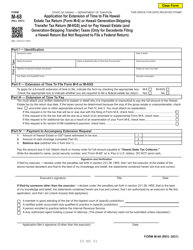

This version of the form is not currently in use and is provided for reference only. Download this version of

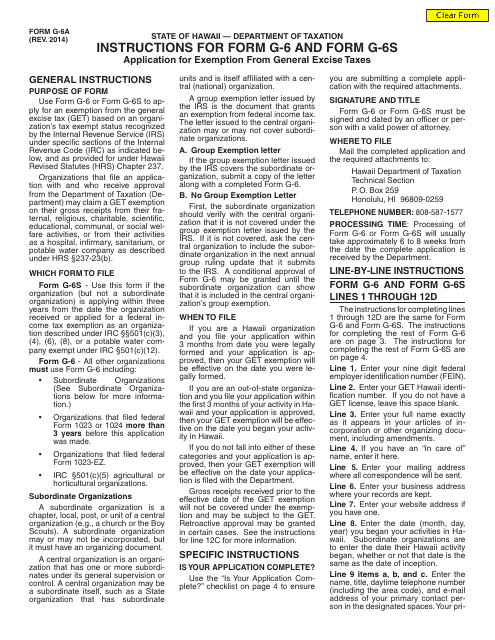

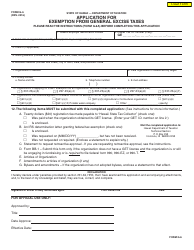

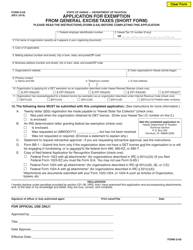

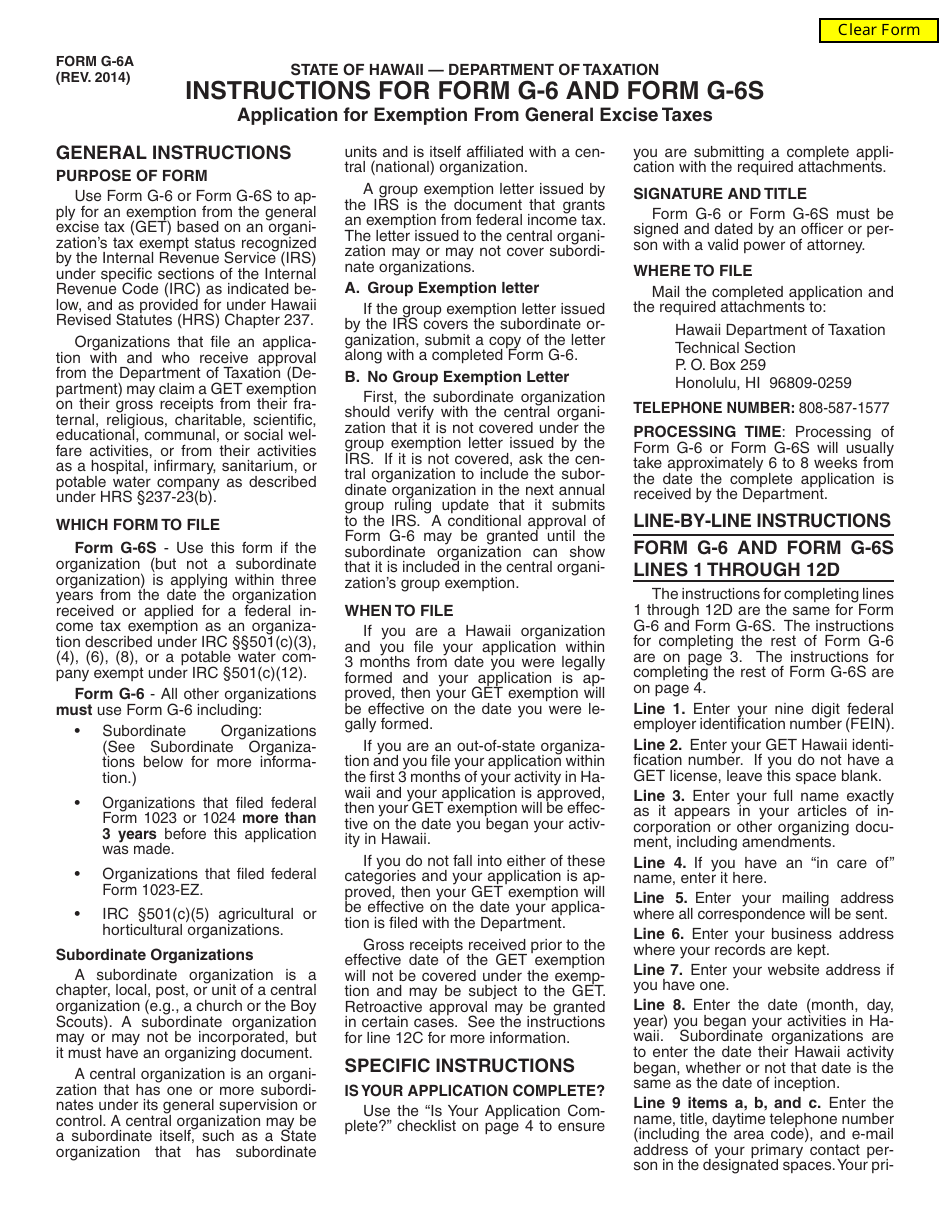

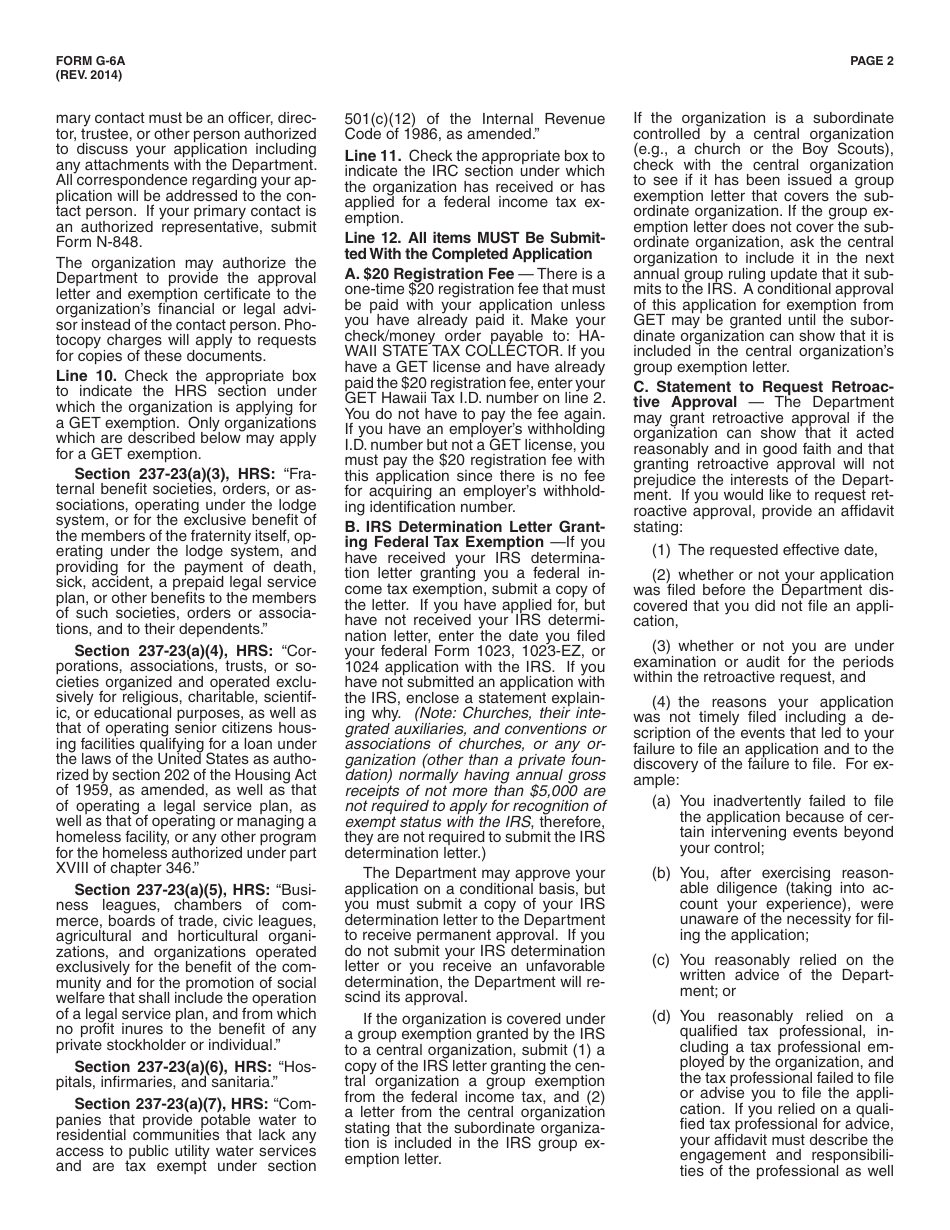

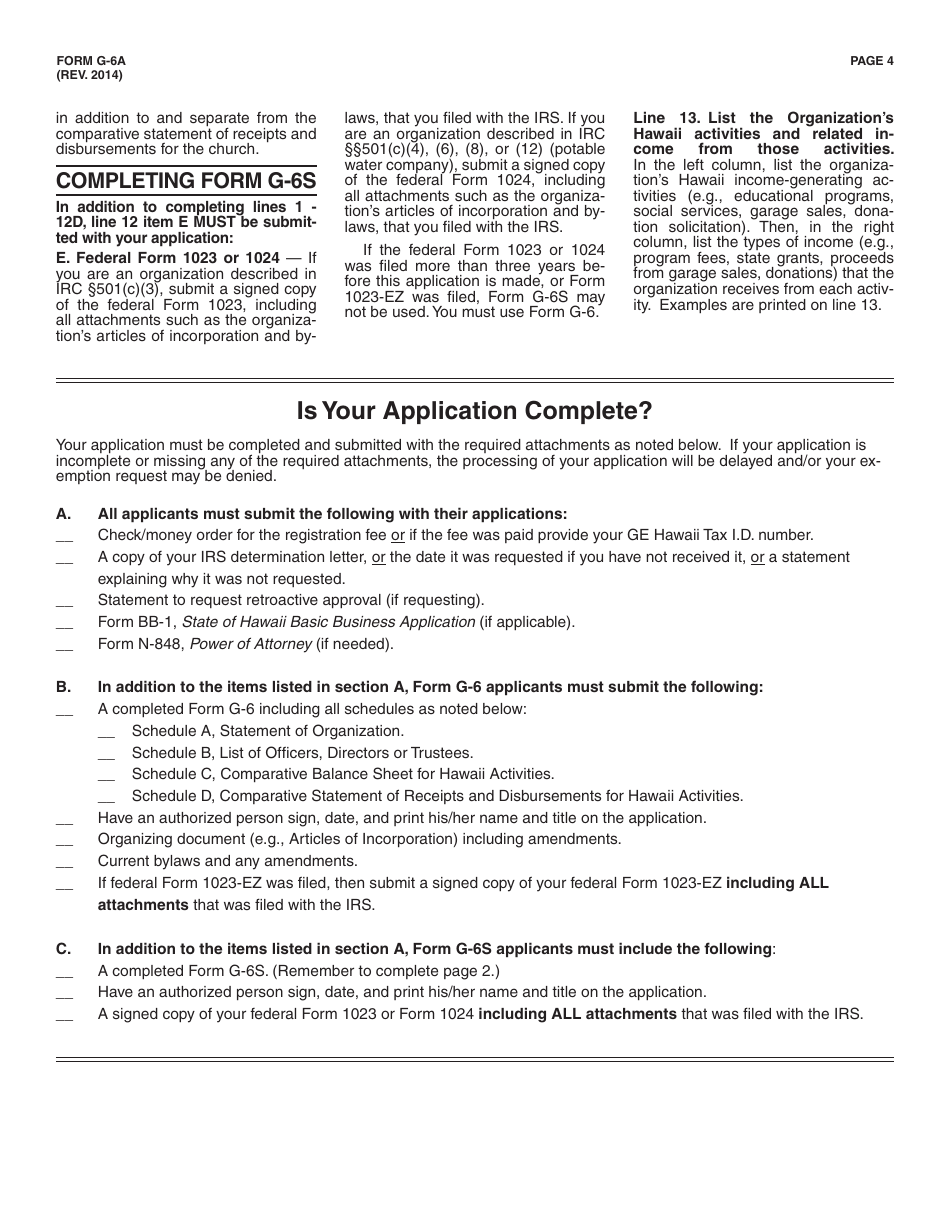

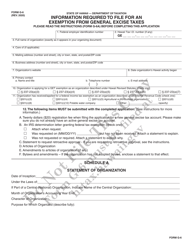

Instructions for Form G-6, G-6S

for the current year.

Instructions for Form G-6, G-6S Application for Exemption From General Excise Taxes - Hawaii

This document contains official instructions for Form G-6 , and Form G-6S . Both forms are released and collected by the Hawaii Department of Public Safety.

FAQ

Q: What is Form G-6?

A: Form G-6 is an application for exemption from general excise taxes in Hawaii.

Q: Who needs to fill out Form G-6?

A: Anyone seeking an exemption from general excise taxes in Hawaii needs to fill out Form G-6.

Q: What is the purpose of Form G-6?

A: The purpose of Form G-6 is to apply for exemption from general excise taxes in Hawaii.

Q: What are general excise taxes?

A: General excise taxes are taxes imposed on business activities in Hawaii.

Q: Are there any fees associated with filing Form G-6?

A: No, there are no fees associated with filing Form G-6.

Q: What documents do I need to submit with Form G-6?

A: The required documents may vary, but generally you will need to provide supporting documentation for your exemption claim.

Q: How long does it take to process Form G-6?

A: The processing time for Form G-6 varies, but typically it takes several weeks to receive a response.

Q: What should I do if my exemption claim is denied?

A: If your exemption claim is denied, you may need to pay the general excise taxes owed or file an appeal with the Hawaii Tax Appeal Court.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Public Safety.