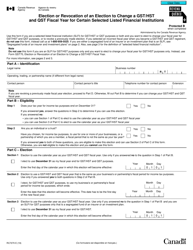

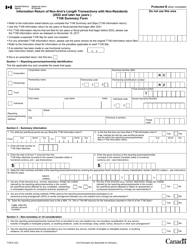

This version of the form is not currently in use and is provided for reference only. Download this version of

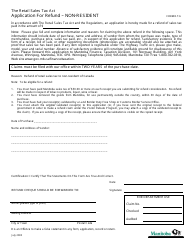

Form R105-S

for the current year.

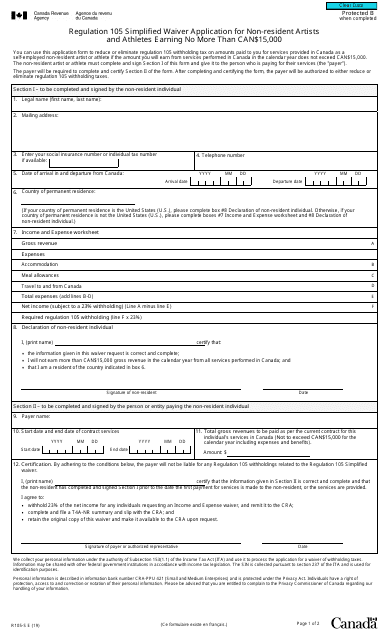

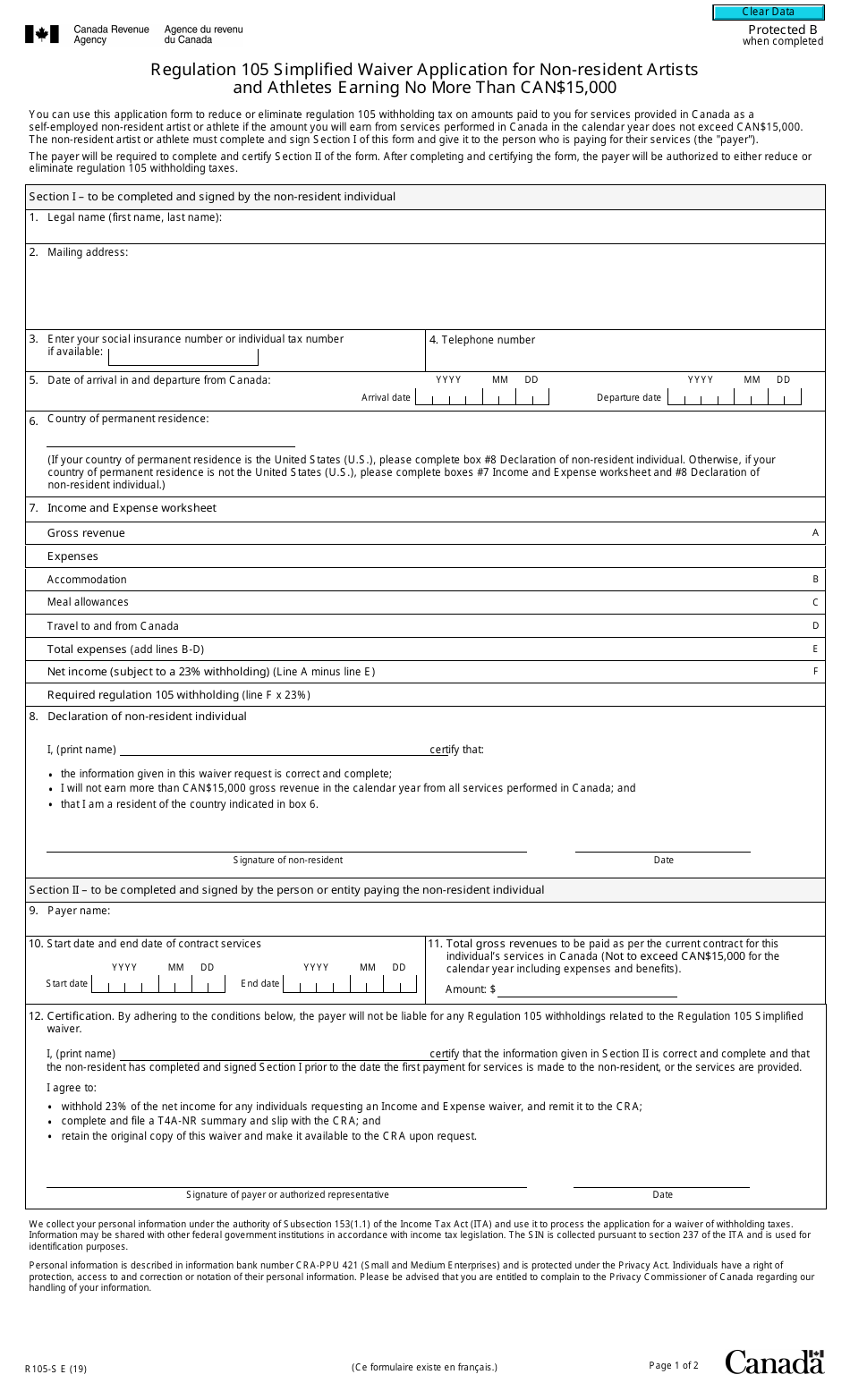

Form R105-S Regulation 105 Simplified Waiver Application for Non-resident Artists and Athletes Earning No More Than Can$15,000 - Canada

Form R105-S is a Canadian Revenue Agency form also known as the "Form R105-s "regulation 105 Simplified Waiver Application For Non-resident Artists And Athletes Earning No More Than Can$15,000" - Canada" . The latest edition of the form was released in January 1, 2019 and is available for digital filing.

Download an up-to-date Form R105-S in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

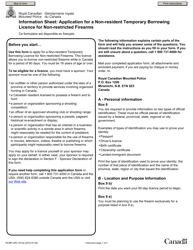

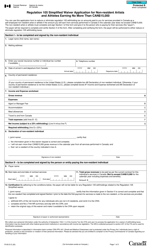

Q: What is Form R105-S?

A: Form R105-S is a Simplified Waiver Application for Non-resident Artists and Athletes in Canada.

Q: Who can use Form R105-S?

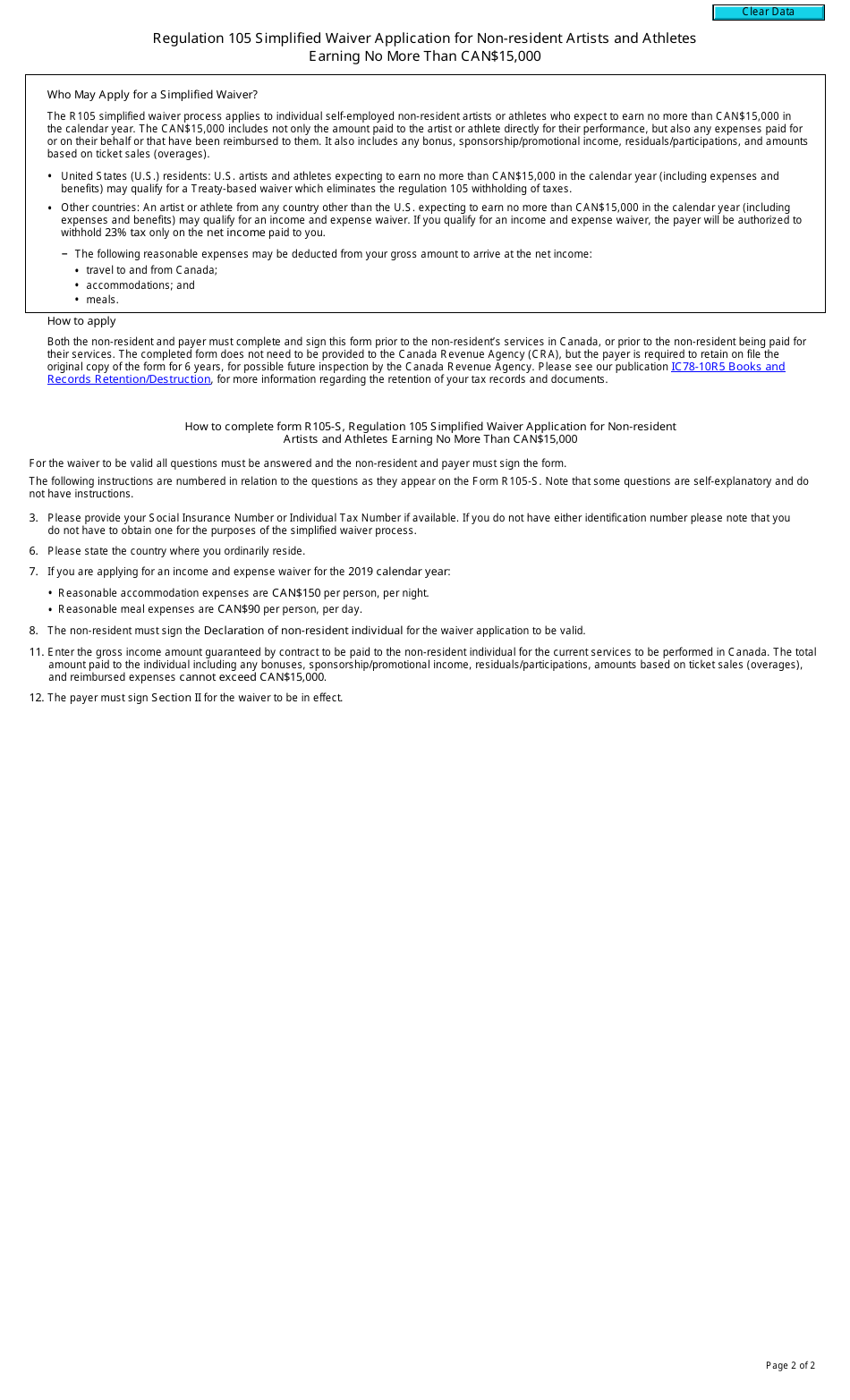

A: Non-resident artists and athletes who earn no more than Can$15,000 can use Form R105-S.

Q: What is the purpose of Form R105-S?

A: The purpose of Form R105-S is to apply for a simplified waiver for non-resident artists and athletes.

Q: How much can non-resident artists and athletes earn to use Form R105-S?

A: Non-resident artists and athletes can earn up to Can$15,000 to use Form R105-S.

Q: What does the Simplified Waiver Application do?

A: The Simplified Waiver Application allows non-resident artists and athletes to reduce or eliminate the amount of tax withheld from their income.

Q: Is Form R105-S specific to Canada?

A: Yes, Form R105-S is specific to Canada.

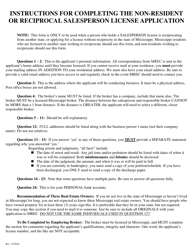

Q: Is there a simplified waiver application for non-resident artists and athletes in the USA?

A: Yes, there is a simplified waiver application for non-resident artists and athletes in the USA called Form W-8BEN.

Q: What is the income threshold for using Form R105-S?

A: The income threshold for using Form R105-S is Can$15,000.

Q: Can non-resident artists and athletes earning more than Can$15,000 use Form R105-S?

A: No, non-resident artists and athletes earning more than Can$15,000 cannot use Form R105-S.