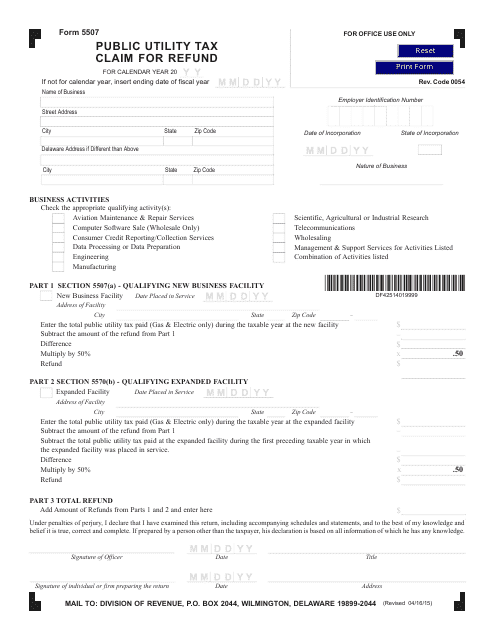

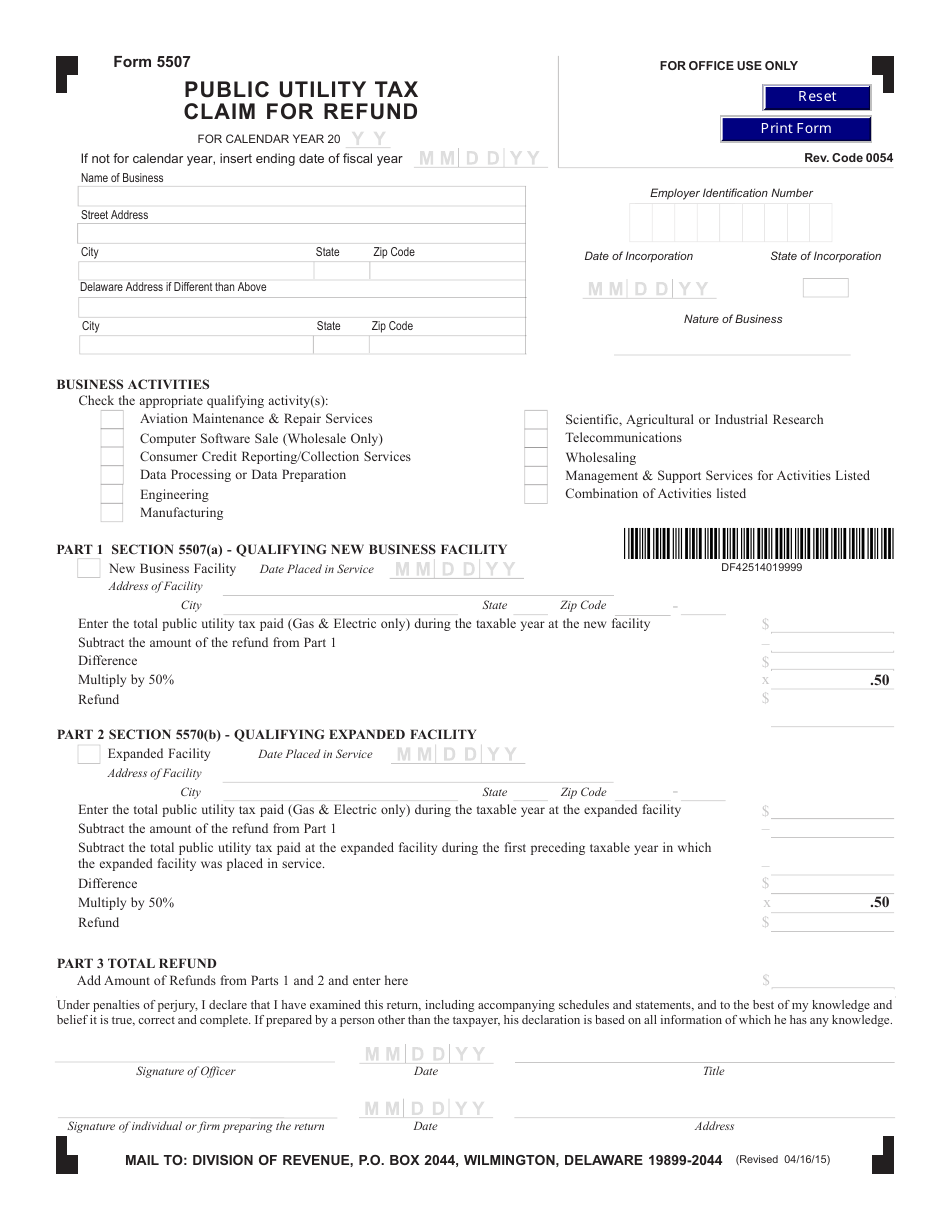

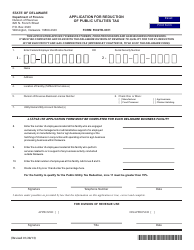

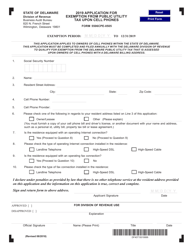

Form 5507 Public Utility Tax Claim for Refund - Delaware

What Is Form 5507?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5507?

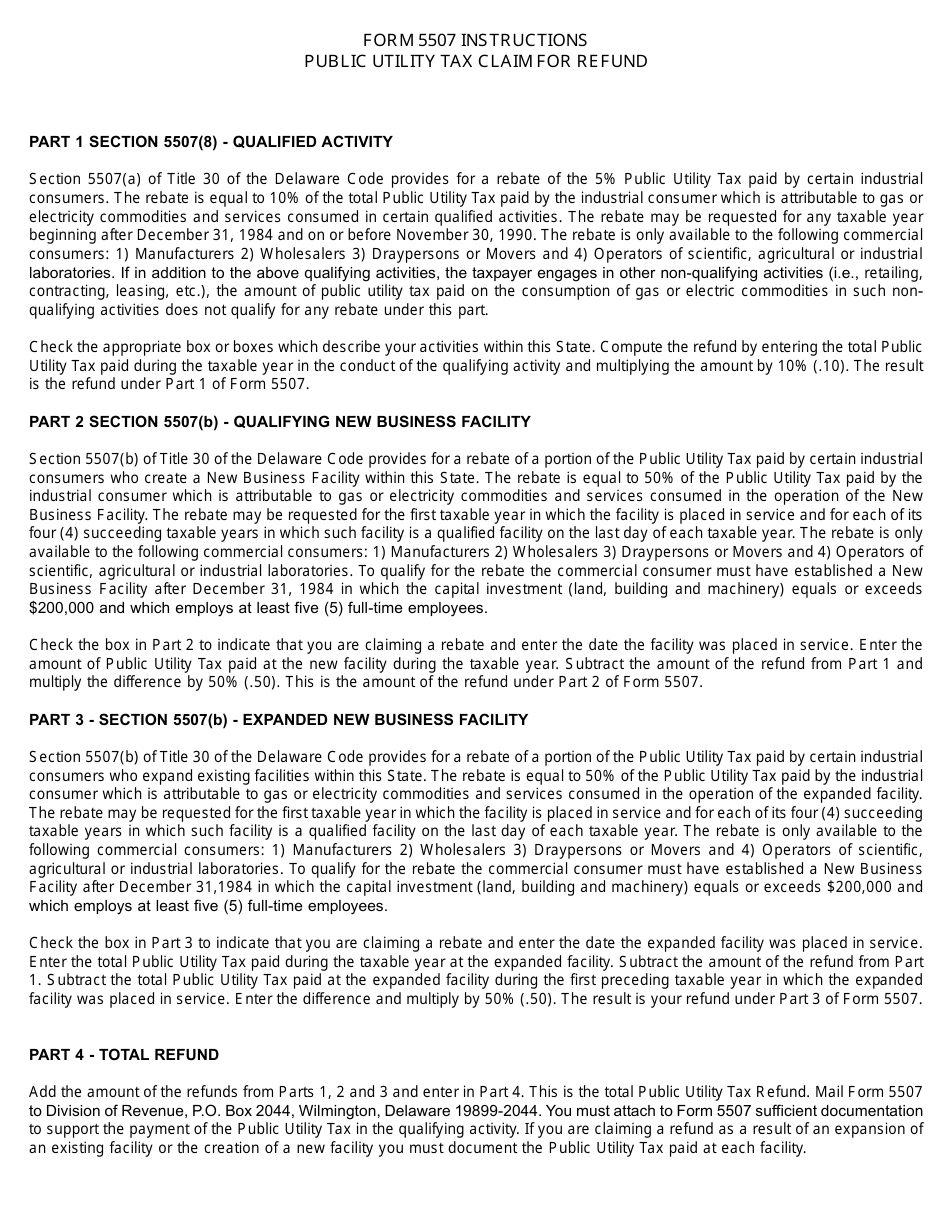

A: Form 5507 is a tax form used in Delaware to claim a refund for public utility taxes.

Q: Who needs to file Form 5507?

A: Any individual or business that has paid public utility taxes in Delaware and wants to claim a refund.

Q: What is the purpose of Form 5507?

A: The purpose of the form is to provide individuals and businesses with a means to claim a refund of public utility taxes paid in Delaware.

Q: What information do I need to complete Form 5507?

A: You will need information about your public utility taxes paid, including account numbers, amounts paid, and supporting documentation.

Q: When is the deadline to file Form 5507?

A: The deadline to file Form 5507 is typically April 30th of the year following the tax year for which the refund is being claimed.

Q: How long does it take to receive a refund after filing Form 5507?

A: The processing time for refunds can vary, but generally it takes 4-6 weeks to receive a refund after filing Form 5507.

Form Details:

- Released on April 16, 2015;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5507 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.