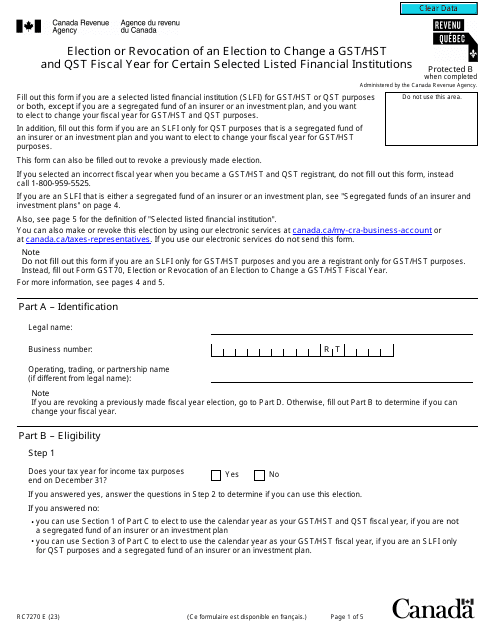

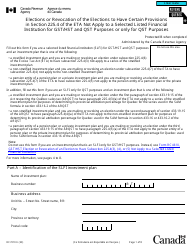

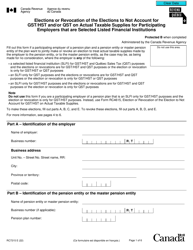

Form RC7270 Election or Revocation of an Election to Change a Gst / Hst and Qst Fiscal Year for Certain Selected Listed Financial Institutions - Canada

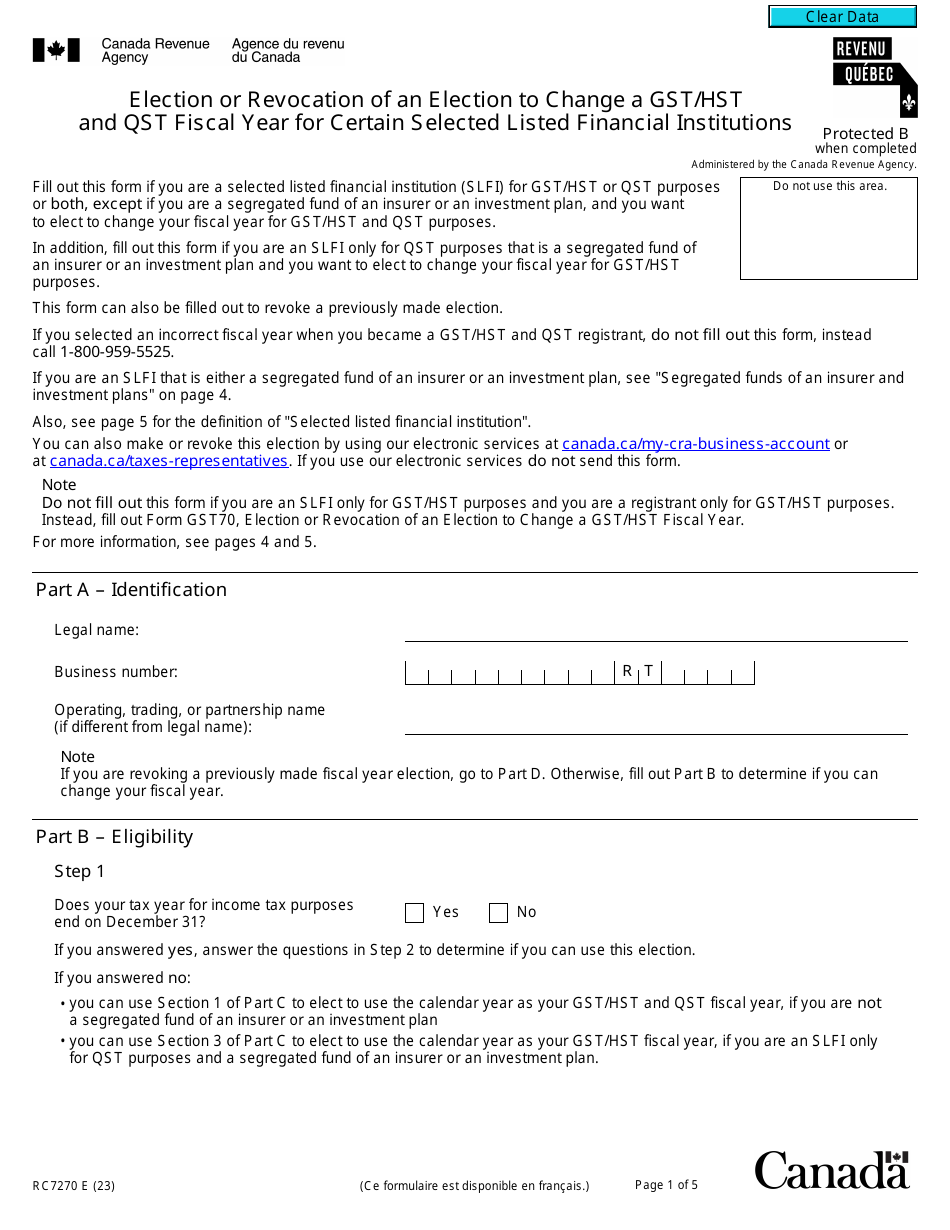

Form RC7270 Election or Revocation of an Election to Change a Gst/Hst and Qst Fiscal Year for Certain Selected Listed Financial Institutions in Canada is used for requesting or revoking an election to change the fiscal year for GST/HST and QST reporting purposes for specific financial institutions.

The selected listed financial institutions in Canada file the Form RC7270 Electoral or Revocation of an Election to Change a GST/HST and QST Fiscal Year.

Form RC7270 Election or Revocation of an Election to Change a Gst/Hst and Qst Fiscal Year for Certain Selected Listed Financial Institutions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC7270?

A: Form RC7270 is used to elect or revoke an election to change the fiscal year for certain selected listed financial institutions for GST/HST and QST purposes in Canada.

Q: What is a fiscal year?

A: A fiscal year is a 12-month period that an organization uses for financial reporting and tax purposes.

Q: Who can use Form RC7270?

A: Form RC7270 is specifically for selected listed financial institutions in Canada.

Q: What is GST/HST?

A: GST/HST stands for Goods and Services Tax/Harmonized Sales Tax. It is a tax imposed on most goods and services in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax. It is a tax imposed on most goods and services in the province of Quebec.

Q: What is the purpose of changing the fiscal year for GST/HST and QST?

A: Changing the fiscal year for GST/HST and QST purposes allows selected listed financial institutions to align their reporting periods with their own internal financial statements.

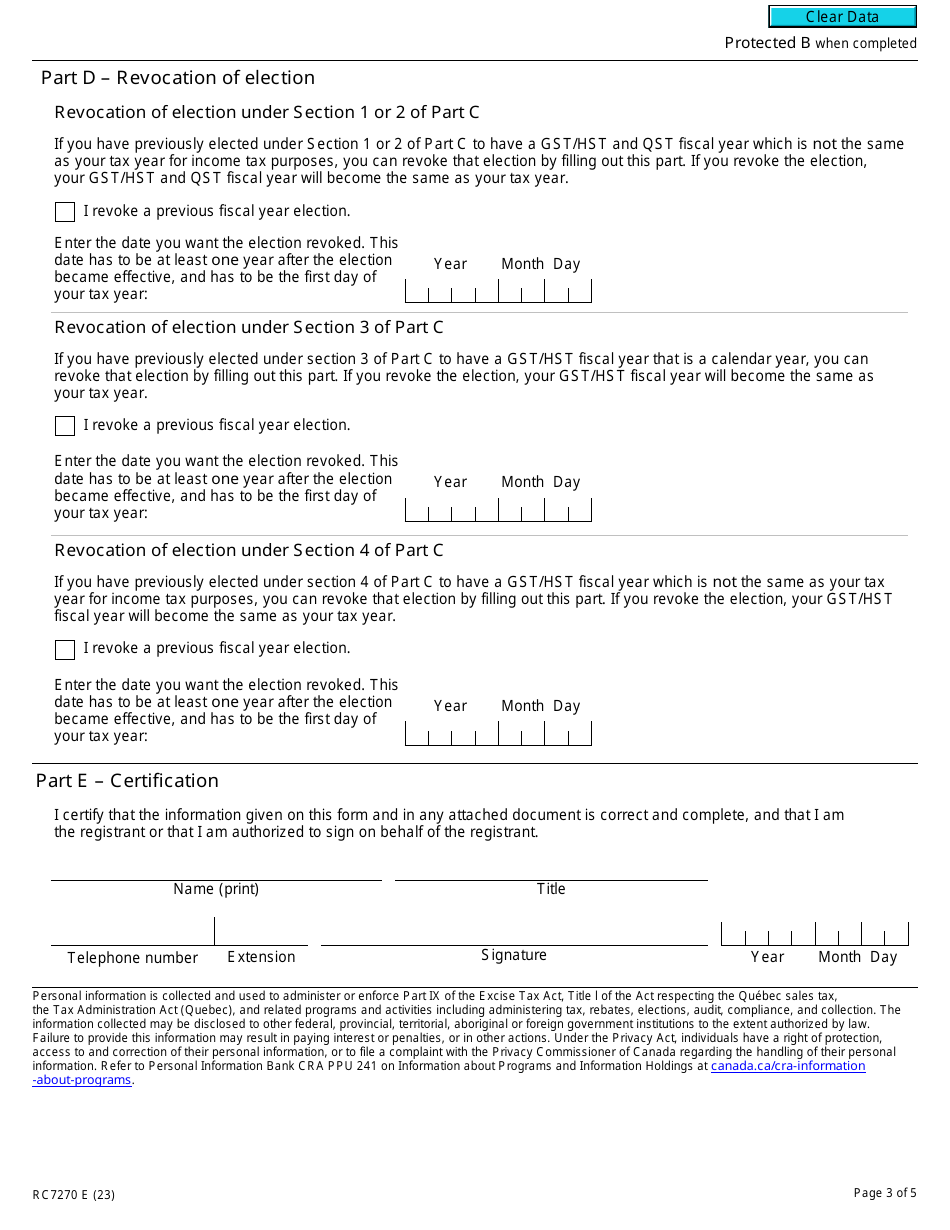

Q: How do you elect or revoke an election to change the fiscal year for GST/HST and QST?

A: You need to complete and submit Form RC7270 to the Canada Revenue Agency.

Q: Are there any deadlines for submitting Form RC7270?

A: Yes, there are specific deadlines for submitting Form RC7270. It is important to refer to the instructions provided with the form or consult the Canada Revenue Agency for the current deadlines.