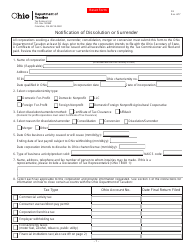

Instructions for Form D5 Notification of Dissolution or Surrender - Ohio

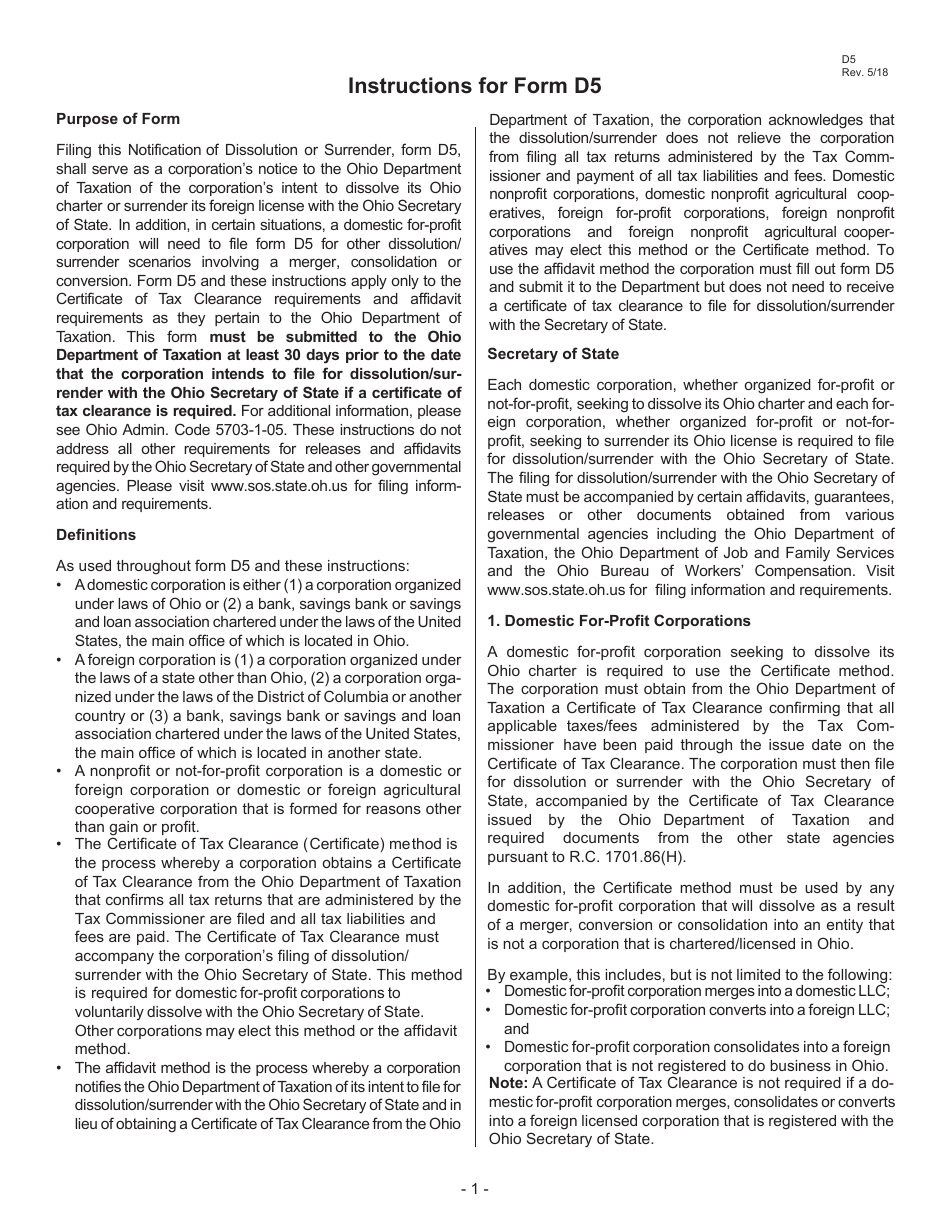

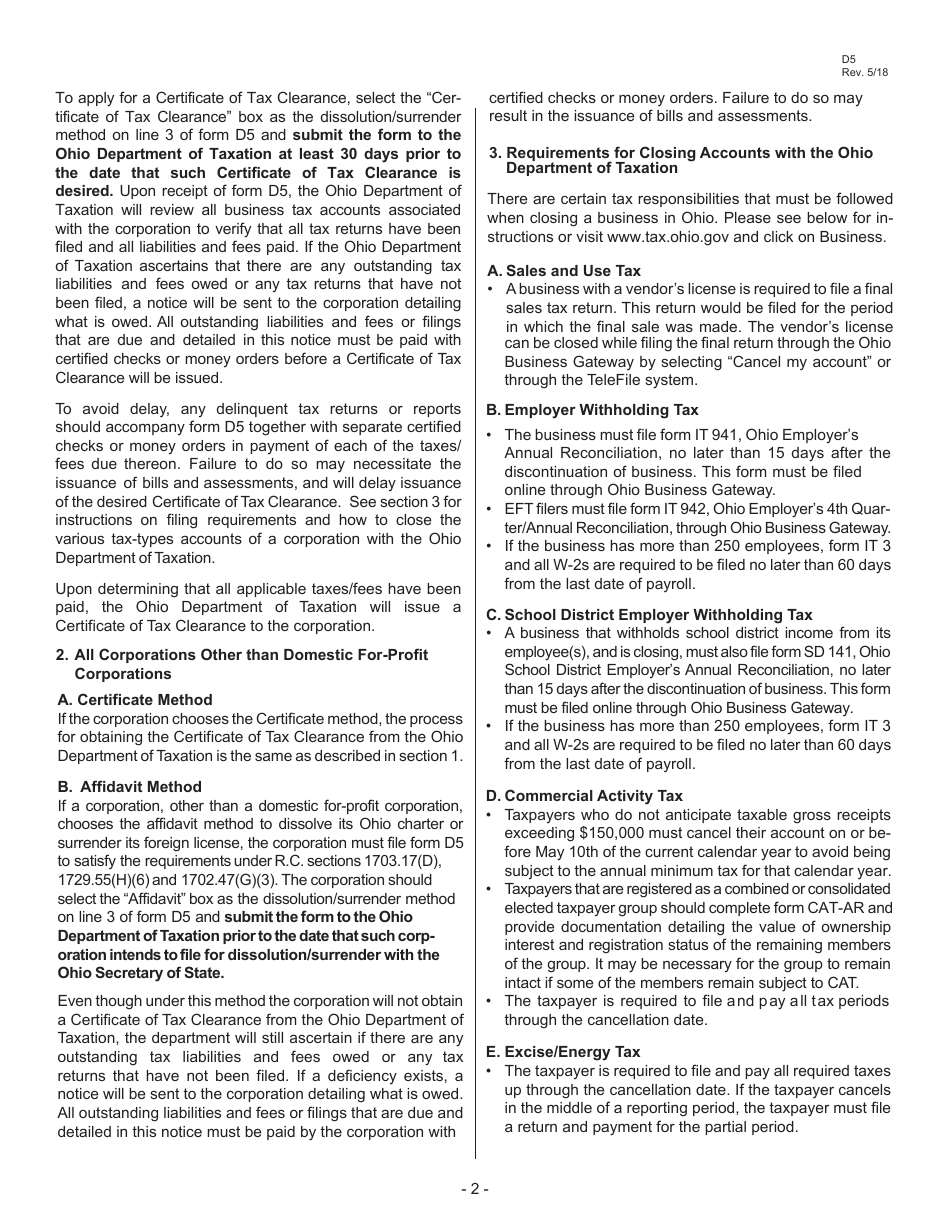

This document contains official instructions for Form D5 , Notification of Dissolution or Surrender - a form released and collected by the Ohio Department of Taxation. An up-to-date fillable Form D5 is available for download through this link.

FAQ

Q: What is Form D5?

A: Form D5 is a notification form used in Ohio to notify the Secretary of State about the dissolution or surrender of a business entity.

Q: When should I use Form D5?

A: You should use Form D5 when you want to dissolve or surrender your business entity in Ohio.

Q: What information is required on Form D5?

A: Form D5 requires the name of the business entity, the date of dissolution or surrender, and the signature of an authorized person.

Q: What happens after I submit Form D5?

A: After you submit Form D5, the Secretary of State will process your notification and update the records to reflect the dissolution or surrender of your business entity.

Q: Is it mandatory to file Form D5?

A: Yes, it is mandatory to file Form D5 if you want to dissolve or surrender your business entity in Ohio.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.