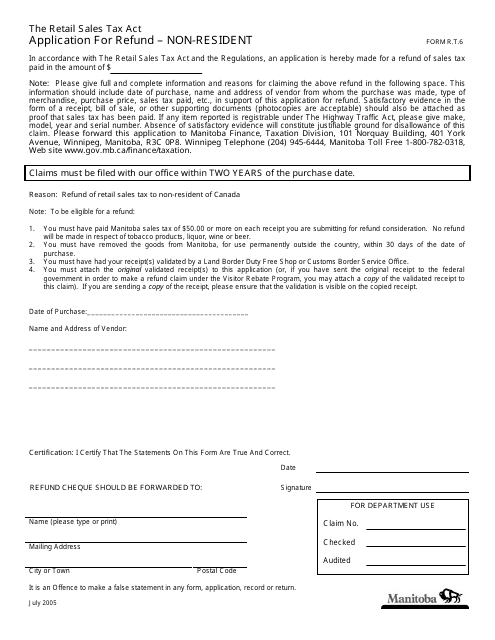

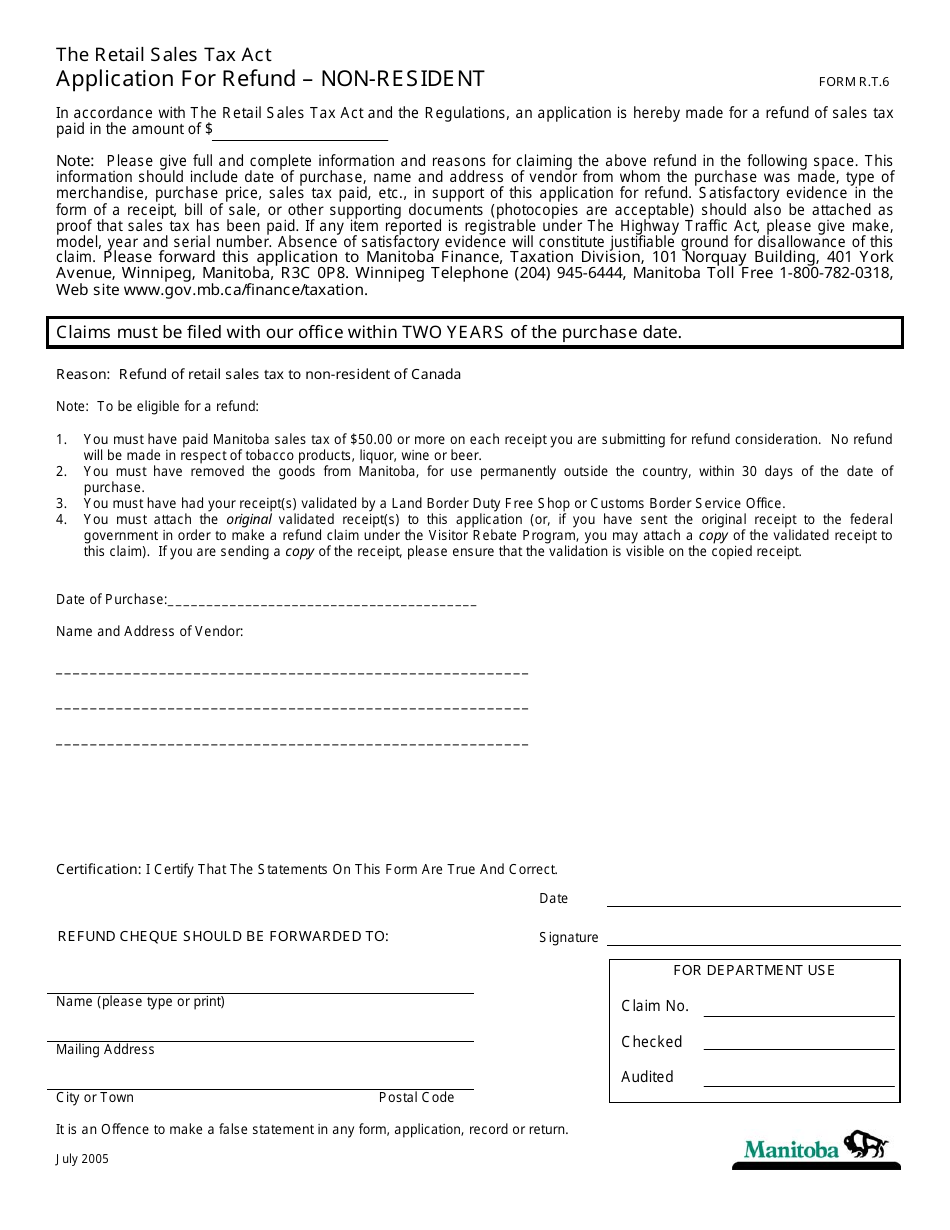

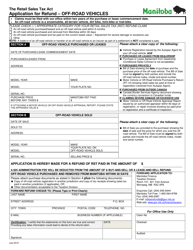

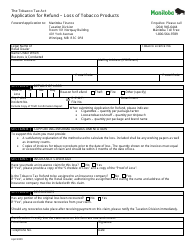

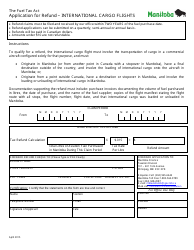

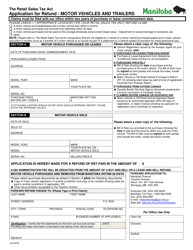

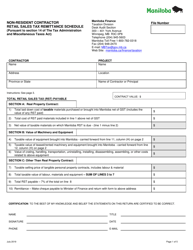

Form R.T.6 Application for Refund - Non-resident - Manitoba, Canada

Form R.T.6 is a Manitoba Department of Finance form also known as the "Form R.t.6 "application For Refund - Non-resident" - Manitoba, Canada" . The latest edition of the form was released in July 1, 2005 and is available for digital filing.

Download a PDF version of the Form R.T.6 down below or find it on Manitoba Department of Finance Forms website.

FAQ

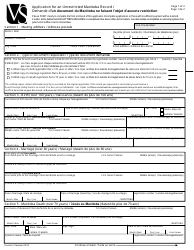

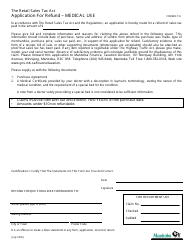

Q: Who can apply for the R.T.6 Application for Refund - Non-resident in Manitoba, Canada?

A: Non-residents of Manitoba, Canada.

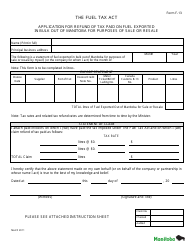

Q: What is the purpose of the R.T.6 Application for Refund?

A: To request a refund of the Retail Sales Tax (RST) paid on eligible purchases.

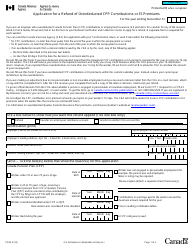

Q: What are the eligibility criteria to apply for a refund?

A: You must be a non-resident of Manitoba, Canada and have made eligible purchases in Manitoba.

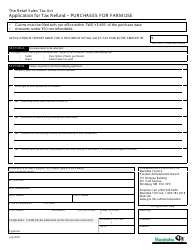

Q: What purchases are eligible for a refund?

A: Eligible purchases include goods and services subject to Retail Sales Tax that will be taken or shipped out of Manitoba.

Q: How long does it take to process the refund application?

A: Processing times may vary, but it typically takes around 4-6 weeks.

Q: What documents do I need to submit with the application?

A: You need to include original receipts and supporting documents for your eligible purchases.

Q: Can I apply for a refund if I am a resident of Manitoba?

A: No, the R.T.6 Application for Refund is specifically for non-residents of Manitoba.

Q: Is there a deadline to submit the refund application?

A: Yes, you must submit the application within 2 years from the date of the eligible purchase.

Q: How will I receive the refund?

A: Refunds are typically issued by check and mailed to your designated address.