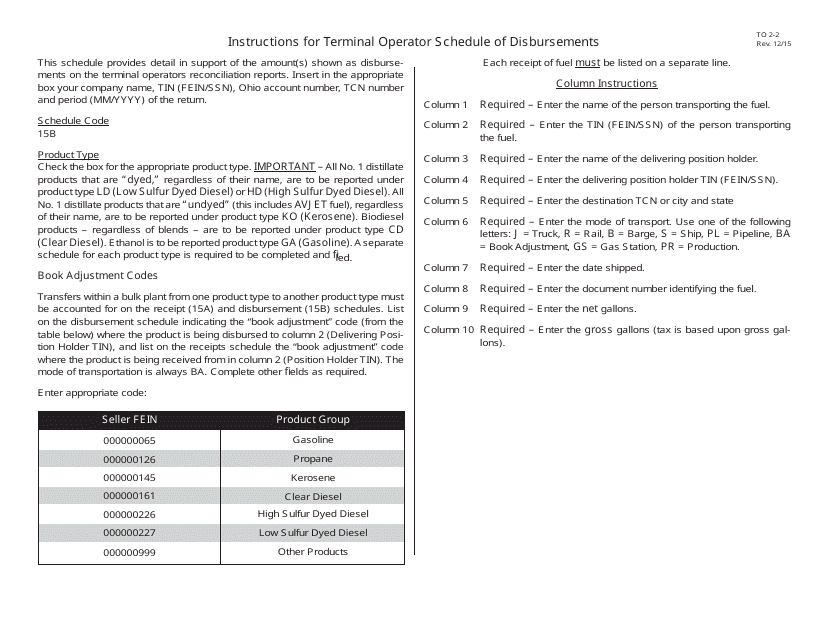

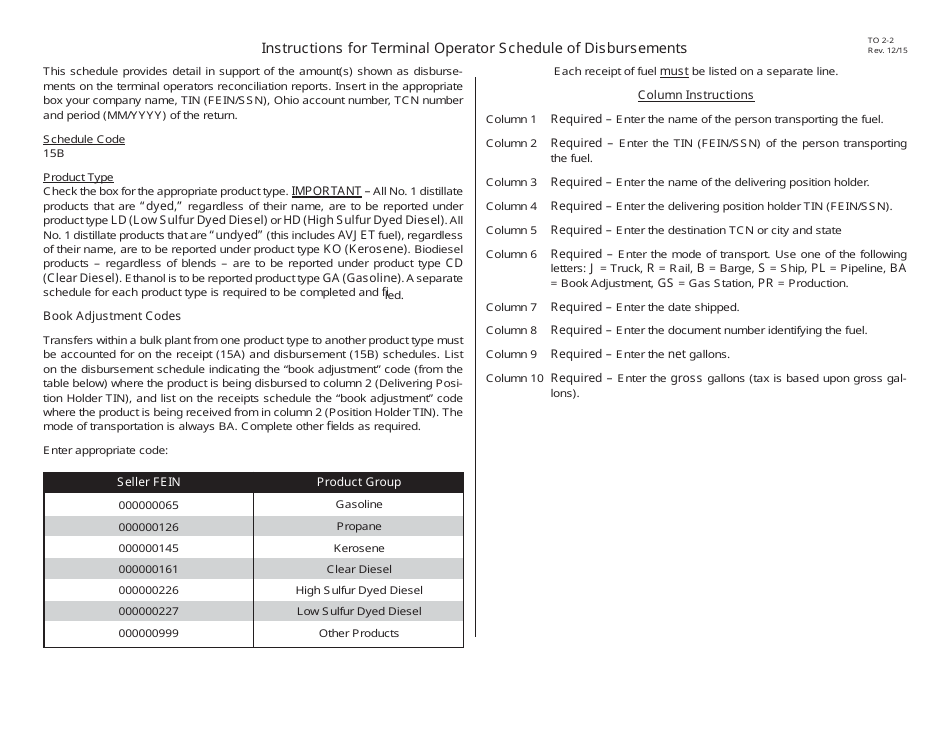

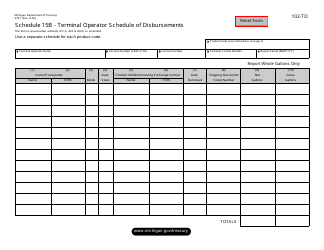

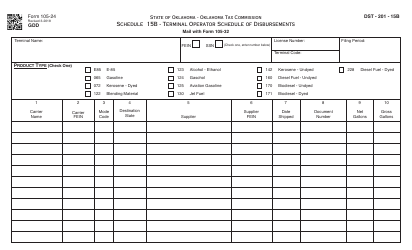

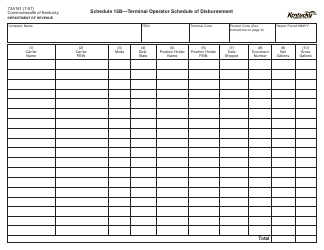

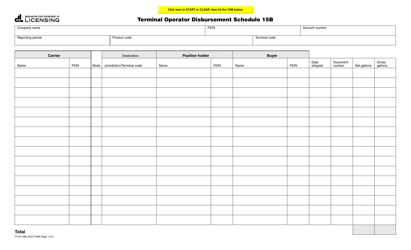

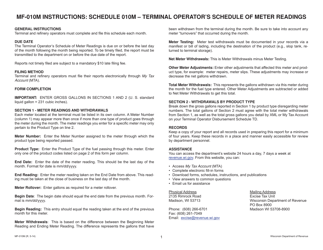

Instructions for Schedule 15B Terminal Operator Schedule of Disbursements - Ohio

This document contains official instructions for Schedule 15B , Terminal Operator Schedule of Disbursements - a form released and collected by the Ohio Department of Taxation.

FAQ

Q: What is Schedule 15B?

A: Schedule 15B is the Terminal Operator Schedule of Disbursements in the state of Ohio.

Q: What is a Terminal Operator?

A: A Terminal Operator is a person or entity that operates a terminal in Ohio, where regulated motor fuel is stored or dispensed.

Q: What is the purpose of Schedule 15B?

A: The purpose of Schedule 15B is to report the disbursements made by a Terminal Operator in Ohio.

Q: What kind of disbursements are reported on Schedule 15B?

A: Schedule 15B reports disbursements of certain taxes and fees, such as the Motor Fuel Tax and Petroleum Activity Tax.

Q: Who is required to file Schedule 15B?

A: Terminal Operators in Ohio are required to file Schedule 15B if they make disbursements of taxes or fees.

Q: How often is Schedule 15B filed?

A: Schedule 15B is filed on a monthly basis.

Q: Are there any penalties for not filing Schedule 15B?

A: Yes, failure to file Schedule 15B or filing it late may result in penalties and interest.

Q: What other documentation may be required with Schedule 15B?

A: Terminal Operators may need to submit supporting documentation, such as invoices or receipts, along with Schedule 15B.

Q: Can Schedule 15B be filed electronically?

A: Yes, Schedule 15B can be filed electronically through the Ohio Business Gateway.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.