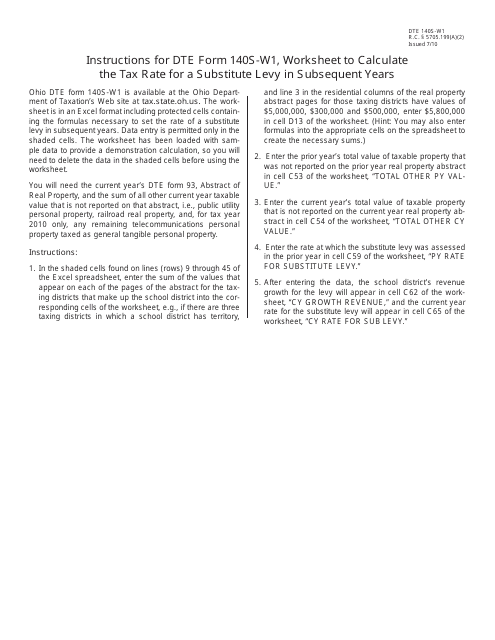

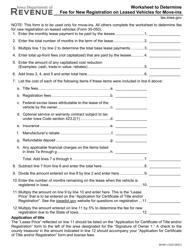

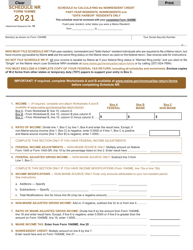

Instructions for Form DTE140S-W1 Worksheet to Calculate the Tax Rate for a Substitute Levy in Subsequent Years - Ohio

This document contains official instructions for Form DTE140S-W1 , Worksheet to Calculate the Tax Rate for a Substitute Levy in Subsequent Years - a form released and collected by the Ohio Department of Taxation.

FAQ

Q: What is the purpose of Form DTE140S-W1?

A: The purpose of Form DTE140S-W1 is to calculate the tax rate for a substitute levy in subsequent years in Ohio.

Q: Which type of levy does Form DTE140S-W1 apply to?

A: Form DTE140S-W1 applies to substitute levies.

Q: What does the form help to calculate?

A: The form helps to calculate the tax rate for a substitute levy.

Q: Who should use Form DTE140S-W1?

A: Form DTE140S-W1 should be used by individuals or entities filing for a substitute levy in Ohio.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.