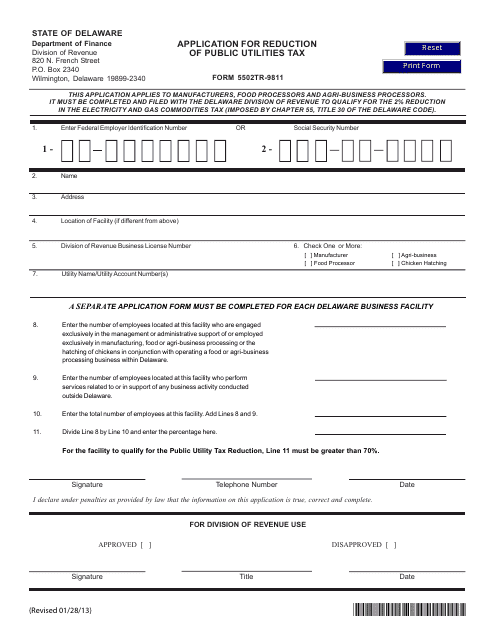

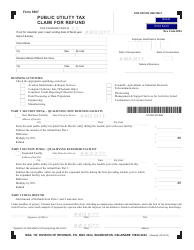

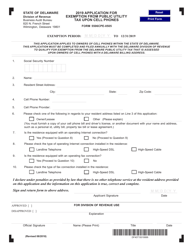

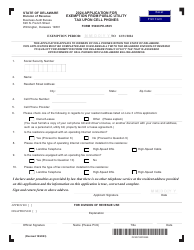

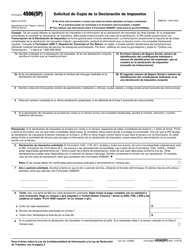

Form 5502TR-9811 Application for Reduction of Public Utilities Tax - Delaware

What Is Form 5502TR-9811?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5502TR-9811?

A: Form 5502TR-9811 is the Application for Reduction of Public Utilities Tax in Delaware.

Q: Who can use Form 5502TR-9811?

A: This form can be used by public utilities companies in Delaware to apply for a reduction in their tax liability.

Q: What is the purpose of Form 5502TR-9811?

A: The purpose of this form is to request a reduction in the amount of tax owed by a public utility company in Delaware.

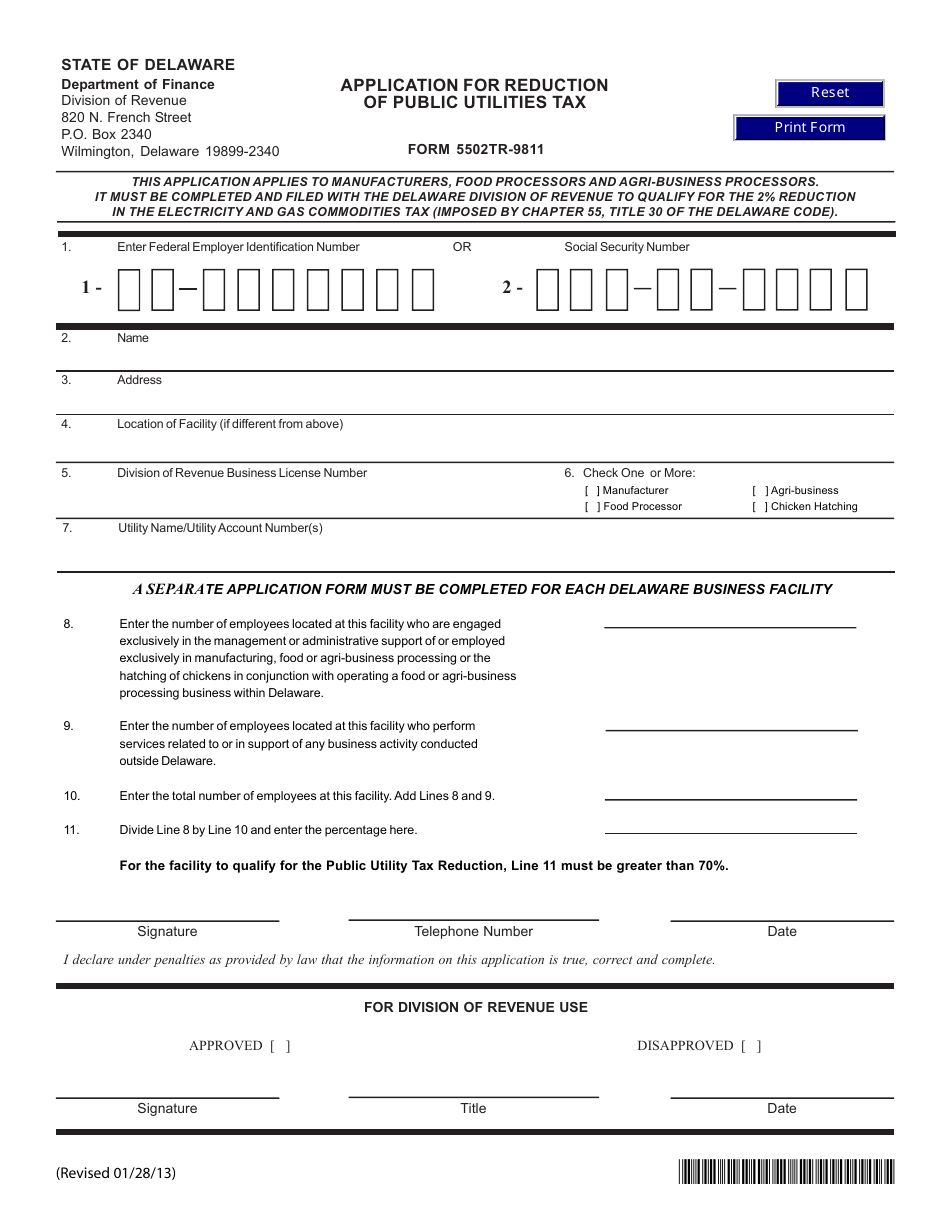

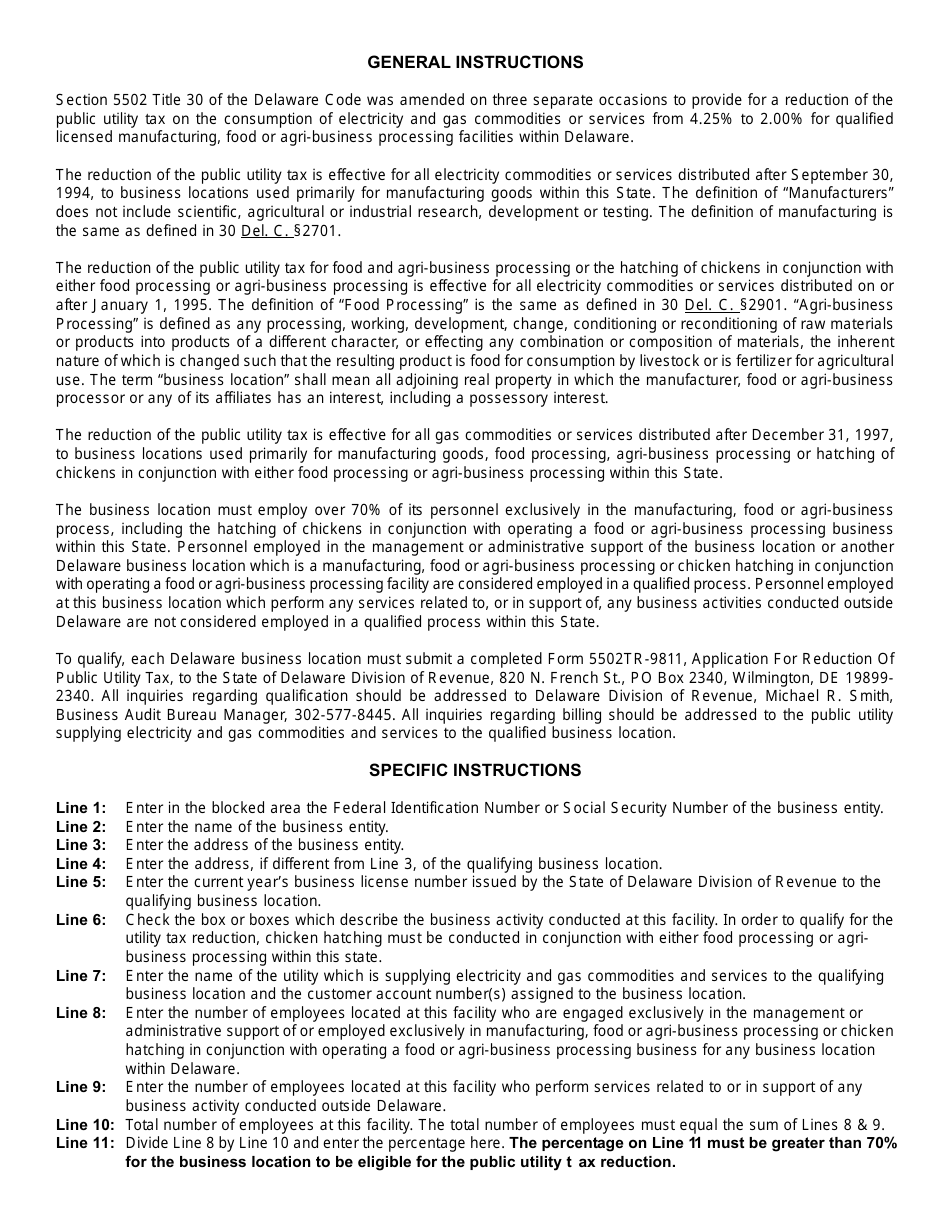

Q: What information is required on Form 5502TR-9811?

A: The form requires information about the public utilities company, details of the tax assessment, and reasons for requesting the reduction.

Q: Are there any fees associated with submitting Form 5502TR-9811?

A: There are no fees required for submitting this form.

Q: What is the deadline for submitting Form 5502TR-9811?

A: The form should be filed with the Delaware Department of Finance no later than the due date for the applicable tax return.

Q: How long does it take to process Form 5502TR-9811?

A: The processing time may vary, but you should expect a response from the Department of Finance within a reasonable timeframe.

Q: What should I do if I need assistance with Form 5502TR-9811?

A: If you need assistance with this form, you can contact the Delaware Department of Finance for guidance.

Form Details:

- Released on January 28, 2013;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5502TR-9811 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.