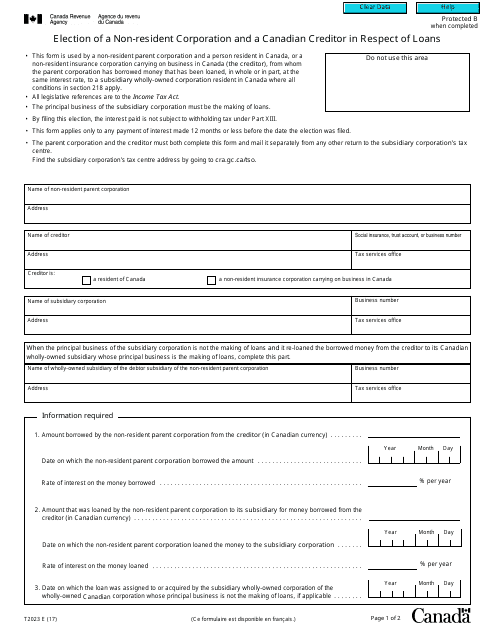

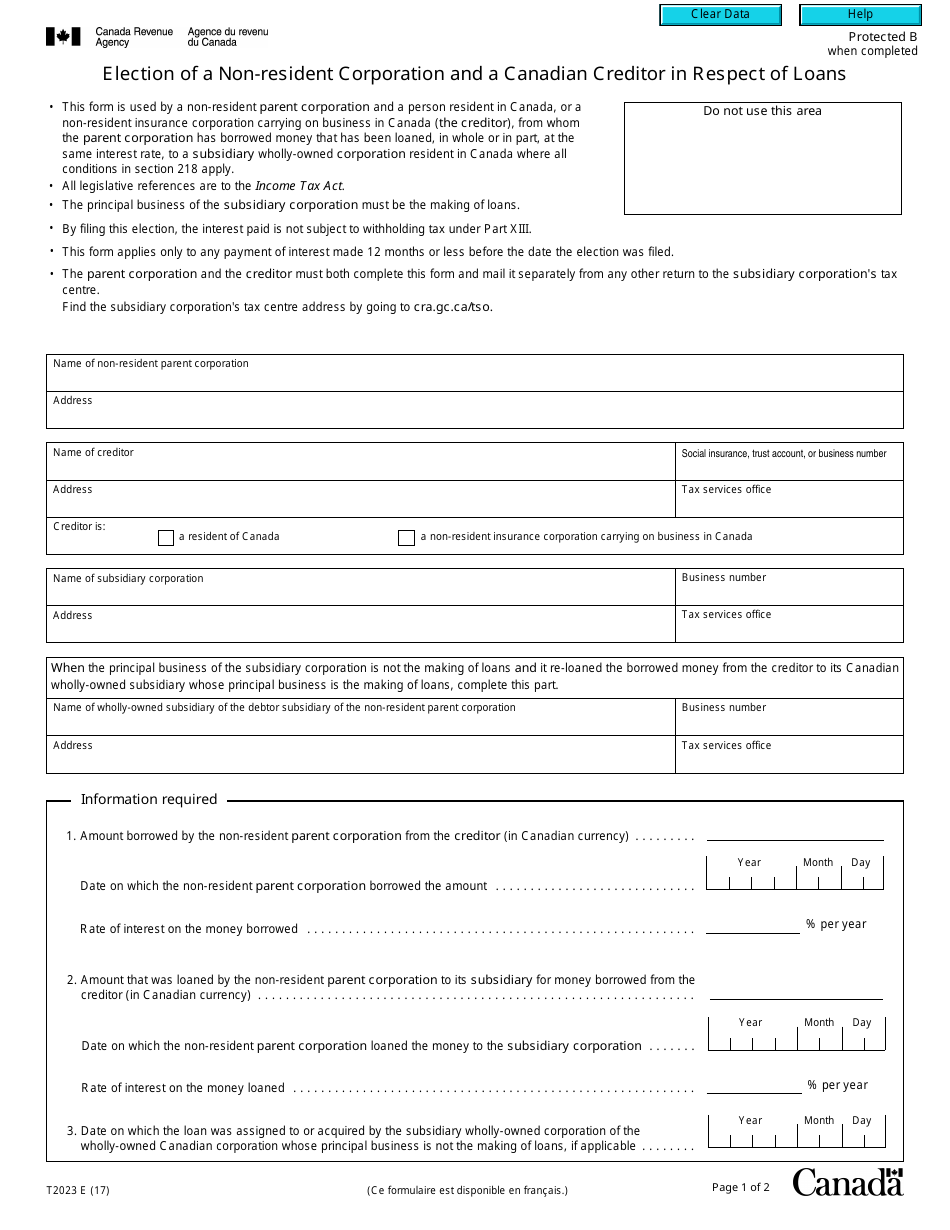

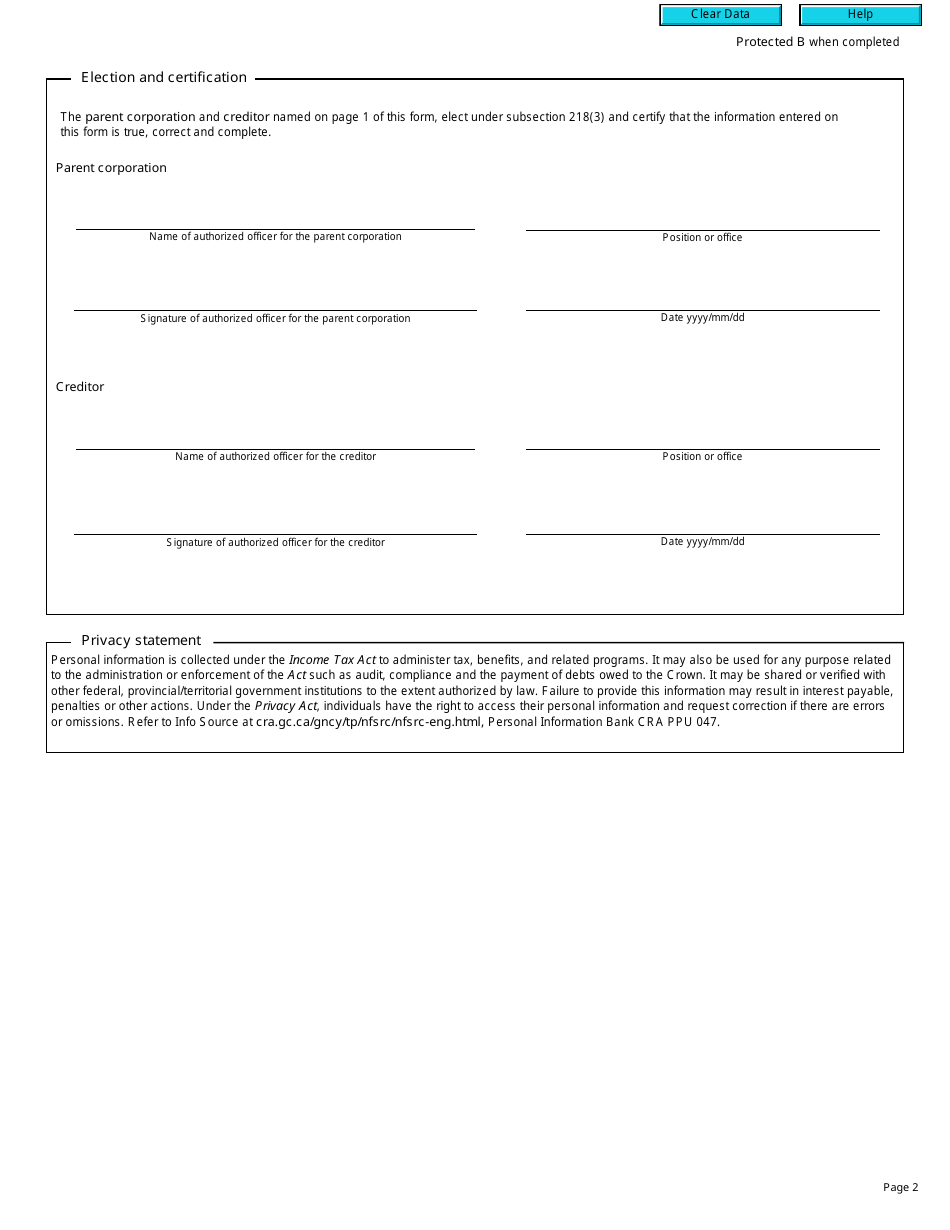

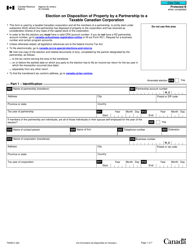

Form T2023 Election of a Non-resident Corporation and a Canadian Creditor in Respect of Loans - Canada

Form T2023 is a Canadian Revenue Agency form also known as the "Form T2023 "election Of A Non-resident Corporation And A Canadian Creditor In Respect Of Loans" - Canada" . The latest edition of the form was released in January 1, 2017 and is available for digital filing.

Download a PDF version of the Form T2023 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2023?

A: Form T2023 is a tax form used in Canada for the election of a non-resident corporation and a Canadian creditor in respect of loans.

Q: Who needs to file Form T2023?

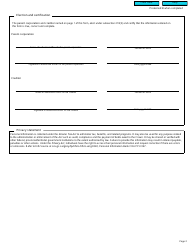

A: Non-resident corporations and Canadian creditors who have entered into loan agreements need to file Form T2023.

Q: What is the purpose of Form T2023?

A: The purpose of Form T2023 is to allow non-resident corporations and Canadian creditors to make an election to have the interest income from the loans be deemed to be taxable in Canada.

Q: How do I file Form T2023?

A: Form T2023 can be filed electronically or by mail to the Canada Revenue Agency (CRA).

Q: What information is required on Form T2023?

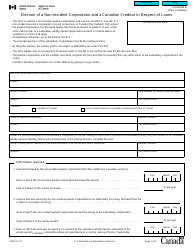

A: Form T2023 requires information such as the name and address of the non-resident corporation, the loan details, and the names and addresses of the Canadian creditors.

Q: What are the benefits of filing Form T2023?

A: Filing Form T2023 allows non-resident corporations and Canadian creditors to potentially reduce or eliminate withholding tax on interest payments.

Q: Are there any deadlines for filing Form T2023?

A: Yes, Form T2023 must be filed within 15 days after the end of the month in which the loan agreement was entered into.

Q: Is there a fee for filing Form T2023?

A: No, there is no fee for filing Form T2023.

Q: Can Form T2023 be amended?

A: Yes, if there are changes to the loan agreement or other relevant information, an amended Form T2023 can be filed.