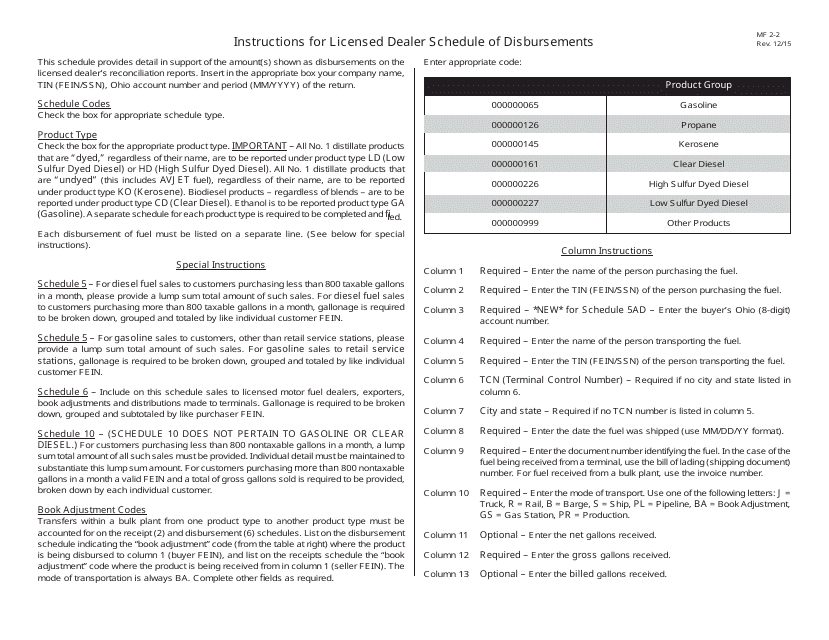

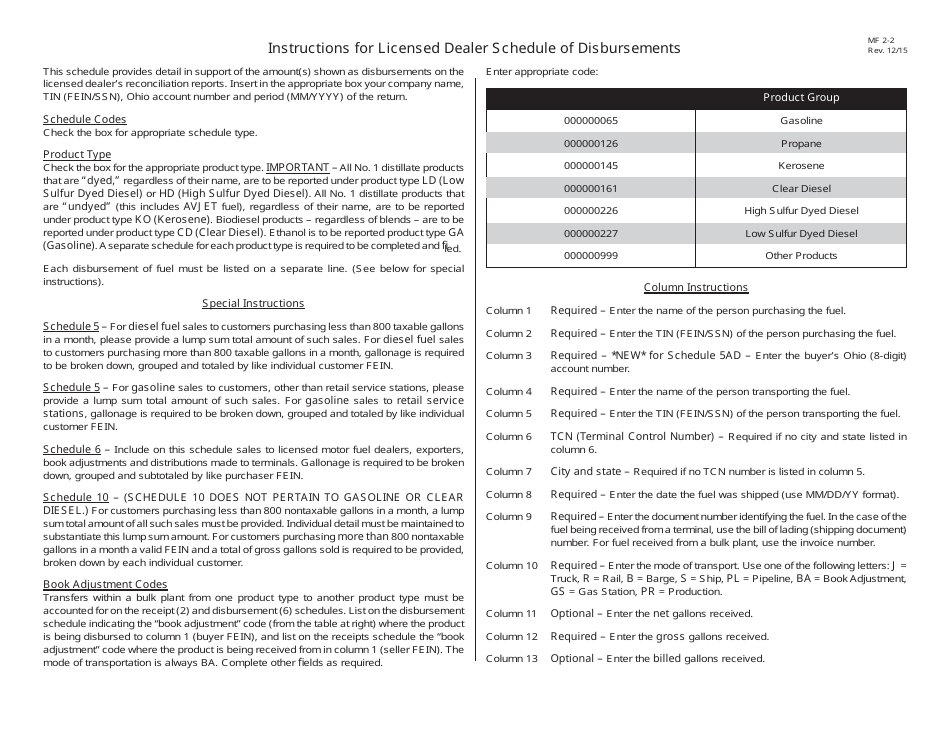

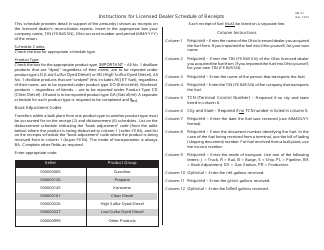

Instructions for Schedule 10, 5, 6 Licensed Dealer Schedule of Disbursements - Ohio

This document contains official instructions for Schedule 10 , Schedule 5 , and Schedule 6 . All forms are released and collected by the Ohio Department of Taxation.

FAQ

Q: What is Schedule 10, 5, 6?

A: Schedule 10, 5, 6 refers to the Licensed Dealer Schedule of Disbursements in Ohio.

Q: What is the purpose of Schedule 10, 5, 6?

A: The purpose of Schedule 10, 5, 6 is to document the disbursements made by licensed dealers in Ohio.

Q: Who needs to complete Schedule 10, 5, 6?

A: Licensed dealers in Ohio need to complete Schedule 10, 5, 6.

Q: What information is required for Schedule 10, 5, 6?

A: Schedule 10, 5, 6 requires information about the disbursements made by licensed dealers, including the date, recipient, and amount.

Q: Can Schedule 10, 5, 6 be filed electronically?

A: Yes, Schedule 10, 5, 6 can be filed electronically through the Ohio Business Gateway.

Q: Are there any fees associated with filing Schedule 10, 5, 6?

A: No, there are no fees associated with filing Schedule 10, 5, 6.

Q: What should I do if I need help with Schedule 10, 5, 6?

A: If you need help with Schedule 10, 5, 6, you can contact the Ohio Department of Taxation for assistance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.