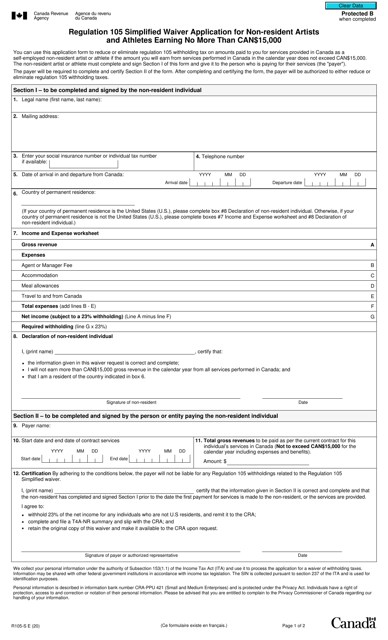

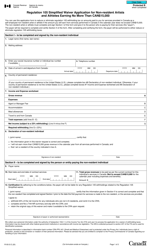

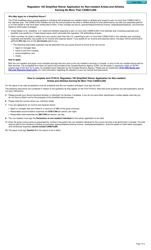

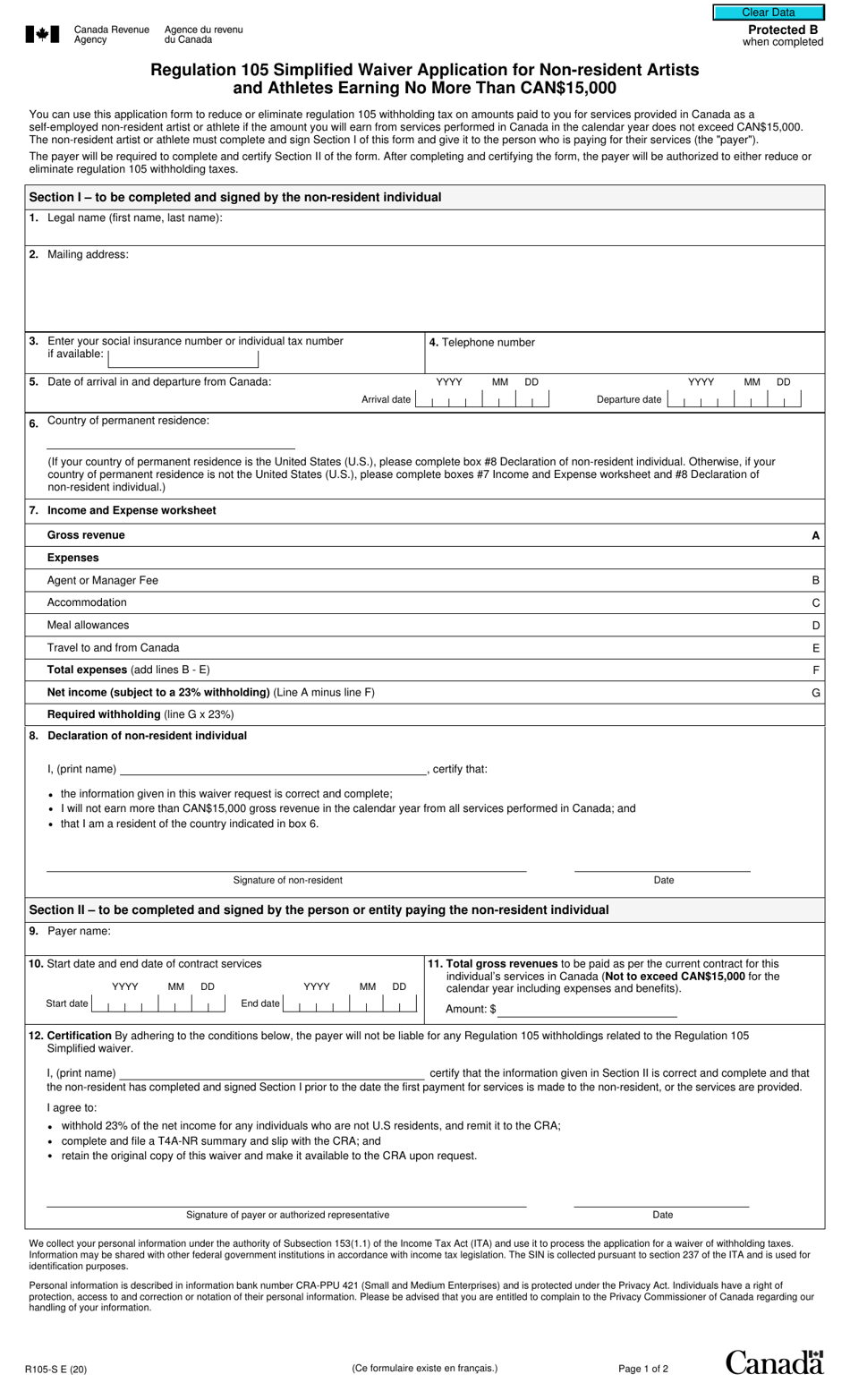

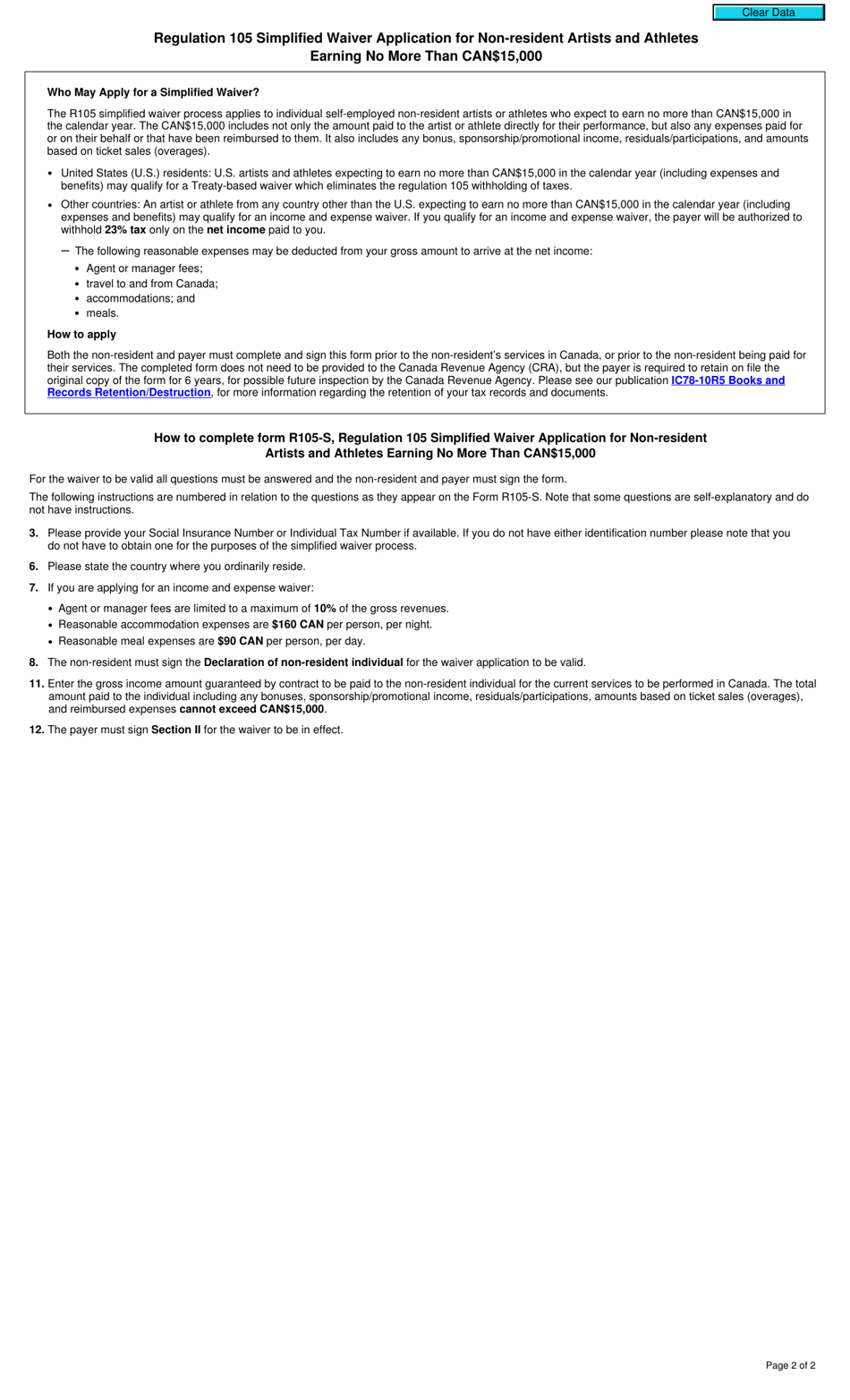

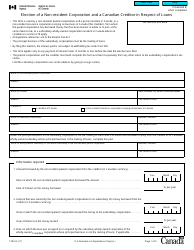

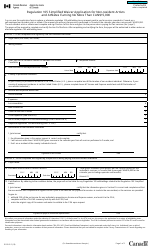

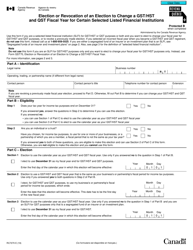

Form R105-S Regulation 105 Simplified Waiver Application for Non-resident Artists and Athletes Earning No More Than Can $15,000 - Canada

Form R105-S is a simplified waiver application for non-resident artists and athletes who earn no more than CAD $15,000 in Canada. It allows them to apply for a waiver of withholding tax on their earnings.

The non-resident artist or athlete should file the Form R105-S Regulation 105 Simplified Waiver Application in Canada.

Form R105-S Regulation 105 Simplified Waiver Application for Non-resident Artists and Athletes Earning No More Than Can $15,000 - Canada - Frequently Asked Questions (FAQ)

Q: What is the R105-S Regulation?

A: The R105-S Regulation is a simplified waiver application for non-resident artists and athletes earning no more than Can $15,000 in Canada.

Q: Who can apply for the R105-S Regulation?

A: Non-resident artists and athletes who earn no more than Can $15,000 in Canada can apply for the R105-S Regulation.

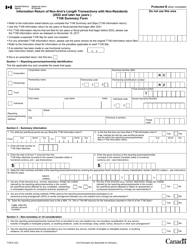

Q: What is the purpose of the R105-S Regulation?

A: The purpose of the R105-S Regulation is to simplify the waiver application process for non-resident artists and athletes.

Q: How much can non-resident artists and athletes earn under the R105-S Regulation?

A: Non-resident artists and athletes can earn no more than Can $15,000 under the R105-S Regulation.

Q: What is a waiver application?

A: A waiver application is a request for an exemption from certain tax rules or requirements.

Q: Are there any eligibility requirements for the R105-S Regulation?

A: Yes, non-resident artists and athletes must meet certain eligibility requirements to apply for the R105-S Regulation.

Q: Is the R105-S Regulation only applicable to non-resident artists and athletes?

A: Yes, the R105-S Regulation is specifically designed for non-resident artists and athletes.

Q: What happens if a non-resident artist or athlete earns more than Can $15,000 in Canada?

A: If a non-resident artist or athlete earns more than Can $15,000 in Canada, they would not be eligible for the R105-S Regulation and may have additional tax obligations.

Q: Are there any other tax regulations or requirements for non-resident artists and athletes?

A: Yes, apart from the R105-S Regulation, non-resident artists and athletes may have other tax regulations and requirements they need to comply with.