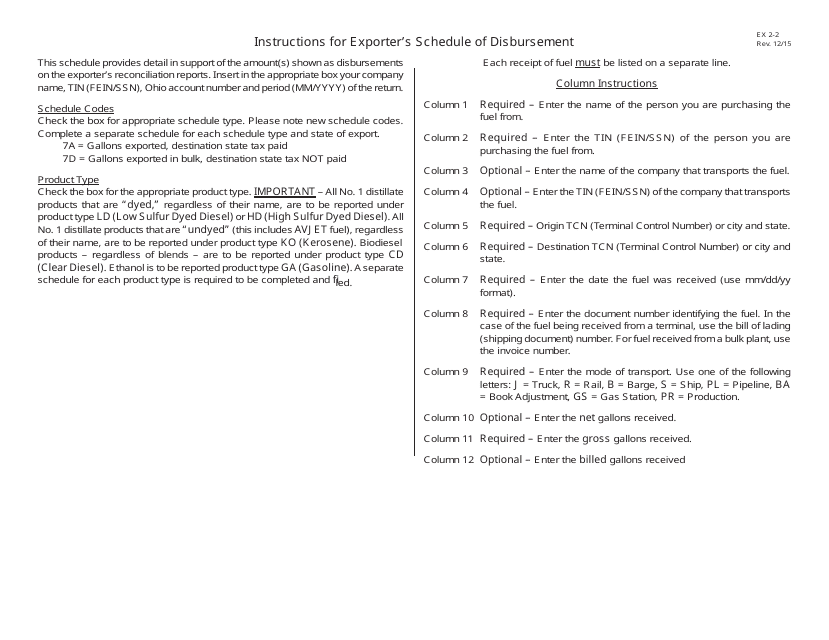

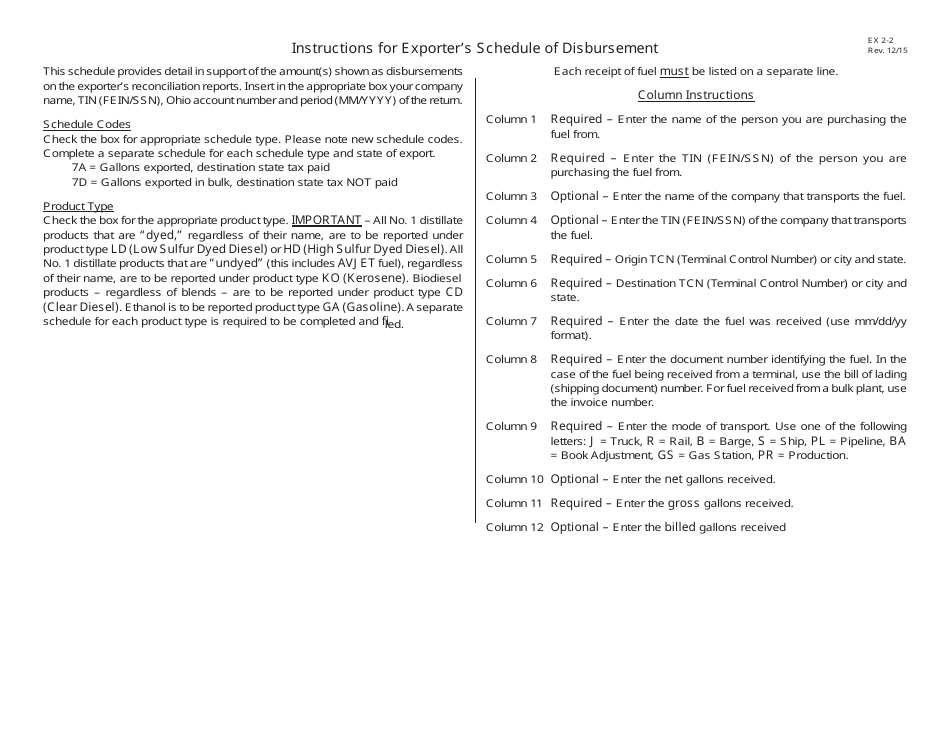

Instructions for Exporter's Schedule of Disbursements - Ohio

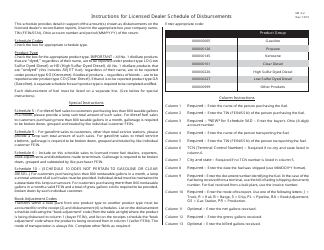

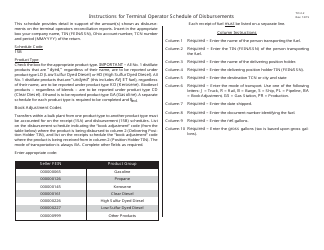

This document was released by Ohio Department of Taxation and contains the most recent official instructions for Exporter's Schedule of Disbursements .

FAQ

Q: What is the Exporter's Schedule of Disbursements?

A: The Exporter's Schedule of Disbursements is a document that provides detailed information about the disbursements made by an exporter in Ohio.

Q: Why is the Exporter's Schedule of Disbursements important?

A: The Exporter's Schedule of Disbursements is important because it helps track and report the payments made by an exporter, ensuring compliance with relevant regulations and providing transparency.

Q: Who needs to prepare the Exporter's Schedule of Disbursements?

A: Exporters in Ohio are required to prepare the Exporter's Schedule of Disbursements.

Q: What information is included in the Exporter's Schedule of Disbursements?

A: The Exporter's Schedule of Disbursements includes details of the disbursements made by the exporter, such as the date, amount, recipient, purpose, and any supporting documentation.

Q: How often should the Exporter's Schedule of Disbursements be prepared?

A: The Exporter's Schedule of Disbursements should be prepared on a regular basis, typically monthly or quarterly, depending on the exporter's specific requirements and the frequency of disbursements.

Q: What are the consequences of not preparing the Exporter's Schedule of Disbursements?

A: Failure to prepare the Exporter's Schedule of Disbursements may result in non-compliance penalties and can negatively impact the exporter's reputation and business relationships.

Q: Are there any templates or guidelines available for preparing the Exporter's Schedule of Disbursements?

A: Yes, there are templates and guidelines available from regulatory authorities and trade organizations to assist exporters in Ohio with preparing the Exporter's Schedule of Disbursements.

Q: Can the Exporter's Schedule of Disbursements be submitted electronically?

A: Yes, the Exporter's Schedule of Disbursements can be submitted electronically, following the specified guidelines and requirements.

Q: Is the Exporter's Schedule of Disbursements confidential?

A: The Exporter's Schedule of Disbursements may contain sensitive financial information and should be handled with confidentiality by the exporter and relevant authorities.

Q: How long should the Exporter's Schedule of Disbursements be retained?

A: The Exporter's Schedule of Disbursements should be retained for a specific period as required by regulations or business policies, typically ranging from 3 to 7 years.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Ohio Department of Taxation.