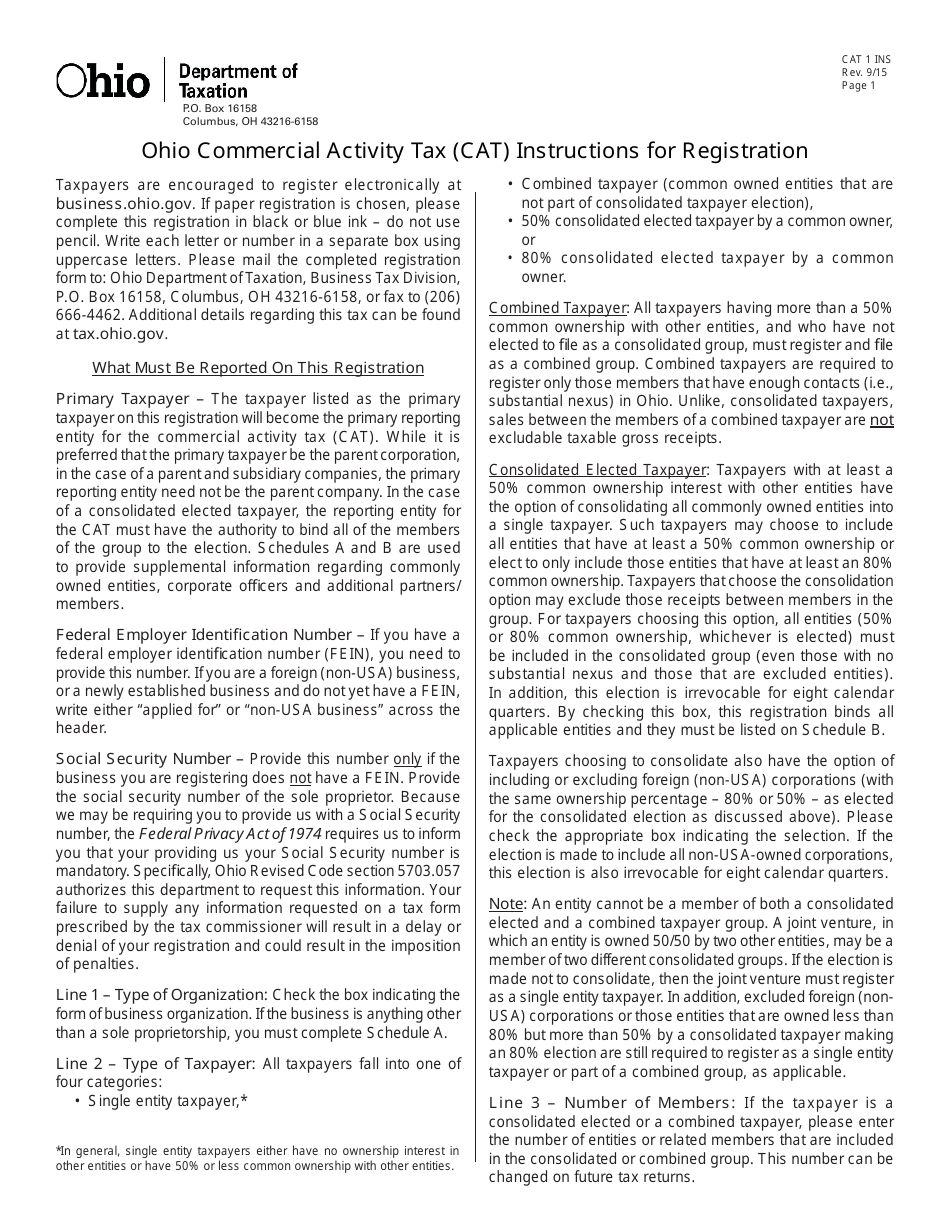

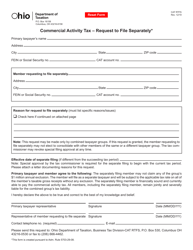

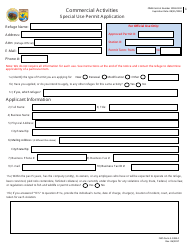

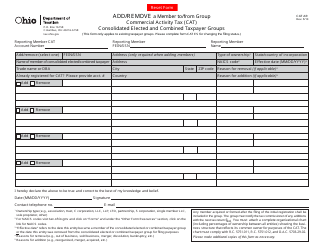

Instructions for Form CAT1 Commercial Activity Tax Registration - Ohio

This document contains official instructions for Form CAT1 , Commercial Activity Tax Registration - a form released and collected by the Ohio Department of Taxation. An up-to-date fillable Form CAT1 is available for download through this link.

FAQ

Q: What is Form CAT1?

A: Form CAT1 is the Commercial Activity Tax Registration form in Ohio.

Q: Who needs to file Form CAT1?

A: Anyone engaged in business activities in Ohio that exceed $150,000 in taxable gross receipts must file Form CAT1.

Q: What is the purpose of Form CAT1?

A: The purpose of Form CAT1 is to register for the Commercial Activity Tax in Ohio.

Q: Do I need to pay a fee to file Form CAT1?

A: No, there is no fee to file Form CAT1.

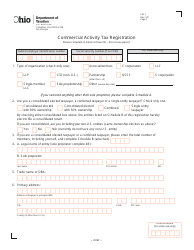

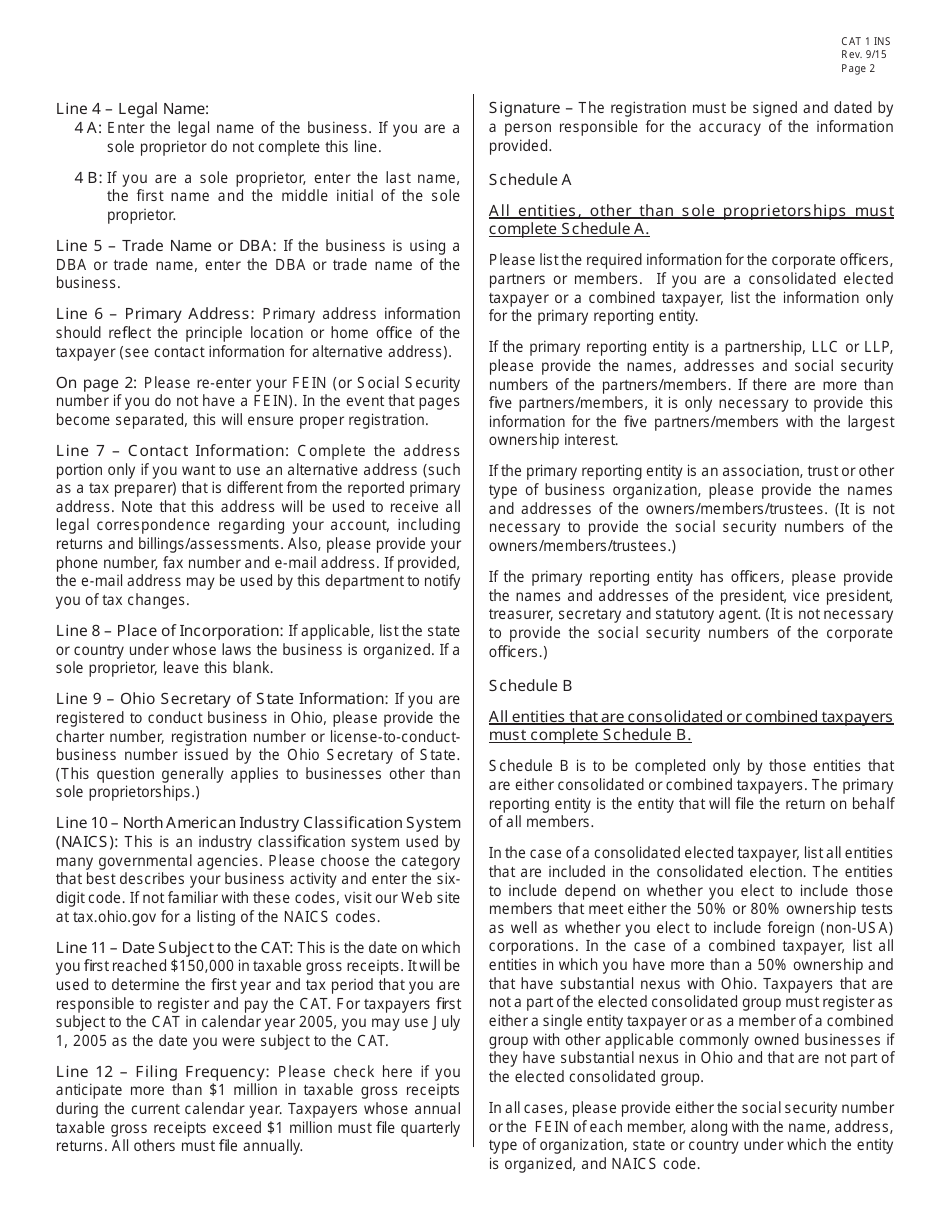

Q: What information do I need to provide on Form CAT1?

A: You will need to provide information such as your business name, address, federal employer identification number, and gross receipts.

Q: When is the deadline to file Form CAT1?

A: Form CAT1 must be filed on or before the 15th day of the fourth month following the close of the taxpayer's taxable year.

Q: What happens if I fail to file Form CAT1?

A: Failure to file Form CAT1 may result in penalties and interest.

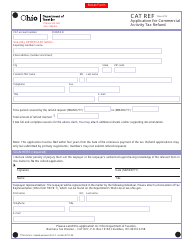

Q: Can I get an extension to file Form CAT1?

A: Yes, you can request an extension to file Form CAT1 by submitting Form CAT1X Extension Request.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.